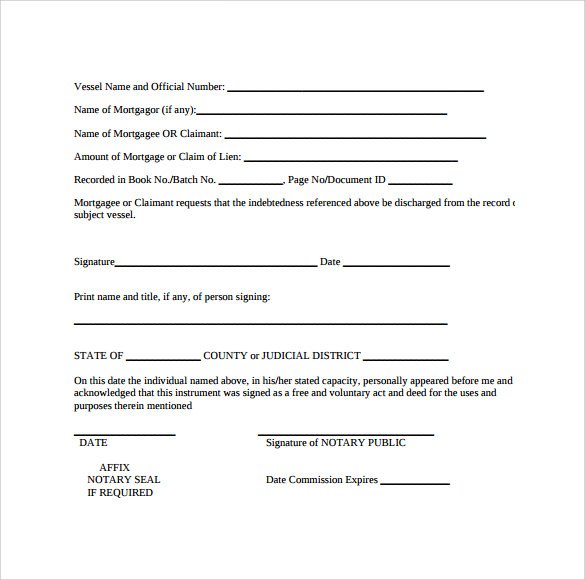

What Is Satisfaction Of Mortgage

A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property. This means the borrower has completely repaid their loan to the lender as agreed upon .

Do I Need Witness Signatures Or A Notary

This depends on your local requirements, but it wouldn’t hurt to go ahead and gather two witness signatures and a notarization. Often you can obtain notary services through your bank or credit union. You’ll need to bring a valid ID to the notary office, so they can verify your identification. If the property you need to sign for is in another state, check to see if that state will accept notarization from another state or use a service that can provide notarization for any state.

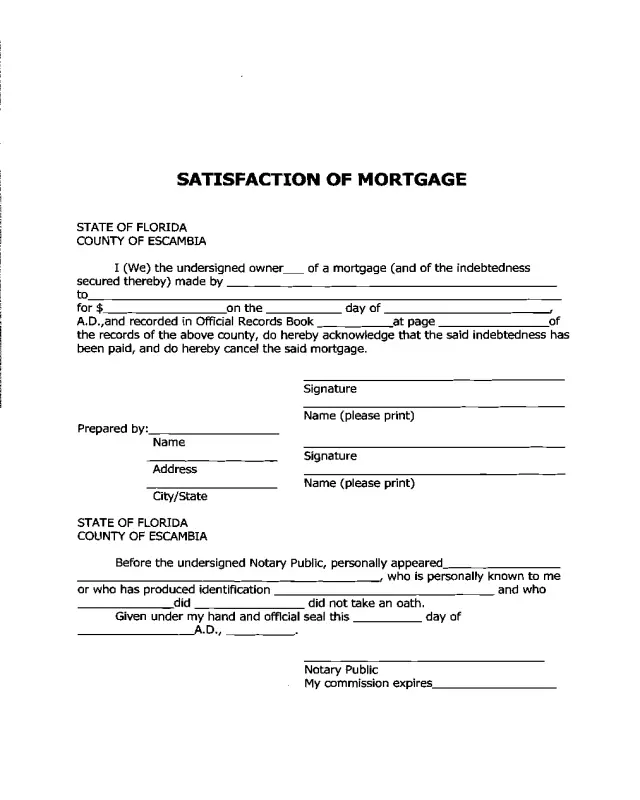

What Happens When You Pay Off Your Mortgage In Florida

Florida is a lien theory state which means a mortgage or deed of trust will create a lien on the title of the property being mortgaged while the mortgagor retains the legal and equitable title. When the lien is paid off, the bank executes what is called a satisfaction of mortgage and then they send it to the county. â

Also Check: How Many Times Annual Salary For Mortgage

Failure To Satisfy That Mortgage Can Cause A Hefty Fine

This article was edited and reviewed by FindLaw Attorney Writers

The satisfaction of a mortgage is particularly important to the owners of real property. Satisfaction occurs when a mortgage loan is paid-in-full where the mortgage is not a lien on the property. Upon completion of payment “Satisfaction of Mortgage” refers to the document provided by the mortgage lender indicating that payment-in-full was received.

