Calculating Payment Towards Principal

There isnt a good direct way to calculate the payment towards principal each month, but we can back into the value by subtracting the amount of interest paid in a period from the total payment each period. Since interest and principal are the only two parts of the payment per period, the sum of the interest per period and principal per period must equal the payment per period.

How To Pay Off Your House Faster

Understanding amortization can help you get creative with paying off your mortgage early. For example, you could throw extra payments at your mortgage that go toward the principal instead of the interestwhich would also save you thousands of dollars!

To see how this plays out, try our mortgage payoff calculator. Lets use the same example from earlier of the $240,000 mortgage at a 15-year term with a 3.5% interest rate.

After 15 years paying the minimum monthly payment of $1,716, youll have paid nearly $69,000 in total interest. But if you squeeze another $100 out of your monthly budget to make your monthly payment $1,816, youll save more than $5,000 in interest and be debt-free a whole year sooner!

Whats An Example Of Amortization

Lets say you work with a top agent to buy a $300,000 house with a 20% down payment . To cover the rest, you take out a 15-year fixed-rate mortgage at a 3.5% interest ratethats a total home loan of $240,000.

Using our mortgage calculator, your monthly mortgage payment would be $1,716 . Later, well show you how to calculate this monthly payment manuallyif youre interested .

To calculate the amortization on this example, lets plug these numbers into the formula we mentioned above:

- $240,000 x 3.5% = $8,400

- $8,400 / 12 = $700

- $1,716 – $700 = $1,016

So, for your first month of making payments, that $1,716 monthly payment will be split into $700 for interest and $1,016 for principalwhich will drop your $240,000 loan balance to just under $239,000.

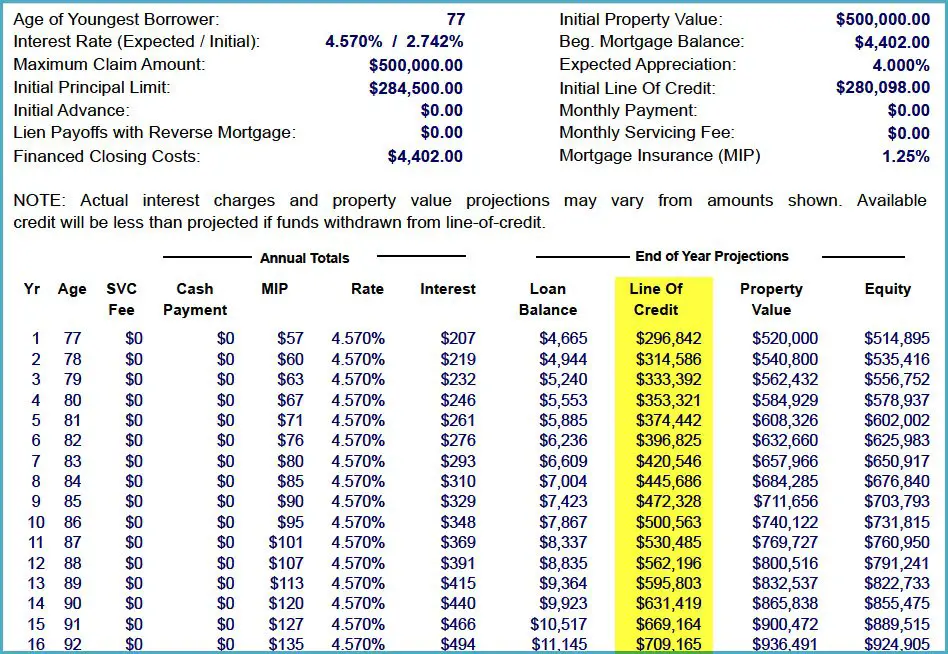

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

What Is Mortgage Loan Amortization

Mortgage loan amortization is the process of paying a home loan down to $0.

A mortgage or any other type of loan is amortized if its paid in regular installments and will be fully paid off after a set period of time.

Your mortgage amortization schedule determines when your home will be paid off and how quickly you build home equity. It also comes into play if you want to pay off the loan early. So its important to understand how your amortization schedule works.

Mortgage Amortization: A Personal Decision

The decision between a short- or long-term loan should depend on your personal finances.

If you have a lot of monthly cash flow, and you want to save on interest, choosing a 15-year loan or shortening your amortization schedule with extra payments could be a smart strategy.

If you have a tighter budget or you want to invest your money elsewhere the traditional 30-year amortizing mortgage makes a lot of sense.

Compare all your loan options before buying a home or refinancing. And make sure you understand how amortization will affect your monthly payments, as well as your home equity options further down the line.

