How Much Interest Will I Pay

The amount of interest youâll pay will depend on a few things, namely the size of the loan, the length of the loan term, and of course the interest rate. Letâs assume youâve been approved to take out a loan of $250,000. Youâre also looking at an interest rate of 3.50% p.a. and intend to pay it off over a period of 25 years. In this scenario, your total interest paid will be $125,468.

If, however, you do a little extra work and find a home loan that offers a more attractive rate, you stand to pay a lot less. For example, if you opt for a home loan with an interest rate of 3.00% p.a. you’ll pay $105,658 in interest over the life of the loan – a difference of almost $20,000.

Thatâs why itâs a good idea to shop around before you borrow: even a small difference in the interest rate can save you tens of thousands of dollars in the long-term. For an idea of what low interest rates currently looks like, be sure to visit our home loan comparison page.

Calculating The Maximum Loan

Lenders calculate the amount you can borrower by considering the monthly payment you can afford, the annual percentage rate , and the number of months in the loan term.

Calculate this using an Excel spreadsheet, and solve for the present value — PV is the loan amount. For this example, use a 31 percent front-end DTI and a monthly payment of $1,092, as calculated above a 5 percent rate and a 30 year term . You also need to enter a future value in this example use zero, which assumes the loan will be paid off at the end of 30 years.

Enter these values into a cell on an Excel spreadsheet: =PV or =PV then press “Enter.” A negative number will be calculated because it represents how much you will pay out. This is the maximum loan amount you can afford.

I Don’t Know What To Enter For Property Taxes Or Homeowners’ Insurance

You can leave these and most other boxes blank if you don’t know what those costs might be, and the Mortgage Qualifying Calculator will generate an answer without them. The same for the inputs under Down Payment and Closing Costs, and Total Monthly Debt Payments. But your results will be more accurate and useful if you can provide these figures.

Also Check: Can You Get A Mortgage On A Foreclosed Home

Using The Mortgage Qualifying Calculator

The Mortgage Qualifying Calculator is designed to be easy to use and largely self-explanatory. Just fill in the various fields with the information requested. Start by choosing if you want to base the calculation on your annual income, the purchase price of the home you’re looking at or the monthly payment you can afford. Then work down the page entering your other information and the calculator will figure out the other two values for you and display them in gray.

For example:

- Enter your annual income and the Mortgage Qualifying Calculator will determine the maximum purchase price you can afford and the associated monthly payment.

- Enter the purchase price and the calculator will tell you the income you need and the monthly payment required. Or,

- Enter the monthly payment you’re thinking of and the Mortgage Qualifying Calculator will tell you the income needed to qualify and the home purchase price that will cover.

Then go down the rest of the page entering the information requested. Your answers will be displayed in gray at the top of the page. Click “View report” for a detailed breakdown and an amortization report.

Negotiate With The Seller

There is no reason you cant ask for seller contributions instead of negotiating for a lower purchase price. Depending on the type of mortgage you choose, the seller can contribute 3 to 6 percent of the home price in closing costs.

This can make all the difference when you want to buy a new home and stop renting. Seller contributions can cover closing costs, buy your interest rate down to a more affordable level, or make a onetime payment to cover your mortgage insurance.

Read Also: Does Chase Allow Mortgage Recast

What Mortgage Can I Get On 50k Salary

This is known as the loan-to-income ratio. For example, if your annual income was £50,000, you might have been able to borrow three to five times this amount, giving you a mortgage of up to £250,000. Now, when you apply for a mortgage, the lender will cap the loan-to-income ratio at four-and-a-half times your income.

How Can You Estimate An Affordable Property Price

Take 30% of your annual gross income, equate this into a loan amount using an average rate of 2.75%, factor in a 10% deposit, and then use these calculations to estimate a potential purchase price.

Assuming that you dont have any debts or liabilities, and using a rate of 2.75% over a 30-year loan term, here are three potential scenarios:

Scenario 1 – $50k income

- With a mortgage at 2.75% p.a. this equates to a loan amount of $305,000.

- With a 10% deposit contribution worth around $34,000, the maximum affordable property price would be $339,000.

Scenario 2 – $75k income

- With a mortgage at 2.75% p.a. this equates to a loan amount of $460,000.

- With a 10% deposit contribution worth around $51,100, the maximum affordable property price would be $511,000.

Scenario 3 – $100k income

- With a mortgage at 2.75% p.a. this equates to a loan amount of $614,000.

- With a 10% deposit contribution worth just over $68,000, the maximum affordable property price would be $682,000.

