What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

How Much Income Do I Need For A 250k Mortgage

You need to make $76,906 a year to afford a 250k mortgage. We base the income you need on a 250k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $6,409.

You may want to be a little more conservative or a little more aggressive. Youre be able to change this in our how much house can I afford calculator.

What To Consider Before Applying For A $250000 Mortgage

Before taking out a $250,000 mortgage, youll want to be well aware of the costs it will come with. These costs include interest, your down payment, and sometimes insurance and other fees.

There are also closing costs which typically clock in somewhere between 2% and 5% of the total loan amount.

Learn More: How to Know If You Should Buy a House

You May Like: 10 Year Treasury Vs Mortgage Rates

Total Interest Paid On A $250000 Mortgage

The total amount of interest youll pay on a $250,000 mortgage will vary based on your interest rate and loan term. High interest rates and long terms will result in the most interest over time, while shorter terms and low interest rates will save you on interest.

Example:

However, if you chose a 30-year mortgage at the same rate, your interest costs would jump significantly, and youd pay $179,673 by the end of your loan term.

How To Account For Taxes And Recurring Expenses

Accounting for recurring charges like PMI and HOA fees requires a little more work, but even these aren’t very difficult to calculate. You can find the total cost of recurring expenses by adding them together and multiplying them by the number of monthly payments . This will give you the lifetime cost of monthly charges that exclude the cost of your loan.

The reverse is true for annual charges like taxes or insurance, which are usually charged in a lump sum, paid once per year. If you want to know how much these expenses cost per month, you can divide them by 12 and add the result to your mortgage payment. Most mortgage lenders use this method to determine your monthly mortgage escrow costs. Lenders collect these additional payments in an escrow account, typically on a monthly basis, in order to make sure you don’t fall short of your annual tax and insurance obligations.

Read Also: How Much Does Getting Pre Approval Hurt Credit

How To Get A $250000 Mortgage

If youve weighed both the upfront and long-term costs of a $250,000 mortgage and are comfortable moving forward, its time to start the mortgage process.

Here are the steps to follow to get a mortgage:

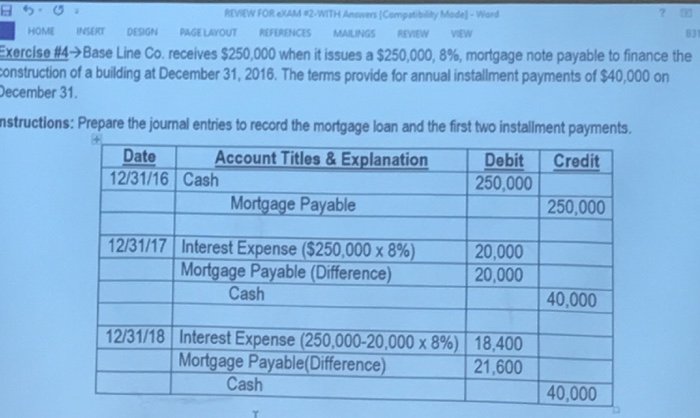

Understanding An Amortization Schedule

The easiest way to understand an amortization schedule is through an example using a mortgage. Let’s say you want to purchase a $100,000 home so the bank agrees to provide with a loan at a fixed interest rate of 5% for 15 years. To better understand how you will pay off the loan, you create an amortization schedule.

Since it is a 15 year loan, the amortization schedule shows you will have to make 180 payments . If there was no interestrate, determining your monthly payment be simple: $100,000 divided by 180 payments = $555.56 per month. But with a 5% interest rate, themonthly payment turns out to be $790.79 .

Next you see that a portion of each payment is interest while the rest goes towards the loan’s remaining balance. The distribution ofthese two amounts in each payment varies with the interest portion declining with each payment. Understanding how the interest is determinedfor each payment is not a tricky as it seems.

