About Our Data Source For This Tool

The lenders in our data include a mix of large banks, regional banks, and credit unions. The data is updated semiweekly every Wednesday and Friday at 7 a.m. In the event of a holiday, data will be refreshed on the next available business day.

The data is provided by Informa Research Services, Inc., Calabasas, CA. www.informars.com. Informa collects the data directly from lenders and every effort is made to collect the most accurate data possible, but they cannot guarantee the datas accuracy.

Where To Go For A Mortgage

Shop around! Your local banks and credit unions will almost all have mortgage loans available and you may be surprised just how much the rates and associated costs and fees may differ. You can also do a fair amount of comparison shopping onlineand even apply for a pre-approval online from certain lenders.

All Comments

How Are Mortgage Rates Impacting Home Sales

The number of mortgage loan applications decreased 3.3% during the week ending October 29, according to MBA. Applications for purchase loans and refinance loans both declined.

- The number of purchase applications was down 3% from the previous week. Compared to the same week last year there was a 9% decrease.

- Refinancing applications were down 4% week-over-week. Its the sixth straight week where the pace of refi applications has slowed. Year-over-year, there were 33% fewer applications.

Purchase activity continues to be held back by high prices and low for-sale inventory, but current application levels still point to healthy housing demand. MBA is forecasting for a record $1.6 billion in purchase mortgage originations this year, and sustained demand leading to another record year in 2022, said Joel Kan, MBAs associate vice president of economic and industry forecasting in a statement.

