Sellers Prefer Buyers Who Will Use Other Types Of Mortgages

Due to the COVID-19 pandemic, the Federal Reserve has slashed down interest rates to boost the economy and the housing market. Unfortunately, the supply of homes cannot keep up with the demand due to scarcity of raw materials.

Today, we have whats called a sellers market. Essentially, if youre selling a house in this atmosphere, you get to be in control. Buyers are not in a position to negotiate and have to face fierce competition with other bidders. Logically, sellers will want to get their money faster, and they wouldnt appreciate buyers using an FHA loan to finance the purchase.

FHA loans are notorious for their strict requirements, especially appraisal and home inspection, making the loan application process run longer than others.

Fha Streamline Refinance Faq

What is the FHA Streamline program?

The FHA Streamline is a refinance program that only current FHA homeowners can use. Its faster and easier than most refinance programs, with no documentation required for income, credit, or home appraisal. An FHA Streamline Refinance can help homeowners lower their annual mortgage insurance premium or even get a partial refund of their upfront MIP payment.

How does the FHA Streamline Refinance work?

The FHA Streamline Refinance resets your mortgage with a lower interest rate and monthly payment. If you have a 30-year FHA mortgage, you can use the FHA Streamline to refinance into a cheaper 30-year loan. 15-year FHA borrowers can refinance into a 15- or 30-year loan. The FHA Streamline does not cancel mortgage insurance premium for those who pay it. But annual MIP rates may go down, depending on when the loan was originated.

Do I have to pay closing costs on an FHA Streamline Refinance?

The borrower pays closing costs on an FHA Streamline Refinance. Unlike other types of refinances, you cannot roll these costs into your loan amount. FHA Streamline closing costs are typically the same as other mortgages: 2 to 5 percent of the mortgage amount, which would equal $3,000 to $7,500 on a $150,000 loan. The difference is, you dont have to pay for an appraisal on an FHA Streamline, which could save about $500 to $1,000 in closing costs.

Does an FHA Streamline Refinance get rid of PMI?Who qualifies for an FHA Streamline Refinance?

*revision To The Annual Mip Premium As Per Mortgagee Letter 2015

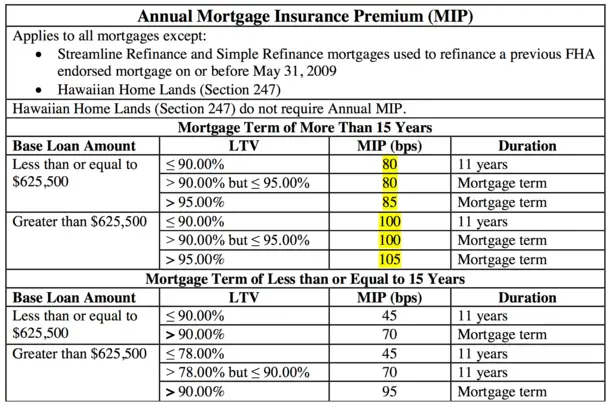

There will be no change in Annual Mortgage Insurance Premiums for all case numbers assigned on or after January 26th, 2015 for the following:

There will be the following reduction in premiums in Annual Mortgage Insurance Premiums for all case numbers assigned on or after January 26th, 2015 for the following:

Recommended Reading: How Do You Calculate Self Employed Income For A Mortgage

Is An Fha Loan Right For You

If youre still debating the merits of an FHA loan compared to a conventional loan, know that a conventional loan is not government-backed. Conventional loans are offered through Fannie Mae or Freddie Mac, which are government-sponsored enterprises that provide mortgage funds to lenders. They have more stringent requirements, so keep in mind that youll need a higher credit score and a lower DTI to qualify.

Regardless of whether you choose a conventional or FHA loan, know that there are a few other costs of which youll need to be aware. You’ll have to pay closing costs, which are the fees associated with processing and securing your loan. These can vary depending on the price of the house and the type of mortgage, but you should budget 3% 6% of your homes value.

You should also budget 1% 3% of your purchase price for maintenance. The exact percentage is going to depend on the age of the house. If your house is newer, odds are less things are likely to break right away. Meanwhile, if the house is on the older end, you may need to set aside more. Finally, if you live in an area with homeowners association fees, youll end up paying for those on a monthly or yearly basis.

Fha Simple Or Streamline Refinances

| Loan amount | Mortgage insurance premium in basis points | Duration of insurance payments |

| 55 | Entire loan term |

Upfront mortgage insurance premiums can be, and often are, financed into the loan amount, explains Peter Boomer, a mortgage executive with PNC Bank. Annual premiums are included in the borrower’s monthly mortgage payment.

If you borrow $100,000 and roll the cost of FHA upfront MIP into your loan, your loan amount will increase to $101,750 . Naturally, that increases your monthly payment, as well. On a $101,750 30-year fixed-rate FHA loan at 4 percent, your monthly mortgage payment would be $485, compared to $477 without financing the MIP.

Tack on the annual premiums, too, and your monthly payment will rise further, adding another $72 per month, bringing the total to $557. That’s assuming you make a minimum down payment of 3.5 percent, in which case you’ll be charged an annual MIP rate of 0.85 percent.

