Calculate The Number Of Payments

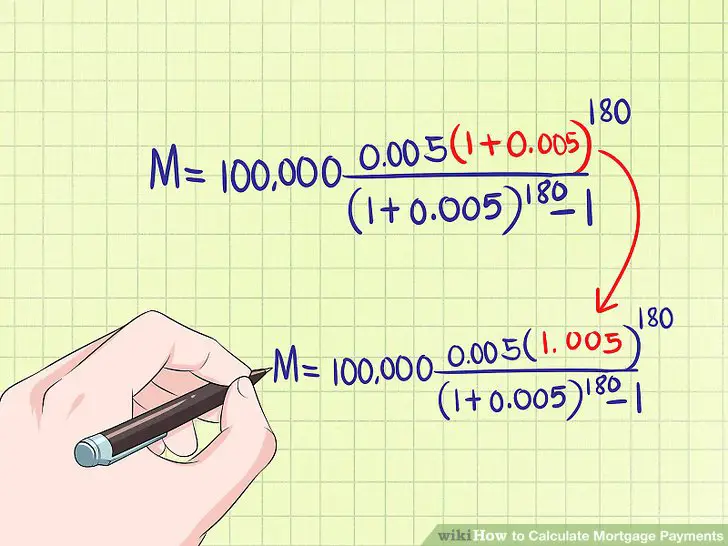

The most common term for a fixed-rate mortgage is 30 years or 15 years. To get the number of monthly payments you’re expected to make, multiply the number of years by 12 .

A 30-year mortgage would require 360 monthly payments, while a 15-year mortgage would require exactly half that number of monthly payments, or 180. Again, you only need these more specific figures if you’re plugging the numbers into the formula an online calculator will do the math itself once you select your loan type from the list of options.

What Are Mortgage Statements

A mortgage statement outlines important information about your mortgage. Mortgage statements are usually an annual statement, with it being sent out by mail between January and March rather than once every month. You may also choose to receive your mortgage statement online.

For example, TD only produces mortgage statements annually in January, while CIBC produces them between January and March. If you have an annual mortgage statement, it will usually be dated December 31. You may also request a mortgage statement to be sent.

Information on a mortgage statement are up to the end of your statement period and include:

- Current interest rate

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

Don’t Miss: What Does The Bank Need For A Mortgage

And How Much More Would The Mortgage Rate Be

Well, that depends on a lot of factors. At the end of the day, the lender mostly cares about getting his money back and earning the interest he asked for. We also call that as a borrowers ability to repay.

The three major factors that govern your ability to repay are:

Debt-to-income ratio This is the ratio of your total monthly debt payments to your total monthly income, in short also called as DTI. Debt includes home loan, auto loan, education loan and any other kind of loan you may have.

Lets say two individuals have the same monthly income of $8,000. If the first one has to make a total debt payment of $1,500 while the other has to pay $6,000 in debt every month.

The risk with the first guy is less because he has more breathing room in case something goes wrong, such as a loss of job. He can always adjust his life-style to still be able to make his payments, while the other one does not have as much cushion.

Loan-to-Value ratio This is the ratio of the amount you took as loan to buy the home vs the market value of the home, popularly known in the industry as LTV.

Say suddenly the economy goes south, people lose jobs and home prices decrease in value significantly. Fewer people will be able to make their payments and some might default on their payment.

In a situation like that, if the bank has to foreclose and sell the home, their chance of recovering their investment is higher when the loan amount is lower.

How To Find The Best Mortgage For You

2016RISKSUMMIT.ORG” alt=”Monthly interest rate calculator > 2016RISKSUMMIT.ORG”>

2016RISKSUMMIT.ORG” alt=”Monthly interest rate calculator > 2016RISKSUMMIT.ORG”> Once youve decided which term is right for you, youll want to do your due diligence to find the best mortgage. Here are five kinds of mortgages to consider. Youll want to do some research and compare mortgage rates from several entities, which could include traditional banks, online lenders and mortgage brokers. Prepare by reviewing your credit report to confirm its correct and have an idea of how much you can afford to pay each month.

The good news is that any time of year can be a good time to shop for a mortgage. Mortgage rates are tied to the bond market, so there’s not a good or bad season, Moffitt explains. He adds that fees for a 10-year mortgage will be similar to those of other mortgages.

If you choose a mortgage with a longer repayment term and decide you want to pay it off faster say in 10 years calculate what your monthly payment would be if you had a 10-year mortgage rate and pay that amount each month. Be sure to instruct your lender to apply the extra funds to the principal. This is a good option for borrowers who want to pay aggressively but who dont want to be locked into higher payments.