Popular Articles

Step by Step Guide

Also Check: Mortgage Rates Based On 10 Year Treasury

How To Calculate The Total Monthly Payment

Typically, the total monthly payment is specified by your lender when you take out a loan. However, if you are attempting to estimate or compare monthly payments based on a given set of factors, such as loan amount and interest rate, you may need to calculate the monthly payment as well.

If you need to calculate the total monthly payment for any reason, the formula is as follows:

Total Monthly Payment = Loan Amount

- i = monthly interest rate. You’ll need to divide your annual interest rate by 12. For example, if your annual interest rate is 6%, your monthly interest rate will be .005 .

- n = number of payments over the loanâs lifetime. Multiply the number of years in your loan term by 12. For example, a 30-year mortgage loan would have 360 payments .

Using the same example from above, we will calculate the monthly payment on a $250,000 loan with a 30-year term and a 4.5% interest rate. The equation gives us $250,000 = $1,266.71. The result is the total monthly payment due on the loan, including both principal and interest charges.

How Home Mortgage Amortization Works

When you make your monthly mortgage payment, the lender divides the total amount into two buckets:

- Principal: This is the outstanding balance on your loan.

- Interest: This is the cost of financing your home.

Some mortgage payments may include an amount for escrow, which is used to pay items such as your property tax and homeowners insurance. However, some loans may allow you to pay those amounts on your own and limit your mortgage payment to Principal and Interest only. The following refers to your P& I payment.

At the beginning of your loan pay-off period, the bulk of your payment is applied to the interest bucket with a small portion going toward the principal. As the lender covers the cost of financing your home purchase, the payment allocation begins to change. Over time, a larger percentage of your payment goes toward the principal and less to interest.

If you keep close track of your loan balance, youll notice the amount you owe diminishes slowly at the beginning of your loan. Youll also notice that it drops much faster toward the end of the pay-off period since interest is calculated on the loan balance. The loan balance reduces every month as you pay off your mortgage. Therefore, so does the interest.

