Employment Trends Play A Key Role In The Housing Market

The local economy of any area is affected by current economic conditions. In areas where new businesses are welcomed to the city, those businesses bring a boost to the local economy. Big employers sometimes transfer employees to the new locations. These employees must find housing thus increasing the demand for more available existing homes and new construction. If unemployment rates are high in the area, housing demand will decrease. New businesses will bring job offers and help increase the population. A growing populace signals a future uptick in the local real estate market.

Tips For Buying An Affordable Home

Suppose you qualify for a large home loan. Does that mean you need to borrow the entire amount your lender is willing to loan you? Of course not.

Assessing how much mortgage you can handle requires a bit of a look into your current and predicted future financial situation. Before you take on the maximum loan you can get and start looking at more expensive houses, consider these tips.

Today’s Best Mortgage Rates

Our rate table lists the best current local mortgage rates available from our lender network. Set your search criteria by entering your loan data and selecting the relevant products from the dropdown, click search and we’ll help you compare the market by showing you the most relevant offers for homeowners.

Don’t Miss: Rocket Mortgage Loan Types

What Salary Do You Need To Buy A $400k House

Now lets take what weve learned and put it into action with an example. Lets say you want to buy a $400,000 house. First, youll need to do the hard work of saving up $80,000 in cash as a 20% down payment.

With a 15-year mortgage at a 3% interest rate, your monthly payment could be around $2,200 . To manage that payment, youd need to be earning at least $8,800 as your monthly take-home pay .

So, to buy a $400,000 home, youd need to be earning a take-home salary of more than $105,000 per year . Keep in mind, youd actually need more than that after you add the cost of property tax and home insurance into your mortgage.

If that doesnt sound like you, dont worry. Try saving a bigger down payment to lower your monthly mortgage until its no more than 25% of your take-home pay. Or look for a smaller starter home in a more affordable neighborhood.

Use Our Mortgage Calculator To Determine Your Home Budget

Sure, you could crunch the numbers yourself by dividing a home price by 180 months and then multiplying the decreasing monthly principal balance by your interest rate. But if you’re anything like us, you probably broke a sweat just reading that formula.

To save yourself the time and headache of doing a ton of math, we built a mortgage calculator to do that for youphew!

Sticking with our example of an income of $5,000 a month, you could afford these options on a 15-year fixed-rate mortgage at a 4% interest rate:

- $187,767 home with a 10% down payment

- $211,238 home with a 20% down payment

- $241,415 home with a 30% down payment

- $281,650 home with a 40% down payment

Remember: This is just a ballpark! Dont forget that grown-up stuff like property taxes and home insurance will top off your monthly payment with another few hundred dollars or so . And if you think youll be buying a home thats part of a homeowners association , youll need to factor those lovely fees in as well.

For example, if you plug in a mortgage amount of $211,238 with a 20% down payment at a 4% interest rate, youll find that your maximum monthly payment of $1,250 increases to $1,515 when you add in $194 for taxes and $71 for insurance. To get that number back down to a monthly housing budget of $1,250, youll need to lower the price of the house you can afford to $172,600.

Also Check: Chase Recast Mortgage

How Much Downpayment Do I Need

A down payment might be the one thing everyone knows is part of the home-buying process, but there is some discussion on how much of a down payment to make how to fund it and who benefits most from a big down payment: the buyer or the lender?

It seems obvious that the bigger the down payment, the better it is for the buyer and for good reason: Its the first jab at reducing the amount of money you must borrow and thus reduces the amount you must repay.The goal for most buyers is to put down 20% of the purchase price, which affords them a lot of benefits, such as:

- Tilting the approval process in your favor. A 20% down payment is a sign of commitment to the lender. They may overlook a few of the negatives in your file if they know youre already one-fifth of the way to paying off the home.

- Not having to pay Private Mortgage Insurance , which protects the lender if you default. PMI usually is about 1% of the loan amount or about $125 a month on a $150,000 mortgage. It is required on loans, if you dont have 20% down.

- Receiving the best interest rates and terms for your mortgage. Again, back to the commitment level.

- Paying less interest and points on a loan, which means making a lower monthly payment. Youre borrowing less, so you pay less.

