You Intend To Move Closer To Family A Few Years Down The Road

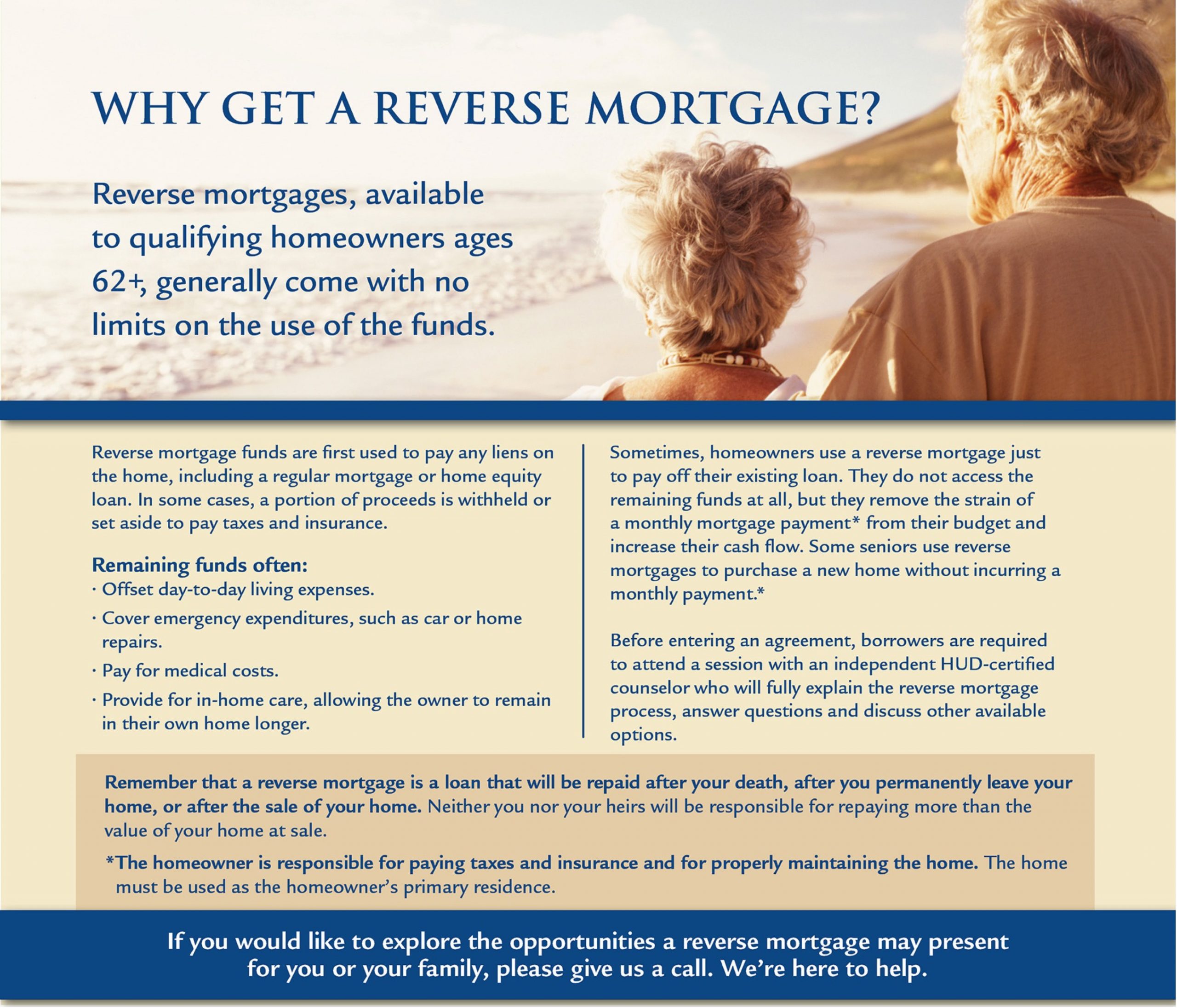

If you have any desire to move in the near term, whether it be closer to family or to a residence that is better equipped for aging, taking out a reverse mortgage today may not be the best idea. The loan becomes due and payable as soon as the borrower moves from the home or passes away, so if you have plans to move in the next few years, you may want to also wait on getting the reverse mortgage.

There is a type of reverse mortgage available, the Reverse Mortgage for home purchase, that allows a borrower to take out a reverse mortgage and purchase a new home within a single transaction. This may be a solution when the time comes to move, and its a way to avoid paying two sets of closing costs both for the purchase and the new reverse mortgage.