Other useful tools:

Don’t Miss: How Do I Qualify For A Zero Down Mortgage

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

What Your Lender Needs To Tell You

If your lender is a federally regulated financial institution, such as a bank, they have to provide certain information.

The following details must appear in an information box at the beginning of your mortgage agreement:

- prepayment privileges

- prepayment penalties

- other key details

Your lender must tell you how they calculate your prepayment penalty. Your lender must also tell you what factors they use to determine the penalty. These details must be clear, simple and not misleading.

Read your mortgage contract carefully. Make sure you understand the details about penalties before you sign your contract. Ask questions about anything you dont understand.

You May Like: How 10 Year Treasury Affect Mortgage Rates

How Does The Risk

Unlike governments, individuals dont have the power to tax people and/or print money. They have to earn money before they can pay back what they owe to someone else.

And that ability to earn is different for different individuals, based on their skills, education, income, assets liabilities and many other factors. Not only that, that ability can also change over time. People who have a good job today may not continue to have that forever.

As a result, the lender always runs some risk of the individual not being able to pay back the loan in full. If an individual defaults on his loan payment, the lender runs the risk of losing his money.

What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

Also Check: How To Purchase A House That Has A Reverse Mortgage

Break Your Mortgage Contract To Change Lenders

You may decide to renegotiate your mortgage contract and change lenders because another lender offers you a lower interest rate. In this case, you may need to pay a prepayment penalty to break your mortgage contract. Make sure the benefits of breaking your mortgage contract will save you money once you include all the fees.

What Is Mortgage Insurance

Mortgages with adown paymentof less than 20% are required to be insured due to the higher level of risk that they carry. This insurance protects the mortgage lender should you default on the mortgage. Mortgage default insurance does not protect you or help you cover mortgage payments.

The largest provider of mortgage loan insurance in Canada is the Canada Mortgage and Housing Corporation , which is owned by the Government of Canada. Some mortgage lenders allow you to go through a private mortgage insurer instead, such as Canada Guaranty or Sagen.

You May Like: What Mortgage Can You Afford Based On Salary

How Do Those Factors Translate Into Mortgage Rate

The lower the DTI, the lower the risk for the investor and lower the mortgage rate hell ask you to pay.

Same applies for LTV. If your loan amount is small compared to the value of the home, the lenders risk is lowered and youll get a better rate.

Higher FICO scores lead to the same outcome. You have demonstrated a good history of paying back your debt. The lender will see you as less risk and offer you a lower rate.

Remember, a lower DTI, a lower LTV and a higher FICO score will get you the lowest rate. That is what you have to aim for.

What You Need To Qualify For A 15

The primary difference between qualifying for a 15-year versus a 30-year mortgage is that for the former, your lender has to make sure you can afford larger monthly payments, and usually that means having a higher income and a lower debt-to-income ratio.

If your DTI ratio is on the higher side, you can work to increase your income or pay down your debt. Some ways you can pay down debt include:

Recommended Reading: How Much Money Should You Spend On Mortgage

About Interest Only Mortgages

If you repay all or part of your mortgage on an interest only basis, your monthly payments only pay the interest due and donât go towards reducing the amount you borrowed. So itâs important you have plans in place and regularly check theyâre on track to repay the full amount by the end date of the mortgage.

Cardinal Financial Company Best For Low

Cardinal Financial Company, which also does business as Sebonic Financial, makes mortgages in all 50 states, including both fixed- and adjustable-rate loans ranging from 10- to 30-year terms.

Strengths: Cardinal Financial has closed loans in as few as seven days , and can accept credit scores as low as 620 for a conventional loan, 580 for an FHA or USDA loan, 550 for a VA loan and 660 for a jumbo loan. This can be ideal if your credit needs some work.

Weaknesses: If youre hoping to compare Cardinal Financials 15-year mortgage rates with those of other lenders, youll have to contact the lender directly this information isnt listed on its website.

You May Like: What Score Do Mortgage Companies Use

My Mortgage Payment Plan

This line graph shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.

Find out how much you can save by changing your payment frequency.

This table shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.| Amortization |

|---|

* These calculations are based on the information you provide they are approximate and for information purposes only. Actual payment amounts may differ and will be determined at the time of your application. Please do not rely on this calculator results when making financial decisions please visit your branch or speak to a mortgage specialist. Calculation assumes a fixed mortgage rate. Actual mortgage rates may fluctuate and are subject to change at any time without notice. The maximum amortization for a default insured mortgage is 25 years.

