What Income Do You Need For A $400k $500k Mortgage

Start here to compare mortgage rates

Coverage and rates tailored to fit your needs

Lower rates

Compare multiple quotes and choose the most economical one

Reputable providers

We work in a network of trusted providers

Owning a home is a dream for many. However, purchasing one is a complex process. From making an offer to negotiating closing costs, the financial aspects of home-buying can be frustrating for even the savviest shopper.

What We’ll Cover

However, one thing that shouldnt feel challenging should be figuring out the income you need to qualify for a mortgage. If youre looking for a jumbo loan between $400K and $500K, read on to learn more.

Is Your Dti Ratio Within A Good Range

Debt-to-income ratio or DTI is a risk indicator that measures how much of your monthly salary goes to your debts. In particular, DTI ratio is a percentage that compares your total monthly debts to your gross monthly salary. Generally, a high DTI ratio means you are not in a good position to acquire more debt. Likewise, a low DTI ratio is a sign that you have enough salary coming in to pay for your mortgage and other debt obligations.

If you have a high DTI ratio, make sure to reduce it before applying for a mortgage. This increases your chances of securing approval. You can lower your DTI by paying off or reducing large debts, such as high-interest credit card balances.

The 2 Main Types of DTI Ratio

Front-end DTI: The percentage of your salary that pays for housing expenses. It includes monthly mortgage payments, property taxes, home insurance, homeowners association dues, etc.Back-end DTI: The percentage of your salary that goes to housing expenses as well as other debt obligations. This includes credit card debt, student debt, car loans, any personal loans, etc.

Lenders assign different DTI limits depending on the type of loan. Most homebuyers obtain conventional loans in the market. These are common mortgages that come with thorough credit and background requirements.

The Two Main Types of Conventional Loans

Meanwhile, borrowers have the option to choose from the following government-backed loans:

Government-Backed Mortgage Programs

Required Income Calculator For A Home Purchase Or A Refinance

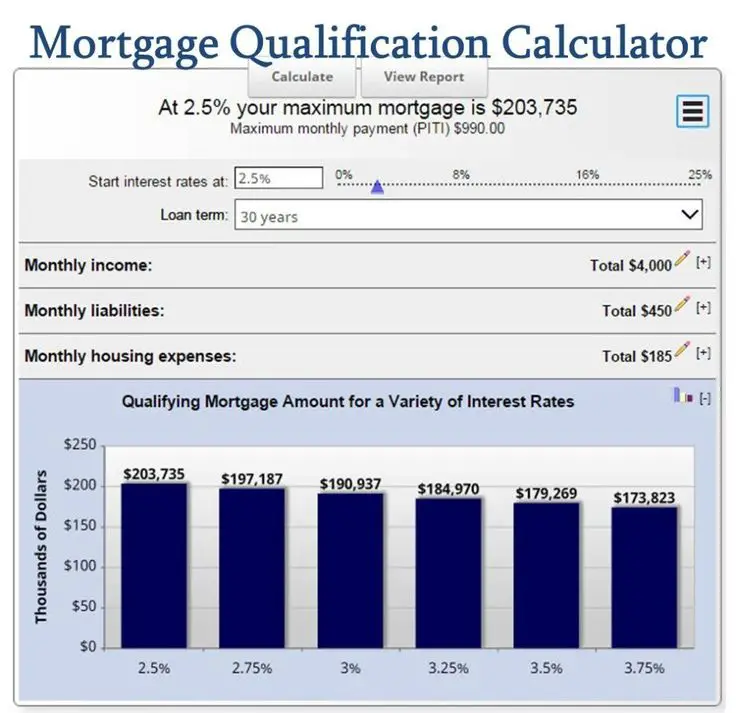

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

Don’t Miss: What’s The Mortgage Rate

How We Calculate How Much House You Can Afford

Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved for a down payment, and what your monthly debts or spending looks like. This estimate will give you a brief overview of what you can afford when considering buying a house.Go one step further by applying some of the advanced filters for a more precise picture of what you can afford for a future residence by including the costs associated with homeownership. The advanced options include things like monthly homeowners insurance, mortgage interest rate, private mortgage insurance , loan type, and the property tax rate. The more variables you enter into the home affordability calculator will result in a closer approximation of how much house you can afford.

How To Determine How Much Home You Can Afford

Buying a house is exciting, especially as you tour new places and eventually fall in love with a home. But how do you determine your price range? To set realistic expectations, consider your personal finances, borrowing options, and the total costs of buying.

