Basis Points Vs Discount Points

When you’re getting a mortgage, you may hear about “basis points” and “discount points.” These points aren’t the same, though.

As explained, a basis point represents 1/100th of a percentage point. Therefore, 100 basis points equal 1%. By contrast, one discount point equals 1% of the loan amount. For example, one point on a $200,000 mortgage would work out to $2,000. When you take out a mortgage, you can buy discount points to reduce the interest rate over the life of the loan. This can lead to lower monthly payments and lowered interest costs in the long term.

So, let’s say you pay $2,000 for one discount point on a $200,000 loan. If you started with an interest rate of 4.5%, buying a single point generally brings the interest rate down to 4.25%. In this case, the monthly mortgage payment would dip from $1,013.37 to $983.88.

Can A Mortgage Be Sold

Federal banking laws allow financial institutions to sell mortgages or transfer the servicing rights to other institutions. Consumer consent is not required when lenders sell mortgages. … Don’t panic if you discover that your mortgage now belongs to another institution. Remember: a loan is a loan no matter who owns it.

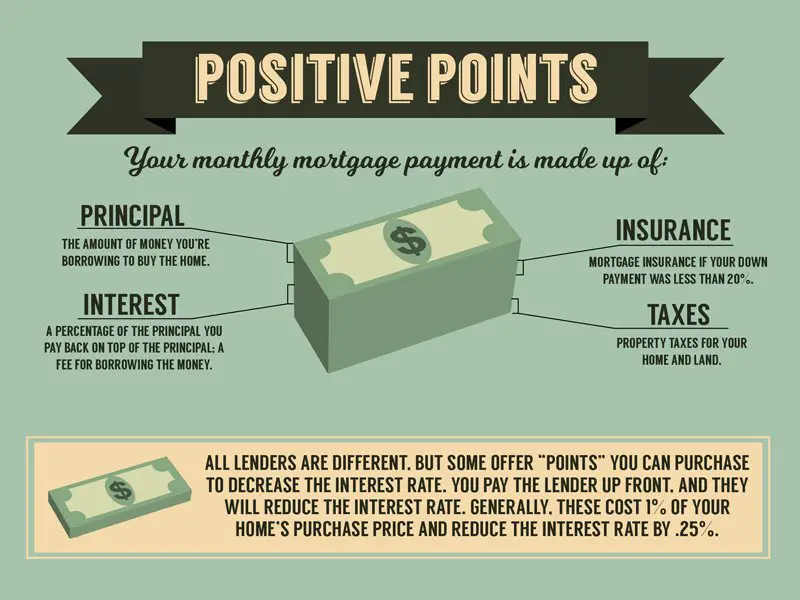

What Do Points Mean On A Mortgage

You have to pay for discount mortgage points at the loanâs closing you canât buy them afterward. Again, one point is typically equal to 1% of the loan principal and generally reduces the rate by .25%. However, one point might lower the rate by more or less than 0.25%, depending on the loan and lender. The more discount points you buy, the lower your interest rate will be, but you usually canât purchase more than four. Most lenders offer two or three points on a loan.

You May Like: How Much Is Mortgage On 1 Million

Are Mortgage Credits Worth It

If the homeowner keeps the mortgage 5 years or less, lender credits are likely worth it. … So if they sell or refinance any time before the end of year 5, the savings from lender credits outweigh the added cost. This point where the upfront savings level out with the longterm cost is known as the ‘breakeven point.

Are Mortgage Points Taxdeductible

Discount points can be taxdeductible, depending on which deductions you claim on your federal income taxes.

To write off discount points, or any other qualifying mortgage interest payments, youd need to itemize your deductions using Schedule A of Form 1040.

If you take the standard deduction, you will not be able to deduct mortgage interest or mortgage points.

Discount points paid on a home purchase mortgage loan can be 100% deductible in the year in which theyre paid. Discount points on a home refinance mortgage loan cannot.

