How Can You Calculate Your Mortgage Amortization

Amortization is most easily calculated with an amortization calculator or pre-built amortization schedule because the calculations change after each payment. There are several online tools available, including free calculators from financial institutions and the Government of Canada.

Here are a couple you may find useful:

This site offers a mortgage calculator and creates an amortization table that shows how much of your payment is applied to principal and interest each month.

Choose The Term Thats Right For You

The thought of paying off a mortgage for 30 years can be scary. Just remember that you have other options besides paying the same amount every month. For example, you may choose to explore a 15-year mortgage or consider an additional principal payment whenever feasible.

Many borrowers end up going with a 30-year mortgage and then refinancing to a shorter term once their income increases. In any case, our dedicated mortgage consultants are here to find the best loan for your needs.

Related Articles

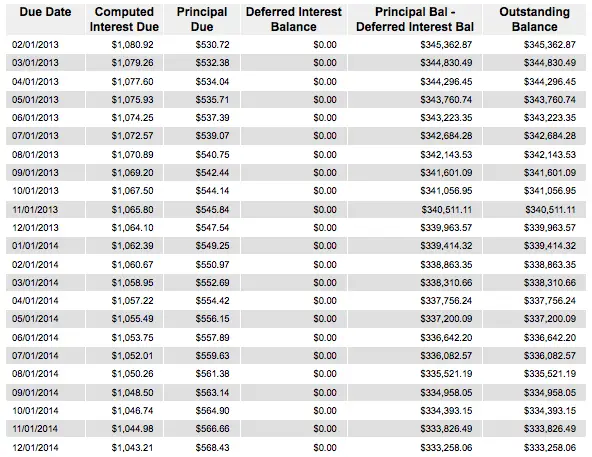

Sample Home Mortgage Amortization Schedule

The complete breakdown of your payments is available in an amortization schedule, also known as an amortization table. This is where you can see how much of your payment applies to principal and interest. It also provides information on the remaining mortgage balance as well as your loans fixed end date.

Below is a sample amortization table for the first few monthly payments of a $500,000 home loan at a 3.1% interest rate, as well as another few months much later in the loan:

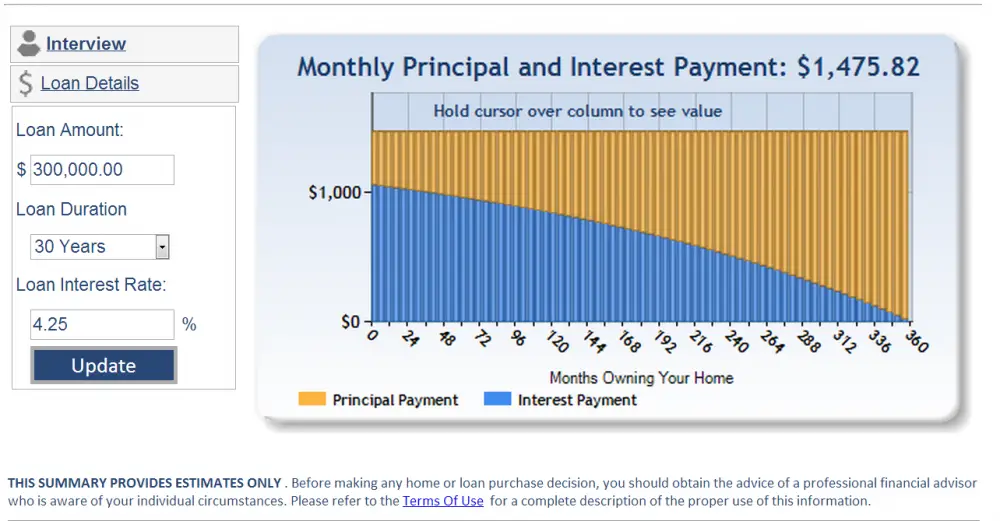

Amortization Graph

Also Check: Mortgage Rates Based On 10 Year Treasury

Can I Change The Amortization Period

You can change your amortization period by refinancing once your mortgage term expires. When refinancing you might want to extend your amortization period to make your mortgage payments more affordable. If you now have more income, you might want to consider shortening your amortization period and paying larger mortgage payments.Refinancing your mortgagecomes with additional paperwork, fees, and amortgage stress testdepending on your mortgage lender. For example, you can skip the mortgage stress test by refinancing with aprivate mortgage lender.

