Don’t Forget Taxes Insurance And Other Costs

If you’re buying a home, you’ll also need to consider some other items that can significantly add to your monthly mortgage payment, even if you manage to get a great interest rate on the loan itself. For example, your lender may require that you pay for your real-estate taxes and insurance as part of your mortgage payment. The money will go into an escrow account, and your lender will pay the bills as they come due. These costs are not fixed and can rise over time. Your lender will itemize any additional costs as part of your mortgage agreement and recalculate them periodically.

The Cost Of A $300000 Mortgage Including Repayments Total Interest And Amortization So That You Can Borrow With Confidence

- 5 year fixed rate from 2.64%

- Prepay up to 25% annually

- All provinces & territories

If youre ready to apply for a mortgage, you might wonder how the amortization period and interest rate you choose has an impact on the total cost of your mortgage. Heres a breakdown of what your monthly payments might be, in interest and over the life of a $300,000 mortgage.

What Is A Mortgage Principal

A principal is the original amount of a loan or investment. Interest is then charged on the principal for a loan, while an investor might earn money based on the principal that they invested. When looking at mortgages, the mortgage principal is the amount of money that you owe and will need to pay back. For example, perhaps you bought a home for $500,000 afterclosing costsand made a down payment of $100,000. You will only need to borrow $400,000 from a bank or mortgage lender in order to finance the purchase of the home. This means that when you get a mortgage and borrow $400,000, your mortgage principal will be $400,000.

Your mortgage principal balance is the amount that you still owe and will need to pay back. As you make mortgage payments, your principal balance will decrease. The amount of interest that you pay will depend on your principal balance. A higher principal balance means that youll be paying more mortgage interest compared to a lower principal balance, assuming the mortgage interest rate is the same.

Recommended Reading: Monthly Mortgage On 1 Million

Factors To Consider When Paying Off The Mortgage Early

Living without any debt is an exciting goal, but paying off your mortgage needs to be done right. Here are some important considerations:

- Will you incur penalties for overpaying your mortgage?Some mortgage lenders have prepayment penalties or other loan terms designed to prevent you from prepaying. Make sure to contact your lender and read the fine print in your mortgage contract to determine if this applies to you.

- Do you have credit card or any other debts? Many other types of debt, like credit card debt, have higher interest rates. It’s usually more advantageous to pay off any consumer debt before you pay off the mortgage.

- Have you set aside a sufficient emergency fund? It’s generally a good idea to set aside money in an emergency fund to cover expenses that are not included in your budget or to protect from a rainy day. Build a solid financial foundation first!

- Is your debt oppressing you? Some people feel debt rules their lives. If debt is stressing you out, use the Mortgage Payoff Calculator to calculate how much extra money you need to put toward your mortgage every month to get out of debt sooner.

Once you’ve determined that you’re ready to pay off your mortgage, it’s time to start reaping the benefits!

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

Easier To Get Positive Cash Flow On A Rental Property

If youre buying a rental property, or if you might convert your personal residence into a rental later, itll be easier to turn a monthly profit on the property with a longer mortgage term and a lower monthly mortgage payment.

In order to get positive monthly cash flow from a rental property, the rental income needs to exceed the propertys monthly expenses, repairs and mortgage payment, explains Mescher. With a 30-year mortgage, the monthly payment is less, so you can achieve positive cash flow even when the rental income is lower, she adds.

Also Check: 10 Year Treasury Yield Mortgage Rates

What Is The Home Mortgage Interest Tax Deduction

The mortgage interest deduction lets you subtract an amount of interest you pay on your mortgage from your taxable income when you file your tax return. The deduction can save you money on your tax bill.

While there is a limit on the amount of the loan, the deduction includes interest on any loan related to building, buying or improving your primary residence. You can also claim it for rental property or second homes that you own with some limitations.

Finding The Extra Funds

Many homeowners do not consider making additional payments because they believe their budgets will not provide for extra funds. Yet, these same individuals may use credit cards to purchase big-ticket items such as televisions or the latest smart phone. They may not stop to calculate the monthly expense of a morning latte and scone. $6.00 spent every day on the way to work totals $120 monthly. A thorough analysis of the monthly budget can reveal many ways to save money that may be applied to the mortgage.

