Benefits Of An Early Mortgage Payoff

There are two main benefits of paying a mortgage early less interest paid and more home equity faster.

But paying off the mortgage is not necessarily always the best choice if you have more expensive debt, like outstanding credit card balances. Or if you havent yet saved for retirement. You may also want that money to purchase additional real estate, as opposed to it being locked up in your home.

This calculator can at least do the math portion to illustrate the power of paying extra and paying off your mortgage ahead of schedule. Youll then need to weigh those savings against other options like paying your credit cards or ensuring youve saved for retirement.

In other words, make sure youre actually saving money by allocating a larger amount of money toward paying off the mortgage as opposed to putting it elsewhere.

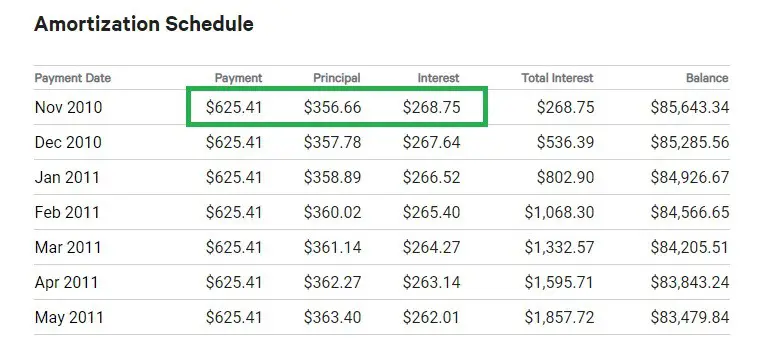

If you want to see the payment schedule, which details every monthly payment based on your inputs, simply tick the box. This will also show you your loan balance each month along with the home equity you are accruing at an ideally faster rate thanks to those additional payments.

To determine your home equity, simply take your current property value and subtract the outstanding loan balance. For example, if your home is worth $500,000 and your loan balance is $300,000, youve got a rather attractive $200,000 in home equity!

And thats all it takes to use this mortgage calculator with extra payments. Happy mortgage saving!

Renting Vs Owning A Home

There are many advantages to owning a home versus renting. Among them is the fact that you gain equity with each payment as opposed to giving your money to a landlord and the ability to paint your living room with zebra stripes if you so desire.

However, theres a mathematical piece of this as well. You have to know how much you need for a down payment and whether owning a home will be cheaper or require you to pay more when looking at the monthly cost of homeownership.

In many cases, its better to get a mortgage because the rate can be fixed for the life of the loan. There are very few controls that can stop landlords from raising your rent every year if they want to. However, not every situation is the same.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

About The Mortgage Payoff Calculator

The calculator has four main sections. First, the top section where you enter the information about your loan and the additional amount you’d like to pay each month. Below that is a short summary showing your new monthly payments and comparative savings. Further down is a chart comparing the trends in your mortgage balance and interest payments over time with both your regular and additional payments.

At the top, there’s a green box labeled “See Report.” Clicking that will display a detailed amortization schedule showing exactly what your total payments, loan balances and accumulated interest payments will be over the life of the loan, on either a month-by-month or year-by-year.

Recommended Reading: What Salary Do I Need For A 200k Mortgage

Calculate The Balance Remaining On Any Mortgage

This mortgage balance calculator will figure the remaining balance of your…show instructions

