What The Mortgage Rate Forecast Means For You

Although most experts predict mortgage rates will continue to rise, the growth will likely be modest. Generally speaking, homebuyers will see an increase in their loans interest rate by only a small amount. With so many factors that go into buying a home, mortgage rates shouldnt have a significant impact for most homebuyers.

The good news for homebuyers, is that the housing market is expected to moderate slightly in 2022. Even with a slight cold down in the housing market, it will still heavily favor sellers. Experts predict that home prices will continue to rise in 2022, but at a slower pace than in the past year. And the expectation is that rates will continue to be historically low.

Consider Different Types Of Home Loans

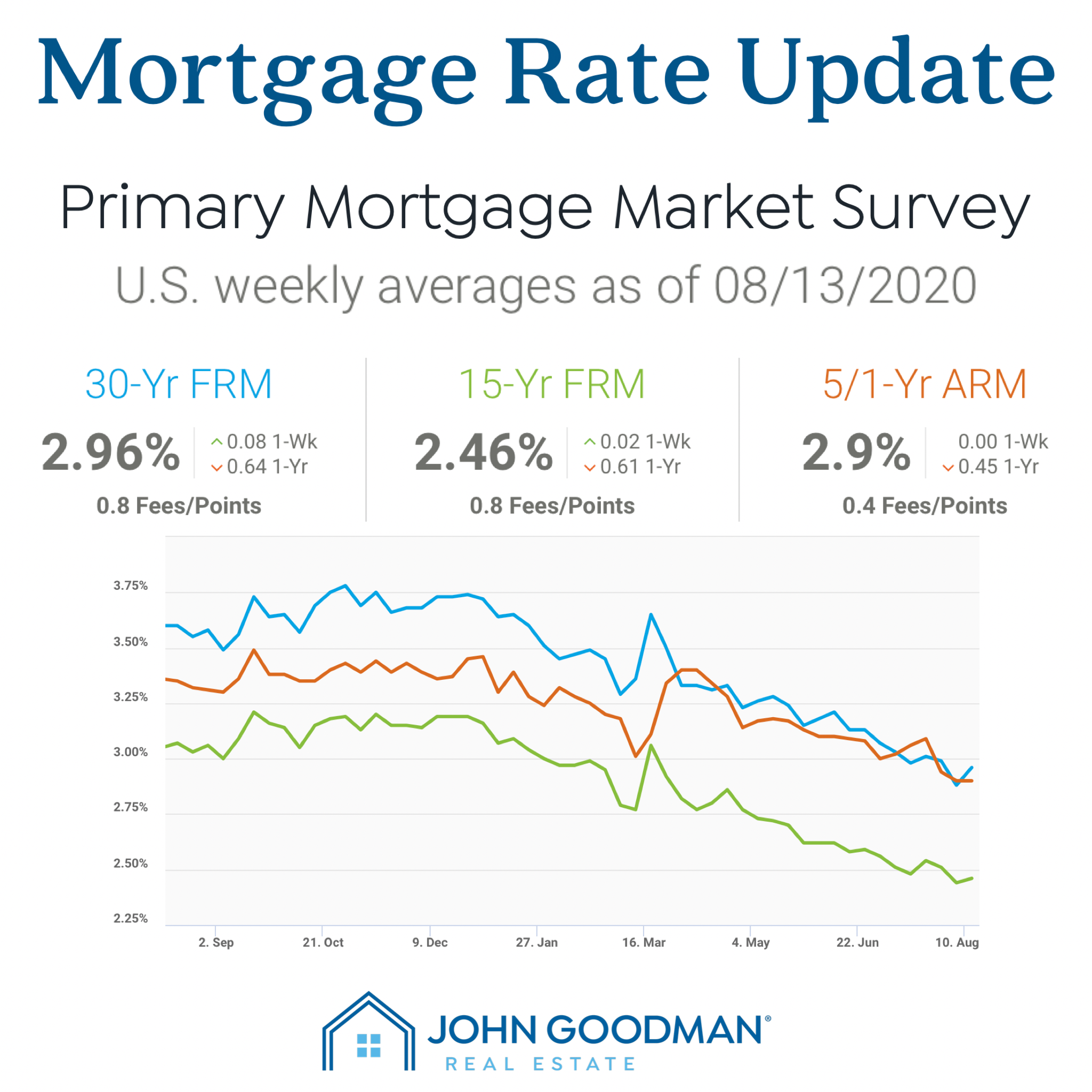

The 30-year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficialdepending on your situation.For example, if you require a lower interest rate, adjustable-rate mortgages offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time . Given that ARM loans are variable, the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. A 15-year fixed rate mortgage, on the other hand, may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed rate mortgage. Consider all your options and choose the home loan that is most comfortable for you.

How Does Our Mortgage Calculator Work

Simply choose from the available options according to the house you would like to purchase:

- Primary home or second home.

- If it is new or resale home.