** Creditor Insurance for CIBC Mortgage Loans, underwritten by The Canada Life Assurance Company , can help pay off, reduce your balance or cover your payments, should the unexpected occur. Choose insurance that meets your needs for your CIBC Mortgage Loan to help financially protect against disability, job loss or in the event of your death.

How Much Are Prepayment Penalties

When you agree to a particular mortgage term, your are signing a contract for that amount of time, generally between 1 and 10 years. If you break your mortgage before that term is over, you’ll be charged a prepayment penalty, as a way to compensate the mortgage provider. How much this can cost varies wildly based on the type of mortgage you have, the time remaining on your term, as well as your mortgage provider – each lender has a different way to calculate prepayment penalties.

The exact prepayment penalty calculation that applies to you will be laid out in your contract, but there are two methods used, outlined below.

Recommended Reading: Does Rocket Mortgage Affect Your Credit Score

Estimate How Much House You Can Afford

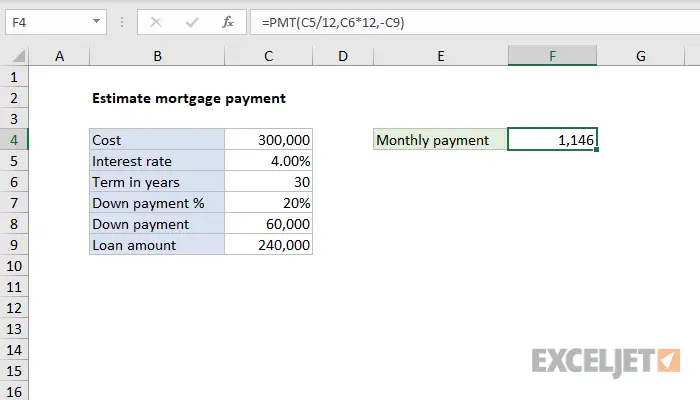

To help you get started, you can use our calculator on top to estimate the home price, closing costs, and monthly mortgage payments you can afford based on your annual income. For our example, lets suppose you have an annual income of $68,000. Youre looking to get a 30-year fixed-rate loan at 3.25% APR. For your down payment and closing costs, youve saved $55,000. See the results below.

- Annual income: $68,000

| Total Monthly Mortgage Payment | $1,587 |

Based on the table, if you have an annual income of $68,000, you can purchase a house worth $305,193. You may qualify for a loan amount of $252,720, and your total monthly mortgage payment will be $1,587. Since your cash on hand is $55,000, thats less than 20% of the homes price. This means you have to pay for private mortgage insurance . Take note: This is just a rough estimate. The actual loan amount you may qualify for may be lower or higher, depending on your lenders evaluation.

The following table breaks down your total monthly mortgage payments:

| Monthly Payment Breakdown | |

|---|---|

| Total Monthly Mortgage Payment | $1,587 |

According to the table, your principal and interest payment is $1,099.85. When we add property taxes and home insurance, your total monthly mortgage payment will be $1,481.34. But because you must pay PMI, it adds $105.30 to your monthly payment, which results in a total of $1,587 every month.

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5/1 ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

Read Also: How To Get Assistance With Mortgage Payments

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

Paying Your Mortgage Weekly Vs Monthly

There isn’t a large difference between paying your mortgage weekly or monthly, if we’re looking at non-accelerated weekly payments. That’s because the total amount paid per year is the exact same for both payment frequencies. You’ll just pay a smaller amount with a weekly payment, but you’ll be making more frequent payments. The real difference is when you choose accelerated weekly payments. Accelerated payments can shave years off of your amortization, and can save you thousands of dollars.

Don’t Miss: Are Home Mortgage Rates Going Down

What Are The Reasons For Breaking A Mortgage

Some scenarios:

- The current interest rate on your mortgage is 4.2% and you have 2-years left on your 5-year fixed rate before you have to renew. You do some research and your bank is currently offering 3.1% on a 5-year fixed rate. Because of current events, you suspect that you won’t be able to get this low rate a few years from now. You do the math and it looks like you’ll save more money in the long run if you switch now.

- You have a variable rate mortgage and you notice the rates are as low as you have ever seen them. So to lock in this new low rate you decide to switch to a fixed rate mortgage.

- You have come into a large sum of money and want to use it to pay off $200,000 of your mortgage principal but can’t because this amount is much higher than what is allowed in your mortgage contract. Thus, you must break your mortgage agreement to proceed.

- You cannot afford your current mortgage monthly payments. The solution would be to get a new mortgage with a longer amortization period so the monthly payments are reduced.

- You have a accumulated a significant amount of credit card debt that is accruing interest at a rate of 19.99%. Your financial advisor strongly suggests consolidating your high interest credit card debt into your mortgage by taking equity out your home and refinancing.