Your amortization period will also be affected by any actions you take during your mortgage term, such as changes to your payment frequency or changes to your payment amount, including additional prepayments or skipping a mortgage payment.

Mortgage Amortization: Learn How Your Mortgage Is Paid Off Over Time

- While your mortgage payment stays the same each month

- The composition changes over time as the outstanding balance falls

- Early on in the loan term most of the payment is interest

- And late in the term its mostly principal that youre paying back

Ever wonder how your home loan goes from a pain in your neck to real estate free and clear?

Well, it all has to do with a magical little thing called mortgage amortization, which is defined as the reduction of debt by regular payments of interest and principal sufficient to pay off a loan by maturity.

In simple terms, its the way your mortgage payments are distributed on a monthly basis, dictating how much interest and principal will be paid off each month for the duration of the loan term.

Recommended Reading: Rocket Mortgage Payment Options

Loans That Get Amortized

Amortization schedules are typically used for installment loans with known payoff dates, fixed interest rates and fixed monthly payments, such as:

- Mortgage loan: Most conventional home loans are 15-year or 30-year terms with a fixed interest rate. Though many homeowners may not keep their mortgage that long, such as if they sell their home or refinance, the loan functions as if you are going to keep it for the entire 15-year or 30-year term.

- Car loan: Many car owners obtain an amortized auto loan for a term of five years or less. Some drivers decide whether they can afford a car based on what their fixed monthly payment will be.

- Personal loan: A personal loan you can obtain from a credit union, bank or an online lender also tends to be amortized. Typically, personal loans are given for a term of three years at a fixed interest rate with a fixed monthly payment. Personal loans are generally used for debt consolidation or small personal projects.

You will pay these loans off with consistent payments until the balance is zero.

Should You Pick A Long Or Short Amortization Schedule

Before deciding on a mortgage loan, its smart to crunch the numbers and determine if youre better off with a long or short amortization schedule.

The most common mortgage term is 30 years. But most lenders also offer 15-year home loans, and some even offer 10 or 20 years.

So how do you know if a 10-, 15-, or 20-year amortization schedule is right for you?

Benefits of a short-term loan

The obvious benefit of a shorter amortization schedule is that youll save a lot of money on interest.

For example, consider a $250,000 mortgage at a 3.5% interest rate:

- A 30-year fixed loan would cost you $154,000 in total interest

- A 15-year loan would cost you only $46,000 in total interest

Short amortization schedules tend to be a sound financial decision if you are buying a starter home and want to build equity more quickly, says Nishank Khanna, chief financial officer for Clarify Capital. It means youll be paying more toward the principal upfront.

Khanna continues, Borrowers who make a large down payment or plan to make accelerated payments, or those who secure loans with low annual percentage rates can shorten their amortization schedule thereby paying less money over the life of their loan and accruing home equity much faster.

However, a shorter amortization schedule isnt for everyone.

Drawbacks of a short-term loan

The biggest drawback to shortening your loan term is that monthly payments will be much higher.

Using the same example of a $250,000 loan at 3.5% interest:

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

What Is Loan Amortization

Loan amortization is the process of making payments that gradually reduce the amount you owe on a loan. Each time you make a monthly payment on an amortizing loan, part of your payment is used to pay off some of the principal, or the amount you borrowed. This lowers the amount you still have to pay off. Some of your payment covers the interest youre charged on the loan. Paying interest doesnt cause the amount you owe to decrease.

Loan amortization matters because with an amortizing loan that has a fixed rate, the share of your payments that goes toward the principal changes over the course of the loan. When you start paying the loan back, a large part of each payment is used to cover interest, and your remaining balance goes down slowly. As your loan approaches maturity, a larger share of each payment goes to paying off the principal.

For example, you may want to keep amortization in mind when deciding whether to refinance a mortgage loan. If youre near the end of your loan term, your monthly mortgage payments build equity in your home quickly. Refinancing resets your mortgage amortization so that a large part of your payments once again goes toward interest, and the rate at which you build equity could slow.