The tax deduction for points paid on a refinance loan is spread over the life of the loan. A homeowner paying points on a 30year mortgage loan can claim 1/30 of the points paid as a deduction annually.

Always consult a professional before filing. This website doesnt give tax advice. Let your tax preparer know if youd like to write off mortgage interest payments and discount points.

Also Check: Can I Get A Reverse Mortgage On A Condo

Are Mortgage Points Tax Deductible

Because the cost of discount points represents prepaid interest, points are deductible for taxpayers who itemize. Though, the loan must be secured by your main home and meet some other criteria. You generally have to deduct them over the life of the loan though sometimes, you can deduct the points in the year you pay them. But you can usually only deduct points paid on up to $750,000 of mortgage debt .

Example. Say you take out a $1,000,000 mortgage loan and purchase one point for $100,000. You’ll only be able to deduct $75,000 the remaining $250,000 isn’t tax-deductible.

In some cases, the seller will agree to pay for points to incentivize a buyer. Points are deductible in this situation, too.

According to the IRS, origination fees are also tax-deductible, but points paid for items that are usually listed separately on the settlement sheet such as appraisal fees, inspection fees, and attorney fees, aren’t.

But What Do These Lower Mortgage Rates Mean For You And What Should You Know Before You Start Comparing Them

Now that were looking in the 3 percent range, were seeing even more competition to get the lowest interest rates while paying the fewest possible points.

Heres the bottom line. Even a fraction of a percentage of difference in interest rate is enough to make someone choose one lender over another. But what does that really equate to? Money Under 30 has created a

Heres an example:

- On a 30-year fixed-rate loan of $150,000 at 3.5 percent APR, your monthly payment is $674.

- Drop the rate to 3 percent, your payment drops to $632.

That saves you $41 a month on your monthly payment not bad, but not earth-shattering. But over 30 years, youll save $14,817 in interest.

So half of a percentage can make a huge difference in how much money you spend or save over time. But if you have to buy down the interest rate by paying up front points , then it may or may not be worth it. For example, on a loan of $150,000 again, one point would be $1,500 that you would need to pay up front. The amount that a point reduces your interest rate depends but typically for every point you pay, you lower your interest rate by one quarter of a percent. So for this example, if you want to get from 3.5 to 3 percent, youd need to pay $3,000.

Read Also: Can You Refinance A Mortgage Without A Job

Can I Roll Points Into My Mortgage

Points can be added to a mortgage loan when you refinance. … One is discount points, which reduce the interest rate of your loan. The second type is origination points, which increase income for your lender and offset their expenses of making your mortgage loan. One point equals 1 percent of your mortgage loan amount.

Mortgage Points Are Tax

If you do end up purchasing discount points, you can actually deduct their costs from your annual tax returns as long as you itemize deductions. You can deduct them for either the year you purchase the home or deduct them incrementally across your loan term, depending on various factors .

- The home you took out the loan to purchase or build must be your primary residence.

- The points werent more than the general average for your area.

- The points werent used for anything like an appraisal fee, inspection, or another charge.

- You didnt borrow funds from your lender or broker to pay the points.

Your closing settlement statement will also need to clearly identify the points . Here is the full set of requirements from the IRS, but you should consult a tax professional if youre thinking of deducting your points.

Also Check: Rocket Mortgage Requirements

Advantages Of Buying Mortgage Points

The biggest perk of buying mortgage points is obvious: You get a lower interest rate high credit score or not. And if you have the loan for a while, a lower rate can save you big money over time, as well as mean a lower monthly payment.

Heres an example: Say youre taking out a 30-year loan for $200,000. You originally qualified for a 3.75% rate, but you purchased two points , bringing your rate down to 3.25%. In this scenario, youd break even on that $4,000 in just over four years. More importantly? Youd save about $20,000 in interest over the long haul.

Another advantage of buying mortgage points is that its tax-deductible. If you itemize your returns, you can write off those points as well as any other mortgage interest you pay during the year. If you spend a good amount on points at closing, it can mean quite a significant write-off come tax time.

