Only Rate Shop When Youre Ready To Buy A House

To shop multiple loans without damaging your credit, only rate shop when youre absolutely ready to purchase a home.

Remember, you want all your applications to take place within a 14 to 30-day window.

If you rate shop over a period of three to six months, youll trigger multiple inquiries on your credit report and lower your credit score.

A lower score might not prevent an approval, but it can result in a higher mortgage rate.

How Much Does A Mortgage Affect Your Credit Score

Ill show how my credit score was affected once I got the mortgage, and how it looks almost a year later. This is based on my personal experiences, and there are literally hundreds of factors which can go into your credit score, so your mileage may vary.

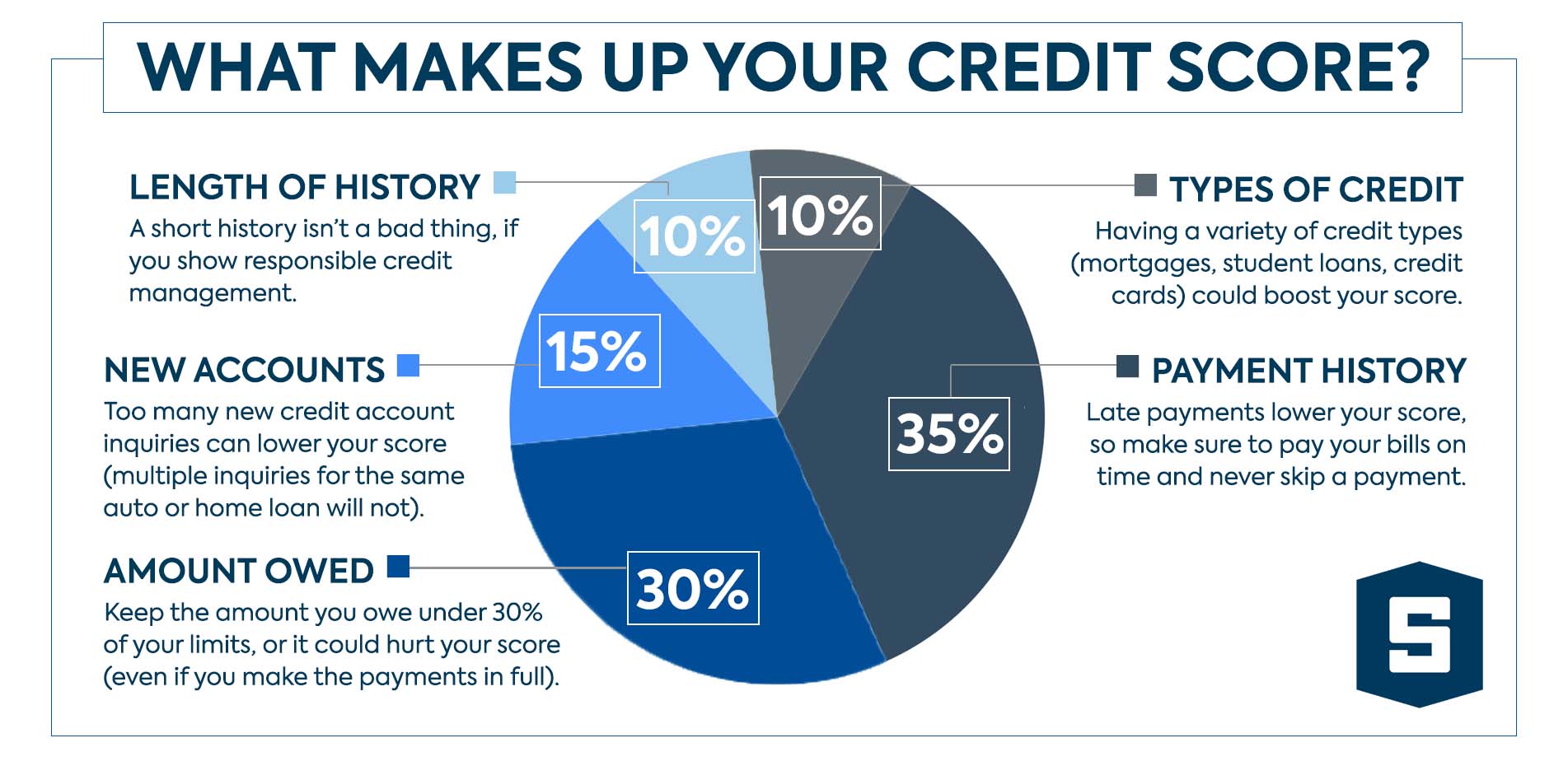

Before jumping in and showing the actual credit scores before and after our mortgage, I think its best to look at some of the factors which explain how it works and what changed in my credit profile. Lets start by looking at the big picture, then work our way down.

How Refinancing A Mortgage Affects Your Credit

Even though there are many long-term benefits of refinancing your mortgage, there are a few ways the refinancing process can make a shorter-term dent in your credit score.

Any application for a loan or credit will have an impact on your credit, explains Melinda Opperman, president and chief relationship officer of the nonprofit Credit.org. How strong that impact is will vary a lot depending on many factors.

The ways a mortgage refinance can impact your credit score include:

Also Check: How To Mortgage Property In Monopoly

Do Credit Inquiries Affect My Fico Score

FICO’s research shows that opening several credit accounts in a short period of time represents greater credit risk. When the information on your credit report indicates that you have been applying for multiple new credit lines in a short period of time , your FICO Scores can be lower as a result. Although FICO Scores only consider inquiries from the last 12 months, inquiries remain on your credit report for two years.

If you apply for several credit cards within a short period of time, multiple inquiries will appear on your report. Looking for new credit can equate with higher risk, but most are not affected by multiple inquiries from auto, mortgage or student loan lenders within a short period of time. Typically, these are treated as a single inquiry and will have little impact on your credit scores.

Too Much Mortgage Refinancing Is Not Good