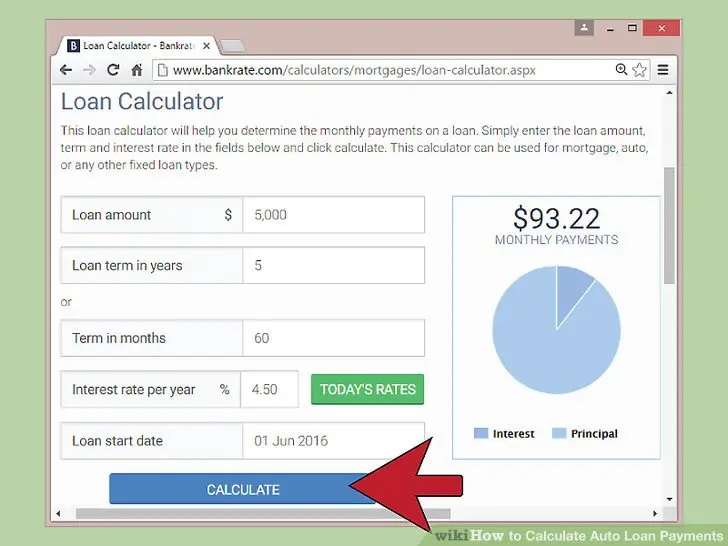

To use this calculator just enter the original mortgage principal, annual interest rate, term years, and the monthly payment. Then choose one of the three options for calculating the number of mortgage payments made to determine the remaining balance.

Note: this mortgage balance calculator is only for fixed rate mortgages where the terms are constant. Don’t use for any mortgage where the terms will vary over time .

Calculate By Loan Term

This option will help you to determine how long it will take to pay off your loan, based on the loan amount, the interest rate, and the proposed term of the loan. If youre simply playing around with different numbers, you can adjust the length of the loan term to determine a payment level thats acceptable to you.

But this option will also give you another important piece of information you need to know, and thats the amount of interest youll pay over the length of the loan. The longer the term, the higher the total interest paid will be. In that way, youll be able to make an intelligent decision about both the monthly payment and the total interest cost of the loan.

When you select this option, youll be asked two additional questions:

- Loan term ranging from 12 to 84 months.

- Extra monthly payment enter any additional principal you plan to add to your monthly payment, but leave it blank if you only intend to make occasional additional payments.

For demonstration purposes, enter 60 months for the loan term. Then hit the black Calculate button.

The loan payoff calculator will display two results:

- Your estimated monthly payment will be $198.01.

- Interest paid $1,880.60, which is the total amount of interest youll pay over the 60-month term of the loan.

Also Check: Can You Refinance A Usda Mortgage

What Is Home Equity

Your home equity is your personal financial investment in your home. Generally speaking, its your homes fair market value, less any mortgage balances or existing liens including the balance you owe on your mortgage.

Its important to note that your homes equity is not the same as your net proceeds. When you go to sell your house, youll have to pay closing costs and other fees related to the transaction. These expenses are paid directly out of your equity before you can even access the money, thereby decreasing your total profit.

Bring Your Lunch Into Work

Sure, bringing an egg salad sandwich to work every day isnt as fun as going to a restaurant with your coworkers. But trading lunch out for eating in can make you a lean, mean, mortgage-free machine.

Suppose packing your lunch frees up $100 to use toward your mortgage every month. Based on our example above of the $220,000 loan, that $100 in lunch money will help you pay off your mortgage four years ahead of schedule and save you nearly $27,000 in interest!

Cant quite spare a whole $100 from your food budget? No worries. Even small sacrifices can go a long way to help pay off your mortgage early. Put Andrew Jackson to work for you by adding just $20 to your mortgage payment each month. Based on our example, youll pay your mortgage off a year early, saving over $6,000 in the process.

Read Also: How To Purchase A House That Has A Reverse Mortgage

Is The House Too Expensive

Another thing a mortgage calculator is very good for is determining how much you can afford. This is based on things like your income, credit score and your outstanding debt. Not only is the monthly payment important, but you should also be aware of how much you need to have for a down payment.

As important as it is to have this estimate, its also critical that you dont overspend on the house by not considering other things like emergency funds and your other financial goals. You dont want to put yourself in a position where youre house poor and can never afford to go on vacation or retire.

Keep Your Payments The Same When Changing Your Mortgage

When you renew your mortgage, you may be able to get a lower interest rate.

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. Lenders call this early renewal option the blend-and-extend option. They do so because your old interest rate and the new terms interest rate are blended.

When your interest rate is lower, you have the option to reduce the amount of your regular payments. If you decide to keep your regular payments the same, you can pay off your mortgage faster.