Heres what well cover:

Read Also: What Is A 30 Year Fixed Jumbo Mortgage Rate

Ugh This Is Making My Head Hurt

Yup. Mortgages arent fun. Still, a house is one of, if not the, most expensive thing youll ever spend money on so its best to give it a ton of consideration. Being saddled with an unruly mortgage will affect you for years and years. To that end, the more thought you give it now, the less worry youll have later. So remember, the question isnt just How much mortgage can I afford? but How much mortgage do I want? for the long term.

More from SmartAsset

How Do I Work Out How Much Income I Need For A Mortgage

Traditionally all lenders have used a basic income multiple as a rule of thumb to determine the maximum amount you can borrow for a mortgage. However, because lenders dont all use the same income multiple equation this means some can be more generous than others.

Most lenders will use an income multiple of 4 times your salary, some will use 5 times your salary but there are a select few who will use 6 times your salary. Lets take a look at how varying income multiples can affect the amount you can borrow for a mortgage.

| Income | |

|---|---|

| £550,000 | £600,000 |

The above table is for demonstrative purposes only and you should always consult your lender or broker for the most up-to-date information.

As you can see from the table above, the income multiple used by your lender can make quite an impact upon the amount you can borrow. A lender using 6 times your income can offer you a mortgage 50% higher than a lender using 4 times your income.

If you are in a relationship as a dual-income household it may make more sense to apply for a joint mortgage as you can use your combined earnings to increase the size of your mortgage.

Rather than taking the time to conduct your own research on what every lenders income multiple policies are, why not let us help? If you get in touch we can arrange for an expert who has an in-depth understanding in this area to speak with you.

Now lets look more closely at some examples of what you would need to earn for a specific mortgage amount:

Also Check: Why Do You Need Mortgage Insurance

How Much Would A $600k Mortgage Cost

So you are considering getting a $600k mortgage but want to know what it will end up costing you.

There are many aspects to consider when applying for a $600,000 mortgage. This includes the down payment, interest rate, mortgage length, and monthly payments.

A 15-year $600k mortgage could save you a considerable amount of money compared to a 30-year mortgage when taking interest into account.

Below you will find how much you could expect to pay each month with various interest rates. On top of that, you will also find the different down payment options explained in detail so you can choose the best way to go about getting a $600,000 mortgage.

This post may contain affiliate links. For more information, see our disclosure policy.

The Income Needed To Qualify For A $500k Mortgage

Similar to the discussion presented above, it can be difficult to determine what income is required for a $500K mortgage. However, we can use an even simpler calculation than the one provided above.

A good rule of thumb is that the maximum cost of your house should be no more than 2.5 to 3 times your total annual income. This means that if you wanted to purchase a $500K home or qualify for a $500K mortgage, your minimum salary should fall between $165K and $200K.

Again, these mortgage income requirements are highly variable and depend on many factors. However, if youre looking to generate a rough estimate of the kind of mortgage you can afford, your best bet is to multiply your total annual income by 2.5 or 3.

The resulting number should give you a general idea of the mortgage amount youll likely qualify for.

You can also follow the 28/36% rule. This means that you should spend no more than 28% of your gross monthly income on housing expenses and no more than 36% on debts. To determine 28% of your monthly income, multiply your monthly income by 28 and then divide by 100.

If your monthly income is $8,000, heres the limit for your mortgage payment each month:

8,000 x 28 = 224,000. Next, divide that total by 100. 224,000 ÷ 100 = 2,240.

Also Check: What Are Mortgage Rates Based On

That Makes Sense I Think My Credit Score Is In Good Shape Thankfully Is There Anything Else That Happens Before I Get The Mortgage

As far as the lenders work goes, not really. When determining the answer to How much mortgage can I afford?, the lender can tell you what theyre willing to give you, but it is very important that you take stock of your current situation and assess your future before committing to a loan. In other words, were back to the question of what size debt are you comfortable taking on.

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

Read Also: How Much Of Your Monthly Income For Mortgage

Proposed Mortgage Qualification Changes In 2020

The Dodd-Frank Act amended the Truth in Lending Act to ensure borrowers have an ability to repay. While the above DTI levels can provide a good baseline for prospective homeowners, GSE Patch rules allowed borrowers with a DTI of above 43% to have their loans considered qualifying mortgages in some cases. The Consumer Finance Protection Bureau also recommended shifting to a broader and more holistic measurement to better understand a consumers ability-to-repay .

Fannie Mae and Freddie Mac Government-Sponsored Enterprises which package residential mortgages into securities allow higher debt levels for homebuyers with a significant student debt load. In addition, on June 22, 2020, the CFPB suggested changing consumer ATR calculation to place more emphasis on loan pricing rather than strictly relying on DTI.