A Reverse Mortgage Is A Loan

An important thing to understand about a reverse mortgage is it is a loan. With that loan, comes all of the problems with owing money to somebody else. These include having to pay interest, carrying the psychological burden of debt, and reducing your future options. For example, if you borrow against something now, you can’t borrow against it later.

In addition, a reverse mortgage isn’t a particularly attractive loan. The interest rate is 1%-2% higher than a typical mortgage, and you can’t even deduct the interest. You see, the IRS rules are that you can only deduct interest that you actually pay. Reverse mortgage interest isn’t paid until the home is sold. To make matters worse, the interest rate is generally variable. Now that doesn’t seem like a big deal in times of low-interest rates, especially for a short-term loan. But a reverse mortgage is not short-term . It’s for the rest of your life. So, when you sign up for a reverse mortgage, you are committing to a high-interest rate, non-deductible, variable-rate loan. That sounds kind of bad when you put it that way, doesn’t it?

How Much Can You Borrow

The amount you can borrow depends mostly on the age of the youngest borrower and how much equity you have in the home. Current mortgage rates and your other financial obligations, including any current mortgage, are also factors.

For a government-backed reverse mortgage , the loan limit is equal to the conforming loan limit for a single family home in a high-cost area. In 2021, that limit is $822,375. Loan limits for government-backed reverse mortgages do not vary from one county to another.

You May Like: Can There Be A Cosigner On A Mortgage

How Do Reverse Mortgages Work

A reverse mortgage gives you access to funds without sending you an immediate bill.

Consider this math: With a traditional mortgage, if you borrow $100,000 at 3.4 percent fixed interest for 30 years, youll have a $443.48 monthly payment . If you borrow $100,000 with a reverse mortgage, your required monthly payments for principal and interest are zero.

Too good to be true? Well, yes. You will still owe money. You just wont have to pay it back until you sell the home, move out or die. If the latter is the end of your reverse mortgage, the payoff responsibility falls on your spouse or heirs who may need to sell the home.

With our example $100,000 mortgage, the borrower pays about $443 each month. Of this amount, around $160 is paid toward principal in the first month to reduce the loan balance. The rest of the payment approximately $283 is interest, or what the lender charges you for loaning you money. The payment plan continues like this every month, with more of the payment going to the principal and less to interest over time, until the loan term is up.

Who Should Get A Reverse Mortgage

A reverse mortgage can help you turn your biggest financial asset into a monthly income. If these criteria apply to you, a reverse mortgage might be a viable option:

- You have a lot of equity in your home or it is paid off

- You want or need more money every month

- You dont expect to have a financial hardship if you max out your proceeds before you die

- You want to preserve your retirement account balances

Reverse mortgages have their value, in the right circumstances. Just be sure to research how a reverse mortgage will affect your finances and your family before you sign on the dotted line.

You May Like: Rocket Mortgage Vs Bank

Don’t Miss: Is It Worth It To Refinance My Mortgage

What Is An Alternative To A Reverse Mortgage

A good alternative to a reverse mortgage is having robust retirement savings and investments to live on. If you do not have the savings to support your lifestyle in retirement, downsizing your housing and your budget could lead to a more comfortable retirement than a reverse mortgage. If you cannot or will not downsize and have no savings, then a cash-out refinance, a HELOC, or selling the home to family members and having them rent it to you may be a better option.

Could Out Live The Loan

As stated, a reverse mortgage pays you instead of you paying them every month. But, one thing to consider is how long you will live after taking out the mortgage. With people living longer than in the past, its possible that you might out-live your home equity and reverse mortgage.

If that happens, youd have no money coming in. Plus, youd end up making payments again to pay back the loan. Owing more than your house is worth is never a good thing, no matter if you were making payments or not.? You have to make up the difference on the loan.

Recommended Reading: How To Search For Best Mortgage Rates

Putting A Reverse Mortgage To Use

Ms. Fox said her reverse mortgage was one part of an overall financial plan. She lives on required minimum distributions from her individual retirement account as well as income from maturing bonds in a taxable account, Social Security, and a survivor benefit from her husband Davids corporate pension.

When she opened the reverse mortgage, she was eligible to borrow $370,000, most of which still sits unused in her line of credit. At this point, she owes $81,000, which includes the money she drew from the line of credit for expenses and accrued interest. Because the yet-untapped funds in the line of credit earn interest, her available borrowing limit the size of her line of credit is now $329,000, she said.

