Option 2 Apply For A New Credit Card

Applying for a new credit card is also a tactic that could reduce your credit utilization ratio. By adding a new line of credit, youre essentially boosting your overall credit line, which can help if youre unable to quickly pay down existing credit card debt.

Before you apply, determine the following:

- What type of credit card you need. If you have poor or fair credit, youll want to consider a card meant to help you build a good credit history, such as a secured card. Secured cards require a deposit in the amount of your credit limit, and protect the issuer in case you default on the debt. On the other hand, if you have good credit or better, you could choose to apply for a card that earns rewards or offers an introductory APR period.

- If you prequalify for any cards. Some issuers such as American Express, Capital One, Chase and Discover allow consumers to check if they prequalify. While prequalification doesnt guarantee youll be approved once you apply, it does indicate a better chance.

How much will this action impact your credit score?

Much like requesting a credit limit increase, the amount that getting a new card can improve your credit score depends on the credit limit youre granted on the new card. The lower it brings your utilization, the better for your score.

Consider the following examples:

Why Are There Different Fico Scores

There are many different FICO scoring models and some credit scoring models that arent provided by FICO, such as the VantageScore credit score.

Each credit score aims to do the same thing: give lenders a quick way to determine a borrowers creditworthiness. So why are there so many different models?

The simple answer is that each model is designed to help lenders determine the credit risk for different types of debt. An auto lender is making a very different type of loan than a mortgage lender or a credit card provider, so they might want to emphasize different details in your credit report.

For example, if youre applying for an auto loan, the lender will likely use the FICO Auto Score model, which is designed for people looking for a car loan. There are other scoring models that lenders may use depending on the loan type youre applying for.

The good news is that, in general, the scores you receive under each scoring model will be similar. If you have a higher credit score than most people when using one model, youll generally have a good credit score with other models.

However, there are some situations where you can have a different credit score than expected depending on the model used. Each formula weighs things differently, so if youre on the cusp of qualifying for a loan, its important to pay attention to the model the lender uses.

Dispute Credit Report Errors

You should start by getting a copy of your credit report and looking for any mistakes, Walsh said. There may be errors on your credit report that could negatively impact your score. In fact, one report by the Federal Trade Commission found that one in five consumers had an error on at least one of their credit reports.

To review your credit reports for errors, start by visiting annualcreditreport.com. This is the only website thats federally authorized to provide free credit reports. Look through each report for mistakes such as incorrect name or address, credit lines that dont belong to you, duplicate entries, incorrect account status and other errors that could lead to a lower score.

Since each credit bureau collects and reports credit information independently, youll need to check all three reports. If you find a mistake, youll also need to dispute it with each bureau. Each one has a slightly different process for disputing errors, but instructions can easily be found on their websites.

Don’t Miss: Does Getting Pre Approved Hurt Your Credit

Set Up Automatic Payments For As Many Bills As Possible

35% of your credit score is determined by your payment history. Most people have a lot of different bills they need to pay, and it can get hard to manage. Automatic payments take the brainwork out of paying your debt obligations.

Whether youre paying the minimum balance or youre trying to get rid of the debt ASAP, automatic payments can help make sure that you never miss a payment.

Good payment history isnt just important for preventing your score from dropping. The longer you go without missing any debt payments, the better it is for your credit score.

Most people should see their credit score increase over time so long as theyre making all their payments on time and not being overzealous with their borrowing.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

You May Like: How Much Does Getting Pre Approval Hurt Credit

Ways To Boost Your Credit Score In 2022

by Maurie Backman | Published on Dec. 14, 2021

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

These moves could raise your credit score and open up your borrowing options.

Prepare Your Credit Score

Improving your credit score may be the difference between being approved for a mortgage or not getting approved. Having good credit is very important when purchasing a home because it will likely be one of the most significant purchases you have ever made. If you do not have good enough credit, your mortgage lender may not approve you for the loan amount you will need. Checking your current credit rating before taking any action can save you time and money when applying for a mortgage.

When applying for a mortgage, your lender might request that you permit them to check your credit score for the decision. However, you can also get your credit score without help. You could pay for a copy of your official FICO score from one of the three companies who calculate them: FICO, eQuire, or VantageScore. Another way is by paying an unofficial company for access to your credit score. This is often cheaper than paying for an official FICO score, but it can be challenging to determine its accuracy. Another way would be to use a free, unofficial source that requires you to fill out forms or offer another service in exchange for your credit score. These are not always accurate, but they are worth looking into if no alternative options are available to you.

Recommended Reading: Rocket Mortgage Qualifications

How To Improve Your Credit Score Before Buying A House

Improving your credit score is the best way to increase your chances of qualifying for a mortgage loan, as well as getting a lower interest rate.

To do this, you should:

- Pay your bills on time: Late payments can hurt your score significantly.