Don’t Miss: 70000 Mortgage Over 30 Years

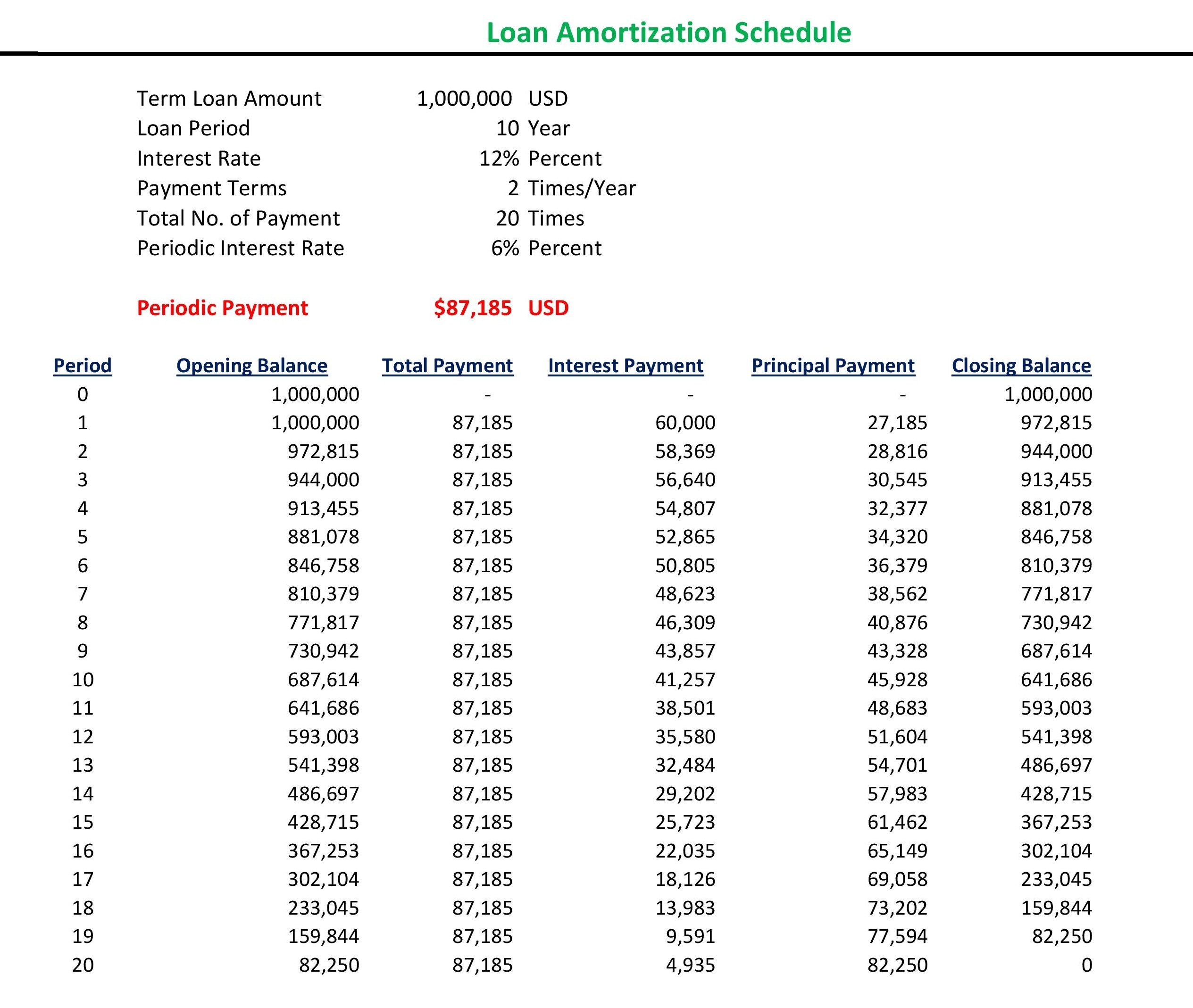

Amortization Schedule Example In Excel

Let us assume that there is a company that has $1,000,000 of loan outstanding, which has to be repaid over the next 30 years. The equated annual repayment will be made annually at an interest rate of 12%.

Therefore, as per the question,

- Outstanding loan = $1,000,000

- Rate of interest = 12%

- No. of period = 30

Using the above information, we have calculated the Periodic Mortgage Payment for the Amortization Schedule excel table.

So the Periodic Payment will be

Then we have calculated the interest paid using the formula mentioned above.

So the Interest Paid will be

So the table below is the mortgage amortization schedule in excel based on the above information,

Therefore, from the above table, it can be seen that the total interest paid is $2,724,309.73 on a loan of $1,000,000, i.e., the interest paid is approximately 2.7 times the actual loan. Also, from the table, it can be seen that the interest paid is more than the principal payment till the 24th year, which indicates the fact that interest payments are higher than the principal payment initially.

You can download this Mortgage Amortization Schedule Excel Template here Amortization Schedule Excel Template

What Is A Mortgage Amortization Schedule

Amortization is the process of paying off a loan by making regular payments.

A mortgage amortization schedule shows how much you’ll pay each month toward your mortgage. The schedule breaks down each payment by showing how much of the payment goes toward your principal and toward interest .

The amortization schedule also tracks how much you have left to pay on your principal after each monthly payment is complete.

The schedule will show that you pay the same amount each month, but the amount you’ll pay toward the principal and interest changes monthly. More of your payment goes toward interest at the beginning, and by the end, most of your payment covers the principal.

This logic may seem weird, but think of it like this, assuming a hypothetical interest rate of 3.5%: 3.5% of $200,000 is less than 3.5% of $150,000, so it makes sense that you’re paying less in interest once you’ve paid down more of your principal.

A mortgage amortization schedule can help you keep track of how much you have left to pay on your mortgage and understand how much you’re paying toward interest. Tracking these numbers can help you make decisions, such as whether you want to refinance for a lower rate or make extra payments toward your principal. Or you just may want to stay informed about what you’re paying.

You May Like: 10 Year Treasury Yield And Mortgage Rates

Free Mortgage Amortization Calculator And Table

In this post, well explain what amortization means and provide an amortization calculator to show the mortgage payoff schedule for any fixed-rate mortgage.

âAmortization is the process by which a loans balance is paid down over time. In the case of a mortgage, there is one payment for each month of the loan term . Each time the borrower makes a payment, the loan balance is reduced, thereby amortizing the loan. After the full term, the loan has been completely amortized and the balance is $0.

To see how this works, try this interactive amortization calculator. We also provide a basic example and explain how the amortization table is calculated below.

Also Check: Rocket Mortgage Requirements

How Do Amortization Schedules Work

Amortization is the simplest way to pay off a large loan, like a home loan. Financial lenders use amortization schedules to present a loan repayment timeline based on a specific maturity date.

In an amortization schedule, each repayment installment is divided into equal amounts and consists of both principal and interest. At the beginning of the schedule, a greater amount of the payment is applied to interest. With each subsequent payment, a larger percentage of that flat rate is applied to the principal.

While the amortization equation can look pretty intimidating, today its easy to calculate through spreadsheet software or online amortization charts. Heres an example of an amortization schedule for a $20,000 loan with 5% interest. Note that each month, the total payment stays the same, while the portion going to principal increases and the portion going to interest decreases. In the final month, only $1.57 is paid in interest because the outstanding loan balance at that point is very small.