Read Also: Should I Have A Mortgage

Mortgage Interest Rates For Homebuyers Continue To Trend Downward Today

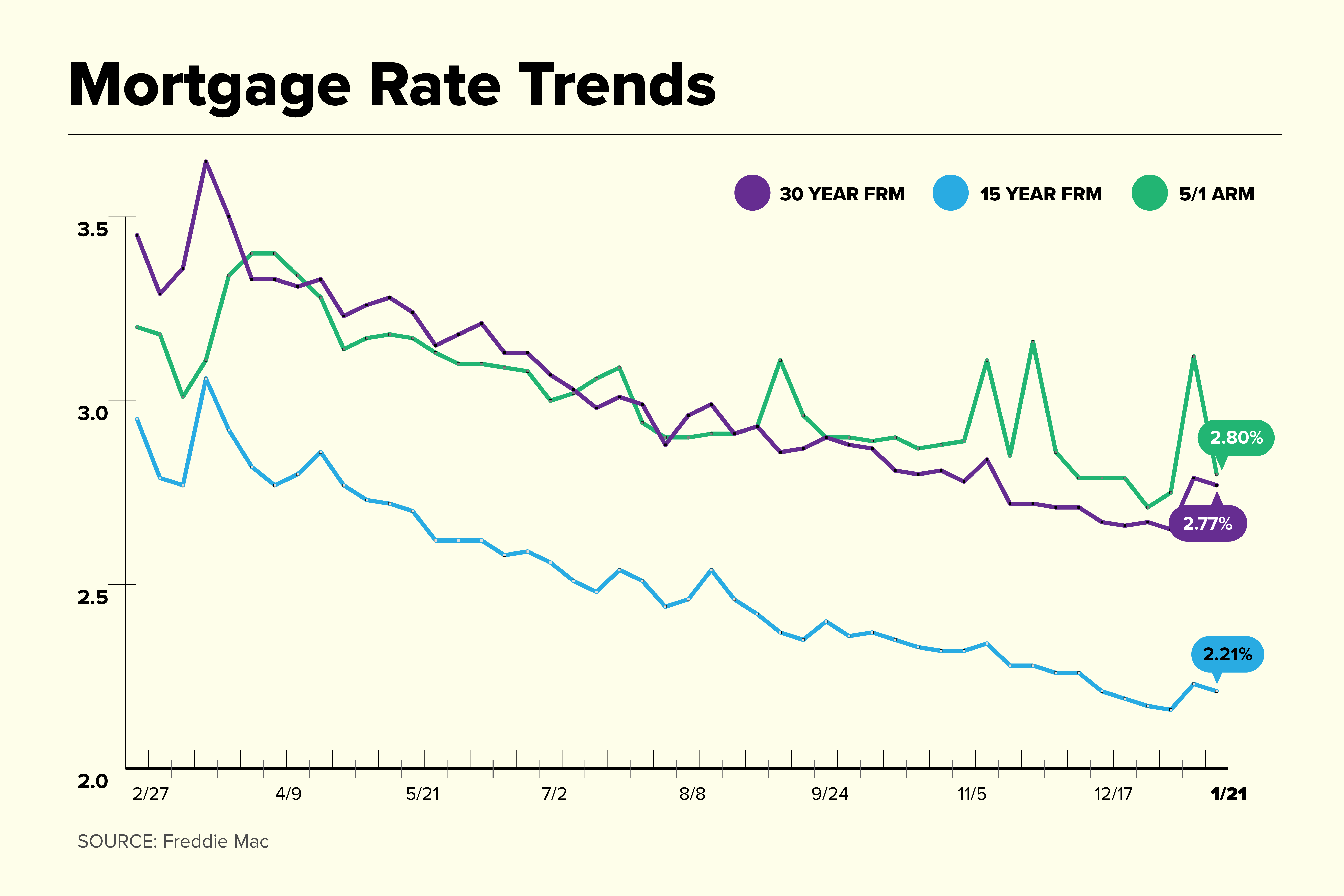

A variety of important mortgage rates decreased today, including the average interest rates for 15-year fixed and 30-year fixed mortgages. We also saw a cut in the average rate of 5/1 adjustable-rate mortgages. Mortgage interest rates are never set in stone, but interest rates are at historic lows. For those looking to secure a fixed rate, now is an ideal time to buy a home. Before you purchase a house, remember to take into account your personal needs and financial situation, and compare offers from various lenders to find the right one for you.

Comparing Current Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youâll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whoâs suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you donât have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wonât show up on your credit report as itâs usually counted as one query.

Finally, when youâre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

Don’t Miss: Do Any Mortgage Lenders Use Fico Score 8

Here We Will Take A Close Look At Where Rates Are Likely Headed And How You Can Benefit From These Analysis

As we settle in to 2021, in a brutal era of COVID, the housing market in Ontario continues to strengthen mainly due to historically low and economically stimulating mortgage interest rates. To this extent, many leading economic thinkers are equating the availability of such low-interest rates to a sort of borderline free money phenomenon. In addition to low rates, a rebounding job market and a lower supply of homes available for sale in Canada and Ontario continue to provide upside pricing pressure.

This strength can be seen across the province in GTA where most regions are showing accelerating growth and substantial month over month increases in value and in other areas across Ontario such as Waterloo Region, Barrie and Ottawa where all-time housing price records are seen.

As we look ahead into 2021, 2022, and even 2023 we can a continuation of this driven by dynamic economic stimulation, that overall point to an era not a trend but an era of low mortgage rates. Specifically, we can see the prime rate in Canada remaining at low levels of .25% until 2023, but as importantly, mortgage rate trends show fixed rates within a 0.25% 0.40% bandwidth of late 2020 rates.

In other words, the lowest mortgage rates offered today are in the 1.49% range for 5 year fixed rates, and should not exceed 2.00% for the best mortgage rates as we move into 2021 and 2022.

Here we will expand on these ideas and others, concerning this era of ULTRA low-interest rates.

Get Started

How Can I Calculate How Much My Ontario Mortgage Payments Would Be

Our Ontario Mortgage Payment Calculator will help you figure out how much youll pay with any rate you find on the site. It only takes a few minutes to use, so give it a try. You can modify the mortgage amount, mortgage term and type, amortization and payment type to see how your mortgage options and payment amount are impacted.

You May Like: How Much Income For A 250k Mortgage

Tips On Finding The Best Toronto Mortgage Rates

Just like any other city, getting the lowest mortgage rates in Toronto requires comparison shopping. One cannot rely on just one lender or one mortgage broker if they want to get the best deal.

The right place to start is with a good mortgage rate aggregator . That way, you see a large representation of the mortgage market, all at once. Its especially important to focus on rate sites that show all top lenders. Unlike rates.ca, most others dont.