- Settle any late bills or accounts in collections: These can hurt your score considerably, too.

- Check your credit report for errors: These should be reported to the credit bureau ASAP, as correcting them can improve your score.

- Pay down your balances: Higher balances equal lower credit scores. Using a high percentage of your available credit lines can also hurt your score, so try to lower your overall credit utilization as well.

- Keep your accounts open: Having a long credit history can actually help improve your score, so even if you pay off a balance in full, keep the account open if you can.

Once youre getting ready to buy a home, you should also take steps to protect your credit. Avoid any big purchases, dont apply for any new credit cards or loans, and make sure to shop around for your loan within the same short period. This will keep those credit inquiries from hurting your score and your chances of getting a loan.

Learn More: How to Build Credit Fast

How To Request Your Free Credit Report

The first step is to request copies of your credit report from the three main credit bureaus: Equifax, Experian, and TransUnion. These organizations are required by law to provide you with a free copy of your credit report once every 12 months.

To request your free copies, visit AnnualCreditReport.com or call 1-877-322-8228. You may order reports from all three companies at the same time or you can stagger your requests so that you receive credit reports from different credit bureaus over the course of a year.

Don’t Miss: Chase Recast

Is A Refinance Loan Right For You

Black suggests using an online mortgage calculator to compare the costs of a new loan with your current loan. She points out that there might be new fees to worry about including new closing costs so youll need to calculate whether the savings will outweigh the costs. Even though you might end up with a lower credit score temporarily, it could be a smart move.

Remember, the purpose of earning good credit is so that you can use it to your advantage, Black says. Using your good credit to qualify for a more attractive loan could help you save money on interest and perhaps even pay off your debt faster.

Boosting Your Credit Score

If you have bad credit but are a first-time home buyer, start maximizing your score before you begin house hunting. Check your credit score so you know where you stand, review your credit history to make sure its accurate and remember to consistently pay your bills on time. You can check your credit for free with our tool if youre a current U.S. Bank customer.

When lenders see multiple applications for credit reported in a short period of time, it can discourage them from giving you a loan. So heres a short list of things to try to avoid when applying for a mortgage so that you can keep your options open.

- Avoid opening new credit cards.

- Avoid closing credit cards .

- Avoid applying for new loans.

- Avoid co-signing on any new loans.

Looking for more ways to improve your credit score? Here are some .

You dont have to have a top credit score to get a mortgage, but it will help you compete for the house you want by potentially giving you more financing options. So, take steps to try to boost your credit, avoid applying for credit products at the same time youre house hunting and talk over your options with a mortgage loan officer who can help.

Connect with us to make homeownership a reality.

An experienced mortgage loan officer is just a phone call or email away, with answers for just about any home-buying question.

Recommended Reading: Rocket Mortgage Loan Requirements

Fico Score 8 Vs Fico Score 9

Group 8 is the most used and group 9 is the most recent. But one place where you’re unlikely to get a live account is free credit reports. FICO charges an institution for using your actual credit scores.

What does your credit score start atWhat credit score do you start with? If you are just starting out, you have no credit history. However, the initial is not zero.What is a good FICO 8 score?FICO 8 is the most widely used FICO scoring model. A FICO credit score of 670-739 is considered “good.” A FICO score of 740-799 is considered “very good” and you likely qualify to receive interest rates above the average from le