- The Autonomous Region where it is located.

Next, you will need to enter:

- The cost of the property. Bear in mind that if it is new, you should enter the amount withou VAT in the field “how much does the home cost tax-free?”.

- The amount you would like to borrow.

- How long you would like to repay it over.

Lastly, click on Calculate and the tool will simulate your online mortgage with the different options available so that you can decide which type best meets your needs.

Recommended Reading: How Much Is Mortgage On 1 Million

What Are Todays Mortgage Rates

Low mortgage rates are still available. Connect with a mortgage lender to find out exactly what rate you qualify for.

1Todays mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

Popular Articles

Resources

How Are Mortgage Rates Impacting Home Sales

The total number of mortgage applications inched lower during the week ending December 17, 2021. The 0.6% decline was driven by a decrease in the number of purchase loan applications, according to the Mortgage Bankers Association.

- The total number of purchase loan applications decreased by 6% week-over-week, breaking a five-week run of increases. Compared to the same week last year, there were 9% fewer applications.

- Refinance applications, on the other hand, increased by 2% from the week prior but were 42% lower year-over-year. Refis made up a little over 65% of all applications.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

How Mortgage Payments Are Calculated

With most mortgages, you pay back a portion of the amount you borrowed plus interest every month. Your lender will use an amortization formula to create a payment schedule that breaks down each payment into principal and interest.

If you make payments according to the loan’s amortization schedule, the loan will be fully paid off by the end of its set term, such as 30 years. If the mortgage is a fixed-rate loan, each payment will be an equal dollar amount. If the mortgage is an adjustable-rate loan, the payment will change periodically as the interest rate on the loan changes.

The term, or length, of your loan, also determines how much youll pay each month. The longer the term, the lower your monthly payments will typically be. The tradeoff is that the longer you take to pay off your mortgage, the higher the overall purchase cost for your home will be because youll be paying interest for a longer period.

How To Get The Best Mortgage Rate

Mortgage rates change daily and can vary widely depending on a variety of factors, including the borrower’s personal situation. The difference in mortgage rates can mean spending tens of thousands of dollars more in interest over the life of the loan. Here are some tactics to help you find the best mortgage rate for your new home loan:

Don’t Miss: Who Is Rocket Mortgage Owned By

How To Get A Good Mortgage Interest Rate

Rates vary by lender, so its always important to shop around for the mortgage lender that’s offering the best terms. Each lender has its own overhead and operating costs and has to charge differently in order to make a profit.

In addition to market and economic factors, the rate youre offered depends largely on your own financial situation. A lender will consider:

- Your repayment history and any collections, bankruptcies, or other financial events

- Your income and employment history

- Your level of existing debt

- Your cash reserves and assets

- The size of your down payment

- Property location

- Loan type, term, and amount

The riskier you are as a borrower and the more money you borrow, the higher your rate will be.

You can apply for a mortgage to several lenders at once, or you can go to a mortgage broker who will do the shopping for you to make sure you’re getting the best rate. Brokers can often find lower rates thanks to their industry connections and access to wholesale pricing.

Regardless of which route you choose, make sure youre comparing the full loan estimateclosing costs includedto accurately see whose pricing is more affordable.

What Is The Difference Between Interest Rate And Apr

Interest rate is a percentage of the total loan balance paid to the lender on a monthly basis . The annual percentage rate, or APR, is the total borrowing cost as a percentage of the loan amount, which includes the interest rate plus any additional fees like discount points and other costs associated with procuring the loan.

You May Like: Can You Refinance A Mortgage Without A Job

What Is A Discount Point

A discount point is a fee you can choose to pay at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score between both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Read Also: Chase Recast Calculator

One More Thing To Consider: The Trade

As you shop for a mortgage, youll see that lenders also offer different interest rates on loans with different points.

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs.

- Points, also known as discount points, lower your interest rate in exchange for an upfront fee. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

- Lender credits might lower your closing costs in exchange for a higher interest rate. You pay a higher interest rate and the lender gives you money to offset your closing costs. When you receive lender credits, you pay less upfront, but you pay more over time with the higher interest rate. Keep in mind that some lenders may also offer lender credits that are unconnected to the interest rate you payfor example, a temporary offer, or to compensate for a problem.

There are three main choices you can make about points and lender credits:

Learn more about evaluating these options to see if points or credits are the right choice based on your goals and financial situation.