Many states have laws that regulate the process by which a mortgage lender provides a satisfaction of mortgage intended to prevent damages from arising when lenders fail to present a satisfaction of mortgage document in a timely manner. While these laws may provide an added incentive for mortgage lenders to fulfill their obligations to payees some states have enacted laws that may unfairly punish minor lapses on the part of the mortgage lender.

The fine imposed on the lender for failure to file the satisfaction piece or otherwise mark the recorded mortgage satisfied within 45 days of the request “shall for every offense, forfeit and pay, unto the party or parties aggrieved, any sum not exceeding the mortgage – money … .” .

What do you need to do to avoid this fine?

Thank you for subscribing!

Your Land Title Registry Offices Role

Land title registry offices are part of your provincial or territorial government. These offices register official property titles. They have processes to make changes to a propertys title.

You, your lawyer or your notary must provide your land registry office with all the required documents. Once it receives the documents, your land registry office removes the lenders rights to your property. They update the title of your property to reflect this change.

Don’t Miss: How Much Interest Will I Pay Mortgage Calculator

Common Times To Use Mortgage Satisfaction

There are generally three ways in which a homeowner pays off the mortgage. The first is by making all the monthly payments. The second is by obtaining another loan. The third is by selling the house and using the proceeds of the sale of the home to pay the mortgage. Typically, a title insurance company will require that the homeowners mortgage by paid and satisfied before a clear title can be given to the new homeowner. The mortgage lender for the new buyer of the home will also require that there be a mortgage satisfaction.