What Is A 30 Year Amortization Schedule

Amortized30 years30year mortgage

. Beside this, what is my amortization schedule?

Amortization is the gradual reduction of a debt over a given period. Our amortization calculator will amortize your debt and display your payment breakdown of interest paid, principal paid and loan balance over the life of the loan.

One may also ask, what does 10 year term 30 year amortization mean? On the other hand, a 10 year fixed rate mortgage has higher monthly payments than a home loan with a longer term. The fact that the loan is due to be paid off in just 10 years, rather than 30 years for example, means that you have to pay more each month.

Similarly, it is asked, what is the formula for calculating amortization?

To calculate amortization, start by dividing the loan’s interest rate by 12 to find the monthly interest rate. Then, multiply the monthly interest rate by the principal amount to find the first month’s interest. Next, subtract the first month’s interest from the monthly payment to find the principal payment amount.

How do you calculate a 30 year mortgage?

The Math Behind Our Mortgage Calculator

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

Calculate Your Ending Balance

Finally, youll calculate your ending balance for that month. To calculate this ending balance, subtract the amount of principal you paid that month from the balance of your loan.

For the first month of the above example, subtract your loan balance of $100,000 by the principal charge of $131.69.

- $100,000-$131.69=$99,868.31

This ending balance will be the beginning balance of the next month. Repeat steps two through four for each month of your amortization schedule. If youre calculating your amortization table yourself, you can check your math with an amortization schedule calculator.

Use This Amortization Calculator To Get An Estimate Of Cost Savings And More

This amortization extra payment calculator estimates how much you could potentially save on interest and how quickly you may be able to pay off your mortgage loan based on the information you provide. It also makes some assumptions about mortgage insurance and other costs, which can be significant. Use this calculator to help you determine whether you should consider paying extra on your mortgage payment.

You May Like: Recast Mortgage Chase

How Amortization Affects Your Loan Payments

Your amortization schedule doesnt just determine when your mortgage will be paid off. It also determines how each monthly mortgage payment is divided between interest and loan principal.

Even though the loan payment every month will likely remain the same total amount, the proportion of interest and principal will differ with each subsequent payment, explains Johnson.

In the first payment you make on an amortizing loan month one youll pay the largest percentage devoted to interest and the smallest percentage devoted to principal.

Conversely, in the last payment you make month 360 on a 30-year mortgage loan the largest percentage of your payment will go toward principal, and the smallest percentage will be devoted to interest, Johnson notes.

The longer the term of your loan, the longer it takes to pay down your principal amount borrowed, and the more you will pay in total toward interest.

Thats why a shorter-term loan, like a 15-year fixed-rate mortgage, has a lower total interest cost than a 30-year mortgage.

| $154,144 |

Mortgage amortization chart

As you can see on the chart below, its not until year 19 that the amount of principal the homeowner has paid surpasses the amount of interest.

Examples generated using The Mortgage Reports mortgage calculator

Amortization affects only principal and interest

Note that your amortization schedule affects only the principal and interest portion of your mortgage payment.

Few Are Disciplined Enough

You may say that you don’t want to be locked into that higher payment and that you’ll simply add extra each month to reduce some of that interest? It rarely happens. Life happens, and the extra money slides through your fingers for things you no longer remember. Forcing yourself to fit the higher payment into your budget from the start is the only way to ensure paying the loan off in 15 years and saving all that interest.

Don’t Miss: Rocket Mortgage Launchpad

Mortgage Term Vs Amortization

One of the most common sources of confusion for prospective home buyers is the difference between a mortgage term and amortization period. Here is a short answer: A mortgage term is the length of your current contract, at the end of which you’ll need to renew The amoritization period is the total life of your mortgage. A typical mortgage in Canada has a 5-year term with a 25-year amortization period.

| Mortgage term | Mortgage amortization | |

|---|---|---|

| Description | The length of time you are committed to a mortgage rate, lender, and conditions set out by the lender. | The length of time if takes you to pay off your entire mortgage. |

| Time frame | CMHC-insured mortgage: Maximum 25 yearsNon CMHC-insured mortgage: 35-40 years |

Fully Amortized Vs Interest

If youve come across the term fully-amortized, you might be wondering what it means.

