What Percentage Of Income Should Go To A Mortgage

Every borrowers situation is different, but there are at least two schools of thought on how much of your income should be allocated to your mortgage: 28 percent and 36 percent.

The 28 percent rule, which specifies that no more than 28 percent of your income should be spent on your monthly mortgage payment, is a threshold most lenders adhere to, explains Corey Winograd, loan officer and managing director of East Coast Capital Corp., which has offices in New York and Florida.

Most lenders follow the guideline that a borrowers housing payment should not be higher than 28 percent of their pre-tax monthly gross income, says Winograd. Historically, borrowers who are within the 28 percent threshold generally have been able to comfortably make their monthly housing payments.

This 28 percent cap centers on whats known as the front-end ratio, or the borrowers total housing costs compared to their income.

The 36 percent model is another way to determine how much of your income should go towards your mortgage, and can be used in conjunction with the 28 percent rule. With this method, no more than 36 percent of your monthly income should be allocated to your debt, including your mortgage and other obligations like auto or student loans and credit card payments. This percentage is known as the back-end ratio or your debt-to-income ratio.

Most responsible lenders follow a 36 percent back-end DTI ratio model, unless there are compensating factors, Winograd says.

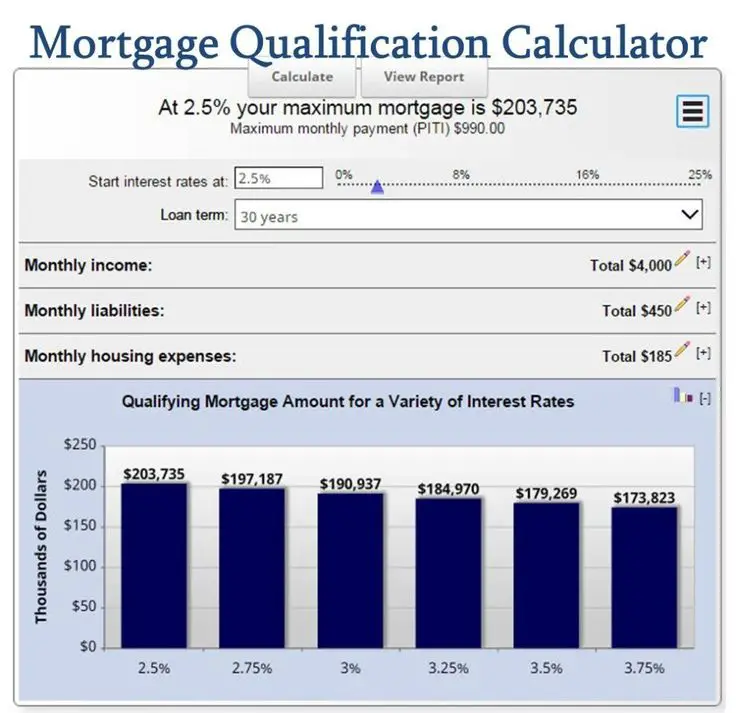

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Will I Be Able To Afford To Pay My Mortgage And Other Household Bills

Once you have decided the rough size of the mortgage you are going for, you should find out what the rough monthly costs would be, which will depend on the type of mortgage. Its important to ask yourself:

- Is the monthly mortgage a payment you can easily afford? A good rule of thumb is that no more than 35 per cent of post-tax income should go on mortgage payments.

- Will the mortgage be more or less than your current rent? If it you are struggling to pay your rent, and the mortgage is more think again

- Will there be bills such as council tax, water or insurance that you are currently not paying? These can add up to thousands of pounds a year

- What happens if interest rates go up, by 1, 2 or 3%? You need to stress test the mortgage for different scenarios. If you cant afford an increase in interest rates, you need to get a fixed rate mortgage, which will normally increase your monthly mortgage costs

- What happens if you lose your job, or suffer a fall in income because you have children and go on maternity leave? If you are planning kids, you cant plan on the basis of dual-income-no-kids lifestyle

- Can you cover the basic maintenance costs of a house? Many new homeowners struggle to pay the always surprisingly large wear and repair costs that go with owning a home

Read Also: Is 680 Credit Score Good Enough For Mortgage

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they don’t just take into account what the mortgage payments will be, they also look at the other debts you’ve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

That’s the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders don’t want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. That’s the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