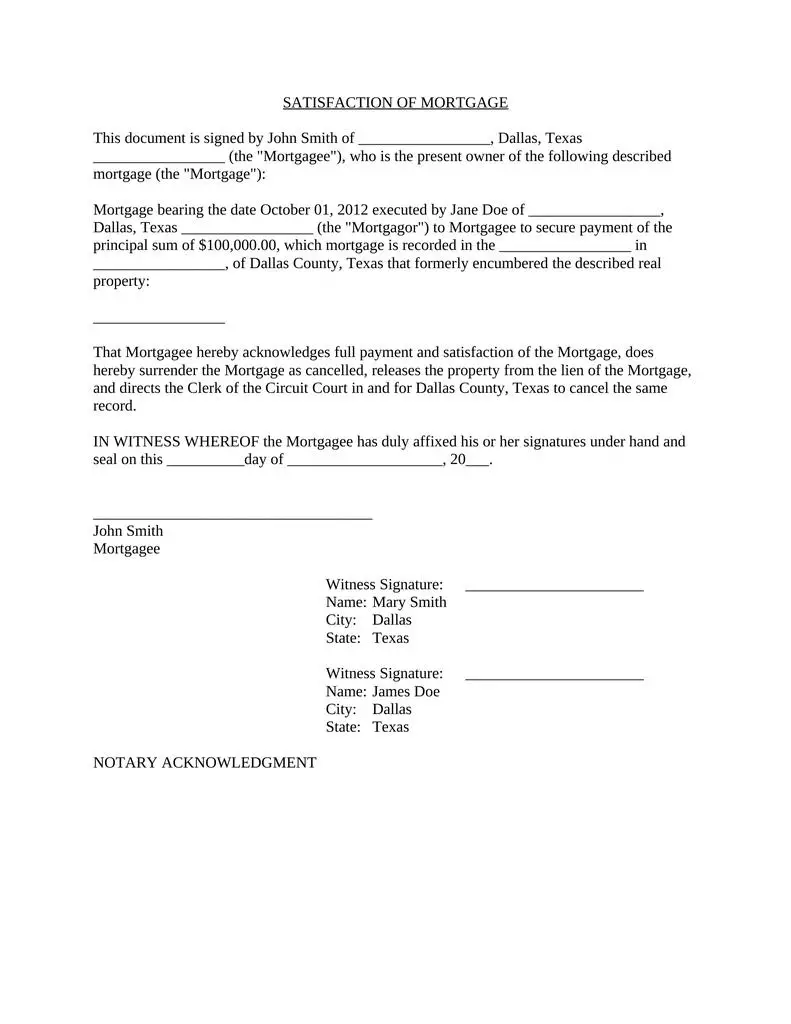

Preparation Of The Satisfaction Of Mortgages

You can get your satisfaction of your mortgage signed and notarized in one place with the help of our lender!

Lenders will be responsible for filing the appropriate documents with the proper authority.

Additionally, suppose you found out your loan was sold to a servicer after it originated, depending on the lender you work with. In that case, you might have to pay a nominal fee for processing the satisfaction of the mortgage.

Don’t Miss: Does Pre Approval For Mortgage Affect Credit

How Do I Look Up A Deed In Florida

Perform a Deed Search and Get a Copy of Your Deed For Free!

Each Florida County has a free search engine for public records. Below you can find links to each county’s search engine. There are many ways to look up the deed on the county’s website. You can search by âNameâ of Grantor or Grantee. â

Considerations For Satisfaction Of Mortgage

The borrower is not personally responsible for creating the satisfaction of mortgage documents and submitting it with the appropriate agency. Additionally, they should still follow the process closely to ensure that all steps have been completed on time.

A specific timeframe for the completion of documents is allowable in some states. This process can work to your advantage in ensuring that your process occurs promptly.

If you think the process for mortgage satisfaction has been completed, make sure it is. You need to know that if one isnt filed with the appropriate agency.

The loan could continue to show a lien even after youre done repaying it, thus an inconvenience to you.

Read Also: What Is A Mortgage Rate Lock

How A Satisfaction Of Mortgage Works

Lending institutions are responsible for preparing and filing the satisfaction of mortgage documents. Procedures surrounding satisfaction of mortgage documents and their filing are governed by individual states.

Many financial planners recommend accelerating mortgage payments in order to pay off a mortgage faster. Making the occasional extra mortgage paymentassuming the lender allows it without penaltycan slash months off the mortgage term and save thousands in interest costs. A viable strategy to expedite paying off a mortgage will help homeowners get the coveted satisfaction of mortgage document even sooner.

The satisfaction of mortgage is also useful if the owner wants to pledge the property as collateral for a business or personal loan. Of course, the merits of taking out a loan using the house as collateral, after spending decades paying off the mortgage, should be thoroughly considered before being done.

Exceptions To Discharge Of The Mortgage Debt And Lien

Of course, there are times when bad things happen. Sometimes, a Satisfaction of Mortgage in the public records does not remove the banks lien against the chain of title.

1. Mistakes, Accidents, or Fraud

Mistakes can be made, for instance. If a borrower gets a notice in the mail from the bank that there has been a Satisfaction of Mortgage filed in the real property records, but there is still a balance due on the home loan, then its obvious that an error has been made.

Under longstanding Florida law, the borrower doesnt get a windfall here. The bank will be able to fix that mistake in the public records.

Its true that cancellation and discharge of a Florida mortgage in the formal county records is considered an absolute bar to collecting any more money from the borrower as well as an extinguishment of the mortgage. However, if there has been a mistake, or an accident, or some kind of fraud, then Florida courts have held this general rule will not apply. Biggs v. Smith, 134 Fla. 569, 184 So. 106 .

2. Foreclosure Judgment

Another big exception to the Satisfaction of Mortgage law happens when the lender forecloses on the property. If the borrower stops paying on the home loan, then the bank can file a lawsuit to foreclose on the home or condo.

Once the foreclosure lawsuit ends, if the bank wins, then it gets a judgment of foreclosure signed by the judge. That allows the lender to sell the home or condo in order to get money to pay off that unpaid mortgage balance.

