Dont Submit Too Many Applications

A credit score of 620 limits your funding options, and every application you submit will likely result in a hard inquiry that can reduce your score even further. Apply for new lines of credit wisely, and research the lenders credit requirements before applying. If youre applying for a home or auto loan, try to submit all your applications within 14 days to limit the damage to your score.

Negotiating With Your Creditors

Despite what many people believe, your creditors are not your adversaries and they are not working against you. Therefore, you should not treat them as such. Instead, your creditors are working with you in an attempt for both of you to gain a profit.

If you fail to do things, such as pay your bills on time, it negatively impacts the ability of your creditor to do business with you. While they should be understanding of any reasonable financial hardships that youhave undergone in the past few weeks or months, they can tell the difference between short term financial problems that were out of your control and blatant financial responsibilities on your part.

Ultimately, its your responsibility to communicate effectively with your creditor so that you can both benefit equally from your business agreement.

For an example, if you are forced to skip on a payment or to default on an entire loan the very first thing you need to do is to contact your creditor and talk about the Issue in detail with them. This action alone will tell them that what has happened is out of your control and that you are trying to correct the Issue in contrast to them believing that you are just behaving irresponsibly. In addition, this will also strengthen your business relationship.

Examples of how your creditor may be willing to help you after you have discussed your problems with them include the following:

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: What Is The Effect Of Paying Extra Principal On Mortgage

Does Rocket Mortgage Use Fico

Check your credit score through our sister company, Rocket Homes®. Keep in mind that the score we use might be slightly different from the one you get from your credit card company or other source. We use a FICO® Score, but educational sources might use a different credit scoring model, such as a VantageScore.

Minimum Credit Score Required For Mortgage Approval In 2022

Join millions of Canadians who have already trusted Loans Canada

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, good income and, of course, high credit scores.

High credit scores, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

Don’t Miss: How Are Home Mortgage Rates Determined

Do Mortgage Lenders Care About Debt Management Plans

If your credit score and payment history are in their wheelhouse, and your debt-to-income ratio is acceptable, most mortgage lenders dont care if youre in a debt management plan.

Neither Fannie Mae nor Freddie Macs underwriting guidelines specifically mention credit counseling or DMPs for conforming loans that are processed through their automated underwriting systems.

But if a human manually underwrites your loan, the decision may be different. Underwriters use their best judgment, and opinions vary. In addition, mortgage lenders can overlay stricter requirements than program minimums.

Getting Auto Loans With A 642 Credit Score

There is no credit score too low to get an auto loan, and you should be able to get one when your credit score is 642, but it might have a relatively high interest rate. Before taking out an auto loan, consider whether the potential toll itll take on your finances is worth it or if you can wait until you get your score in the good range.