Also Check: What Is Rocket Mortgage Interest Rate

Additional Ways To Find Your Mortgage Balance

Mortgage companies will send out a mortgage statement â electronically or by mail â on an annual basis. These statements reveal the mortgage balance, number of payments that were made, and interest charged.

But what if you want to proactively find your exact mortgage balance â as stated by your mortgage company? Two popular options include:

- â Your mortgage company can give you your mortgage balance over the phone. Simply call and ask.

- Go online â Your mortgage company website will probably show your mortgage balance. You’ll have to create an online account â with a login and password â that will enable you to view your mortgage balance anytime you wish.

Use The Early Mortgage Payoff Calculator To Determine The Actual Savings

- This calculator will illustrate the potential savings

- Of paying off your home loan ahead of schedule

- Knowing the actual numbers can help you determine if it makes sense

- To make extra payments based on your financial goals

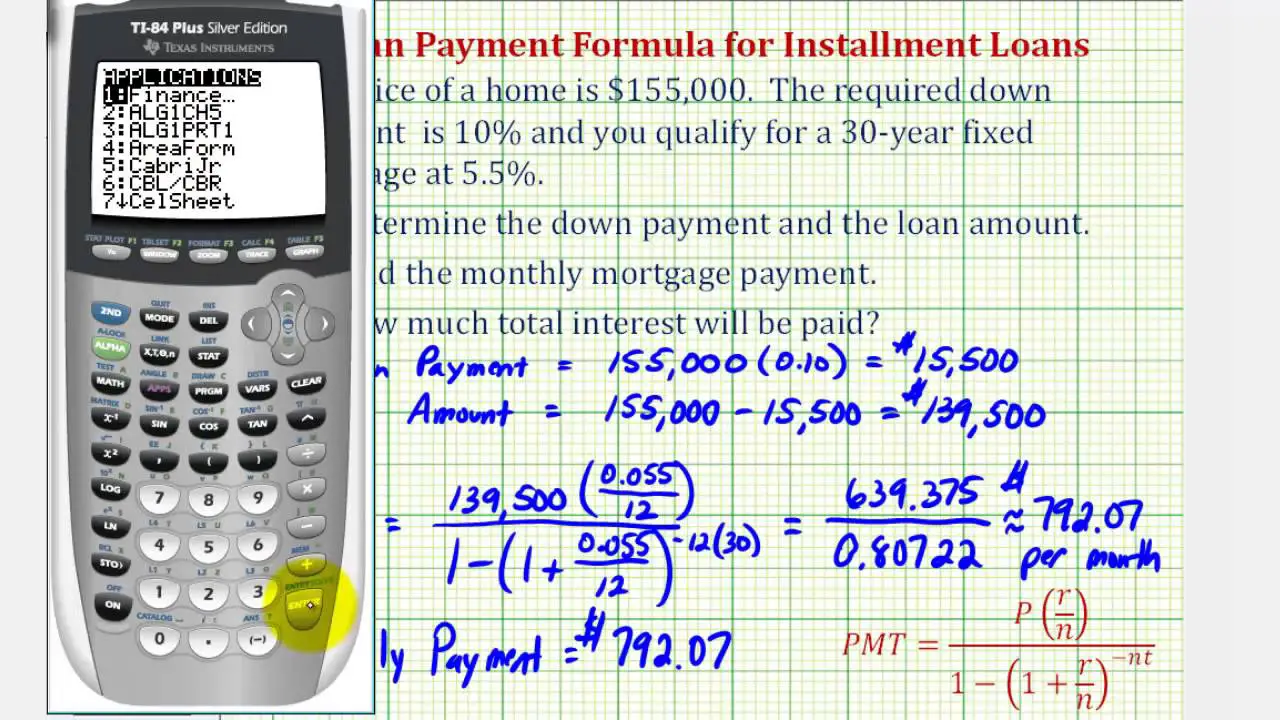

For example, if youre interested in paying off your mortgage off in 15 years as opposed to 30, you generally need a monthly payment that is 1.5X your typical mortgage payment.