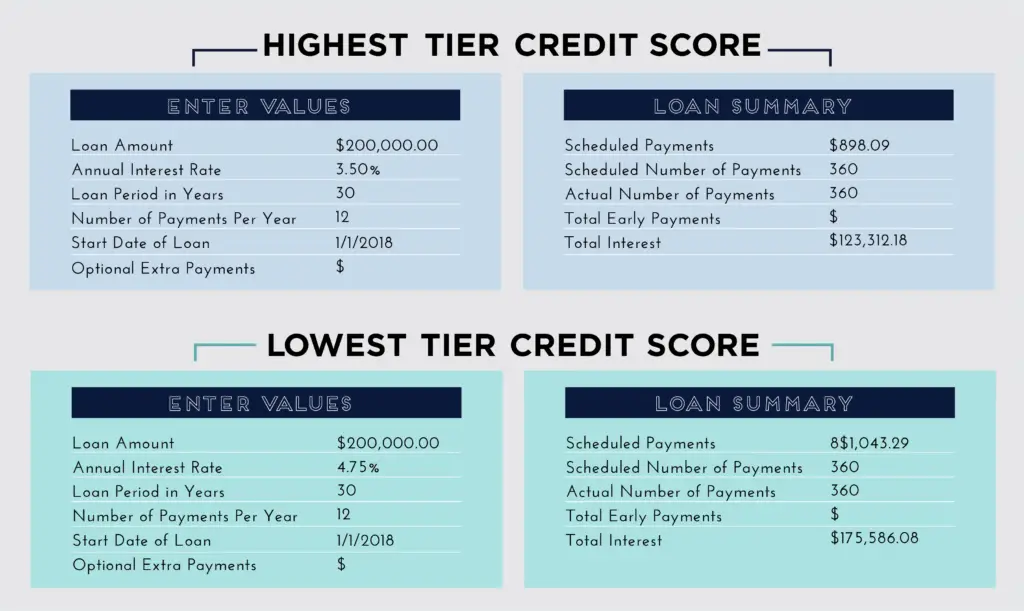

How Your Credit Score Impacts Your Apr

Your credit score has a major effect on the APR of your loan. The APR of any installment loan, such as a mortgage, reflects the cost of interest expense and fees over the life of the loan. The higher the APR, the more the borrower will have to pay.

If you apply for a $250,000, 30-year mortgage, you can wind up paying wildly different amounts depending on your credit score, as shown below.

Read Also: Does Prequalification For Mortgage Affect Credit Score

How Long Does It Take To Rebuild Credit

Typically, it takes at least 3-6 months of good credit behavior to see a noticeable change in your credit score. It is difficult to make a change any faster, unless the negative information on your credit report was a minor blip, like being late with bill payments one month.

While it is impossible to put a specific time frame on , it is safe to say the less negative information you have on your report late payments, maxed out credit cards, constant credit applications, bankruptcy, etc. the easier it is to repair your credit score.

It takes more time to repair a bad credit score than it does to build a good one. Mistakes penalize your credit score and can prevent you from being approved for a loan. Though there are lenders that offer loans with bad credit, they end up costing hundreds or thousands of dollars in higher interest rates when borrowing. A poor credit score also can be a roadblock to renting an apartment, setting up utilities, and maybe even getting a job!

You are not going to lose nearly as many points if you are late with one payment as you will if you are delinquent for several months to the point where your account has been turned over to a collection agency. The severity of the second situation is far greater than the first and your score will reflect that.

Here are some time frames for negative information that detracts from your credit score.

How To Improve Your Credit Score Before Applying For A Mortgage

If you want to buy a home, one of the best things you can do to make the home buying process easier is to improve your FICO score. Regardless of the credit scoring model that your lender ultimately uses, you can take some basic steps to boost your credit score.

Remember that a lower credit score makes it harder to qualify for a loan and affects the interest rate that the bank or credit union will charge. That means that boosting your credit score can make a mortgage cheaper, making it easier to afford homeownership.

There are five factors that comprise your FICO credit score:

Each step you take to improve your credit score will reduce your mortgage interest rate, making it well worth the effort to improve your credit.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Sign Up For Experian Boost

If your low score is primarily the result of being new to the credit-seeking game and you are timely with your payments for utilities and your cell phone, ask the lender to pull a report from Experian, using its Experian Boost plan. This hybrid model draws on what the industry calls alternative credit data non-traditional payments that provide lenders useful insight into an applicants creditworthiness.

The way forward gets a little steeper from here, so its a good idea to know what youre up against.

What Fico Score Do You Need To Get A Mortgage

A credit rating of 580 is generally considered the minimum acceptable rating for a home loan. At this level, the borrower must qualify for a revolving loan from the Federal Housing Administration. However, you need a credit score of at least 620 to qualify for this type of mortgage.

Perfect credit scoreWhat is considered an excellent credit score? According to Experian, one of the three major credit reporting agencies, the VantageScore is between 750 and 850 and a good score between 700 and 749. Note, however, that the VantageScore is 750. Not quite the same weight. same as the FICO score equal to 750.Can you really get a perfect credit score?Increase the available balance. Work on increasing your available credit ov

You May Like: Reverse Mortgage Manufactured Home

Tips To Increase Your Credit Score

If you are like many consumers and dont know your credit score, there are several free places you can find it. The Discover Card is one of several credit card sources that offer free credit scores. Discover provides your FICO score, the one used by 90% of businesses that do lending. Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar, but not identical. Same goes for online sites like Credit Karma, Credit Sesame and Quizzle.

The Vantage Score comes from the same place that FICO gets its information the three major credit reporting bureaus, Experian, TransUnion and Equifax but it weighs elements differently and there could be a slight difference in the two scores.

Once you get your score, as Homonoff suggested, you might be surprised if its not as high as you expected. These are ways to improve the score.

What Fico Score Do I Need Buy A Home

- Regular Loan: 620. While you can get a regular loan with a credit rating of as little as 620, these mortgages often require higher credits.

- FHA Loans: 500. If your credit score is above 500, your best chance is getting a home loan from the Federal Housing Administration.

- VA credit: 640.

- Large loan: 700.

Read Also: Can You Refinance A Mortgage Without A Job