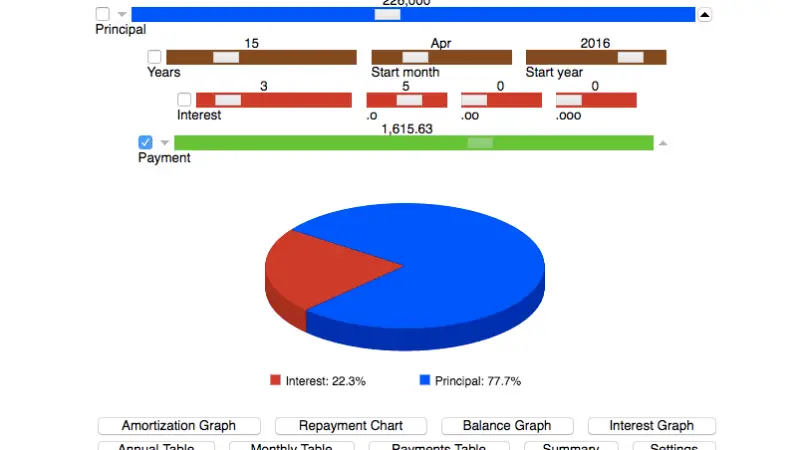

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowner’s insurance and, if applicable, mortgage insurance and condominium or homeowner’s association fees.

Look Closely At All Your Expenses

You’ve got to put food on the table, clothes on your back and gas in your car-and have a little fun now and then. You also need to be prepared for emergencies as well.

Your mortgage specialist will help you make sure you have money left over to pay for the necessities of life, as well as some of your lifestyle choices. The following calculations are used by most lenders as a guide to help determine the maximum you should spend on housing costs and overall debt levels:

If your monthly housing and housing-related costs don’t leave you enough money for your other expenses, then you have a few options.

You and your mortgage specialist may also need to factor in expenses or changes that you know are on the horizon. Maybe you’ll need to replace your car within the next year. Or if you’re expecting your first baby you may need to consider the impact of a maternity or paternity leave on your budget in addition to expenses related to having a baby.

Also Check: What Percent Down Payment To Avoid Mortgage Insurance

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

How Does The 28/36 Rule Of Thumb Work

So, how do mortgage lenders use the 28/36 rule of thumb to determine how much money to lend you?

Lets say you earn $6,000 a month, before taxes or other deductions from your paycheck. The rule of thumb states that your monthly mortgage payment shouldnt exceed $1,680 and that your total monthly debt payments, including housing, shouldnt exceed $2,160 .

A mortgage lender may use this guideline to gauge or predict that youll be able to take on a certain monthly mortgage payment for the foreseeable future, Andrina Valdes, COO of Cornerstone Home Lending in San Antonio, told The Balance by email. The 28/36 rule answers the question: How much house can you afford to buy?

The rule of thumb should be something you calculate before you start shopping for homes, as it gives you an accurate estimate of how much home you can afford.

You May Like: What Is The Current Trend In Mortgage Rates

The Percentage We Recommend

At Rocket Mortgage®, the percentage of income-to-mortgage ratio we recommend is 28% of your pretax income. This percentage strikes a good balance between buying the home you want and keeping money in your budget for emergencies and other expenses. However, its important to remember that you dont need to spend up to your monthly limit. Think of 28% as the maximum amount you should spend monthly on your total mortgage payment. Remember to include your principal, interest, taxes, insurance and homeowners association dues in your total before you sign on a loan.

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

You May Like: Which Credit Reporting Agency Do Mortgage Lenders Use

Know Your Local Housing Market And Plan Accordingly

The real estate market is in an unpredictable place. Home sales went largely on pause during the global COVID-19 pandemic, a struggling stock market caused many in-contract sales to fall through and changes in the short-term rental market might mean former rentals go on the market as homes for sale.

On the one hand, mortgage rates were trending down at the time this was written . They might stay low, keeping monthly payments quite affordable. If thats the case, you could afford to put in a larger offer than youd expected. On the other hand, real estate in your area could come back with a vengeance and drive prices up.

If your maximum spend on a home is $250,000, but desirable homes in your area have been selling for 5% above the asking price, its time to recalibrate. Anticipate going over by 5% and crunch some new numbers. With a maximum budget of $250,000, that will translate to looking for homes with an asking price thats $12,500 or 5% of your actual budget lower than your max.

The bottom line is that the performance of recent sales in your market are the best indicator for how your own purchase will go. If other homes are selling for under the asking price, you should feel empowered to offer under asking on the home of your dreams.