Also Check: Can I Have A Co Signer On A Mortgage

Does A Mortgage Have To Be Recorded In Florida

§695.01 requires that any mortgage must be ârecorded according to lawâ in order for the mortgage to âbe good and effectual in law or equity against creditors or subsequent purchasers for a valuable consideration and without noticeâ¦.â Consequently, recording is required to protect a lien from innocent third parties â

Failing To File A Satisfaction Of Mortgage The Afterthought That Can Haunt Your Property

Following the acquisition or financing of a property, most parties to the transaction are happy to circulate the Congratulations! missives as soon as the closing has occurred the seller has their proceeds, the buyer/borrower has their property and/or the loan funds, and the prior financing have been paid off but the champagne corks shouldnt be popped quite yet. There is one crucial post-closing item that too often gets overlooked and, if not addressed, can cause headaches rivaling a hangover down the line recording the satisfaction or discharge of mortgage.

While it is the lenders burden to prepare and arrange for the filing of the document that evidences the mortgage satisfaction , it is the property owner who ends up feeling the pain if that fails to happen, particularly when it cant obtain clear title when it seeks to refinance or sell the property. And in many circumstances it can be costly and time consuming, even causing delays in closing, to chase the necessary discharge documents and get them on record in order to clear title. To avoid these issues it is good practice to ensure the mortgage satisfaction is timely recorded and, luckily, state legislatures have provided incentives for lenders to do just that

You May Like: Can You Add A Name To A Mortgage

What Is A Satisfaction Of Deed

A Satisfaction of Mortgage is a document signed by a mortgagee acknowledging that a mortgage has been fully paid and that the mortgage is no longer a lien on the property. In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds.

Deeds Of Trust Versus Mortgages

In some states, the mortgage agreement is replaced by a deed of trust. This legal document is similar to a mortgage in one important way: it secures a loan by placing a lien on a piece of property. Unlike a mortgage agreement between a borrower and a lender, the deed of trust agreement involves a borrower, a lender and an independent third party known as a trustee. The trustee holds the deed on the property and has the power to sell the property at public auction if the borrower defaults on the loan. Unlike a mortgage foreclosure, which must be processed through the court system, a deed of trust foreclosure can take place without judicial intervention.

The Deed of Reconveyance is the equivalent of the Satisfaction of Mortgage document. It states that the debt defined in the Deed of Trust has been paid and transfers ownership from the trustee back to the borrower. The Deed of Reconveyance should be filed with the correct county agency. Not filing the document promptly after the home loan is paid could result in penalties payable by the property owner.

You May Like: How To Negotiate The Best Mortgage Rate

What Is Satisfaction In Mortgage

A satisfaction of mortgage is a document serving as evidence that youve paid off your mortgage in full, releasing the lien associated with the loan from your property and transferring the title to you. This document typically includes: Borrower and lender contact information. Loan and property information.

The Mortgage Satisfaction Law

When the homeowner is finally able to make the last payment on the mortgage, the lender is required to formally release the mortgage. Releases are not automatic. The county court or county agency that keeps the record of the mortgages needs to be formally notified the debt has been paid.

The law on mortgage satisfactions is outlined in Florida Statute 701.04. The lender must comply with this law within a specific time period typically 60 days from the date of the last or full payment.

- The lender must prepare the mortgage satisfaction. This document identifies the property , the owners, the lenders, and the original amount of the mortgage. It also states that the debt has been paid in full or satisfied.

- The lender must properly record the mortgage satisfaction with the proper county records department. This usually requires also paying a small fee.

- The lender must make clear any liens based on the mortgage are removed.

- The lender must give the borrower notice that mortgage satisfaction has been recorded. The notice gives the borrower the chance to make sure the satisfaction was recorded correctly. An experienced Sebastian or Vero Beach mortgage satisfaction lawyer can verify the mortgage satisfaction process. If the lender failed to follow the law, the borrower has the right to file a lawsuit against the lender to force the filing of a proper mortgage satisfaction.