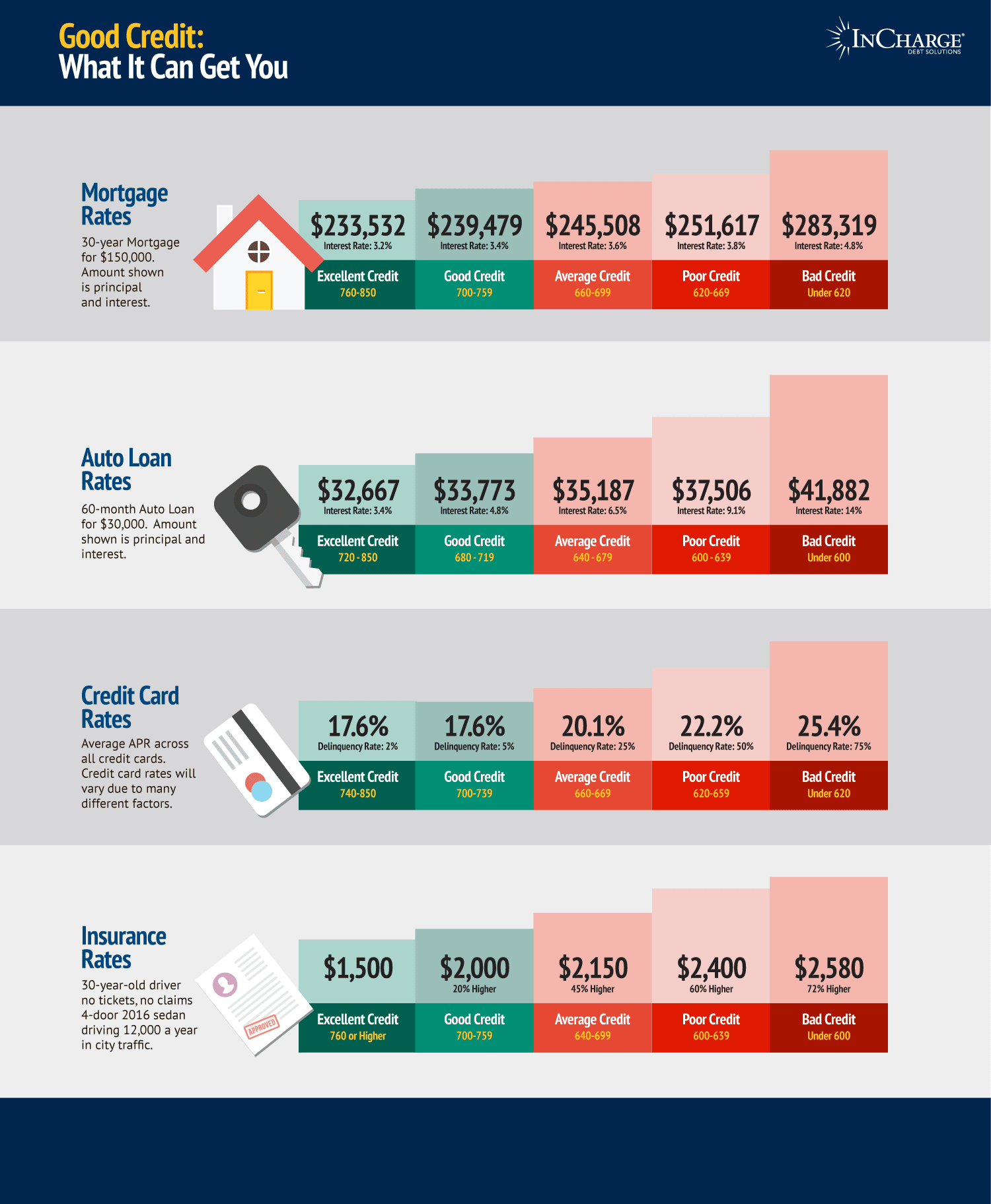

According to a 2020 quarterly report by Experian, people with credit scores of 642660 had average interest rates of 10.13% on their used car loans and 6.64% on new car loans, whereas people with credit scores of 781850 received average rates of 3.80% and 2.65%. 11 Waiting until your score improves could save you hundreds of dollars each month and thousands of dollars over the life of the loan.

If you need to buy a car before your credit improves, then consider getting a used car that you can pay for upfront.

If youre set on getting an auto loan with bad poor credit, then you should pay as large of a down payment as you can afford, and consider getting prequalified or applying for a preapproval from your bank or credit union to increase your bargaining power.

Also Check: How To Get A Mortgage If Self Employed

What Is Considered An Excellent Credit Score For A Mortgage

Asked by: Katelynn Schmitt

It’s recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won’t be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

Check Your Credit Report And Correct Any Errors

Before applying for a mortgage, request a copy of your credit reports from the three major credit agencies: Experian, Equifax andTransUnion. Normally you can access your credit reports from each bureau for free once per year, but due to the COVID-19 pandemic, youre entitled to a free credit report from each of the agencies once a week through the end of 2022.

If you find inaccurate or missing information, file a dispute with the credit reporting agency and the creditor. Clearly identify each item youre disputing and be sure to include supporting documents.

Recommended Reading: Does A Mortgage Loan Cover The Down Payment

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Do Mortgage Lenders Use Fico 9

FICO Score 9 is already being used by hundreds of lenders, and eight of the nation’s top 10 lenders have either evaluated it, are in the process of evaluating it or plan to do so, according to FICO’s Lee. He said he expects FICO 9 to overtake FICO 8, but lenders’ testing of the new model could take years.

Also Check: Is It Too Late To Refinance A Mortgage

What Is The Best Credit Card For A 620 Credit Score

With a fair credit score, you could be eligible for both secured and unsecured credit cards. Unsecured credit cards come with a credit limit based on your score and income. Secured cards usually limit your credit limit to the amount of money you deposit, but your credit limit can grow over time based on your payment history. Secured cards have very low credit score requirements.

The higher your score, the more money will be available to you each month. Your score could also determine your eligibility for low rates, limited fees and rewards. Once again, you should check each cards score requirements before applying. Only apply for one of the best credit cards for a fair credit score not higher credit scores.

If you cant get approval for an unsecured card or the card has a high interest rate and fees, a secured card can still help you improve your credit variety, payment history and credit use. Remember to limit your applications, as multiple applications can do more harm than good.

Improve Your Credit Score With Borrowell And Credit Karma

Instead of going directly through the credit bureau, you can open an account with Borrowell or Credit Karma. Both companies will email your credit score and credit report to you for free every week. It’s free to sign up, and you can access your credit report within minutes of becoming a member. In my opinion, this is the easiest and cheapest way to stay on top of your credit. Borrowell will send you a copy of your Equifax Canada credit report while Credit Karma has partnered with TransUnion.

These companies make money through affiliate partnerships with various loan and credit card companies. You will receive credit offers based on your credit score. You are under no obligation to apply, and I would exercise extreme caution before doing so. Instead, take advantage of the free credit reporting, as well as the educational resources both companies offer to help you improve your credit score.

Also Check: What Is A 5 1 Arm Mortgage

Is 800 A Good Credit Score To Buy A House

While having a credit score of 800 seems lofty, even scores in the 700’s can help home buyers get lower mortgage rates. Many loan programs have a minimum credit score requirement to get approved for a mortgage. For example, most lenders will require a credit score of 580 to get approved for an FHA loan.

