How Long Does Chase Pre

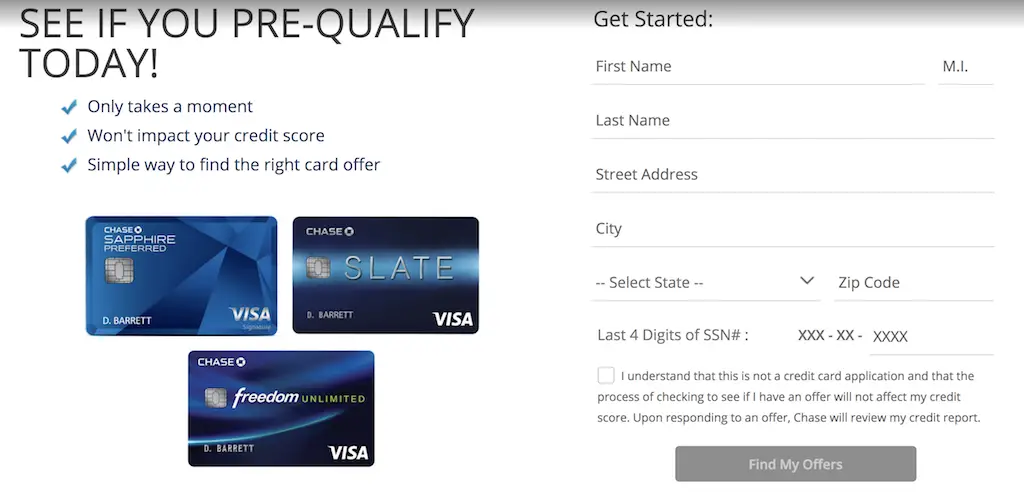

Pre-approval offers come with an expiration date, usually 30 or 60 days in the future. But these expiration dates dont matter too much, since you have to go through a full credit check when you actually apply, anyway.

Usually, there isnt much harm in waiting to apply for a credit card, as long as your credit scores stay about the same. If your pre-qualified offer expires, you can just re-check your status, and you may get the same offer.

But you may want to secure an offer quickly, while you know youre pre-qualified, before anything changes about your credit or the economy at large. This is especially true if you get an offer with better terms, like a bigger introductory bonus.

Insider tip

You can check your pre-qualification status online with other credit card companies too, like American Express, Capital One, Citi, and Bank of America. Many other issuers, including credit unions, send offers by mail but dont always have online pre-approval tools. Checking your status with many issuers may give you a better idea of your approval odds.

My Favorite Chase Credit Cards

I consider these four the best Chase credit cards right now for most people:

- Southwest Rapid Rewards Premier Card a personal best because we live near a big Southwest airport

- Chase Freedom Card a solid 1% cashback card with rotating categories for

- Chase Freedom Unlimited a no-frills cashback card with a new account bonus of $200 after you spend $500 on purchases in your first three months.

More detail on why I like each:

Personally, my favorite is the Southwest Rapid Rewards Premier Card because it helped me get Companion Pass that much easier. Theres a sign-up bonus of 40,000 Rapid Rewards after spending $1,000 plus you earn 1 point per $1 spent, 2 points per $1 spent on Southwest and their partners.

You also get an additional 20,000 points after you spend $12,000 total on purchases in the first year. Thats a total of 60,000 bonus points after $13,000 in spending.

Finally, you get 6,000 points on your anniversary and the annual fee is only $99, reasonable for a travel card.

The best Chase card without an annual fee is definitely the Chase Freedom Flexcard. You can earn a $200 after $500 in purchases in the first 3 months.

The Table Below Represents The Fastest Growing Companies In The Housing Sector:

The Inc. 5000 ranks Americas top private companies by median growth, total revenue and jobs added. To qualify, companies must have generated revenue by March 31, 2017 and made at least $100,000 in revenue that year, have a minimum revenue threshold of $2 million in 2020 and be privately held, based in the U.S. and independently owned. Companies submit their revenue figures, and Inc. asks for verification for 2017 and 2020.