Refinancing might become problematic for your credit score if you are constantly refinancing or applying for new credit related to your mortgage. While there are certain exceptions, credit rating companies often frown at having your credit score pulled too many times over a short period, and from too many different potential creditors.

In fact, FICO might penalize you for being unable to honor a credit contract or for having too many inquiries on your credit report. Also, every time you refinance, your credit score is pulled, and having too many credit score requests in a relatively short period of time often has a negative impact on your credit score.

Similarly, interest rate shopping for a refinance on your current mortgage can result in multiple credit inquiries in a short period. Fortunately, back in 2009 FICO and other credit scoring systems changed the way multiple inquiries are treated on your credit score for certain kinds of debt, such as mortgages or student loans.

If you are going to shop around, FICO recommends submitting all of your applications within a 30- to 45-day period. In its newest scoring model, even if you do not end up accepting a new loan, FICO treats all of your inquiries during that period as just one credit pull, minimizing the impact on your score. However, FICO acknowledges that some lenders still choose to use older FICO scoring models, so some people still prefer to limit their inquiries to a 14-day period.

Don’t Miss: Can You Get A 30 Year Mortgage On Land

How To Shop For A Mortgage Without Hurting Your Credit

Buying a home is an intensive process. You have to save up money for a down payment, search for the perfect home, and figure out how to get yourself a mortgage. Thats a lot for anybody, but on top of all this, you also have to worry about how all these decisions will affect your credit score. Shopping and applying for a mortgage can impact your creditbut it doesnt have to.

Lets take a look at the ways shopping for a mortgage will affect your credit score and how to minimize the impact.

Not Keeping Tabs On Your Credit

No one likes surprises, especially before buying a house. If you or your spouse have obvious credit issuessuch as a history of late payments, debt collection actions, or significant debtmortgage lenders might offer you less-than-ideal interest rates and terms . Either situation can be frustrating and can push back your ideal timeline.

To tackle potential problems in advance, check your credit report for free each year at annualcreditreport.com from each of the three credit reporting agencies: Transunion, Equifax, and Experian. Look for errors and dispute any mistakes in writing with the reporting agency and creditor, including supporting documentation to help make your case. For additional proactive help, consider utilizing one of the best credit monitoring services.