You May Like: Rocket Mortgage Qualifications

Example Mortgage Amortization Schedule

Lets assume you took out a 30-year mortgage for $250,000 at a fixed interest rate of 4 percent. At those terms, your monthly mortgage payment would be $1,193.54, and the total interest over 30 years would be $179.673.77.

Heres a snippet of what your amortization schedule in this example would look like in the first year of the loan term:

| Date |

| $179,673.77 | $0.00 |

As shown, the amount of your payment thats allocated to the principal increases as the mortgage moves toward maturity, while the amount applied to interest decreases.

Note that this is the case for a typical 30-year fixed-rate mortgage. Amortization schedules and how the payment is distributed to the interest and principal can vary based on factors like how much youre borrowing and your down payment, the length of the loan term and other conditions. Using Bankrates calculator can help you see what the outcomes will be for different scenarios.

Things You Need To Know About Amortization Schedules

Am-or-ti-za-tion. Try saying that five times fast!

In addition to earning you a zillion Scrabble points, amortization is an important concept for every home buyer to comprehend. After all, its the secret to understanding your mortgage loan and paying it down over time. And for a debt as large as a home, thats a secret you should know!

If youre taking on a mortgage, there are a few key questions you should be able to answer about amortization schedules. Here are five of the most important things you should know:

Recommended Reading: Rocket Mortgage Vs Bank

Next Step: Talk To A Local Lender

Whether you need a home loan or you want to refinance your existing loan, you can use Zillow to find a local lender who can help.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- House

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Calculating An Amortization Schedule If You Don’t Know Your Payment

Sometimes, when you’re looking at taking out a loan, all you know is how much you want to borrow and what the rate will be. In that case, the first step will be to figure out what the monthly payment will be. Then you can follow the steps above to calculate the amortization schedule.

There are a couple ways to go about it. The simplest is to use a calculator that gives you the ability to input your loan amount, interest rate, and repayment term. For instance, our mortgage calculator will give you a monthly payment on a home loan. You can also use it to figure out payments for other types of loans simply by changing the terms and removing any estimates for home expenses.

If you’re a do-it-yourselfer, you can also use an Excel spreadsheet to come up with the payment. The PMT function gives you the payment based on the interest rate, number of payments, and principal balance for the loan. For instance, to calculate the monthly payment in the example above, you could set an Excel cell to =PMT. It would give you the $1,288 figure you saw in that example.

Read Also: Chase Recast

Types Of Interest Rates

Amortizing intangible assets is important because it can reduce a businesss taxable income, and therefore its tax liability, while giving investors a better understanding of the companys true earnings. Now that you understand the lease liability, lets discuss how to prepare the lease liability amortization schedule in LeaseGuru. Since the loan in this example is fully amortized, the payment done at the end of the 60th month completes the payment of the entire loan amount. Construct a complete amortization schedule for the dishwasher payments along with the total interest paid. Under GAAP, for book purposes, any startup costs are expensed as part of the P& L they are not capitalized into an intangible asset. The amount due is 14,000 USD at a 6% annual interest rate and two years payment period. The repayment will be made in monthly installments comprising interest and principal amount.

Calculate Your Interest Charge

The next step is calculating the interest charge. Multiply your beginning balance by your monthly interest rate. Again, to calculate your monthly interest rate, divide your annual interest rate by 12.

- 4.5%/12=0.00375

For the first payment of the above example, youll multiply $100,000 by 0.00375. This gives you an answer of $375.

- $100,000×0.00375=$375

This is the interest youll pay the first month. Keep in mind that your interest charge will decrease every month.

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

How Amortization Schedules Work

What is included in an amortization schedule?

- Interest costs: For every payment, a portion goes toward paying off interest. The interest of each payment is calculated by multiplying the remaining balance of your loan by the interest rate.

- Principal repayment: After applying the interest charge, the rest of the payment goes toward paying down the principal of the loan.

- Scheduled monthly payments: Each of your monthly payments is listed individually for the entire duration of your loan.

The interest of a loan is calculated based on the loans most recent balance. When a payment exceeds the amount of interest, this payment reduces the principal. The interest rate is then applied to this new principal balance, and because the balance is lower, the amount of interest will also be lower. This is why the interest and principal in an amortization schedule have an inverse relationship. As the portion of interest in a payment decreases, the portion of principal in the payment increases.

The amortization schedule will generally contain seven columns:

The number of rows in your amortization table depends on the term of your loan. For example, if you have a 30-year mortgage, youll pay your loan off over the course of 360 months. This means your amortization table will have 360 rows.

Alternatively, the columns of your amortization schedule may be each month of your loan term, while the rows are your beginning balance, payment, principal, interest, ending balance and total interest.