Read Also: Can You Get A Mortgage With 0 Down

What Is A Debt

Your debt-to-income ratio compares your gross monthly income with how much you owe each month . To get this ratio, divide your monthly expenses by your gross monthly income. This number turns into a percentage and becomes your debt-to-income ratio. Lenders typically want the number to be below 43%, but some programs allow it to be higher. Your lender can help you determine your debt-to-income ratio and review which loan programs you may qualify for.

What Documents Are Needed For A Mortgage Preapproval

- Pay stubs from at least the past 30 days Your current income is a major consideration in getting preapproved for a loan, so your lender wants to see that you have a reliable, predictable cash flow coming in.

- Federal income tax returns from the last two years These will help verify your employment history and show the lender a longer-term track record of your income.

- Bank statements from at least the past two months Lenders like to make sure all your money is accounted for, so they want to check your bank statements to see that there arent any major unexplained deposits or withdrawals that could affect your loan.

- Investment account statements Returns on your investments can count as income, and lenders need to know about all your sources of money, not just your day job.

- Documentation related to any gift funds youre receiving If a family member or friend is giving you money to help you buy a home, put together a document signed by them explaining the gift and the amount, and that the gift will not need to be repaid.

- ID (such as a drivers license or passport Lenders need to make sure they know who theyre giving their money to, so theyll want to verify your identity and that youre a U.S. citizen. Foreign nationals can get financing, but its much more complicated.

Read Also: Would I Be Eligible For A Mortgage

What Are The Current Mortgage Rates

Mortgage interest rates are always changing, so it’s important to check current rates and see what you qualify for prior to purchasing a home. It’s also a good idea to get prequalified for a mortgage and lock in that rate so you want be impacted if rates go up. There is a fee for rate locks, and it varies by lender and depends on how long you want to lock the rate. Most rate locks range from 30 to 90 days.

What Kind Of Documentation Is Required

- Your social security card

- W-2 statements and tax returns for the previous two years

- Two months of pay stubs

- Employment verification letter

- Divorce decree along with financial information regarding alimony and other financial settlements

- Documents related to other assets, including retirement accounts

With 10% down, the minimum credit score is 500

Recommended Reading: How To Sell A Mobile Home With A Mortgage

How Chase Mortgages Work

Chase has branches in 32 states and Washington, DC, and it offers loans in all 50 states.

Chase has the following types of home loans:

Chase does not offer USDA mortgages, reverse mortgages, construction loans, or home equity loans.

If you refinance, you can choose between a rate-and-term refinance or cash-out refinance. You may also streamline refinance your FHA or VA mortgage.

No Recent Chase Cards

Theres been speculation that if youve recently opened up new Chase cards within the past few months that your odds of being pre-approved go down significantly. Generally, its said that you should wait until 6 months after your latest Chase card approval before expecting a pre-approval though it could come sooner.

Also Check: How Do You Calculate Points On A Mortgage

There Are Many Different Mortgage Options Available

There are a variety of different mortgage options available to suit all lifestyles and budgets. A 30-year mortgage is the most popular, but your loan term could be as little as 10 years. Most mortgages have a fixed interest rate, which doesn’t change over the life of the loan. However, if you’re willing to accept a degree of risk, you might opt for a mortgage with an adjustable interest rate. These usually have much lower interest rates for a limited amount of time, but the interest rate could become much higher if interest rates rise.

Discuss your lifestyle and budget with your lender to determine which mortgage option works best for you.

How Much Mortgage Can I Afford

You’ll need to take several things into account when determining how much you can comfortably afford. Consider how much you make, your monthly expenses, how much money you have saved, how much you can put towards a down payment, current interest rates and current home values.

You should also think about how much you feel comfortable paying each month for a home. Don’t forget to include other expenses for things like cars, food, gas, groceries, entertainment and clothes. Write everything down and review your budget so you can see how much you bring in versus how much you spend each month. Our Affordability Calculator can help you get an idea of how much you can afford.