If you find current but accurate negative items, such as late payments or delinquent accounts, theres no way to remove those items quickly. Unfortunately, theyll stay on your credit report for seven to 10 years. But you can boost your score by paying your bills on time, making more than the minimum monthly payments on debts, and not maxing out your available credit. Above all, be patient. It can take at least one year to improve a low credit score.

Recommended Reading: Is A Reverse Mortgage Good Or Bad

Its Totally Fine To Shop Around For A Mortgage

- You should definitely shop around for your home loan

- This ensures you explore all options and obtain the lowest rate possible

- Fortunately FICO has an algorithm designed specifically for mortgage inquiries

- Doesnt penalize mortgage shopping in a specified window of time

The developers of the FICO score know how mortgage shopping works and have adjusted their super secret algorithm accordingly.

First off, FICO ignores any mortgage inquiries made in the 30-day window prior to scoring, meaning those recent credit pulls shouldnt adversely affect your credit scores.

For example, if mortgage lender A pulls your credit, then you decide to get quotes and/or pre-approved with mortgage lenders B and C in the same week, they wouldnt count against you.

This allows to you shop without worry of your credit scores going down each time you do.

Additionally, FICO counts multiple mortgage inquiries in a certain time span as a single inquiry.

How Does Getting A Mortgage Affect Your Credit Score

In short, it all depends on your financial situation. If youre in good fiscal health with plenty of savings, the shift can be nominal.

There are other ways to shop for a mortgage without hurting your credit, too. You can work with Credit Karma or another financial services group to help you understand your credit issues and get a feel for your credit-worthiness. You can also use these groups to apply for and field you offers as well. Once youre ready to fill out your mortgage application, a hard inquiry will be performed.