Is 825 A Good Credit Score

A FICO® Score of 825 is well above the average credit score of 711. An 825 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

You May Like: How To Get The Best Interest Rate On A Mortgage

You Should Have A Debt

Debt-to-income ratio is your monthly take-home income versus what you pay out towards debt. For instance, if you have $5000 take home pay every month, and your minimum payments on all your debts total $2500 every month, you have a debt-to-income ratio of 50%. Getting it as low as possible will show the lender you have plenty of income to put towards mortgage payments.

There Should Be No Bankruptcies Consumer Proposals Or Excessive Derogatory Items On Your Credit Report

A derogatory item is a late payment, a missed payment, or a payment that was not enough. While you can still get approved for a mortgage with an old bankruptcy, derogatory item, or consumer proposal on your credit report, you will find it much more difficult and the interest rates you have access to wont be very good.

You May Like: How Much Do Mortgage Underwriters Make

Mortgage Lenders Pull All Three Reports But Only Use This One

According to Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,” tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

Other Requirements To Buy A House

Theres more to know than just credit minimums. After all, underwriting guidelines comprise hundreds of pages.

In addition to credit scores, lenders evaluate borrowers based on:

- Down payment: Most loan programs require at least 3% down.

- Income and employment history: Most lenders want to see at least two years of steady income and employment

- Savings: Youll need cash to cover the down payment and closing costs sometimes youll need to have cash reserves left over after paying these costs

- Existing debts: Your debt-to-income ratio compares preexisting debts like student loans, auto loans, and credit card minimum payments against your monthly gross income. The lower your DTI, the better

The size of your loan also matters. When you have lower credit, your loan amount will likely need to stay within FHA loan limits or conforming loan limits.

Don’t Miss: What Is The Best Reverse Mortgage Company

How Do My Fico Scores Affect My Ability To Get A Mortgage

Lending a huge amount of money is risky business. Thats why mortgage lenders need a good way to quantify the risk, and your FICO® scores with all of the data and research that go into them fit the bill.

Different lenders have different requirements for their loans. And because there are many different types of mortgages from many different types of lenders, theres no one single minimum FICO® score requirement.

What Credit Score Is Needed For A Va Loan

Qualifying service members, veterans and surviving spouses can buy homes with little or no down payment and no private mortgage insurance requirements, thanks to housing benefits from the U.S. Department of Veterans Affairs, commonly known as VA loans. Issuers of VA loans have some discretion in setting minimum credit score requirements, but they may accept applications from borrowers with FICO® Scores as low as 620.

You May Like: How To Figure Out What Mortgage You Qualify For

Understanding Mortgage Credit Scores

Your credit report is separate from your credit score, though the score is developed from the report. In addition to viewing credit reports from the three major reporting bureaus, you also should obtain your FICO score. Your score is like a report card. Fair Isaac & Co. assigns you a number based on the information in your credit report. Since there are three credit-reporting bureaus, you have three FICO scores. Here are the scoring factors:

Is Your Credit Score High Enough To Buy A House

If your credit score is above 580, youre in the realm of mortgage eligibility and homeownership. With a score above 620, you should have no problem getting credit-approved to buy a house.

But remember: Credit is only one piece of the puzzle. A lender also needs to approve your income, employment, savings, and debts, as well as the location and price of the home you plan to buy.

To find out whether you can buy a house and how much youre approved to borrow get pre-approved by a mortgage lender. This can typically be done online for free, and it will give you a verified answer about your home buying prospects.

Recommended Reading: Is Heloc Considered A Mortgage

How To Maintain A Good Credit Score During Covid

Taking steps to protect and maintain your credit score has always been important. Thats especially true if youre planning on buying a home.

So its important to stay on top of your finances during this challenging time. That includes paying your bills on time, and contacting lenders and service providers if you do run into trouble. Here are a few things you can do:

- Create a budget to know where you stand. The Barclays Budget Planner can help.

- If you foresee problems paying your loan or credit cards, contact them right away to explore your options.

- If you think youll be late paying your phone, utilities or other service providers, contact them to let them know and to discuss a possible arrangement. You can also find helpful advice at Barclays money management.

- To help you manage during this period, you can also find valuable ideas and resources at Barclaycard coronavirus help and support about protecting yourself from fraud and managing your finances.

- Youll also find other information about managing your Barclaycard account during the crisis at the Frequently Asked Questions page.

Maintaining Your Credit Score:

You can take the following measures to maintain a good credit score:

- Check your credit score before you start looking for a house. You can rectify any issues that may hamper your chances of approval.

- Maintain a low debt-income ratio by not applying for loans other than your mortgage. Get rid of any large debts you have like, credit card bills or an unsecured loan. Large loans can contribute to maintaining a good credit score only if you make timely payments.

- Avoid submitting multiple mortgage applications at the same time. Multiple lenders pulling your credit report can hamper your score.

Recommended Reading: Why Do I Pay Escrow On My Mortgage