Once the mortgage is satisfied, you should now be free and clear too:

Don’t Miss: How Much Second Mortgage Can I Afford

Satisfaction Of Mortgage: Why Do You Need It

So youve fully paid for a mortgage and got the satisfaction of the mortgage document. Or maybe you didnt get it at all.

But what is it exactly? What is it used for, and why do you need it?

This article will talk about the importance of this document and why every mortgagor needs to have it. Continue reading to learn more.

How Do I Get The Title To My House In Florida

If the deed is lost or misplaced and the homeowner needs the original document, a property owner can simply request, from the County recorder, a certified copy of the recorded document either in-person or by mail. In most instances, a certified copy has the same legal significance as the original document. â

Recommended Reading: How Much Is Mortgage Tax In Ny

How Long Does It Take To Get A Satisfaction Of Mortgage

In general, it takes 30 days to receive a satisfaction of mortgage, but it can depend on your states laws. In Florida, for example, lenders have 60 days from the time the borrower pays off the mortgage to prepare and record the documentation.

For Sheldons own mortgage, the process took about three weeks.

What Does Release Mortgage Mean

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments. Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

Also Check: How Much Income For Mortgage Calculator

Is Satisfaction Of Mortgage A Deed

A Satisfaction of Mortgage is used to acknowledge the same of a Mortgage agreement. In essence, the Deed of Reconveyance and Satisfaction of Mortgage both serve the same function, which is to show that the borrower has repaid the loan fully and that the lender has no further interest in the property.

Questions To Ask When Obtaining A Mortgage Satisfaction

One of the most frustrating things about working in the title industry is having to reopen a file that has been filed away after closing because an issue arises. This can happen every once in a while when another agent working on a new deal involving a property you previously closed realizes a satisfaction was not properly recorded months or years after your closing.

Worse, it comes up during an underwriter or lender audit that reveals the satisfaction, sometimes called the cancellation, release, or re-conveyance, was never properly recorded. In order to prevent such an issue, release tracking is an important part of post-closing due diligence for every settlement agent to adopt.

Consumers, investors, and regulators are demanding more transparency about the service providers that work with lenders in the real estate, title, and mortgage settlement industries. As a result, organizations like the American Land Title Association have developed guidance to empower title companies and real estate law firms to create documented policies and procedures for Best Practices.

While the best practices put forth by ALTA are completely voluntary, its a valuable guideline to ensure that title companies and real estate law firms are meeting the expectations of lenders, underwriters, and state and federal regulators during audits.

In order to avoid any post-closing mishaps, title agents should follow ALTAs BEST PRACTICE #4:

Also Check: What Is The Mortgage On 1.4 Million

What Is Lost Mortgage Satisfaction

A Satisfaction of Mortgage is a document signed by a mortgagee acknowledging that a mortgage has been fully paid and that the mortgage is no longer a lien on the property. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

How Do I Make A Legally Binding Loan Agreement

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder’s office if you wish, though it’s not legally necessary. It’s sufficient for both parties to keep their own copy, ideally in a safe place.

Also Check: Do Medical Collections Affect Getting A Mortgage

Ready To Buy Your Next Property

Whenever youve fully paid for a mortgage, always remember to request satisfaction of the mortgage document from your lender. Its evidence that youve fully paid off your mortgage.

If you found this article helpful, check out other related topics like:

The Insurance Nerd

Alejandro Rioja aka. “The Insurance Nerd” is a serial entrepreneur who founded Flux Ventures, a holdings company that owns: 1) Flux Chargers, the top rated and best selling power bank in over 90 countries, with a #1 worldwide rank by Mashable, Engadget, and Digital Trends 2) Flux.LA, a software and marketing consulting firm that will get your site at the top of Google 3) Flux Capital, an investment firm and 4) Young Slacker Media, a series of popular websites and a very profitable snapchat channel .Feel free to reach out if you have any questions!