- Lower payments mean faster payoff. Getting rid of a 30-year mortgage in 25 years is realistic if your payments are low enough that you can afford to throw extra money at the principal every month.

Rocket Mortgage: Loan Types And Products

Rocket Mortgage has a range of loan options for those who want to purchase a home and for homeowners looking to refinance an existing mortgage. Right now it offers the followings types of mortgages:

You will have access to most types of mortgage refinance loans though Rocket Mortgage, including standard rate and term refinancing, and cash-out refinance loans. It also offers government-secured loans for refinancing, such as VA Interest Rate Reduction Refinance Loans and FHA streamline refinance loans.

Currently, Rocket Mortgage doesnt offer USDA loans, construction loans, or adjustable-rate mortgages . You also wont be able to obtain any type of renovation loan, home equity loan, or home equity line of credit through Rocket Mortgage. So its not the best lender for financing a rehab project, unless a cash-out refinance makes sense for you.

Rocket Mortgage offers conventional loans with 15-year and 30-years terms. It also has a unique loan product called the YOURgage®, which has a flexible repayment term of 8 to 29 years. The YOURgage has a minimum down payment of 3%, a credit score requirement of 620, and your debt-to-income ratio must be 50% or less.

Read Also: Reverse Mortgage Manufactured Home

How To Figure Out Exactly How Much House You Can Afford

Sure, youve been saving up to buy a home for a while now, but when it comes down to it, how much house can you actually afford to buy? It’s crucial that you be realistic about what you can manage, since purchasing a home is a long-term undertaking. It’s a much bigger question than just how much money you have in the bank currently, or the total cost of the house you’ll need to consider things like potential renovations, your debt, taxes, and insurance. And what’s the most important factor? All things mortgage.

Before starting to look at homes, use the Rocket Mortgage® Home Affordability Calculator to get a customized picture of what you can afford. Keep reading for our guide to being smart when it comes to managing your money during the home buying process.

Let’s Talk Mortgage

There are several mortgage-specific factors that you need to think about when deciding on how much you can ultimately afford. First is the term, meaning the length of time you have to pay back the amount youve borrowed. The most common loan terms are 15 and 30 years, but there are other terms lengths available. The term will impact how much you’ll be paying each month in your installments.

The next thing to noodle on is your mortgage interest rate, which is money collected over the entire life of the loan. The rate is determined by the lender, and can vary depending on your credit score, down payment, and other factors.

How to Calculate Your Debt-to-Income Ratio

What Kind Of Mortgage Is Right For Me

The answer to this question is totally dependent on your present situation. To determine what kind of mortgage is right for you, you would need to realistically consider your financial situation. Some important questions you would need to answer include whether you are able to make a down payment, the length of time you would spend in the house, the state of things with your annual salary for the period of the mortgage as well as your credit history.

