How Much Is The Monthly Payment On A 200 000 Mortgage

200,000monthly paymentpaymentsmortgagerepaymentpaidmonth

How much is the monthly payment for a 250 000 mortgage?

Mortgage Loan of $250,000 for 30 years at 3.75% Month Monthly Payment Principal Paid 1 1,157.79 376.54 2 1,157.79 377.72 3 1,157.79 378.90 4 1,157.79 380.08

what’s the monthly payment on $100 000 mortgage?mortgage$100,000monthly paymentpaymentspaymentsmortgage

Contents

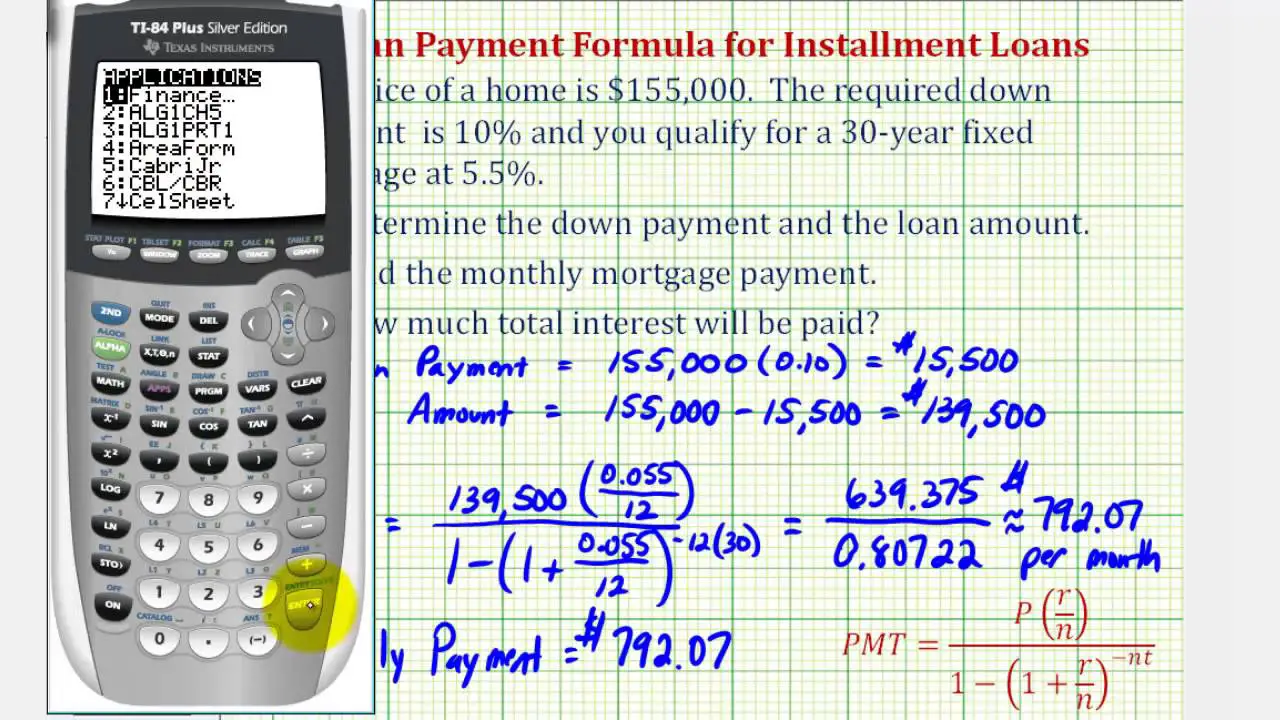

How To Calculate Mortgage Payments

Calculating mortgage payments used to be complex, but mortgage payment calculators make it much easier. Our mortgage payment calculator gives you everything you need to test different scenarios, to help you decide what mortgage is right for you. Heres a little more information on how the calculator works.

Mortgage Calculations And Mortgage Considerations

Use the free online Mortgage calculator to calculate your monthly repayments, compare Mortgage repayments over different periods and define what is the most affordable option for your financial situation. The Mortgage calculator will provide you a monthly interest repayment over 1 year,2 years,3 years,4 years,5 years, 10 years and compare them to a monthly repayment period of your choosing .

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

Monthly Payments On A 150000 Mortgage

At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £716.12 a month, while a 15-year term might cost £1,109.53 a month.

Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

-

See your monthly payments by interest rate.

Interest

-

£156,607.75

Can You Afford A 15000000 Mortgage

Is the big question, can your finances cover the cost of a £150,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £150,000.00

Do you need to calculate how much deposit you will need for a £150,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

Don’t Miss: Rocket Mortgage Launchpad

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make. When youre ready to apply, compile necessary documentation like income verification and proof of assets and start shopping for the best rates.

Read Also: How Much Does Getting Pre Approval Hurt Credit

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Fixed Monthly Payment Amount

This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. Simply add the extra into the “Monthly Pay” section of the calculator.

It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that interest will accrue at such a pace that repayment of the loan at the given “Monthly Pay” cannot keep up. If so, simply adjust one of the three inputs until a viable result is calculated. Either “Loan Amount” needs to be lower, “Monthly Pay” needs to be higher, or “Interest Rate” needs to be lower.