If she needed extra cash, Ms. Fox said she would rather take tax-free funds from her reverse mortgage than pay income tax on additional withdrawals from her I.R.A. or capital gains tax on stock sales in her taxable account.

The HECM also will provide flexibility when she must pay the entrance fee to the continuing care retirement community she plans to move into in several years. She could use the proceeds from the sale of a home she co-owns in California, along with the HECM money. She could sell the townhome when market conditions are right and pay off the loan balance then.

I want the ability to move without having to depend on the immediate sale of the townhome, she said. It stresses me out when I think of it.

Where To Learn More

For anyone considering a reverse mortgage, its a good idea to consult a trusted advisor. A good place to start is looking at a simple reverse mortgage calculator to get an idea of the amount you may be able to borrow. Consult ARLO, the All Reverse Loan Optimizer to help gather some of the loan options available in the market today.

Don’t Miss: What Fico Score Does Mortgage Use

You Have To Pay For It

Reverse mortgages have costs that include lender fees , FHA insurance charges and closing costs. These costs can be added to the loan balance however, that means the borrower would have more debt and less equity. Youll also be paying pesky servicing fees each month that can be as high as $35 if your interest rate adjusts on a monthly basis.

You Have Medical Bills

People of retirement age with health issues may obtain reverse mortgages as a way to raise cash for medical bills. However, they must be healthy enough to continue dwelling within the home. If an individuals health declines to the point where they must relocate to a treatment facility, the loan must be repaid in full, as the home no longer qualifies as the borrowers primary residence.

The guidelines in this article refer to home equity conversion mortgages , which are backed by the Federal Housing Administration .

Moving into a nursing home or an assisted living facility for more than 12 consecutive months is considered a permanent move under reverse mortgage regulations. For this reason, borrowers are required to certify in writing each year that they still live in the home theyre borrowing against, in order to avoid foreclosure.

You May Like: How Does Selling A Home With A Mortgage Work

Reverse Mortgage Process: How Do You Get One

The first thing to do is shop for a lender. Many large banks have stopped writing reverse mortgages, though they are still available at smaller banks and credit unions.

There are also plenty of on-line lenders like One Reverse Mortgage, Liberty Equity Solutions and Home Point Financial Corp.

All mortgages have costs, but reverse mortgages can be pricey compared to traditional mortgages. Between the interest rate, origination fees, mortgage insurance, appraisal fees, title insurance fees and other closing costs, the total could be as high as $40,000.

That would eat up much of the equity a borrower has in their home. And the origination fee is based on the homes value, which is usually much larger than the loan amount.

So it pays to shop around for the best deal. Once you have chosen a lender, the property is appraised to determine its market value. Most reverse mortgages are processed within 30-60 days. Borrowers can receive 50% to 66% of the value of their equity depending on their age and interest rate, which is generally about 5%.

Once the loan is approved, borrowers have four disbursement options lump sum, monthly payments, credit line or a combination of the three.

Option #3 Move In With Family

Selling the home and moving in with family members is another great option to consider. Often seniors have difficulty with this decision because they do not want to be a burden to their family. While I understand this, I doubt your children or family members want to watch their loved one starve to death because they ran out of money in retirement.

Hard conversations need to be had in these situations. With the sale of the house, you could help support your family members financially to ease any type of added financial burden. Family needs to stick together and if this is something that is possible, it should be considered before a reverse mortgage is an option.

You May Like: Rocket Mortgage Conventional Loan

You May Like: What Is A Good Ratio Of Mortgage To Income

Is A Reverse Mortgage A Ripoff

Reverse mortgage scams are engineered by unscrupulous professionals in a multitude of real estate, financial services, and related companies to steal the equity from the property of unsuspecting senior citizens or to use these seniors to unwittingly aid the fraudsters in stealing equity from a flipped property.

Reverse Mortgage Lines Of Credit

Reverse Mortgage Lines of Credit are available at some Credit Unions in British Columbia and Ontario. A reverse mortgage line of credit functions like a reverse mortgage in that no payments are required until you sell your house, or you and your surviving spouse pass away. You may make payments of interest or interest and principal if you wish. The limit on the line of credit is based on similar criteria to the reverse mortgage: property value, geographic location, type of housing, and amount of current debt.

Also Check: Does Applying For Mortgage Hurt Credit

When A Reverse Mortgage Doesn’t Make Sense

We’ve already touched on some scenarios when a reverse mortgage may be the wrong choice: you’re not sure how long you’ll keep living in the home, your spouse can’t be a co-borrower, you’d struggle to maintain the home, or the home has sentimental value to your loved ones. Let’s further discuss some scenarios where a reverse mortgage might not suit your circumstances.

Who Is A Good Candidate For A Reverse Mortgage

With all the potential complexities and risk of putting your home on the line, is a reverse mortgage actually a good idea? For some homeowners, the answer might be yes:

- If you anticipate staying in your home for a long time Since youll pay another set of closing costs with a reverse mortgage, you need to stay in the home long enough to justify the expense. So, if youre 62, have a history of longevity and believe your current place is your forever home, a reverse mortgage could make sense. Plus, if you live in a market where home values are appreciating at a fast clip , your property may be worth plenty more by the time you or your heirs pay back the loan.

- If you need more money to manage everyday expenses If youve found yourself struggling to manage the expenses of retirement, a reverse mortgage can help give you liquid cash to help deal with those responsibilities.

Recommended Reading: How To Get A Pre Qualification For Mortgage

What Is A Reverse Mortgage

A reverse mortgage is a type of loan product for homeowners that are 62 years and older. It lets a homeowner exchange part of the equity in a house for cash. This might sound like a traditional home equity loan. However, the big difference and appeal of a reverse mortgage is the money borrowed does not have to be paid back until the borrower no longer lives in the home as their principal residence or the obligations of the loan cant be met. Not meeting the obligations of the loan is a big warning that I will get back to shortly.

Reverse mortgages seem like a good idea on the surface. After all, there are a lot of different celebrities that appear to be very trustworthy endorsing them. Although a reverse mortgage might look like it could solve a difficult financial situation in retirement, anyone considering a reverse mortgage should use extreme caution before making a final decision. They are a dangerous loan product that can have devasting consequences.

For Whom Is A Reverse Mortgage A Bad Idea

Reverse mortgages have extremely high fees compared with other options and are usually a bad idea for most people. They are an especially bad idea for anyone with a family home that they want to leave to their heirs. People inheriting the home may not be able to pay off the reverse mortgage. However, if the family does have the money to pay off the reverse mortgage, they may be better served financially by avoiding the fees of the reverse mortgage and having the inheriting family members slowly purchase the home from the person who needs the extra cash from the reverse mortgage.

Also Check: What Do Mortgage Lenders Use For Credit Score

Cons: The Downsides Of A Reverse Mortgage

Your homes equity will shrink. A big downside to reverse mortgages is the loss of home equity. Because youre not paying down your reverse mortgage balance, youll make less profit when you sell, or limit your borrowing power if you need a new loan.

Youll pay high upfront fees. With loan origination fees up to $6,000, upfront mortgage insurance premiums worth 2% of your homes value and other closing costs, reverse mortgages are more expensive than other home loan types.

You may be disqualified from other income benefits. Consult with a financial planner or attorney before you decide how to receive your funds. Why? Your eligibility for Supplemental Security Income or Medicaid may be impacted if you receive reverse loan funds.

Youll reduce your heirs inheritance. As a reverse mortgage balance grows, the equity your heirs would receive is diminished. If they cant repay the loan when you pass away or move, they wont be able to keep the home.

You might lose your home to foreclosure. Youre still responsible for paying property taxes and insurance, and if you default on your property taxes, you could lose your home to tax foreclosure. A reverse mortgage lender can foreclose on the home if youre not living in it for more than 12 consecutive months due to health care issues.

You cant use a reverse loan for investment or vacation homes. You must prove youre living in the home that youre financing to qualify for a reverse mortgage.

Whats The Catch On Reverse Mortgage

A reverse mortgage does not guarantee financial security for the rest of your life. You dont receive the full value of loan. The face amount will be slashed by higher-than-average closing costs, origination fees, upfront mortgage insurance, appraisal fees and servicing fees over the life of the mortgage.

Recommended Reading: How Much Is Tax And Insurance On A Mortgage

A Reverse Mortgage May Be A Good Idea If:

- You and your spouse are both 62 or older

- Youre in good financial standing

- You and your spouse are physically able to maintain the home

- Youve considered the needs of your heirs

- Youve built enough equity that you have a low mortgage balance and the payout from a reverse mortgage would cover your needs

- Your home value is or has been increasing