Also Check: What Does A Mortgage Payment Consist Of

Its Hard To Look For Fha

For various reasons, to begin with, it is already hard to apply for an FHA loan at any given time. Although it is advertised that you can qualify with as low as a 500 credit score, in reality, every FHA lender will have its overlays. When we say overlays, these are additional requirements determined by the lenders themselves, even though not demanded by the government agency.

Since the start of the COVID-19 pandemic, it has been increasingly hard to find an FHA lender who even accepts 580 credit scores. And its no wonder. The economy has not fully recovered, and lenders prefer conventional mortgages over FHA home loans.

Fha Streamline Refinance: Key Takeaways

If youre trying to decide whether an FHA Streamline Refinance loan is worth it, there are a few key things to keep in mind:

- The FHA Streamline can refinance only existing FHA loans Not USDA, VA, or conventional mortgages

- You can skip traditional underwriting steps like the credit check and income verification

- The FHA Streamline doesnt require a home appraisal which can save time and money

- You cant cash out home equity

- The new loan will require the FHAs mortgage insurance premium

- You can refinance only primary residences Not vacation homes or investment properties

Provided you meet the basic requirements for an FHA Streamline, this loan is an excellent way to refinance into a lower rate and monthly payment with less hassle than a traditional refi.

Also Check: What Is The Lowest Fixed Rate Mortgage

How To Get Rid Of Pmi Mip On An Fha Loan

An FHA loan sounded like a good idea at the time.

But now that youre paying high mortgage insurance premiums, month after month and year after year, you might not be so sure. In fact, someone with a $250,000 FHA loan can expect to pay about $30,000 in mortgage insurance premiums over the life of the loan.

The good news is you can cancel your FHA mortgage insurance and you can start today.

There are two methods for removing your FHA mortgage insurance, commonly known as FHA MIP.

Refinancing Into Lower Fha Mip

Not everyone is eligible for a conventional refinance, and thats ok. There may be a way to lower your FHA mortgage insurance cost even if you cant remove it altogether.

You may have a higher rate of MIP than what is available today.

Here is a history of FHA MIP rates charged by the Federal Housing Administration:

- Prior to January 2008: 0.50% annual MIP

If you received a loan in January 2013, for instance, you could refinance into todays lower MIP and save $40 per month per $100,000 borrowed. Plus, you may save even more by getting a lower mortgage rate.

Keep in mind, though, that your new FHA loans MIP will become noncancelable. Thats because your new loan will originate after June 2013, when FHA MIP rules changed.

Reduced upfront and monthly MIP for certain refinancing homeowners

If you got your FHA loan prior to May 31, 2009, you can receive lower MIP rates via an FHA Streamline Refinance.

Eligible candidates receive annual MIP of 0.55% and reduced upfront MIP of 0.01% .

Thats a savings of $3,480 upfront and $50 per month on a $200,000 loan.

You May Like: Does Rocket Mortgage Affect Your Credit Score

Can You Cancel Fha Mip

Unfortunately, the FHA has changed its rules so that new borrowers cannot cancel their FHA mortgage insurance. Only borrowers with FHA loans dated before June 3, 2013 can cancel.

If youve had your FHA mortgage that long, cancelling may still not be possible. Youll have to meet some requirements. The primary hurdle is that your LTV must be 78% or lower at the time of your request. Generally, it takes about 10 years for borrowers to bring their LTV down to that level.

You Pay For Mortgage Insurance Longer On An Fha Loan

When you get a conventional mortgage, you dont always have to pay mortgage insurance, but youll need at least 20% of your houses worth. On the other hand, for FHA loans, mortgage insurance is inescapable regardless of how much money you pay down at the beginning.

An upfront mortgage insurance premium at closing and an annual mortgage insurance premium wrapped in your monthly mortgage payment. Now, the upfront one is just a fact of life. For the monthly premium, however, you must be borrowing a loan amount not greater than 90% so that you only have to pay insurance for eleven years. If you make a down payment below 10 percent, you keep insurance for the life of your loan.

No matter how much cheaper the mortgage insurance can be for FHA loans than conventional loans, thats a lot of money if you have to pay insurance premiums for thirty years.

Read Also: What Mortgage Lenders Use Vantagescore

Your Loan Cant Be Delinquent

FHA requires an ontime payment history to qualify for this refinance program.

The three most recent mortgage payments must have been paid in full and on time at least 210 days must have passed since your current loans origination date and you must have made at least six payments on your existing loan.

Can I Cancel My Mortgage Insurance At Some Point

Mortgage insurance is maintained at the option of the current owner of the mortgage. In many cases, the lender will allow the cancellation of mortgage insurance when the loan is paid down to 80% of the original property value. However, lenders may take more than your home value into account to consider eliminating PMI. If you’ve had late payments in recent months, it may disqualify you from removing PMI earlier than is required by law. Lenders requirements for this can vary state to state so contact your loan servicer directly to find available options.

You May Like: Is Quicken Loans A Mortgage Broker Or Lender

The Good News: Lower Pmi On Fha Mortgages

FHA made the announcement in January of 2015 that FHA insured mortgages originated after January 26, 2015 would be assessed lower PMI charges.

