How Can I Stop Paying Pmi On A Conventional Loan

Once you reach the 80% LTV meaning you have 20% home equity you can request that your lender remove the PMI charge. Keep in mind, you have to ask for its removal, your lender does not automatically remove PMI until you reach 22% home equity. Keep in mind that the lender may use the original purchase price as a basis for that equity figure.

For instance, you purchased the home for $100,000 with 5% down. Its now worth $120,000 and the loan amount is $90,000. Using the current value, you have 25% equity. But if your lender uses the original purchase price, you only have 10% equity and would have to refinance to get out of PMI.

In addition, if your house value went down, dont be surprised if the lender uses your homes new, lower value.

Not all lenders and loan servicers use these conservative calculations. But its worth exploring other options if the lender says you dont yet have adequate equity.

To cancel PMI, the borrower must:

- Have at least 20% equity in the home according to the lenders or servicers calculations

- Make the request for PMI removal verbally or in writing to their lender

- Have an on-time payment history with no payment made more than 30 days late in the 12 months prior to the removal request

- Have an on-time payment history with no payment made more than 60 days late in 24 months, or two years, leading up to the removal request

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

What Is An Amortization Schedule

An amortization schedule shows your monthly payments over time and also indicates the portion of each payment paying down your principal vs. interest. The maximum amortization in Canada is 25 years on down payments less than 20%. The maximum amortization period for all mortgages is 35 years.

Though your amortization may be 25 years, your term will be much shorter. With the most common term in Canada being 5 years, your amortization will be up for renewal before your mortgage is paid off, which is why our amortization schedule shows you the balance of your mortgage at the end of your term.

Also Check: Can You Do A Reverse Mortgage On A Mobile Home

Types Of Pmi And How It Is Pmi Typically Paid

There are two main kinds of PMI

Which of these is better? Well, we would suggest going with the borrower-paid insurance. The main reason is that lender-paid PMI typically comes with a higher mortgage rate. The PMI is temporary whereas the mortgage rate is permanent.

So youâd rather have a low mortgage rate and a PMI paid out-of-pocket yourself, only because you can cancel PMI later anyway and get to keep the low mortgage rate for the life of the loan.

Conforming Loans With Private Mortgage Insurance

Conforming loans get their name because they meet or conform to Fannie Mae or Freddie Mac guidelines for the loan amount and the borrower’s creditworthiness.

Key Takeaways

Conforming Loan Insurer

A loan conforming to Fannie Mae or Freddie Mac’s standards is not insured by either Fannie or Freddie. PMI is not government insured it’s backed by private companies.

PMI Cost for Conforming Loans

PMI is generally cheaper than the mortgage insurance premiums on FHA loans. How much a borrower will pay for PMI depends on the loan type, down payment percentage, property type, location and other factors.

You May Like: Does Rocket Mortgage Sell Their Loans

Cost Of Private Mortgage Insurance

The cost of your PMI premiums will depend on several factors.

- Which premium plan you choose

- Whether your interest rate is fixed or adjustable

- Your loan term

- Your down payment or loan-to-value ratio

- The amount of mortgage insurance coverage required by the lender or investor

- Whether the premium is refundable or not

- Your credit score

- Any additional risk factors, such as the loan being for a jumbo mortgage, investment property, cash-out refinance, or second home

In general, the riskier you look according to any of these factors , the higher your premiums will be. For example, the lower your credit score and the lower your down payment, the higher your premiums will be.

According to data from Ginnie Mae and the Urban Institute, the average annual PMI typically ranges from .55% to 2.25% of the original loan amount each year. Here are some scenarios: If you put down 15% on a 15-year fixed-rate mortgage and have a credit score of 760 or higher, for example, you’d pay 0.17% because you’d likely be considered a low-risk borrower. If you put down 3% on a 30-year adjustable-rate mortgage for which the introductory rate is fixed for only three years and you have a credit score of 630, your rate will be 2.81%. That happens because you’d be considered a high-risk borrower at most financial institutions.

How Do I Avoid Paying Pmi Altogether

To avoid PMI, youll need at least 20 percent of the homes purchase price set aside for a down payment. For example, if youre buying a home for $250,000, you need to be able to put down $50,000.

Another strategy is a piggyback mortgage. With a piggyback loan, youd actually get two separate mortgages, one for 80 percent of the homes value and one for 10 percent. Youd make a 10 percent down payment from your savings, and use the smaller of the two loans to complete the 20 percent down payment.

The upside of this strategy is avoiding PMI, but a piggyback mortgage means having two loans and two monthly payments to make, so consider this option carefully. Some piggyback loans also have shorter terms than the primary mortgage, so your monthly payments will be higher.