The 5% interest rate is an annual interest rate. To determine the monthly interest rate, it must be divided by 12. Thenthe monthly interest rate is multiplied by the remaining balance to determine how much interest needs to be paid. Here is the process for determining the first month’s interest and portion that goes toward the loan’s remaining balance.

Step 1. 5% annual interest rate / 12 = 0.42% monthly interest rate

Step 2. 0.42% * $100,000 = $416.67

Step 3. $790.79 – $416.67 = $374.13

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How To Get The Best Deal

Got new car fever? Well, first, you need to do a little homework. With the internet, the mystery of the automobile buying process has been unveiled and you can be a well-informed buyer ready to negotiate for the best price. First of all, go to ConsumerReports.org to check out vehicle reliability. You may be eying that shiny red sports car, but if its review states that this manufacturer has a history of poor performance or something like electrical issues, you may want to reconsider.

Test drive the vehicle you have in mind, but renting one from a car rental company for a couple days is the ultimate test.

Understanding 0% Financing Vs Factory Rebate

Many times dealerships will offer a choice of 0% financing or a factory rebate. How do you know which is better? Figure out the interest you would pay for the life of the loan if you financed with your bank. If the interest is more than the rebate, then take the 0% financing. For instance, using our loan calculator, if you buy a $20,000 vehicle at 5% APR for 60 months the monthly payment would be $377.42 and you would pay $2,645.48 in interest. If the rebate is $1,000 it would be to your advantage to take the 0% financing because the $1,000 rebate is less than the $2,645.48 you would save in interest. Be aware though, that unless you have a good credit rating, you may not qualify for the 0% financing and this option may only be offered on selected models. People with poor credit are a major source of profits because they can be charged far higher interest rates. Some “buy here, pay here” dealerships specifically focus on subprime borrowers.

Also Check: Reverse Mortgage For Condominiums

How Is The Monthly Payment Calculated For A 350k Mortgage

This calculates the monthly payment of a $350k mortgage based on the amount of the loan, interest rate, and the loan length. It assumes a fixed rate mortgage, rather than variable, balloon, or ARM. Subtract your down payment to find the loan amount. Many lenders estimate the most expensive home that a person can afford as 28% of ones income.

How To Prepare For A 250 00000 Mortgage

When preparing for a £250,000.00 mortgage, particularly if you are a first time buyer looking at your first mortgage, we recommend: Use the mortgage calculator to provide an illustration of monthly repayment amounts for different terms and interest rates on a £250,000.00 mortgage

How much would the mortgage payment be on a $250K house? Assuming you have a 20% down payment , your total mortgage on a $250,000 home would be $200,000. For a 30-year fixed mortgage with a 3.5% interest rate, you would be looking at a $898 monthly payment.

To afford a house that costs $250,000 with a down payment of $50,000, youd need to earn $37,303 per year before tax. The monthly mortgage payment would be $870. Salary needed for 250,000 dollar mortgage.

See the monthly payment for a thirty year, 250k loan by interest rate. Whats the monthly payment? What are the costs? Can I afford a $250,000 home? What if I pay a bigger down payment?

Also Check: Does Getting Pre Approved Hurt Your Credit

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

What To Do With Your Trade

Although it’s convenient to trade in your old vehicle to the dealer at the time of purchasing another, it’s not to your best advantage. You are likely to get the least value from the dealer, as they have to move it yet again and need to ensure a safe profit margin on selling it. They do not have to take your old automobile, and will offer you what will make them the highest profit. Some dealerships may offer artificially high trade in values, but only offer them in association with a higher price on the vehicle they sell you.

Selling Your Used Car Privately

The best option typically is to sell your vehicle privately. It seems even government agencies are freely giving out this advice from the Arizona Attorney General to the FTC. Don’t underestimate the value of your old car. Go to Kelly Blue Book online to do your valuation research. If you can sell it, even for a small amount, it’s extra bargaining power for your new vehicle.