Finally, points can mean a lower monthly payment over the loan term. These monthly savings might even allow you to buy a higher-priced home than you originally planned for. In the $200,000 scenario above, heres how points would impact your mortgage payment:

| MORTGAGE RATE |

|---|

What Are Mortgage Points And How Do They Work

1-min read

A mortgage point equals 1 percent of your total loan amount for example, on a $100,000 loan, one point would be $1,000.

Mortgage points are essentially a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payments .

In some cases, a lender will offer you the option to pay points along with your closing costs. In exchange for each point you pay at closing, your mortgage APR will be reduced and your monthly payments will shrink accordingly.

Typically, you would buy points to lower your interest rate on a fixed-rate mortgage. Buying points for adjustable rate mortgages only provides a discount on the initial fixed period of the loan and isn’t generally done.

Also Check: Rocket Mortgage Qualifications

Drawbacks Of Lender Credits

Theres always a catch: In exchange for those lower closing costs, lender credits increase your interest rate. That means youll end up with a higher monthly mortgage payment and more interest paid over the life of the loan.

At some point this choice becomes more expensive, Bossler says.

Cohn also cautions borrowers to make sure a lender isnt inflating closing costs to the point where lender credits end up hurting you. She advises comparing apples to apples with multiple lenders to make sure you understand the base interest rates and closing costs, without points or credits, before adding in those adjustments.

If it looks too good to be true, it probably is, Cohn says.

Lower A Key Monthly Payment

Youve likely heard of buying down the interest rate on a mortgage or paying up front for points. They are one and the same. You can use mortgage points to your advantage and lower the overall cost of buying a home. If you can pay more than the minimum down payment on a home, then look to purchase as many points as you can and still meet your savings goals. A point is a fee equal to one percent of your mortgage loan amount. The point is typically included in your closing costsit pays a portion of the future in advance. This is then reflected in the lower interest rate youll pay each month for the length term of the loan.

Are you still asking yourself, How do mortgage points work? Take a closer look through the infographic below and then find out how much you can save with mortgage points.

Recommended Reading: What Does Gmfs Mortgage Stand For

Is Buying Mortgage Discount Points A Smart Idea

As with much in life, the answer depends on the details. This rule of thumb may help: The longer you keep the mortgage, the more money you save by buying points.

Buying points could be helpful if:

-

Youre purchasing your forever home

-

You have enough cash upfront to make a large down payment and still have some left for lowering the rate. You expect to keep the loan long enough that youll exceed the break-even point in this calculator

But buying points can be a bad thing if:

-

Youll sell the home or refinance before youve hit your break-even point

-

You need the cash youll use to buy points

-

You reach the break-even point, but the monthly savings are so small that it doesnt make a meaningful dent in your budget

What Do Mortgage Points Mean

Mortgage points actually refer to two different things: loan origination fees and discount points. Most of the time, discount points are what people mean when they talk about a mortgage with points. Discount points refer to the amount of money that a person pays to a lender to get a loan at a specific rate. These points are a way of pre-paying interest on the loan.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How Discount Points Work

When you apply for a loan and get approved, your lender will give you a loan offer. In your offer, the lender will typically offer you multiple rates, including a base rate, as well as lower rates that you can get if you purchase discount points.

Those discount points represent interest that youre repaying on your loan. If you decide to purchase points, you pay the lender a percentage of your loan amount at closing and, in exchange, you get a lower interest rate for the loan term. Typically, for every point you purchase, you get to lower your interest rate by 0.25%.

Like normal mortgage interest that you pay over the life of your loan, mortgage points are typically tax-deductible. However, points are usually only used for fixed-rate loans. Theyre available for adjustable-rate mortgages , but when you buy them, they only lower your rate for your intro periodseveral years or longeruntil the rate adjusts.