Its important to understand that, unlike conventional loans, FHA actually imposes two different PMI charges on mortgages that it insures. .

FHA charges an UFMIP premium equal to 1.75% of the new mortgage balance. That rate did not change with the January 2015, announcement. However, monthly MIP did drop, and substantially at that.

FHA has varying rates on annual MIP, depending on the size of the loan and the amount of the down payment. But on what is by far the most common loan type for FHA borrowersa 30-year mortgage with less than 5% down, and a loan balance of up to $625,500the annual premium rate dropped from 1.35% down to 0.85%.

What this means is that had you taken a $200,000 mortgage prior to January 26, 2015, the annual premium would be $2,700 , or $225 per month. But as of now, it would be just $1,700 , or $141.67 per month.

Resource: Check out FHA rates online at LendingTree

How Fha Mortgage Insurance Works

An FHA loan is a certain type of mortgage thats backed by the Federal Housing Administration. Its designed to help prospective homeowners who wouldnt otherwise qualify for an affordable conventional loan, especially first-time homebuyers. FHA loans are available to borrowers with credit scores of at least 500. Its possible to put as little as 3.5% down with a credit score of at least 580, otherwise a down payment of at least 10% is required.

Unlike private mortgage insurance, FHA mortgage insurance is required on all FHA loans regardless of the down payment amountand cant be cancelled in most cases.

Currently, if you put down less than 10% on an FHA loan, youre required to pay mortgage insurance for the entire length of the loan. If you put down 10% or more, the mortgage insurance can be removed after 11 years of payments.

Recommended Reading: What Is The Federal Interest Rate For Mortgage

What Is Mortgage Insurance For Fha Loan

Unlike other forms of insurance, such as homeowners or life insurance, FHA mortgage insurance protects the lender. Each FHA mortgage contains a premium to safeguard the lender against poor loans.The FHA mortgage insurance premiums are accumulated and used to compensate lenders who have foreclosed on delinquent borrowers. Due to the FHA’s default insurance, lenders are more likely to lend to prospective house purchasers who might not qualify for a mortgage otherwise.For example, the down payment on an FHA house loan is now 3.5 percent, and the approval requirements are much less stringent than those on conventional home loans.

Currently, the cost is 1.75% of the loan amount. Here is the FHA mortgage insurance premium calculation.

30-year FHA upfront mortgage insurance example| 1. Sales price | |

| 2. Less down payment | $ 7,000 |

| 5. Funding fee cost | $3,377.50 |

The combined cost of the basic mortgage and the financing charge results in a total loan amount of $196,377.50.The principle and interest payment is determined by the “base” mortgage amount and the upfront fee.

30-year mortgage insurance calculation| 5% to 9.99% down payment | 1/26/2015 |

| 4.99% or less down payment | 1/26/2015 |

| Less than, and equal to 5% down payment | 1/26/2015 |

| Greater than 5% down payment | 1/26/2015 |

| Sales price | |

| / = | $ 136.71 |

- 1-unit home – $356,362

- 4-units – $685,400

How Do I Cancel Fha Mortgage Insurance

Despite what youve heard, FHA mortgage insurance premium is not permanent. Neither is conventional mortgage insurance.

Some homeowners can simply let their mortgage insurance fall off others need to refinance out of it.

With mortgage rates near historic lows, and home values rising, many are choosing to do the latter.

Homeowners are saving hundreds per month by refinancing especially when they can take close to 1% off their interest rate.

Getting rid of FHA MIP is a big deal. Ready to start? You can check your eligibility for a new, PMIfree mortgage via a refinance.

In this article

| No MIP |

Recommended Reading: How Much Do You Pay On A 30 Year Mortgage

What Documents Do I Need For An Fha Streamline Refinance

The FHA Streamline Refinance is a low-doc refinance loan, meaning it requires less paperwork than most other mortgages. But youll still need some documentation, including:

- A loan application

- A current mortgage statement showing a six month payment history

- Contact information for your employer

- Two months worth of bank statements showing you can cover out-of-pocket closing costs

- Utility bills showing you use the home as a primary residence

If you use the FHAs credit-qualifying Streamline Refinance, you will need to re-qualify with your income and credit score. This option would be required if youre removing a co-borrower from the loan.

How Long Does Mip Last

Unfortunately, if you purchased or refinanced with an FHA loan on or after June 3, 2013 and you had a down payment of less than 10%, MIP lasts for the term of the loan. With down payments of 10% or more, you still have to pay MIP for 11 years.

If you havent purchased or refinanced with an FHA loan since June 3, 2013, the outlook is a little better. On a 15-year term, MIP is canceled when your LTV reaches 78%. For longer terms, the LTV requirement remains the same and you have to pay MIP for at least 5 years.

Theres one other way to stop paying these premiums if youre currently in an FHA loan. Assuming you meet the other qualification factors , you can refinance into a conventional loan and request mortgage insurance removal once you reach 20% equity in your home.

Recommended Reading: What Is The Most Accurate Mortgage Calculator