Read Also: What Credit Score Do You Need For A Conventional Mortgage

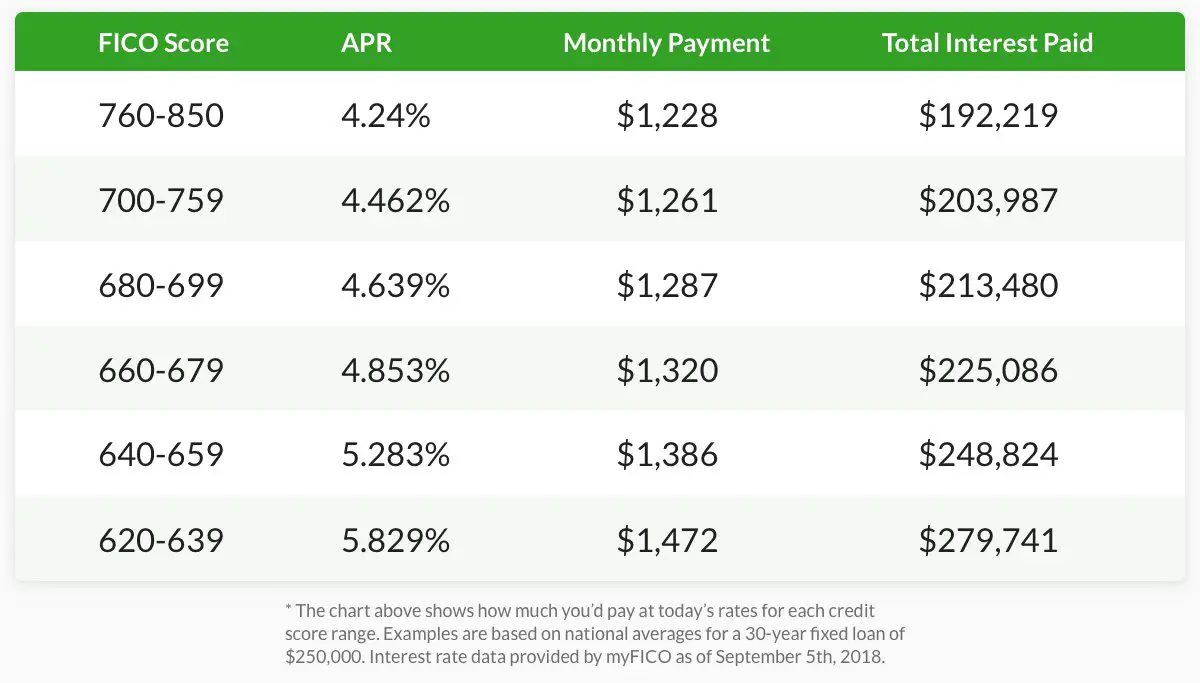

Good Credit Puts Money In Your Pocket

Good credit management leads to higher credit scores, which in turn lowers your cost to borrow. Living within your means, using debt wisely and paying all billsincluding credit card minimum paymentson time, every time are smart financial moves. They help improve your credit score, reduce the amount you pay for the money you borrow and put more money in your pocket to save and invest.

1 Scores and rates as of January 9, 2015, as reported on myFICO website.

Whats In My Credit Report

Your credit report is a summary of your credit history. It includes information about you, your financial obligations to creditors, payment history, debts sent to collections, and requests for info from creditors, businesses, or individuals.

Read our blog post to learn how to request a free copy of your credit report.

Information from your credit report is used to determine your credit score. Your credit score, along with the other information in your credit report, informs lenders how likely you are to be a credit risk. Your credit score is usually a three-digit number the higher the number, the better the score.

Recommended Reading: Can My Wife Get A First Time Buyer Mortgage

Buying A More Expensive House Than You Can Afford

When a lender tells you that you can borrow up to $300,000, it doesnt mean you should. If you max out your loan, your monthly payments might not actually be manageable. Typically, most prospective homeowners can afford a loan amount between 2 and 2.5 times their gross annual income.

In other words, if you earn $75,000 per year, you might be able to afford a home priced between $150,000 and $187,500. Investopedia’s mortgage calculator can help you estimate monthly payments, which is a better barometer of whether you can afford a home in a certain price range.

Mortgage lending discrimination is illegal. If you think you’ve been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report to the Consumer Financial Protection Bureau or with the U.S. Department of Housing and Urban Development .

Buying a more expensive house than you can reasonably afford can land you in trouble if you have to stretch your monthly budget to make mortgage payments. In other words, you might wind up feeling house poor and experience buyers remorse.

Also, consider that homeownership comes with added expenses in addition to those monthly mortgage payments. You need to save for inevitable maintenance expenses, repairs, insurance, property taxes, homeowners association fees , and other costs that you do not have to pay as a renter.

Skipping The Home Inspection

Unless you have a lot of cash to fix up a home and are willing to risk having to pay for unforeseen repairs, waiving a home inspection can be a costly mistake. Home inspections are meant to find major issues with a home, and they are intended to protect the buyer.

If you dont get an inspection, you will have no recourse if a major issue, such as cracked pipes or water damage, surfaces after you close on a home. That means you might be footing the entire bill to fix those issues. When you make an offer on a home, you can include a home inspection contingency that gives you a penalty-free exit from the deal if a major issue is uncovered and the seller is unwilling to fix it before closing.

With that contingency in place, you can withdraw your offer and usually get your full earnest money deposit refunded. The home inspection fee is non-refundable and typically paid by the buyer to the home inspector up-front. It typically ranges from $300 to $500, depending on location and the size of the property. Its a small price to pay when you weigh it against the potential costs of having to replace a furnace, water heater, roof, or other big-ticket itemswhich could mount into the thousands.

You might consider additional inspections, such as a pest inspection, mold or radon inspection, or a sewer scope, for example, if your lender requests it. These and other inspections can help protect your investment and safety.

Don’t Miss: Is The Property Tax Included In Mortgage Payments

Do Mortgage Inquiries Affect Your Credit Score Yes But You Can Still Shop

Mortgage Q& A: Do mortgage inquiries affect credit score?