If youre looking for a good roadmap to finding deals, heres a simple four-step process to securing the mortgage with the lowest borrowing costs:

1. Get solid advice on the right mortgage term given your five-year plan

- The term you pick has a huge effect on your interest costs

- You can get this advice online or in-person

- It never hurts to talk to an experienced mortgage advisor, but dont put too much weight in their opinions because some bankers and brokers have a bias to one term

2. Identify the lowest rates for that term

- You can easily do this on a rate comparison website

- Read the rate notes carefully because some of the cheapest rates come with lots of fine print and restrictions

3. Ask them to list all material features and limitations of the rate in question

- Things like the prepayment penalty calculation method, porting rules and refinance options can enormously impact your borrowing costs

- Pick the mortgage with the best combination of upfront interest savings and after-closing flexibility

Today’s Mortgage Rates For Nov 19 : Rates Tick Down For Homebuyers

Here’s what declining rates means for you if you’re in the market for a home loan.

A few important mortgage rates slid today, including average interest rates for both 15- and 30-year fixed mortgages. The 5/1 adjustable-rate mortgage — a variable rate — also trended down. Mortgage interest rates are never set in stone, but interest rates are at historic lows. If you plan to buy a home, now might be a good time to lock in a rate that works for you. But as always, make sure to first take into account your personal goals and circumstances before buying a house, and shop around to find a lender who can best meet your needs.

You May Like: What Is Congress Mortgage Stimulus Program

A Drop In Commissions Revenue For Those In The Industry

As a result in declining originations, Fannie Mae expects commissions to decline as well. This seems reasonable, given the decline in origination activity projected to be within 10% and 25% between the two major government-sponsored entities.

A reduction in commissions would be due in large part to decreased refinancings, and will hurt those companies that saw a boom in revenue and net income in the past year. At the very least, investors in some of the biggest mortgage finance lenders — like Mr. Cooper Group, PennyMac Financial Services, and Rocket — could expect to see a slowdown in revenue and income growth when compared with 2020’s growth.

You Can Do Better Than The Average

The average national rates, however are just an average. You can do better by shopping around. The average rate for mortgages clicked on by Bankrate readers Tuesday was 2.62 percent, up from 2.47 percent the previous Tuesday.

This clicked-on rate reflects purchase mortgages and refinances with all terms, including 30-year and 15-year loans. The rates may include discount points.

The sweetest deals come with caveats. For instance, to score the best combination of rate and costs, youll generally need a credit score of 740 or higher and a down payment of 20 percent or more. And many of the lowest rates posted on Bankrate.com include discount points, a way of buying down the rate by paying more at closing.