What Is A Good Mortgage Interest Rate

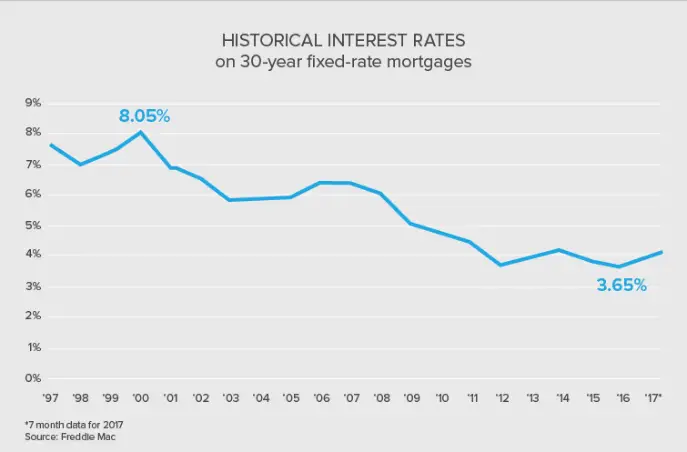

In general, you can consider a good mortgage rate to be the average rate in your state or below. This will vary depending on your credit score better scores tend to get better mortgage rates. Overall, a good mortgage rate will vary from person to person, depending on their financial situation. In 2020, the US saw record-low mortgage rates across the board, and it’s expected they’ll stay low throughout 2021.

You May Like: Rocket Mortgage Launchpad

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

Calculate Your Mortgage Payment

If you cant or dont want to pay cash, mortgage lenders and mortgages will be part of your home buying process. Its important to figure out what youll likely pay each month to see if it fits into your budget.

You can use a mortgage calculator to estimate your monthly mortgage payment based on factors including your interest rate, purchase price and down payment.

To calculate your monthly mortgage payment, heres what youll need:

- Interest rate

- Insurance

- HOA fees

What you can afford depends on a number of factors, including your income, debt, debt-to-income ratio, down payment and credit score.

You also want to consider closing costs, property taxes, insurance costs and ongoing maintenance expenses.

The type of loan you choose can also affect how much house you can afford. When shopping for a loan, think about whether a conventional mortgage, FHA loan, VA loan or USDA loan is best for your particular situation.

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Will My Mortgage Go Up

Only if you have a variable rate mortgage typically a tracker that follows the base rate, or a loan on a lenders standard variable rate. A tracker mortgage will directly follow the base rate the small print of your mortgage will tell you how quickly the rise will be passed on, but next month your payments are likely to increase and the extra cost will fully reflect the base rate rise. On a tracker currently costing 2.1% the interest rate will rise to 2.25%.

On a standard variable rate it is less straightforward these can change at the lenders discretion. Most commentators say there is no reason for banks and building societies not to pass on the full increase, so you should expect a rise. If your lender wanted to, it could increase rates by more. As an example, HSBCs standard variable rate is 3.54% if it passes on the full rise borrowers paying it will move to a rate of 3.69%. On a £150,000 mortgage arranged over 20 years that will mean monthly repayments go up by £11.66.

Most borrowers are, however, on fixed-rate mortgages. Interest rates have been so low in recent years that locking in has been attractive, and since 2019, 96% of new mortgages for owner-occupiers have been taken on fixed rates. In total, 74% of outstanding mortgages are fixed, and these borrowers will not see any immediate impact from the change.

Why Apr Is Important

The APR, or annual percentage rate, is the all-in cost of your loan. It includes your loans interest and finance charges, accounting for interest, fees and time.

Since APR includes both the interest rate and certain fees associated with a home loan, APR can help you understand the total cost of a mortgage if you keep it for the entire term. The APR will usually be higher than the interest rate, but there are exceptions.

Don’t Miss: Rocket Mortgage Qualifications

What Is A Good Mortgage Rate

Mortgage rates change based on economic conditions, so a good mortgage rate now may not be the same as a good mortgage rate one year or five years from now. Published mortgage rates are typically based on an applicant with an excellent credit score, so they may not apply to you if your credit score isn’t high. To find a good mortgage rate for you, get quotes from at least a few lenders so you can compare them and get a sense of what’s available.

What Is Mortgage Interest

Interest is charged by lenders in exchange for allowing you to borrow money. For borrowers, mortgage interest is charged based on your mortgage principal balance. The mortgage interest charged is included in your regular mortgage payments. This means that with every mortgage payment, you will be paying both your mortgage principal and your mortgage interest.

Your regular mortgage payment amount is set by your lender so that youll be able to pay off your mortgage on time based on your selected amortization period. This is why your mortgage payment amount can change when yourenew your mortgageorrefinance your mortgage. This can change your mortgage rate, which will impact the amount of mortgage interest due. If you now have a higher mortgage rate, your mortgage payment will be higher to account for the higher interest charges. If youre borrowing a larger amount of money, your mortgage payment may also be higher due to interest being charged on a larger principal balance.

However, mortgage interest isnt the only cost that youll need to pay. Your mortgage might have other costs and fees, such as set-up fees or appraisal fees, that are necessary to get your mortgage. Since youll need to pay these extra costs in order to borrow money, they can increase the actual cost of your mortgage. Thats why it can be a better idea to compare lenders based on theirannual percentage rate . A mortgages APR reflects the true cost of borrowing for your mortgage.

Read Also: 10 Year Treasury Vs Mortgage Rates

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.