Each year Americans buy roughly double as many used vehicles as new vehicles. You can put a”for sale” sign on your car parked out front if you live in a high traffic area. Sites like Craigslist or Auto Trader can also help send buyers your way.

Another option with your old automobile is to keep it. An old pick up truck used for heavy work can help protect the value of a new vehicle by minimizing wear and tear, along with depreciation. Automotive insurance companies typically offer multiple vehicle discounts.

Also Check: Can You Get A Reverse Mortgage On A Condo

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

Amortization Schedule On A $250000 Mortgage

An amortization schedule spells out the annual principal and interest costs for each year of a home loan and can be a good way to gauge the long-term costs of financing your house.

As the examples below show, your monthly mortgage payments go mostly toward interest at the beginning of your loan and more toward principal further into your term.

Heres what an amortization schedule for a 30-year, $250,000 loan looks like, assuming a 4% APR:

| Year |

|---|

| $0.00 |

Also Check: Rocket Mortgage Payment Options

My Monthly Payments Will Be

If you take out a $200,000 mortgage payment at 5.000% for 30 years, your monthly mortgage payment would be $1,073.64.

The payments on a fixed-rate mortgage don’t change over time. The loan over the repayment period. This means that the proportion of interest paid vs. principal repaid changes each month. As the loan amortizes, the amount of monthly interest paid decreases while the amount of principal repaid increases.

Note: Principal and interest are usually only a portion of the monthly payment made to your bank. Most lenders also require payments for and property taxes, too. Those payments get dropped into an escrow account so the bank can automatically make the annual insurance and property tax payments on your behalf when the bills come due.

Where To Get A $250000 Mortgage

If you qualify, you can get a $250,000 mortgage from any mortgage lender, bank, or credit union. Rates and terms vary by company, though, so youll need to shop around to get the best deal.

Traditionally, this would mean reaching out to each lender individually to get a quote, which can be time-consuming and tedious.

With Credible, shopping around for your loan is much more streamlined. It only takes a few minutes to get pre-approved, and you can get quotes from several mortgage lenders at once.

Once youve compared your quotes, you can decide which lender to proceed with. Youll then need to complete their full application and provide the required financial documentation.

Don’t Miss: Chase Recast Calculator

Mortgage Affordability And Your Down Payment

Because Canada has minimum down payment rules in place, the amount of money you’ve saved for a down payment can limit your maximum mortgage affordability. The minimum down payments in Canada are:

- 5% of the purchase price up to $500,000, plus

- 10% of any part of the price between $500,000 and $1 million, or

- 20% of the total purchase price for homes valued at over $1 million.

Let’s consider an example. If your down payment amount is fixed at $15,000, the maximum home price you will be able to afford is $15,000 divided by 5%, or $300,000. If your down payment is $30,000, then your maximum affordability will increase to $550,000. You can run the numbers yourself on our mortgage affordability calculator.

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Read Also: Can You Do A Reverse Mortgage On A Mobile Home

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

How Are Monthly Payments On A$ 250 000 Mortgage Calculated

Amortization means that at the beginning of your loan, a big percentage of your payment is applied to interest. With each subsequent payment, you pay more toward your balance. Estimate your monthly loan repayments on a $250,000 mortgage at 4% fixed interest with our amortization schedule over 15 and 30 years. Was this content helpful to you?

Read Also: Recasting Mortgage Chase

Mortgage Payment Calculator With Taxes And Insurance

Use this PITI calculator to calculate your estimated mortgage payment. PITI is an acronym that stands for principal, interest, taxes and insurance. After inputting the cost of your annual property taxes and home insurance costs, you’ll see the full impact of your monthly payment on your household budget. Fill in the blanks and hit “view report” to see the payment schedule, which shows how much of your payment goes toward interest, and how much toward principal. Because the amount of interest is determined by the balance owed, over time the interest remitted with each payment decreases, with more of your monthly payment going toward principal.