Simply put, if a borrower makes regular monthly payments that will pay off the loan in full by the end of the loan term, they are considered fully-amortizing payments.

Often, youll hear that a mortgage is amortized over 30 years, meaning the lender expects payments for 360 months to pay off the loan by maturity.

This relates to the fact that most mortgages have 30-year terms, such as the popular 30-year fixed.

To better illustrate, lets consider interest-only mortgage payments, which are often an option on home loans.

If your lender gives you the choice to pay just the interest portion of the mortgage payment each month, it would not be considered a fully-amortized payment.

Why? Because if you continued to make those payments each month, they wouldnt pay off the loan.

In fact, an interest-only payment would do absolutely nothing to pay off the principal balance of the loan. It would only tackle the monthly interest expense.

If you had a loan with an outstanding balance of $300,000 and solely made interest-only payments for five years, you would still owe $300,000 after those 60 months were up.

So for a loan to be fully amortized, you need to make both a principal and interest payment each month.

You May Like: Requirements For Mortgage Approval

The Full Monthly Repayment Chart And Understanding Your Payment Allocations

No one factor affects the cost of purchasing a house more than length of the loan. This may seem like a no-brainer, but so many people look only at the monthly cost and never consider the total cost. That is a huge error. Using our amortization calculator you can enter various scenarios to reveal the true cost of the place you will call home & any other type of loan.

Free Mortgage Amortization Calculator And Table

In this post, well explain what amortization means and provide an amortization calculator to show the mortgage payoff schedule for any fixed-rate mortgage.

“Amortization is the process by which a loans balance is paid down over time. In the case of a mortgage, there is one payment for each month of the loan term . Each time the borrower makes a payment, the loan balance is reduced, thereby amortizing the loan. After the full term, the loan has been completely amortized and the balance is $0.

To see how this works, try this interactive amortization calculator. We also provide a basic example and explain how the amortization table is calculated below.

Also Check: Rocket Mortgage Requirements

Home Ownership Has Other Costs

If you are a renter, you are accustomed to charges for utilities, but if you move into a larger house, be prepared for a larger heating and cooling bill. If anything needs repaired, you are responsible for all the parts and installation. So you need to build a rainy day fund, because odds are against you that one day the air conditioner will fail or the roof will leak or one of your major appliances will go on the blink. Without an emergency fund, these types of events can put you in the red. Lawn maintenance is another expense which may be new to you. Lawn mowers, weed whackers, hedge trimmers, etc. will be an immediate expense. If you live in a neighborhood with a homeowners association, monthly or quarterly fees may be required.

Changing The Amortization Of The Mortgage

Only a few things will change the amortization of your mortgage. A change in the interest rate on the mortgage can change the amortization, but usually, the monthly payment will increase to keep the amortization on schedule.If a payment or payments are late, the amortization will lengthen, because the missed or late payment will cause additional interest to accrue. On the other hand, making an additional payment will shorten the amortization, since the additional payment will be used to reduce the principal. A reduced principal amount will result in less interest accruing. Some people will make an extra payment per year on their mortgage. The effect is that it will decrease the amortization by a number of years, allowing them to pay off their mortgage early.If nothing changes with the frequency of the mortgage payments, such as early or late payments, then typically your amortization will not change for the duration of the mortgage term. Once the term has come to an end and the mortgage is up for renewal, it is possible to increase or decrease the amortization without penalty on the actual date of renewal.When discussing your mortgage options, First Foundation Residential Mortgage Brokers will calculate different amortization scenarios to help you decide which payment fits best with your lifestyle and overall financial plan.

Related Terms

Read Also: 10 Year Treasury Yield Mortgage Rates

First What Exactly Is Amortization The Mortgage Amortization Period Explained

So, what is the amortization period? Its the total amount of time it takes to pay off a loan. The mortgage amortization period is the total number of years it will take to pay your mortgage in full. Typically, this is 20, 25 or 30 years. This seems like a very long time but as with any long-term goal, break it into smaller, more manageable steps.

In the case of your mortgage, these smaller steps are called terms, explained below.