Recommended Reading: Recasting Mortgage Chase

When Are Mortgage Points Worth It

If you are buying a home and have some extra cash to add to your down payment, you can consider buying down the rate. This would lower your payments going forward. This is a particularly good strategy if the seller is willing to pay some closing costs. Often, the process counts points under the seller-paid costs. And if you pay them yourself, mortgage points usually end up tax deductible.

In many refinance cases, closing costs are rolled into the new loan. If you have enough home equity to absorb higher costs, you can pay mortgage points. Then you can finance them into the loan and lower your monthly payment without paying out of pocket.

In addition, if you plan to keep your home for a while, it would be smart to pay points to lower your rate. Paying $2,000 may seem like a steep charge to lower your rate and payment by a small amount. But, if you save $20 on your monthly payment, you will recoup the cost in a little more than eight years.

The lower the rate you can secure upfront, the less likely you are to want to refinance in the future. Even if you pay no points, every time you refinance, you will incur charges. In a low-rate environment, paying points to get the absolute best rate makes sense. You will never want to refinance that loan again.

But when rates are higher, it would actually be better not to buy down the rate. If rates drop in the future, you may have a chance to refinance before you would have fully taken advantage of the points you paid originally.

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

How Mortgage Refinance Points Are Used

Refinancing points can be used in several different ways, including:

Discount points You can sometimes buy down the interest rate on your home loan by paying points at closing. For every point that you pay, for instance, your interest rate may be reduced by a quarter of one percent. Its common to buy 0 to 4 points. This up-front purchase is tax-deductible, which can mean additional savings for the borrower.

Eliminate prepayment penalty Many mortgage loans include restrictions on early payoffs or buyouts. If you pay off your loan early, you could face stiff fees. Sometimes, refi points can be used to get rid of that penalty.

To secure other terms There is a wide range of home loan products out there. Mortgage refinance points can be used to secure various types of favorable terms. A willingness to pay points upfront can have huge benefits in the long run.

Origination fee Usually, this fee is charged by the lender to cover the costs of making the loan. As with the discount points, the origination fee should be tax-deductible. The IRS has specific language surrounding origination fees, so you need to ensure these points were used to obtain the mortgage rather than covering ancillary closing costs.

What Are Origination Fees

Why do so many lenders quote an origination fee? To get a true no point loan, they must disclose a 1% fee and then give a corresponding 1% rebate. Wouldnt it make more sense to quote a loan at par and let the borrower buy down the rate?

The reason lenders do it this way is because of the disclosure laws in the Dodd-Frank Act. If the lender does not disclose a certain fee in the beginning, it cannot add that fee on later. If a lender discloses a loan estimate before locking in the loan terms, failure to disclose an origination fee will bind the lender to those terms.

This may sound like a good thing. If rates rise during the loan process, it can force you to take a higher rate. Suppose you applied for a loan when the rate was 3.5%. When you are ready to lock in, the rate is worse. Your loan officer says you can get 3.625% or 3.5% with the cost of a quarter of a point . If no points or origination charges show up on your loan estimate, the lender wouldnt be able to offer you this second option. You would be forced to take the higher rate.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

When Paying Points Is Worth It

When you buy discount points, you decrease your monthly payment, but you increase the upfront cost of your loan. Due to the difference in monthly payments, it usually takes between five and 10 years to recoup the upfront cost of discount points.

Instead of buying points, many borrowers instead choose to make larger down payments in order to build equity in their homes quicker and pay off their mortgages early, another way to save money on interest payments.