Recommended Reading: Are Discount Points Worth It

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

You May Like: Chase Mortgage Recast Fee

Who Is This Calculator For +

This calculator is most useful if you:

- Calculate mortgage rates you are considering

- Compare differences of various home loan term programs

- Haven’t decided on what type of loan you want yet

- Want to get an idea of monthly or annual cost of buying a property

- Are looking to assess the long term benefit of making prepayments in addition to regular loan repayments

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Is Your Mortgage Payment Calculator Free

Yes, our mortgage payment calculator is free. In fact, all of our calculators, articles, and rate comparison tables are free. Ratehub.ca earns revenue through advertising and commission, rather than by charging users. We promote the lowest rates in each province offered by brokers, and allow them to reach customers online.

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price, then select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youll need for closing costs. You can also use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up, and show what your outstanding balance will be over time.

If youre buying a new home, its a good idea to use the calculator to determine what you can afford before you start looking at real estate listings. If youre renewing or refinancing and know the total amount of the mortgage, use the Renewal or Refinance tab to estimate mortgage payments without accounting for a down payment.

Don’t Miss: Does Getting Pre Approved Hurt Your Credit

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

How To Lower Your Mortgage Payments

There are a few ways to lower your monthly mortgage payments. You can reduce the purchase price, make a bigger down payment, extend the amortization period, or find a lower mortgage rate. Use the calculator to see what your payment would be in different scenarios.

Keep in mind that if your down payment is less than 20%, your maximum amortization period is 25 years. As for finding a lower mortgage rate, its a good idea to speak to a mortgage broker for assistance.

Recommended Reading: Does Rocket Mortgage Sell Their Loans

What Is Included In Your Monthly Mortgage Payment

themortgagemortgagesincludethe monthly paymentamonthly paymentpay theyour

. People also ask, what is the mortgage payment on a $150 000 house?

Monthly payments on a $150,000 mortgageAt a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total $716.12 a month, while a 15-year might cost $1,109.53 a month.

how does a mortgage payment breakdown? A mortgage payment has four parts: principal, interest, taxes, and insurance. For example, if you put down less than 20 percent towards your down payment, then your mortgage loan breakdown most likely includes private mortgage insurance as well, to be discussed later on.

Also Know, how do you calculate a monthly payment?

To calculate the monthly payment, convert percentages to decimal format, then follow the formula:

How much is a mortgage monthly?

Monthly Pay: $1,861.14

How Much Do I Need To Put Down

A down payment of 20% or more will get you the best interest rates and the most loan options. But you dont have to put 20% down to buy a house. There are a variety of low-down-payment options available for home buyers. You may be able to buy a home with as little as 3% down, although there are some loan programs that require no money down.

Read Also: Can You Do A Reverse Mortgage On A Mobile Home

What Are The Repayments On A 200k Mortgage

How much deposit would I need for a 200k mortgage?

The minimum deposit lenders will generally accept is 5% of the property value. These are known as 95% mortgages, and if you want to go for one of these your options may be limited. This is because most lenders ask for at least 10% of the property value as a deposit.

What Is The Average Mortgage Payment In Florida

. Simply so, what is the average mortgage payment on a 300 000 House?

Based on their mortgage calculator it seems reasonable to look at houses up to about $300,000. Their calculator estimates the monthly payments to be about $1500 a month for this price. We will be making about $50,000 a year plus about $20,000ish for a down payment.

Likewise, how much do you have to put down on a house in Florida? That’s because you‘ll only need to put 3.5% of your new home’s value at the time of purchase. Compare this to a conventional loan that requires a 20% down payment.

In this way, what is the average mortgage monthly payment?

The median monthly mortgage payment for U.S. homeowners is $1,030 according to the latest American Housing Survey from the U.S. Census Bureau. That’s up slightly from 2011 when the average American paid $1,015.

What is a reasonable mortgage payment?

One rule of thumb says that most homeowners can afford a property that’s between 2 and 2 ½ times their annual gross income. Some experts take the position that you should spend no more than 28 percent of your gross income on your mortgage payment, including principal, interest, taxes and insurance.

Don’t Miss: Rocket Mortgage Qualifications

What Does Piti Stand For +

PITI is an acronym used to shorten the following terms:

- Principal the amount you owe your lender, not including interest

- Interest the payment made to your lender for the service of providing the loan

- Property Taxes added fees required by the government

- Home Insurance protection for your property and loan

This PITI calculator is designed to take all of these costs into consideration, giving you an accurate idea of your loans monthly and annual repayments.

Determine What Your Ideal Down Payment Amount Should Be

A down payment is a portion of the cost of a home that you pay up front. It demonstrates your commitment to investing in your new home. Generally, the more you put down, the lower your interest rate and monthly payment. There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers. Use this down payment calculator to help you answer the question how much should my down payment be?.

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down-payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate of 3.946%.1

Also Check: Who Is Rocket Mortgage Owned By

What Is The Total Amount Repayable

When you take out a mortgage, you agree to pay the principal and interest over an agreed term. Your interest rate is applied to your balance, and as you pay down your balance, the amount you pay in interest changes.

This means that at the beginning of your mortgage, a big percentage of your payment is applied to interest. With each subsequent payment, you pay more toward your balance.

Estimate your monthly repayments on a £150,000 mortgage at a 4% fixed interest with our total amount repayable schedule over 15 and 30 years.

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- : Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

Also Check: Reverse Mortgage On Condo