When preparing to take out a mortgage, you may have concerns about your credit report being pulled numerous times within a short period of time.

This can occur while shopping for that perfect mortgage with multiple mortgage lenders or mortgage brokers over the span of a few weeks or even months.

But while mortgage inquiries can certainly add up, they wont necessarily lower your credit score or affect your ability to obtain home loan financing.

What Exactly Happens When A Mortgage Lender Checks My Credit

The credit check is reported to the credit reporting agencies as an “inquiry.”

Inquiries tell other creditors that you are thinking of taking on new debt. An inquiry typically has a small, but negative, impact on your credit score. Inquiries are a necessary part of applying for a mortgage, so you can’t avoid them altogether. But it pays to be smart about them. As a general rule, apply for credit only when you need it. Applying for a credit card, car loan, or other type of loan also results in an inquiry that can lower your score, so try to avoid applying for these other types of credit right before getting a mortgage or during the mortgage process. Learn more about credit scores

You May Like: What Banks Look For When Applying For A Mortgage

Keeping Your Credit Score Intact After Securing A Mortgage

Your credit score may initially dip after adding a home loan to your debt load. You still have to prove that you can responsibly pay it back. Make your payments in full and on time.

If you dont pay your mortgage on time, it can reflect negatively on your credit score. Contact your mortgage lender right away and explain your situation if you ever find yourself unable to pay your mortgage or other debt, says the Federal Deposit Insurance Corporation. Reputable credit counseling organizations can help you create a plan to help lessen some of the potential negative effects on your credit score.

Does Rate Shopping Hurt Your Credit An Interview With The Experts

When buying a house, interest rates matter. Even a slightly higher interest rate can increase the amount that you have to pay on your mortgage. For example, an increase of as little as one or two percent over a 30-year mortgage could turn into tens of thousands of dollars more that you’ll pay over the lifetime of your mortgage.

So it makes sense to shop around for the lowest possible rate you can qualify for. However, consumers are also aware that inquiring too many times on a loan can have a negative impact on your credit scores

You’re stuck between the proverbial rock and a hard place: On the one hand, you need to shop around for a mortgage. On the other hand, shopping around too much is said to hurt your credit scores. So how can you get a lower interest rate without shopping around too much?

I went straight to the source for the answers — I interviewed representatives from FICO and from one of the three main credit bureaus, Experian — to find out exactly how you can find the balance between rate shopping and credit score impact. I wanted to show you how you can get the best of both worlds! FICO scoring models are the most widely used credit scores around, although there are other credit scores that some financial institutions use. And there are more than just three credit bureaus but Experian, Equifax, and TransUnion are the three main credit reporting bureaus that financial institutions use.

In this blog post , I’ll reveal exactly what the experts suggest:

Don’t Miss: What Is The Rate For A 15 Year Mortgage

Tracking My Credit Score

There are several ways you can track your credit score. Before we got our mortgage I started using a out of curiosity mostly I wanted to see how they work and what they track. I signed up and got a copy of my credit scores based on the three major credit bureaus .

Getting Your Real Credit Score

Many people say that you should get the FICO credit score directly from MyFICO. This seems to be the obvious option since FICO is the company that creates the scores.

However, you can get your score for less by going through FreeScore360. They offer you a seven day trial and then it is only $19.95 per month going forward, which includes all three of your credit score, credit monitoring, and $1 million of id theft insurance.

Apply For Only One Loan Type At A Time

If youre planning to take out an important loan soon, such as a mortgage, avoid applying for other types of loans at the same time. If you apply for other loans or credit, those hard credit inquiries will show up on your credit report as separate inquiries even if you apply within the same 14-day time frame.

Read Also: What Mortgage Lenders Use Vantagescore

Does Prequalification Hurt My Credit Score

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Whether you need a loan to purchase a home or car, or youre in the market for a new credit card, youll want to take the time to see if you prequalify.

Prequalification provides consumers a way to find out what their chances are of being approved for a new loan or credit product before filling out an application form. Plus, the prequalification process wont negatively affect your the way it will once you formally apply.