You May Like: Recasting Mortgage Chase

How Much Home Can I Afford

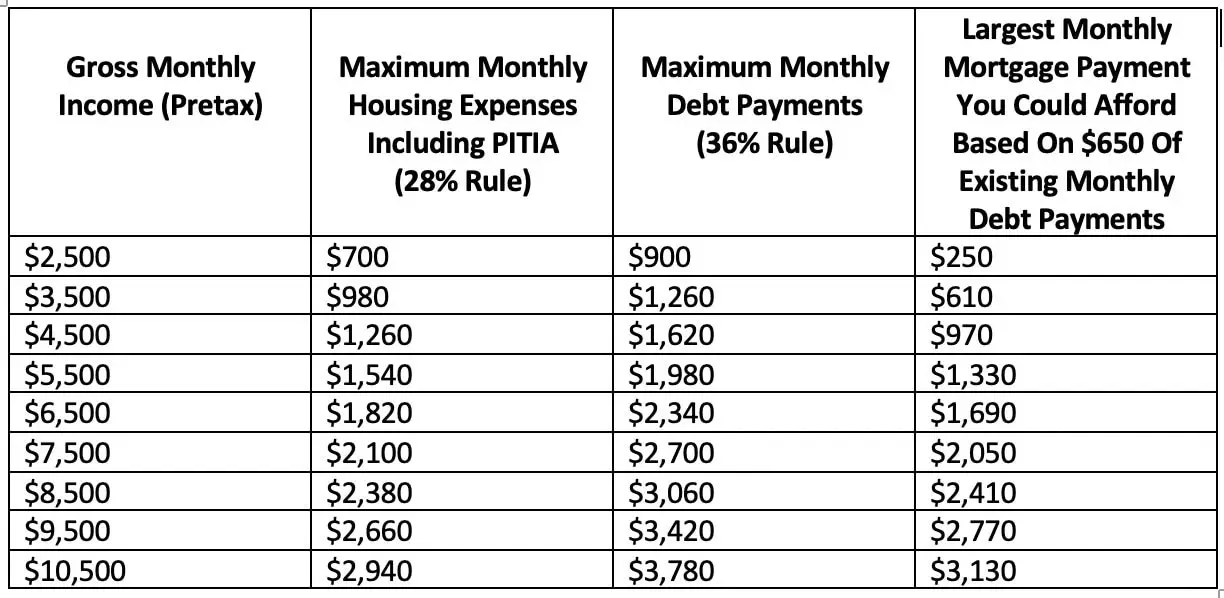

Properly estimating your budget is critical if you want to ensure you can afford your home. Experts generally recommend spending no more than 30% of your monthly income on housing, so tally up your earnings and work backward.

Youll also want to factor in things like insurance, maintenance, HOA dues, and other fees that come with buying a home. And, of course, dont forget the savings youll need for your down payment and closing costs.

Use Credibles monthly payment calculator below to see how much home you can afford:

Enter your loan information to calculate how much you could pay

Checking rates wont affect your credit score.

Use A Mortgage Affordability Calculator As A Starting Point

- Before you start perusing real estate listings

- Use an affordability calculator to determine if homeownership

- Makes sense financially and is within reach

- Then you can look into a pre-qual or pre-approval to fine-tune the numbers and make sure all red flags are addressed

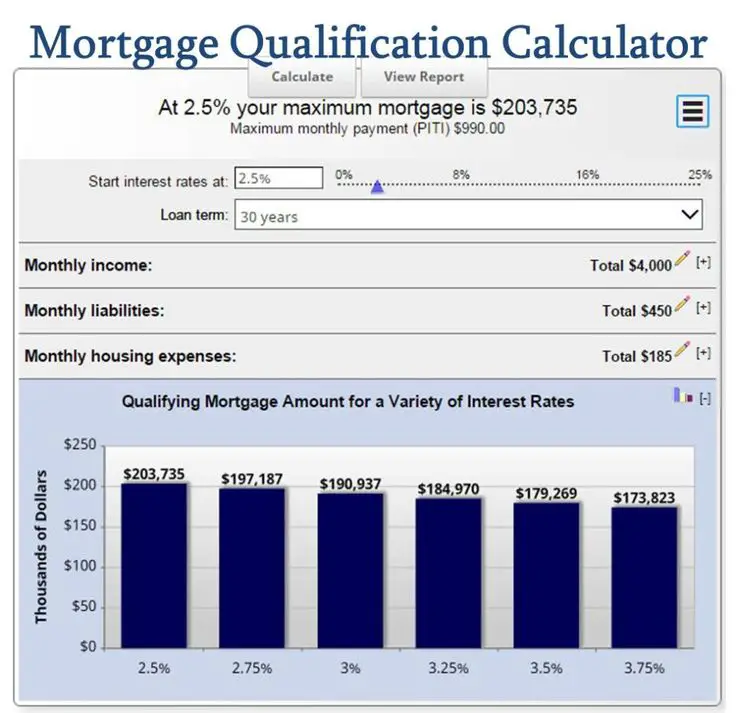

The mortgage affordability calculator below can give you a head start in front of other prospective home buyers competing for the same property.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Rocket Mortgage Rates And Fees

One of the most important considerations when choosing a mortgage lender is understanding what the loan will cost. Because in 2020, the most recent year for which data is available, Quicken Loans was still the lender behind Rocket Mortgage, our scoring reflects Quicken Loans’ rates and fees.

In order to provide consumers with a general sense of what a lender might charge, NerdWallet scores lenders on two factors regarding fees and mortgage rates, based on the most recently available Home Mortgage Disclosure Act data:

-

Quicken Loans, the lender behind Rocket Mortgage in 2020, earns 1 of 5 stars for average origination fee.