Tax refunds represent another source of additional funds to make payments on a home loan. Many taxpayers receive sizable refunds. These funds can be dedicated to the loan easily. Other sources can come from financial awards or settlements from insurance companies.

The speed at which a home loan can be retired varies depending on the extra amount paid and when it is applied to the principal. Making larger payments earlier in the term will save the borrower a considerable amount of interest. For example, for a $160,000 loan with 7 percent interest for 30 years, the payment would be $1064.40. Of that, only $131.83 is principal, and $932.57 is interest. If the consumer pays an additional amount equal to the principal, an entire month of the duration of the loan is eliminated.

Read Also: Chase Recast Mortgage

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

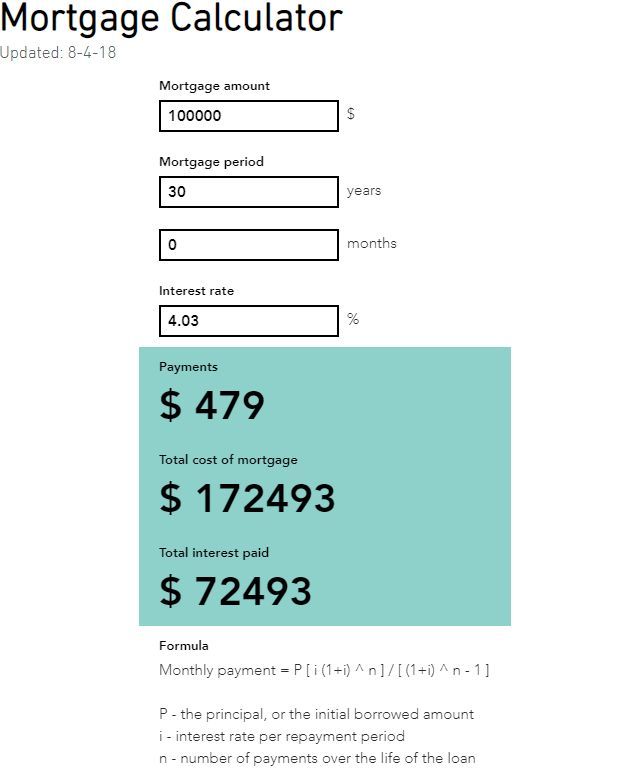

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

What Are The Limits To The Mortgage Interest Deduction

Since 1987, there have been limits placed on the amount of the mortgage for which you can claim interest deductions. The amounts have gotten smaller and smaller, with the most recent limit listed in the 2017 Tax Cuts and Jobs Act, also known as TCJA.

Limits on Mortgage Interest Tax Deduction

Limits on the mortgage tax deduction have come about because of rising home prices. It was estimated that the mortgage interest deduction cost the federal government $60 billion a year in tax revenues before the 2017 tax overhaul, according to William G. Gale at the Brookings Institution.

The figure dropped to half that after the 2017 tax overhaul.

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

How Much Interest Will I Pay On My Mortgage

In determining the price of a home, many people only consider the listing price of a home, without considering the cost of interest on a loan used to finance the home. The truth is that you will probably pay a significant amount of interest over the life of your mortgage but thats okay. You simply need to be prepared for it.

Interest on any loan, mortgage, credit cards, or otherwise, is the fee you pay to the lender for allowing you to borrow the initial sum of money. The amount of money you actually borrow is called the principal on the loan. The interest rate determines the amount you owe on each loan payment and how much youll pay over the life of the loan.

The Rate Determines How Much Interest You Pay on Your Mortgage

Getting the lowest interest rate possible is important. The rate determines how expensive your mortgage really is. The lower the interest rate, the lower the fee you pay to borrow money from a lender.

It makes a big impact when you can see how a small change in the rate can change how much interest you owe. Lets look at a few examples to see how small adjustments can create very different outcomes.