Example Of Mortgage Payment Percentage

Based on the 28 percent and 36 percent models, heres a budgeting example assuming the borrower has a monthly income of $5,000.

- $5,000 x 0.28 = $1,400

- $5,000 x 0.36 = $1,800

Going by the 28 percent rule, the borrower should be able to reasonably afford a $1,400 mortgage payment. However, factoring in the 36 percent rule, the borrower would also only have room to devote $800 to their remaining debt obligations. Applied to your own financial situation, this may or may not be feasible for you.

Also Check: How To Lock Mortgage Rate For 6 Months

Determine How Much Home You Can Afford

First, you need to determine how much of your monthly income you can spend on housing. You need to remember to leave yourself a reasonable cushion for savings, insurance, taxes and other expenses.

One good way to begin is by analyzing your debt-to-income ratio. Your DTI is a numerical representation of how much you spend on recurring debts per month. Lenders look at your DTI when they consider your mortgage application to determine if you can afford to take on more debt. Your DTI can also help you determine if you should be renting or buying.

Rule : Consider Your Total Housing Payment Not Just The Mortgage

Most agree that your housing budget should encompass not only your mortgage payment , but also property taxes and all housing-related insurancehomeowners insurance and PMI. To find homeowners insurance, we recommend visiting . Theyre what we call an insurance aggregator, which means they compile all the best rates from around the online marketplace and present you with the best ones.

As for just how big a percentage of your income that housing budget should be? It all depends on whom you ask.

Don’t Miss: Can A Reverse Mortgage Be Refinanced

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property that costs between two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Recommended Reading: What Factors Go Into Mortgage Approval

How Might Your Circumstances Change In The Future

Once you’ve got your basic budget, you can play around with the inputs. If you’re planning on having children soon, think about how that will change your household finances.

Once you come up with an estimate, you can use a mortgage calculator which can give you an idea of about how much debt you can comfortably take on.

How Much Income Is Needed For A 200k Mortgage

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a broader range of interest rates.

You May Like: Who Has The Best Reverse Mortgage Rates

Your Savings And Investments

Now that youve looked at your DTI and any debt you may have, think about your budget. How does a mortgage payment fit in? If you dont have a budget, keep track of your income and expenses for a couple of months. You can create a personal budget spreadsheet or use any number of budgeting apps or online budgeting tools.

In the mortgage process, its important to look at your budget and savings for a couple of reasons. One, you might need savings for a down payment, which well discuss in a later section. However, for now, lets go over something called reserves. These may be required, depending on the type of loan youre getting.

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

Read Also: Can I Change Mortgage Companies

Know How Much Home You Can Afford

Before you even start looking for a home, you need to know exactly how much home you can afford â otherwise, you could spend time looking at homes that are out of your price range. If that happens, it’s hard not to be disappointed later when you view less expensive homes.

To get an idea of what you can afford, you’ll need to take into account the following:

- Your household income

- Your current debts and your monthly payments associated with those debts

- Your estimated monthly housing-related costs, including mortgage payment, property taxes, property insurance, condominium fees, school taxes, utilities and maintenance costs

- Your anticipated closing costs and other one-time costs

- Your current spending practices

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

You May Like: How Much Mortgage On 200k

Check Your Credit History

When you apply for a mortgage, lenders usually pull your credit reports from the three main reporting bureaus: Equifax, Experian and TransUnion. Your credit report is a summary of your credit history and includes your credit card accounts, loans, balances, and payment history, according to Consumer.gov.

In addition to checking that you pay your bills on time, lenders will analyze how much of your available credit you actively use, known as credit utilization. Maintaining a credit utilization rate at or below 30 percent boosts your credit score and demonstrates that you manage your debt wisely.

All of these items make up your FICO score, a credit score model used by lenders, ranging from 300 to 850. A score of 800 or higher is considered exceptional 740 to 799 is very good 670 to 739 is good 580 to 669 is fair and 579 or lower is poor, according to Experian, one of the three main credit reporting bureaus.

When you have good credit, you have access to more loan choices and lower interest rates. If you have poor credit, you will have fewer loan choices and higher interest rates. For example, a buyer who has a credit score of 680 might be charged a .25 percent higher interest rate for a mortgage than someone with a score of 780, says NerdWallet. While the difference may seem minute, on a $240,000 fixed-rate 30-year mortgage, that extra .25 percent adds up to an additional $12,240 in interest paid.