-

Quicken Loans earns 3 of 5 stars for offered mortgage rates compared with the best available rates on comparable loans.

Borrowers should consider the balance between lender fees and mortgage rates. While it’s not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive.

Some lenders just charge higher upfront fees.

You can decide to buy discount points a fee paid with your closing costs to reduce your mortgage rate.

Deciding whether to pay higher upfront fees is a matter of considering how long you plan to live in your home and how much cash you have to apply toward closing costs when you sign the loan paperwork.

» MORE: ‘Should I buy points?’ calculator

Important Market Trend Indicators

Several online real estate websites list houses for sale in a particular region. Among these are Trulia and Zillow. Both of these sites allow a prospective buyer to search for properties for sale in a selected area. This is one way to determine the number of homes currently on the market, how long they have been for sale and the listing prices. Another way is to search real estate ads in the local newspaper. Many local real estate brokers and agents maintain a website with their listings. This is an excellent source of information regarding listing prices, time properties have been on the market, detailed information such as cost per square foot of homes and median price ranges in selected areas. Some sites list the average sales per month. The softness of a market is determined by inventory that is moving slowly or has remained level for twelve months or longer. An indicator of an improving market is to compare how long it took a house to sell six months to a year ago compared to now.

Don’t Miss: Will Mortgage Pre Approval Hurt Credit Score

Rocket Loans Rates Fees & Other Terms

Category Rating: 80%

- Overall APR range: Rocket Loans offers fixed-rate personal loans with an APR range of 7.16% – 29.99%. Rocket Loans rates are comparable to what many other lenders offer.

- How rates are determined: Your exact interest rate will depend on your credit profile, income, loan amount and more.

- Origination fee: Rocket Loans personal loans have an origination fee of 1% to 6% of the loan amount. The fee will be subtracted from the initial amount you receive.

- Late fee: There is a $15 late fee for payments that are more than 10-days overdue.

- Early repayment fee: Rocket Loans does not charge any fees for paying off a loan early.

- Loan amounts & timelines: Rocket Loans personal loans range from $2,000 to $45,000. Borrowers get 36 to 60 months for repayment.

What Is Mortgage Affordability

Mortgage affordability refers to how much youâre able to borrow, based on your current income, debt, and living expenses. Itâs essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term âaffordabilityâ is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but itâs important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrowincluding the household income of the applicants purchasing the home, the personal monthly expenses of those applicants , and the expenses associated with owning a home .

You May Like: Can I Get A Reverse Mortgage On A Condo

How To Apply For A Rocket Loans Personal Loan

Applying for a personal loan typically involves prequalifying for a rate, submitting a formal application and awaiting loan approval. Follow these steps to apply for a Rocket Loans personal loan:

Will Mortgage Rates Go Down

Mortgage rates go up and down based on factors like the prime rate. However, current interest rates are at or near record lows, so they are more likely to go up over time than they are to drop further.

If you plan to purchase a home, your best bet is getting pre-qualified with one of the top mortgage lenders now so you can lock in todays low rates.

Read Also: Reverse Mortgage Mobile Home

How Much Income Is Needed For A 200k Mortgage

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a broader range of interest rates.

Rocket Mortgage Ease Of Application

Rocket Mortgage allows you to complete your mortgage application online, providing shortcuts along the way to make the process even faster. You can apply on the Rocket Mortgage app or on its website, which unsurprisingly, given Rocket’s online-first roots is fully optimized for mobile. The biggest difference between applying on your phone versus your computer is the size of your screen.

If you’d prefer to work with an actual person face to face , you can reach out to a mortgage broker affiliated with Rocket Mortgage.

A typical online application takes about half an hour, according to Rocket Mortgage, but you can work at your own pace. You’ll start by creating an account, then answering basic questions like the ZIP code where you’re planning to buy a home. Much of your financial information, such as bank and investment accounts, can be downloaded directly by Rocket Mortgage from many U.S. financial institutions. Rocket can also import income and employment information for many working Americans.

Then, you’re at the “See solutions” stage. This is where Rocket Mortgage pulls your credit data and reveals your loan choices, as well as how much house you can afford. From there, you can customize your options by changing the term, the money due at closing or your interest rate.

Recommended Reading: Are Discount Points Worth It