Also Check: Should I Refinance My Mortgage To Pay Off Debt

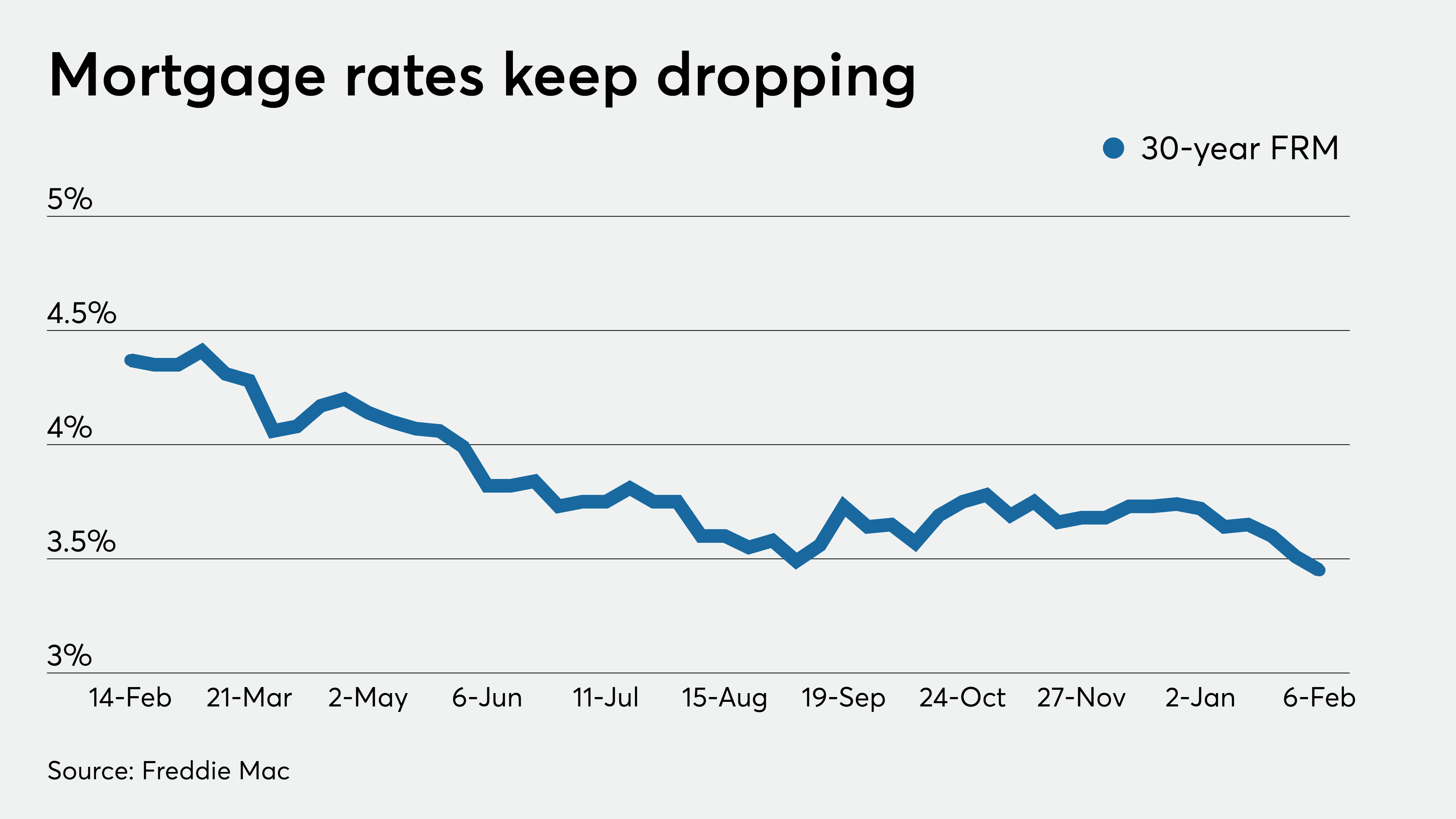

Mortgage Rate Forecast For July 2021

Rates have remained enticingly low throughout the first half of 2021 lower than many experts predicted six months ago. And the outlook for July doesnt call for a radical rate leap, either.But several factors are in play that can easily result in you paying at least slightly more for a purchase or refinance home loan in the coming weeks or months. Thats the consensus opinion among the group of industry pros Bankrate recently polled, who envision mortgage rates edging marginally higher at worst or standing pat over the next month.

Over the next month, rates may rise a bit but will likely be pretty close to where they are today around 3 percent for the 30-year fixed-rate mortgage, says Leonard Kiefer, deputy chief economist for Freddie Mac in McLean, Virginia. While inflation has ticked higher in recent months, many analysts consider much of the increase in consumer prices to be transitory. Thus, even with higher inflation rates, mortgage rates have held pretty steady. Id expect these near historically low mortgage rates to stay through at least early summer.

Learn more about specific loan type rates| Loan Type |

|---|

How To Compare Toronto Mortgage Rates From Top Lenders

Rates.ca makes it easy to find your best mortgage rate from leading lenders and mortgage brokers in the Toronto area. Simply enter your mortgage requirements and youll instantly see an array of rates meeting that criteria.

From there, focus carefully on the features and restrictions of each rate. The mortgage with the lowest borrowing cost is the one with an optimal combination of upfront interest savings, flexibility, low fees and low prepayment charges.

And dont dismiss a lender or broker whos located outside of Toronto. Ontario brokers outside of the city often have better deals. Moreover, mortgages can now be closed electronically, regardless of where your mortgage provider is located.