Don’t Miss: How Much Per 1000 On Mortgage

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

How To Get Started Mortgage

BURSAHAGA.COM” alt=”Prequalify Home Loan > BURSAHAGA.COM”>

BURSAHAGA.COM” alt=”Prequalify Home Loan > BURSAHAGA.COM”> Consider these tips before you shop for a home or mortgage:

Understand what the bank means by preapproval and other terms, and properly communicate to the seller or seller’s agent the type of approval you have in hand.

Months before you apply for mortgage preapproval, get at least one of your credit reports. This will allow you to troubleshoot any errors in advance of a bank’s review. You are each entitled to a free credit report from each of the three credit reporting agenciesEquifax, Experian, and TransUniononce a year go to AnnualCreditReport.com, the official, federally-authorized site managed by the three agencies. Your spouse or partner should pull his or her reports as well. We recommend staggering requests so you get one of the three every four months. That way, you can be generally on top of problems.

When shopping for mortgages, don’t worry that your credit score will take a hit due to multiple inquiries by mortgage lenders. Normally, multiple inquiries can affect your credit score, but the three credit reporting agencies consider multiple inquiries in a short period of time for the same reasonin this case, mortgage shoppingas if they were one inquiry.

Don’t Miss: Can I Get Cosigner For Mortgage

Mortgage Prequalification Letter: 1 To 3 Days

Before you start house hunting, apply for a prequalification letter from a mortgage lender. This will give you a rough estimate of how much a lender could offer you in a mortgage.

Dont wait on a prequalification letter just because youre not sure which lender to go with yet. Its not a contract between you and a lender, so you can get your prequalification letter from one lender and your mortgage from another.

Getting a prequalification letter takes one to three days, and its surprisingly simple. All you need to do is provide a lender your best guess on your income, credit history, assets, debt, and down payment. The more accurate your response, the more accurate your prequalification will be, but most lenders wont require any documentation at this phase.

Featured Topics

However, when youre shopping for a home, its important to know where you stand financially. Look at your credit reports, bank statements, outstanding debts, and credit scores. If you dont know what your credit profile looks like, check Credit.coms free credit report.

Prequalify For Mortgage Online

Results of the mortgage affordability estimate/prequalification are guidelines the estimate isn’t an application for credit and results don’t guarantee loan approval or denial.

Tools and calculators are provided as a courtesy to help you estimate your mortgage needs. Results shown are estimates only. Speak with a Chase Home Lending Advisor for more specific information. Message and data rates may apply from your service provider.

FHA loans require an up-front mortgage insurance premium which may be financed, or paid at closing and monthly premiums will apply.

For the Adjustable-Rate Mortgage product, interest is fixed for a set period of time, and adjusts periodically thereafter. At the end of the fixed-rate period, the interest and payments may increase. The APR may increase after the loan consummation.

All home lending products except IRRRL are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations apply.

Home lending products offered by JPMorgan Chase Bank, N.A.

Chase, JPMorgan, JPMorgan Chase, the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A. JPMorgan Chase Bank, N.A. is a wholly-owned subsidiary of JPMorgan Chase & Co.

You May Like: Can You Add Money To Mortgage For Improvements

Mortgage Payments Must Fit Your Budget

We all have ideas of our dream home, whether its a swimming pool in the backyard or lots of space for relaxing and hosting family and friends. However, these homes may not be in your budget. Before you start looking at houses, you should know what you can realistically afford. As a rule, you shouldn’t spend more than 43% of your income on your monthly debts. Run your numbers through a mortgage calculator before you start looking for a home so you can see what’s in your budget.

Underwriting Requirements For Chase Homeloans

If you have a FICO score of 620 or higher, you should be ableto qualify for a Chase conventional refinance or a home purchase loan with atleast 3% down.

But meeting this credit score guideline doesnt guaranteeyour approval. Another big factor underwriters consider is your debt-to-income ratio .