So if youre currently paying $1,000 per month in principal and interest payments, youd have to pay roughly $1,500 per month to cut your loan term in half. Of course, thats just a ballpark estimate. It will depend on the mortgage rate and the loan balance.

This early payoff calculator will also show you how much you can save in interest by making larger mortgage payments.

You might be surprised at the potential savings, but be sure to consider where youd put that money elsewhere. It might earn a better return in the stock market or someplace else.

You May Like: What Is Congress Mortgage Stimulus Program

Payoff In 14 Years And 4 Months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

If Pay Extra $500.00 per month

| Remaining Term | 14 years and 4 months |

| Total Payments |

| 24 years and 4 months |

| Total Payments |

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options.

Types Of Mortgage Calculators

In addition to a calculator that helps you determine the amount of your monthly mortgage payment, there are others that help you analyze various scenarios when it comes to your mortgage. Well give the basics on each of them before digging a little deeper regarding the information you need to make the most use of the calculator.

Also Check: Can I Use My Partner’s Income For A Mortgage

Equity Increases With Home Improvements

You can also increase your equity by completing home improvements. New mechanicals, landscaping, additions and renovations often boost your homes value, in turn increasing your equity stake.

Some of the most popular home improvements include minor kitchen remodels, exterior improvements, bathroom remodels and finishing basements. Its rare to complete a home improvement project with a 100% return on your investment, but you can come close if you take a strategic approach. Focus on improvements that buyers love, and be cautious of overimproving.

How Much Interest Do You Pay

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Borrowing less

- Paying extra each month

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Shorter-term loans like 15-year mortgages often have lower rates than 30-year loans. Although you would have a bigger monthly payment with a 15-year mortgage, you would spend less on interest.

Read Also: Can You Write Off Points On A Mortgage

Try Refinancing From Fha Loan To Conventional Loan

Federal Housing Administration loans help millions of Americans secure affordable homes. FHA loans are backed by the government to help consumers purchase houses with low down payments . Loan rates are also typically competitive at the beginning of the term.

Conventional home loans only require property mortgage insurance if the loan balance is above 80% of the home’s value. As the homeowner pays down their loan the insurance requirement is dropped. FHA loans charge an annual mortgage insurance premium which must be paid for the entire life of the loan. MIP is around 0.80 to 0.85 percent of the loan value. This premium cannot be canceled and must be paid yearly until the end of the mortgage.

Is There a Way to Eliminate PMI?

Yes. You can get rid of the PMI cost if you refinance from FHA to a conventional loan. To do so, you must raise your credit score to qualify for refinancing. At the very least, you should have a 620 credit score to obtain a conventional loan. But the higher your credit score, the more favorable rates you can get . This helps lower your current interest rate once you shift to a conventional loan. But again, if you shorten your term to 15 years, be ready for higher monthly payments.

To learn more about when to refinance, read our feature on top reasons for refinancing.

Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

You May Like: What Does A Co Signer Do For A Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Department Of Veterans Affairs Loan

VA loans are a great idea in theory! They were designed to make it easier for our countrys military veterans to purchase homes, but the program falls short in practice. VA loans are backed by the Department of Veterans Affairs and allow veterans to purchase a home with practically no down payment.

When you buy a home with nothing down, a slight shift in the market could mean you owe more than the market value of your home. Thats a recipe for disaster because it could leave you stuck in a home until the market recovers. VA loans also have lot of fees, and interest rates are usually higher than those for conventional loans.

Recommended Reading: Is Quicken Loans A Mortgage Broker Or Lender

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how big your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a one million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

Calculate Your Payment And More

How much interest can be saved by increasing your mortgage payment? This mortgage payoff calculator helps you find out. Click the “View Report” button to see a complete amortization payment schedule.

Learn more about specific loan type rates| Loan Type | Purchase Rates | Refinance Rates |

|---|---|---|

| The table above links out to loan-specific content to help you learn more about rates by loan type. | ||

| 30-Year Loan |

Don’t Miss: Can You Pay Back A Reverse Mortgage Early