Don’t Miss: Who Is The Trustee In A Mortgage Loan

Summary Of Current Mortgage Rates

Current mortgage rates decline this week. The average rate for a 30-year mortgage moved down to 3.09%, while the rate for a 15-year fixed-rate loan and a 5/1 adjustable-rate mortgage saw lower rates as well.

Mortgage rates were higher for all loan categories this week:

- The current rate for a 30-year fixed-rate mortgage is 3.09% with 0.7 points paid, a of 0.05 percentage points from last week. A year ago, the 30-year rate averaged 2.78%.

- The current rate for a 15-year fixed-rate mortgage is 2.35% with 0.6 points paid, down 0.02 percentage points week-over-week and 0.03 percentage points lower than the same week last year.

- The current rate on a 5/1 adjustable-rate mortgage is 2.54% with 0.3 points paid, ticking down 0.02 percentage points from last weeks rate. A year ago, the 5-year ARM rate averaged 2.89%.

© Copyright 2021 Ad Practitioners, LLC. All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author’s alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Moneys full disclaimer.

How Does Payment Frequency Affect My Mortgage Payments

More frequent mortgage payments means that each mortgage payment will be smaller. However, mortgage payments do not scale linearly. For example, a bi-weekly mortgage payment amount is not exactly half of amonthly mortgage payment amount. Instead, bi-weekly payments are slightly less than half of a monthly payment.

For example, for a $500,000 mortgage with a 25-year amortization and a mortgage rate of 2%, a monthly payment would be $2,117, while a bi-weekly payment would be $977.

A bi-weekly payment of $977 is equivalent to paying $1,954 per month, but choosing a mortgage with a monthly payment frequency will require a monthly payment of $2,117. Thats because with bi-weekly payments, youll be making 26 bi-weekly payments per year. That is equivalent to 13 months of mortgage payments per year, accelerating your payment schedule. Your more frequent payments will also reduce your mortgage principal faster, allowing you to save on interest and pay down more off your principal with each payment.

For example, 12 months of $2,117 monthly payments will result in roughly $25,400 being paid in a year.

26 bi-weekly payments of $977 will result in roughly $25,400 being paid in a year. The total amount paid per year is the same.

The table below compares monthly payments, bi-weekly payments, and weekly payments for a mortgages total cost of interest for a 25-year amortization at a 2% mortgage rate.

Recommended Reading: What Do Mortgage Rates Follow

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether its the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider refinancing if your current mortgage rate exceeds todays mortgage rates by 0.75 percentage points. It doesnt make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings. You also have to consider whether your credit score would qualify you for todays best refinance rates.

Many online lenders can give you free rate quotes to help you decide whether the money youd save in interest charges justifies the cost of a new loan. Try to get a quote with a soft credit check which wont hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time and youd pay off your house sooner.

What Is A Good Loan Term

One important thing you should consider when choosing a mortgage is the loan term, or payment schedule. The most common loan terms are 15 years and 30 years, although 10-, 20- and 40-year mortgages also exist. Another important distinction is between fixed-rate and adjustable-rate mortgages. The interest rates in a fixed-rate mortgage are stable for the duration of the loan. Unlike a fixed-rate mortgage, the interest rates for an adjustable-rate mortgage are only fixed for a certain amount of time . After that, the rate fluctuates annually based on the market rate.

When choosing between a fixed-rate and adjustable-rate mortgage, you should take into consideration the length of time you plan to stay in your house. For those who plan on staying long-term in a new house, fixed-rate mortgages may be the better option. Fixed-rate mortgages offer more stability over time in comparison to adjustable-rate mortgages, but adjustable-rate mortgages might offer lower interest rates upfront. However you may get a better deal with an adjustable-rate mortgage if you’re only planning to keep your home for a few years. There is no best loan term as a rule of thumb it all depends on your goals and your current financial situation. Be sure to do your research and think about your own priorities when choosing a mortgage.

You May Like: What Is Tip In Mortgage

What Is A Good Interest Rate On A Mortgage

Todays mortgage rates are near historic lows. Freddie Macs average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs.

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and the loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. Its estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didnt get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Recommended Reading: How To Pay Off Your Mortgage Quickly