Chase recommends keeping your DTI below 36%. To calculateyour DTI, add up your total monthly debts including things like personal loans,student loans, and credit card payments. Then dividethat number by your pre-tax monthly income.

For example, if you have $1,800 in regular debt payments andearn $4,000 a month, your DTI would be 40% .

Required documents

Like any lender, Chase will request plenty of supporting documents during the loan originationprocess.Chase will want to see:

- W2s showing employment for the past two years

- The most recent months pay stubs

- Bank and investment statements for the past three months

- A signed contract to purchase aspecific home

Chases online mortgage application lets you upload documentsquickly, but you could also deliver them in person if youre working with aChase loan officer in a local branch.

Read Also: What Are The Interest Rates On A Mortgage

Would You Qualify For A Mortgage From Chase

Chase doesnt have an explicit credit score requirement, but in general, youll need about a 620 FICO score or higher to be considered for a mortgage. Keep in mind that to qualify for the best interest rate, the higher your credit score the better.

Besides your credit score, Chase will consider your income and work history, down payment savings and debt-to-income ratio. For down payment savings, your best bet is to aim for 20% of the home price. That amount helps you get the lowest interest rates, eliminates the need for private mortgage insurance and provides you with 20% equity in your home immediately. Now, if youre applying for the DreaMaker® Mortgage, FHA or a VA loan, you wont need 20%. But in general, putting 20% down is the most favorable route to homeownership.

Your debt-to-income ratio is an important factor during the application process. This percentage helps your mortgage lender understand your ability to pay your monthly loan payments. In general, most lenders look for 36% or less for the most favorable loan terms. For some loans, they can go up to 44% or so, dependant on your full financial situation.

To calculate your DTI, total your monthly debt payments. Debt includes your student loans, credit card payments, auto loans, child support, etc. Next, divide your monthly debt liabilities by your pre-tax monthly income and multiple by 100 to find your percentage.

Buyers And Sellers Need To Know The Difference Early In The Process

Shopping for a mortgage became easier in early October when the Consumer Financial Protection Bureau began mandating that lenders provide a new, simplified disclosure form to help consumers compare home loans. This disclosure is most useful after you’ve found the home you want and need a solid estimate of borrowing costs from a variety of lenders.

But before you get to that stage, you’ll need to prove to a seller that a bank will lend you what you need to close on the deal. To avoid miscommunication snarls, you have to understand the difference among lender guarantees.

Read Also: How Much Mortgage Can I Get With 50k Salary

Chase Mortgage Vs Fairway Independent Mortgage Corporation

Fairway is the better lender if you have a low credit score, or none at all. Chase pulls your credit score to approve you for a mortgage. But Fairway lets you apply with alternative credit data, such as proof that you pay bills on time.

Your choice could also come down to which type of home loan you need. Chase has HELOCs and the Chase DreaMaker mortgage, while Fairway has USDA mortgages, reverse mortgages, and renovation loans.

A Mortgage Preapproval Is A Letter From A Lender Saying That Its Tentatively Willing To Lend You A Certain Amount For A House

Getting preapproved for a mortgage is a crucial first step in the home-buying process. It gives you an idea of how much you can borrow, which will help narrow down your search to houses in your price range. The preapproval process could also uncover potential issues that would prevent you from getting a mortgage, so you can work them out before setting your heart on a house.

A mortgage preapproval lets sellers know you have the borrowing power to back up an offer you make to buy their home, which could make your offer more competitive. It tells real estate agents, who work on commission, that spending time on you could well pay off with a transaction. And it alerts lenders that youre a savvy borrower who may soon be taking out a mortgage loan.

In short, getting preapproved for a mortgage signals that youre serious about buying a home.

Fortunately, getting preapproved is relatively quick and simple. Lets explore what you need to do for a mortgage preapproval and how it can benefit you during the home-buying process.

Don’t Miss: How Much Mortgage Protection Insurance Cost