Also Check: How Much Does Getting Pre Approval Hurt Credit

How Much Is Pmi For A Conventional Loan

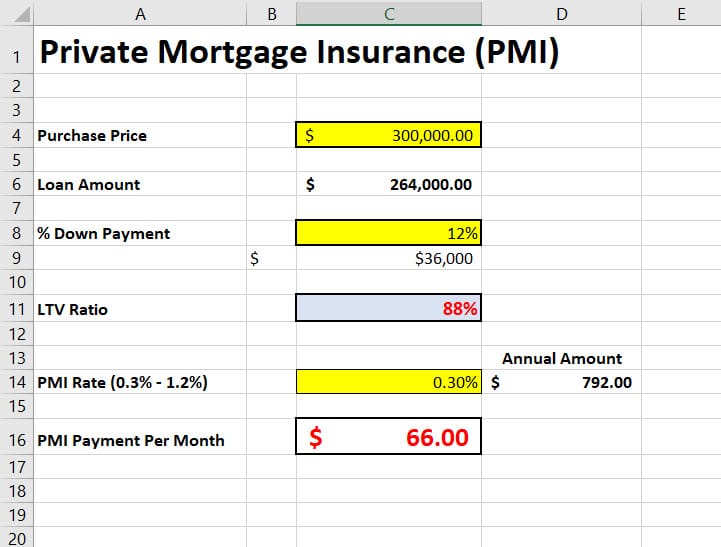

PMI for a conventional loan is calculated based on the home price, loan amount, down payment, and your credit score.

Generally, lower down payments mean higher monthly PMI premiums. Bigger down payments mean lower PMI premiums and less paid out toward mortgage insurance over time.

Related reading: Conventional 97 Loan: How to Qualify for a Low Down Payment Mortgage

Freddie Mac, one of the government-sponsored entities that backs conventional conforming loans, says homeowners should expect to pay between $30-70 a month per $100,000 financed.

Based on that range, a homeowner who borrowers $300,000 from a mortgage lender might pay anywhere from $90 to $210 per month depending on credit score, down payment, and other factors.

What Does Pmi Cost

On average, PMI costs range between 0.22% to 2.25% of your mortgage. How much you pay depends on two main factors:

- Your total loan amount: As a general rule, PMI expenses are higher for larger mortgages.

- Your credit score: Lenders typically charge borrowers with high credit scores lower PMI percentages.

Lenders typically maintain charts that show the PMI percentage to charge in various situations. You can ask your lender for a specific percentage to make your calculations easier.

You May Like: What Does Gmfs Mortgage Stand For

Mortgage Insurance Vs Home Insurance

Mortgage insurance doesn’t cover you or your home. It’s not a substitute for a home insurance policy, which protects the structure of your home, personal belongings, and your pocketbook in case you’re financially liable for something. Home insurance is typically required by your lender no matter the size of your down payment and is highly recommended even after you pay off your home. Mortgage insurance, however, is only required if you’re unable to make a 20% down payment on a new home loan or refinance.

If you’re going through the home-buying process and have additional questions about insurance, check out our guide to home insurance for first-time buyers.

How Do I Get Rid Of Pmi

Fortunately, there are a few ways to eventually get rid of PMI if youre required to pay it now. The first is consistently making payments until you have 20% equity in your homeor an LTV of 80%at which point the lender is required to cancel it. However, this doesnt happen automatically you should contact your lender and ensure that PMI is indeed canceled once you meet the qualifications.

Another situation in which you no longer need to pay PMI is if your home value increases and you now have more than 20% equity built up. In this situation, your LTV might reach 80% faster than you were originally required to pay PMI. If that happens, great. You should have your home reappraised, and if you owe less than 80% of the newly appraised value, its time to get in touch with your lender to have your PMI canceled. Keep in mind that you are responsible for the costs associated with having your home appraised in this situation.

Finally, if your cash flow has unexpectedly increased and you can afford to pay off your mortgage faster, you may consider doing soat least for a few months. By making extra payments toward your loan, you can pay down the principal faster and reach an LTV of 80% sooner than originally planned.

Don’t Miss: Rocket Mortgage Loan Types

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

How To Avoid Paying Pmi With A Piggyback Loan

If you cant gather up enough funds for a 20% down payment but are adamant about not paying mortgage insurance, a piggyback loan may be a good alternative. It involves taking out a first mortgage up to 80% of your homes value, and piggybacking a home equity loan or home equity line of credit on top of it. Heres how it works:

- Borrow 80% of your homes value with a first mortgage

- Borrow 10% of the homes value with a home equity loan or HELOC

- Make a 10% down payment

This particular example is also known as an 80-10-10 loan. If youre buying your home, theres an added bonus: The interest on both mortgages is usually tax-deductible.

Don’t Miss: Can You Get A Reverse Mortgage On A Condo

Reducing The Pmi Rate

But to take a more specific example, lets look at what PMI might look like for a borrower with a 679 score who is taking a 5% down conventional loan.

MGIC, a popular mortgage insurance provider, says this borrower would pay 1.28% of the loan amount per year with this criteria, or about $266 per month on a $250,000 loan.

Heres where credit score really impacts your PMI rate. If this borrower raised their credit score a single point, to just 680, they would qualify for a more competitive PMI rate of 0.96%.