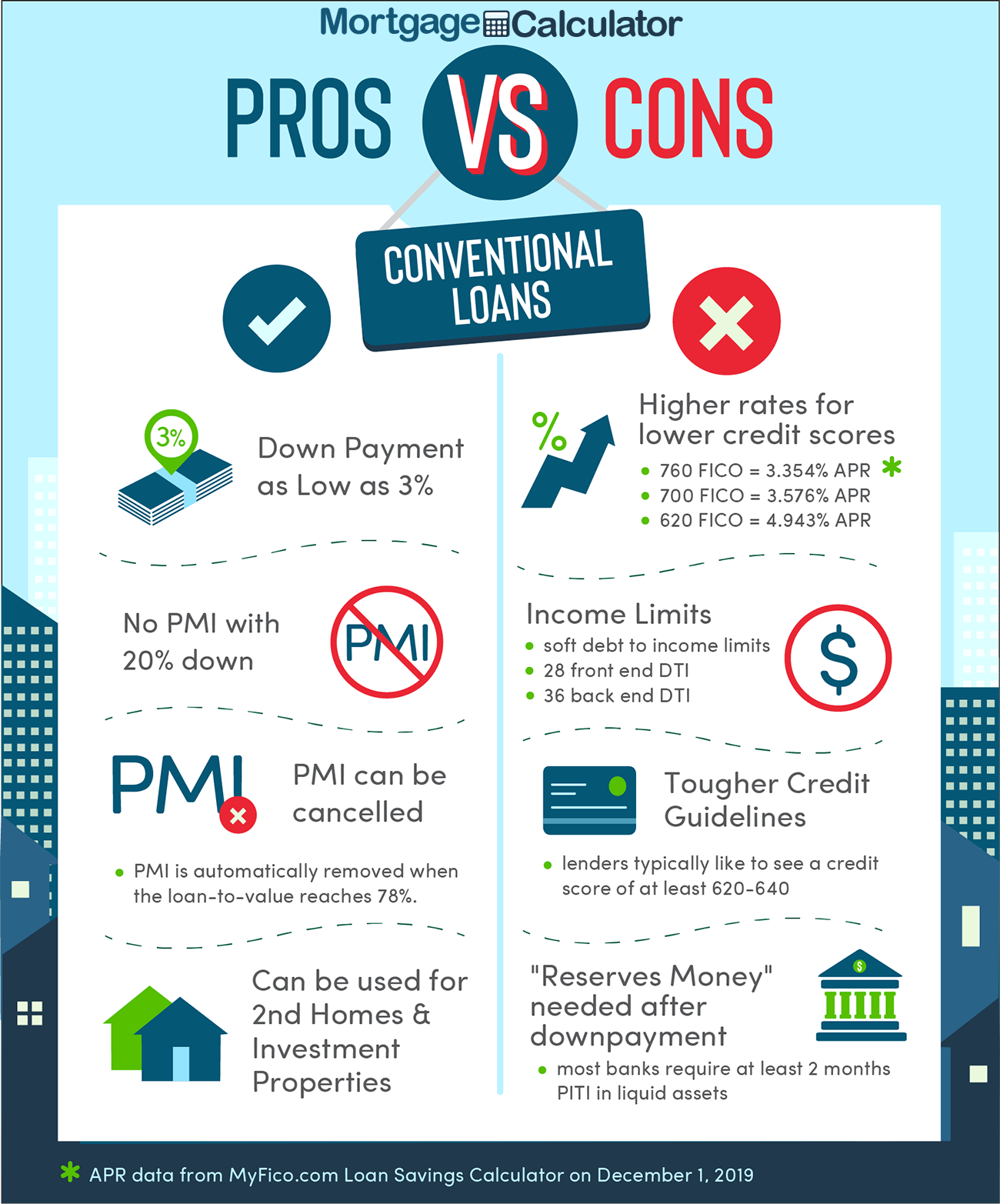

Still, in some cases, buying points may be worthwhile, including when:

- You need to lower your monthly interest cost to make a mortgage more affordable

- Your credit score doesnt qualify you for the lowest rates available

- You have extra money to put down and want the upfront tax deduction

- You plan to keep your home for a long time, so you may recoup the cost

Of course, this really only applies to discount points. Origination points, on the other hand, are closing costs paid to a lender in order to secure a loan. While these fees are sometimes negotiable, borrowers usually have no choice about whether to pay them in order to secure a loan.