For these examples, well assume this is a conventional mortgage with a 30-year term. Lets look at how different loan amounts impact the amount of interest youll pay on your loan first.

| Loan amount | |

|---|---|

| $718,695.06 | $1,718,695.06 |

Now, lets look at how different interest rates impact the cost of your mortgage.

| Interest Rate | |

|---|---|

| $373,023.14 | $773,023.14 |

Understand Your Mortgage Payment

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest.

Keep in mind that you may pay for other costs in your monthly payment, such as homeowners insurance, property taxes, and private mortgage insurance . For a breakdown of your mortgage payment costs, try our free mortgage calculator.

Recommended Reading: Who Is Rocket Mortgage Owned By

Whats Deductible And What Isnt

There are several types of home loans eligible for the mortgage interest tax deduction. But there are some restrictions.

Types of Loans that May Let You Claim the Mortgage Interest Tax Deduction

- Traditional mortgage

- Home equity loan

- Line of credit

The chief requirement for being able to deduct interest payments is that the loan was secured by your primary or secondary home for which its being used to buy, build or improve. You cannot claim a deduction on personal loans or loans secured by a third, fourth or other home.

How To Calculate The Blended Interest Rate

This method of calculating a blended interest rate is simplified for illustration purposes. It does not include prepayment penalties. Your lender can combine the prepayment penalty with the new interest rate or ask you to pay it when you renegotiate your mortgage.

Example : Calculate the blended interest rate

Suppose interest rates have gone down since you signed your mortgage contract. To take advantage of these lower rates, you’re considering terminating your mortgage and renegotiating a new mortgage with your current lender.

Suppose you have:

- months until end of the term: 24

- current interest rate for a 5-year term offered by the current lender: 4.0%

- current term: 5 years or 60 months

- payment frequency: monthly

| Steps to calculate a blended interest rate | Example | Enter your information |

|---|---|---|

| Step 1: multiply your current interest rate by the number of months remaining on your current term | 5.5% x 24 months = 132 | |

| Step 2: subtract the number of months of the new term from the number of months remaining on your current term | 60 months 24 months = 36 months | |

| Step 3: multiply todays interest rate by the difference between the number of months of the new term and the number of months remaining on your current term | 4% x 36 months = 144 | |

| Step 4: add the results of Step 1 and Step 3 | 132 + 144 = 276 | |

| Step 5: divide the results of Step 4 by the number of months in the new term | 276 / 60 = 4.6 |

Also Check: Chase Mortgage Recast Fee

How Big Is The Uk Mortgage Market

Historically across the United Kingdom, around 65 thousand to 70 thousand mortgages are approved each month. This is from a low of around 30 thousand after the 2008 to 2009 global financial crisis. Prior to the recession, the monthly rate was closer to 80 thousand to 130 thousand mortgages completed each month.

The UK Mortgage Market is Over £1.5 Trillion

In the fourth quarter of 2020, there were £76.5 billion new mortgage originations in the UK, according to the Financial Conduct Authority . At the end of the fourth quarter of 2020, there were £1,438.4 billion in unsecuritised home loans outstanding, with £102.956 billion in securitised home loans. Total residential mortgages to individuals summed of £1.541 trillion across 13,404,487 loans in the fourth quarter of 2020.

Overall mortgage debt tends to grow around 3% to 6% per annum, though there can be significant fluctuations in that rate of growth due to factors like BREXIT, the global economic crisis which happened in 2008, COVID-19 lockdowns, etc. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to foreign property ownership, the localised balance between immigration and construction, etc.

How Much Can You Afford To Borrow

Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit. In this example, the lender would be willing to offer a loan amount of £171,000. Meanwhile, some lenders may offer first-time buyers a 100% mortgage with a £0 deposit. However, obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. This is usually one percent higher than a mortgage that requires a deposit. Consider this expensive trade-off before choosing a zero-deposit deal.

If you know the interest rate youll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. The example is shown in the table below.

Default Calculation

| £551,596 £524,016 = £27,580 | £240,272 £228,258 = £12,014 |

If you had £200 in other monthly home ownership related fees, then this might take a renter equivalent of £1,000 down to £800.

Recommended Reading: Who Is Rocket Mortgage Owned By