They could get it down to 0.65% if they boosted their score by a point and increased their down payment to 10%. Thats more than a half apercentage point less than where we started.

Mortgage insurance rates are closely tied to your credit score and down payment, and the lower both of those are, the more youll pay. Following are PMI rates at the time of this writing, according to MGIC.

| Borrower 1 |

|---|

These figure are estimates and for example purposes only. Mortgage Insurance Rates change daily.

The best rates go to the borrowers with high credit scores and high down payments.

Now, does that mean that if you have a low credit score and cannot afford a large down payment, youre doomed to paying high mortgage insurance rates?

No. But you may want to consider loan programs that have different types of mortgage insurance and lower mortgage insurance rates. See the next section for conventional loan alternatives.

What Is The Importance Of A 20% Down Payment

A lender typically requires the borrower to contribute at least 20% to avoid mortgage insurance. By requiring the borrower to pay at least that much, the lenderâs main goal is to protect itself from any loss in case of a foreclosure.

And how does the protection work? Say, a foreclosure happens and the property price has dropped since the purchase. In that case, the lender runs the risk of recovering less than the loan amount.

But as long as the property price drop is less than 20%, the bank can still sell it off at a price so as to recover the loan amount in full and not lose anything.

In other words, this 20% contribution from the borrower acts as a protective cushion for the lender to get back what itâs owed.

Don’t Miss: Reverse Mortgage For Condominiums

Example Of Private Mortgage Insurance

Assume you have a 30-year, 2.9% fixed-rate mortgage for $200,000 in New York. Your monthly mortgage payment would be $832.00. If PMI costs 0.5%, you would pay an additional $1,000 per year or . As a result, your monthly PMI payment would be $83.33 each month, or , increasing your monthly payment to $915.33.

You may also be able to pay your PMI upfront in a single lump sum, eliminating the need for a monthly payment. The payment can be made in full at the closing or financed within the mortgage loan. In many cases, this is the more affordable option as long as you plan on staying in the home for at least three years. For the same $200,000 loan, you might pay 1.4% upfront, or $2,800.

However, it’s important to consult your lender for details on your PMI options and the costs before making a decision.

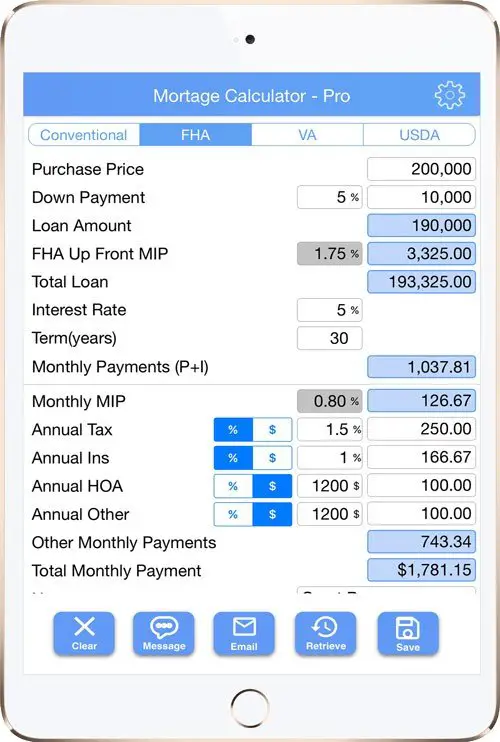

How Is Mortgage Insurance Calculated

Mortgage insurance is always calculated as a percentage of the mortgage loan amount not the homes value or purchase price.

For example: If your loan is $200,000, and your annual mortgage insurance is 1.0%, youd pay $2,000 for mortgage insurance that year.

Since annual mortgage insurance is recalculated each year, your PMI cost will go down every year as you pay off the loan.

For FHA, VA, and USDA loans, the mortgage insurance rate is preset. Its the same for every customer .

Conventional PMI mortgage insurance is calculated based on your down payment amount and credit score.

Typically, the ongoing annual premiums for mortgage insurance are spread across 12 monthly installments. You simply pay it each month as part of your regular mortgage payment.

Calculating mortgage insurance by credit score

The following chart compares cost differences between the three major types of mortgage insurance, based on a $250,000 loan amount, and varying credit levels.

Don’t Miss: How Does The 10 Year Treasury Affect Mortgage Rates

Should I Pay Off My Pmi Early

Its very important that you cancel your mortgage insurance as soon as you can because the savings can be significant for your monthly payments. Lets take our previous example of a $300,000 loan amount and assume this is a one-unit primary property. Recall that you can request mortgage insurance termination when you reach 20% equity and it auto cancels at 22% equity.

On a 30-year fixed loan there are nine payments between the time you cross the 20% threshold and when the payments would auto cancel after breaking through the 22% barrier. If you had a mortgage insurance rate that was 0.5% of your loan amount, your savings would be $1,125. If you had a 1% mortgage insurance rate, you would save $2,250 in mortgage insurance payments over those 9 months.