Consumer Financial Protection Bureau Notice of Proposed Rulemaking:he Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach. The Bureau is proposing a price-based approach because it preliminarily concludes that a loans price, as measured by comparing a loans annual percentage rate to the average prime offer rate for a comparable transaction, is a strong indicator and more holistic and flexible measure of a consumers ability to repay than DTI alone.

Why Mortgage Lenders Require A Down Payment

For mortgage lenders whether its a bank, credit union or other type of lender a down payment helps offset their risk because it means the borrower immediately has some skin in the game and an investment to protect.

The more money you put down, the less the lender stands to lose if you default on payments and the lender has to foreclose, especially early in the loan term. This is why borrowers who put less than 20 percent down usually have to get PMI, as it protects the lender by repaying the unpaid portion of the loan if the borrower defaults.

Down payments on government-backed loans tend to be lower because the loan is at least partially guaranteed by a federal agency. If the borrower defaults, the lender can recoup some or all of the remaining loan amount from the FHA, VA or USDA, depending on the loan program.

Recommended Reading: How Much Is Mortgage For A Million Dollar Home

So What Actually Goes Into Your Mortgage

Instead of thinking of the price tag of a home as affordable, look at whether you can afford to borrow the money it will cost and can repay the loan in monthly payments.

First, lets figure out what your ideal mortgage payment will be also known as what youll essentially be paying instead of rent. Aside from the actual mortgage, there are some key expenses that will impact your monthly payments.

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

You May Like: When Is It Worth To Refinance A Mortgage

Jumbo Loan: 10 Percent

Jumbo loans are a specific type of conventional loan that dont conform to Fannie Mae and Freddie Mac standards for loan amounts. In 2021, that means any conventional loan not backed by a government agency that exceeds $548,250 though high-cost areas have higher limits. Jumbo loans typically require 10 percent down or more.

Example Required Income Levels At Various Home Loan Amounts

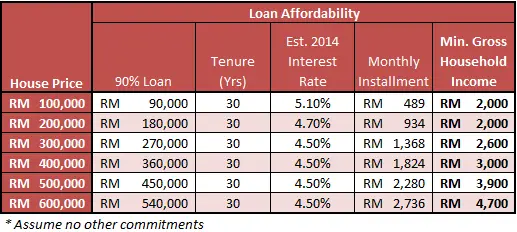

The following table shows the required income needed to have a 28% DTI front end ratio on a home purchase with 20% down for various home values. For the sake of this calculation a 30-year fixed-rate home loan is presumed, with a rate at 5% APR.

This table also presumes a $1,000 annual homeowners insurance policy along with $2,500 in annual real estate taxes. Both numbers are close to the national average, though local conditions can vary widely based upon environmental risks like flooding or earthquakes, along with some states having higher property values or charging higher property tax rates.

| Home Price | |

|---|---|

| $16,379.43 | $196,553.13 |

Home buyers with a high debt load are more likely to be limited by their back end ratio than the front end ratio. If a consumer has a high debt load before buying a home, they have a number of options to improve their chances at getting improved for a home loan:

ARM loans may be easier to qualify for since they come with a lower teaser rate. But buyer, beware. After the initial teaser period, the rate changes annually. This means higher mortgage payments once interest rates increase. ARMs usually come in 3/1 ARM, 5/1 ARM or 10/1 ARM. For instance, if you take a 5/1 ARM, the rate starts off low and you pay the same mortgage payments for the first five years. When this happens, many homeowners end up surprised when their payments substantially increase after the introductory period.

Read Also: Do Mortgage Companies Verify Tax Returns With The Irs

Where You Want To Buy

When it comes to real estate, its all about location, location, location especially when it comes to what you can afford. Every market and even every neighborhood within a market is different, and you can probably find a variety of price ranges where youre looking.

Its also good to keep in mind the property taxes youll be needing to pay depending on the state or city youre looking in and whether theres any additional home insurance youll need .

What Is The Total Amount Repayable

When you take out a mortgage, you agree to pay the principal and interest over the life of the loan. Your interest rate is applied to your balance, and as you pay down your balance, the amount you pay in interest changes.

This means that at the beginning of your loan, a big percentage of your payment is applied to interest. With each subsequent payment, you pay more toward your balance.

Estimate your monthly loan repayments on a £600,000 mortgage at 4% fixed interest with our total amount repayable schedule over 15 and 30 years.

Recommended Reading: What Is The Mortgage Rate In Florida

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment