Can I Buy A House With 687 Credit Score

Is 687 a Good Credit Score? A 687 FICO® Score is considered Good. Mortgage, auto, and personal loans are relatively easy to get with a 687 Credit Score. Lenders like to do business with borrowers that have Good credit because its less risky.

Is 690 a good FICO score? A 690 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

How hard is it to get 850 credit?

Your 850 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Can I buy a house with 736 credit score? A 736 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, and people with scores this high are in a good position to qualify for the best possible mortgages, auto loans and credit cards, among other things.

Lower Credit Card Interest And Higher Limit Approval

Some 70% of Americans have at least one credit card, with 34% carrying three or more cards. The American Bankers Association reported that at the end of 2020 there were 365 million open credit card accounts in the United States. The average debt on those cards: $6,200.

The lower the credit score, the higher the amount of interest on that balance. The higher the score, the lower the interest as well as more lenient repayment plans and high credit limits.

What Is A Excellent Credit Score

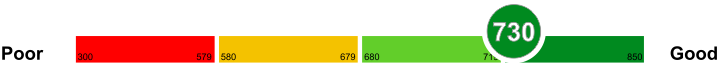

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. … Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent.

Recommended Reading: Who Is Rocket Mortgage Owned By

Good Credit Score For Mortgages

A good credit score for a home loan is one that will qualify you for the lowest interest rates possible. Different financial institutions will have varying credit score range cut-offs for different APRs. The Federal Deposit Insurance Corporation showed how credit score ranges can affect a sample $250k/30 year mortgage. A good score for a mortgage in this example would fall between 700 and 759.

|

FICO Score |

|

|---|---|

| $1,491 | $286,760 |

Mortgage companies use different credit score models to determine your rates FICO Score 2, FICO Score 4 and FICO score 5. For the most part, these models are powered by similar factors including payment history, length of credit history, and your current debt obligations.

Most lenders will not provide a mortgage to homebuyer whose credit score is below 620. The only exceptions are FHA loans which are insured by the Federal Housing Administration. If the borrower defaults on a loan of this type, the government protects the borrower against the damages. Note that people whose credit score ranges between 500 and 579 typically need to make a down payment of at least 10%.

Individuals with good credit scores can also qualify for FHA loans if they wish to lower their interest rates.

Can You Get A Personal Loan With A Credit Score Of 730

Most lenders will approve you for a personal loan with a 730 credit score. However, your interest rate may be somewhat higher than someone who has Very Good or Excellent credit.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

See Also:12 Best Personal Loans for Good Credit

Read Also: Chase Mortgage Recast

What Is A Good Credit Score And Tips To Maintain It

Get answers to commonly asked questions related to the credit score and credit reports

If you are wondering what exactly constitutes a good credit score and how it is calculated, we have all the details for you. Read on to find out everything about a good credit score and the various benefits it offers.

About Good Credit Score

What Is The Fastest Way To Improve A Good Credit Score

You can work to improve your good credit score and upgrade to the next credit range. First, its very beneficial to know the five factors that impact your credit in order of what affects your credit the most. Those factors and their weighted importance are:

Next, always pay your payments on time and in full. This is what lenders want to see mostthat if they give you access to credit, youre responsible and pay it back reliably. You can make sure you never miss a payment by signing up for automatic payments whenever possible.

Lastly, take advantage of the free credit report youre entitled to annually from each national credit bureaus. In 2020, more than 280,000 consumers filed complaints about mistakes on their credit reports, and many more Americans have errors on their credit reports they arent aware of. Inaccurate or unsubstantiated negative items on your report could be drastically dragging down your credit score, so always review your credit report and file a dispute for any errors found.

If you dont have time to check your report yourself, you can hire credit repair services. Lexington Law provides professional credit repair services, taking all the hassle out of filing disputes out of your hands.

Also Check: How Much Is Mortgage On 1 Million

What Kind Of Credit Score Are We Talking About

Before jumping into the article any further, its important to clarify what type of credit score you are talking about. There are tons of different types of credit scores. Two of the most popular types of credit scores are FICO and Vantage Scores . Since most lenders utilize the FICO model, I will focus on that one.

You should also know that there are different types of FICO scores. Just like new software systems like Microsoft Windows are rolled out every few years, FICO every few years comes out with different editions of its scoring model.

For example, here are some of the previously released editions:

- FICO 98

- Installment loan

- Personal finance

These industry scores dont typically follow the 300 to 850 scoring model of the general credit score so you might see perfect scores of 900. Since we are dealing with credit cards here, the credit card score would be the most relevant.

Myfico Loan Center: Free Info On Loans & Interest Rates

myFICO is the consumer division of FICO. Since its introduction over 25 years ago, FICO® Scores have become a global standard for measuring credit risk in the

Find helpful customer reviews and review ratings for CPN Kick Start Program: 730+ Credit score on your CPN FAST! at Amazon.com. Read honest and unbiased

If you are wondering if 730 credit score is good or bad, then you have no need to worry. The answer is that credit score under 730 is considered a good

Don’t Miss: Chase Recast Calculator

How Common Is A 700 Credit Score

A 700 credit score is considered a good score on the most common credit score range, which runs from 300 to 850. How does your score compare with others? You’re within the good credit score range, which runs from 690 to 719. Your 700 score is better than 37.2% of consumers, according to credit scoring company FICO.

Understanding Your Credit Score

Your credit report is an essential part of getting your credit score, as it details your credit history. Any mistake on this document could lower your score. Its easy to check your credit score, and youre entitled to a free credit report from all three major credit reporting agencies once a year.

Its good practice to stay on top of your credit score and check it often for any errors to ensure youre in the best possible position. From there, you can assess your options for a conventional or government-backed loan and, when youre ready, apply for a mortgage.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

How Your Credit Score Affects Your Mortgage Rate

Although its up to specific lenders to determine what score borrowers must have to be offered the lowest interest rates, sometimes even the difference of a few points on your credit score can affect your monthly payments substantially. For example, the difference between a 3.5 percent interest rate and a 4 percent rate on a $200,000 mortgage is $56 per month. Thats a difference of $20,427 over a 30-year mortgage term.

A low credit score can make it less likely that you would qualify for the most affordable rates and could even lead to rejection of your mortgage application, says Bruce McClary, spokesman for the National Foundation for Credit Counseling. Its still possible to be approved with a low credit score, but you may have to add a co-signer or reduce the overall amount you plan to borrow.

You can use Bankrates loan comparison calculator to help you see interest rates for credit scores.

Using myFICO.coms loan savings calculator, heres how much youd pay at the current rates for each credit score range. These examples are based on national averages for a 30-year fixed loan of $300,000.

| Source: myFico. APR rates as of Nov. 5, 2021. Assumes a $300,000 loan principal amount. |

| How your credit score affects your mortgage rate |

|---|

| FICO score |

| If your score changes to 640-659, you could save an extra $34,017. |

How Your Credit Score Affects Your Mortgage

Your credit score can have a positive or negative impact on your mortgage. A high credit score will work in your favour, while a low score or no credit history will work against you. This is because your credit determines how much of a risk you are for defaulting on your mortgage loan.

If your credit score indicates that you dont have a lot of debt and make regular, timely payments, youll have a higher credit score and will be seen as low-risk. If you have lots of debt and pay your bills late, youll have a lower score and will be seen as high-risk.

Understandably, banks dont want to lend lots of money to someone they deem as potentially unlikely to pay it back. If they do, it will be at a much higher interest rate that reflects that risk. Those higher interest rates mean higher mortgage payments and a larger cost over time.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

What Does A 730 Credit Score Mean And How It Affects Your Life

Having a 730 FICO score means that you are in a good position when trying to obtain credit. You will not have to use expensive dealer finance when trying to buy a car, you will be in a very strong position when applying for a mortgage and you will be able to get a large monthly limit on any credit cards.

However, you probably will not have access to the most exclusive offers and lowest cost finance rates which would be reserved for those in the excellent credit score group. They would not only be able to obtain cheaper finance, but also take out that finance over a longer period which reduces the size of the monthly payment that needs to be made.

Therefore, if you have a credit score of 730 it is worth trying to push it higher. Financial institutions use computer programs to make lending decisions. Moving your credit score higher means that the automated decision making in place will allow the credit professional you are dealing with to advance you more credit at a lower rate.

Financial institutions have a fixed amount of money they can lend to borrowers in each credit score category. This is known as their Risk Appetite. The limits and measures here are approved by the lenders Board of Directors so these limits are firm and cannot be changed easily.

The lending limits are generally higher the better the credit score of the borrower, so someone wishing to borrow a large amount had better have the best credit score possible.

You May Like: Rocket Mortgage Conventional Loan

What Mortgage Rate Can I Expect With My Credit Score

In the table below, you can see how much your interest rate might be depending on your credit score, how much your monthly payment might be, and how much youd likely pay in total interest.

This is based on a $200,000, 30-year loan and the interest rates as of Aug. 13, 2020.1

Keep Reading: 750 Credit Score Mortgage Rate: What Kind of Rates Can You Get?

What Does Fico 733 Mean

733 A good credit score. Scores above 733 on your credit file can make you eligible for an advance credit card. Credit ratings for good credit start around 700 and end around 750. A high credit score is one that has been in a top tier of company for many years, providing great chances for obtaining mortgages, auto loans, and credit cards.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

How Much Excellent Credit Can Save You

Using the same FICO loan savings calculator in the example above, heres how much the calculator estimated youd spend on interest based on credit score:

- 760850 score $84,000

- 680699 $99,200

- 660679 $107,500

Theres big money to be saved if you have a higher credit score. Thats why many people try to improve their credit before buying a house.

However, with a 700 score, youre already paying less in interest than many home buyers.

And you can always refinance into a lower rate if you improve your scores over time. In fact, your payment history matters and faithfully making ontime mortgage payments is one of the best ways to increase your credit score.

What A Fair Credit Score Means For You:

Borrowers within the “fair” credit score may push interest rates higher for their lines of credit. Borrowers in this range may incur higher charges associated with a loan or line of credit. It may be difficult to obtain a 30-year mortgage at the lower end of this range and you may expect higher interest rates. Auto loan APRs may have higher rates and credit cards may have lower limits and higher APRs.

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

Good Credit Score Home Loans

Once your credit score climbs into the 700 to 749 range, youre in the good credit score range for a home loan. Qualifying will usually be easier and loans will most likely be less expensive. All types of mortgages are available once you have good credit:

- Conventional loan: A conventional mortgage becomes easier to get with good credit, even if youre carrying a lot of debt relative to your income. Instead of needing a debt-to-income ratio of 36% or less, you might get approved with a ratio as high as 45%. That means your existing monthly obligations and proposed mortgage payment must total no more than 45% of your gross income. If youre putting down less than 20% on a conventional mortgage, a good credit score will reduce your PMI premiums.

- Jumbo loan: If your income is high enough, jumbo loans become accessible with a credit score of 700 or higher.

- FHA loan: These loans become less advantageous as your credit score increases because youre more likely to qualify for a less expensive conventional loan.

- VA loan: Veterans Administration loans are still a great option for those who qualify. The average VA borrower in June 2020 had a credit score of 733 if they were refinancing and 720 if they were buying, according to Ellie Mae.

Learn More: Mortgage Qualifications: How to Qualify for a Mortgage

What Is A Credit Score

Your score is probably one of the biggest criteria that lenders evaluate in the mortgage application process. Your lender can actually get the whole picture of your financial situation just by looking at your credit score. In technical terms, Credit score is also referred to as FICO score that is used to determine the candidates creditworthiness. The higher the score, the candidate is more likely considered to pay his/her debts and a lower score usually indicates the opposite.

So the question is, what are the factors that make up your FICO score and determine your creditworthiness? The main factors are listed down below:

Read Also: Rocket Mortgage Launchpad