Read Also: Can You Apply For A Mortgage Before Finding A House

How Much Do I Need To Earn For A 100000 250000 Or 500000 Mortgage

Our calculator shows that for a £100,000 mortgage you will need to earn at least £22,500 as a single applicant or between you if youre applying for a joint mortgage. Bear in mind that a £100,000 mortgage can result in different LTVs and therefore different rates, depending on the amount of deposit you have and the overall value of the property.

For a £250,000 mortgage you will need to earn at least £56,000 as a single applicant or between you if applying as a couple, while for a £500,000 mortgage you will need a earn at least £111,500 as a single applicant or as joint income for a shared mortgage.

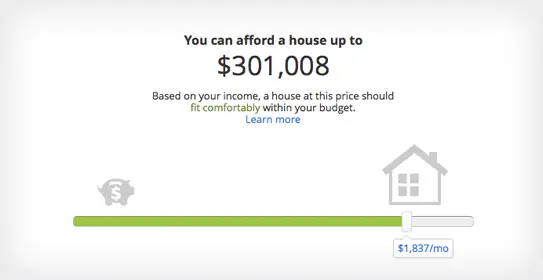

Find Your Home Buying Budget

Its definitely possible to buy a house on $50K a year. For many borrowers, lowdownpayment loans and down payment assistance programs are making homeownership more accessible than ever.

But everyones budget is different. Even people who make the same annual salary can have different price ranges when they shop for a new home.

Thats because your budget doesnt just depend on your annual salary, but also on your mortgage rate, down payment, loan term, and more. Heres how to find out what you can afford.

In this article

Also Check: Is It A Good Idea To Pay Off Your Mortgage

Can I Live Off 50k A Year

Where you live is a huge component of how well you can live on a $50k-a-year salary, and it can impact your budget dramatically. In some states, you might have to push and pull a $50,000 salary to cover all your expenses and still have some left over. In other states, you can live pretty comfortably on $50k per year.

That Makes Sense I Think My Credit Score Is In Good Shape Thankfully Is There Anything Else That Happens Before I Get The Mortgage

As far as the lenders work goes, not really. When determining the answer to How much mortgage can I afford?, the lender can tell you what theyre willing to give you, but it is very important that you take stock of your current situation and assess your future before committing to a loan. In other words, were back to the question of what size debt are you comfortable taking on.

Don’t Miss: Why Are Mortgage Rates Lower Than Prime

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Does Your Debt

An important metric that your bank uses to calculate the amount of money you can borrow is the DTI ratio comparing your total monthly debts to your monthly pre-tax income.

Depending on your , you may be qualified at a higher ratio, but generally, housing expenses shouldnt exceed 28% of your monthly income.

For example, if your monthly mortgage payment, with taxes and insurance, is $1,260 a month and you have a monthly income of $4,500 before taxes, your DTI is 28%.

You can also reverse the process to find what your housing budget should be by multiplying your income by 0.28. In the above example, that would allow a mortgage payment of $1,260 to achieve a 28% DTI.

Also Check: What Percentage Of Your Income Should Be For Mortgage

Factors That Determine The Amount Of Home You Can Afford

The tables above illustrate how different factors affect the amount of house you can buy. Lets explain the math a bit:

- Annual salary: Having a higher annual salary will naturally increase your home buying budget.

- Debt-to-income ratio: The tables above assume the best-case scenario where you have no other monthly debt payments, such as a student loan, a credit card payment, or a car loan. The more pre-existing debt you have, the less you can afford to spend on a home.

- Initial payment: A higher down payment will allow you to buy a more expensive home or enjoy a lower monthly mortgage payment.

- Interest rate: The younger you are mortgage interest rate, the more you can borrow and the more house you can buy.

Related: How to Buy a Home in 2021: 8 Tips to Win the COVID Home Buying Season

How Much Rent Can I Afford $50 000 Salary

Qualification is often based on a rule of thumb, such as the 40 times rent rule, which says that to be able to pay a certain rent, your annual salary needs to be 40 times that amount. In this case, 40 times $1,250 is $50,000. Therefore, if you make $50,000, you qualify for $1,250 per month in rent.

You May Like: What Does A Co Signer Do For A Mortgage

Can I Afford A House Making 35000 A Year

If youre single and make $35,000 a year, then you can probably afford only about a $105,000 home. But you almost certainly can t buy a home that cheap. Single people have a tough time buying homes unless they make an above-average salary. Marriage allows a couple to combine their incomes to better afford a home.

Can I Borrow Up To Five Times My Salary

It is possible to borrow five times your salary but only if you meet the lenders affordability tests and requirements for loan-to-value and minimum salary. To get a mortgage of this scale, youre likely to need a deposit of at least 10%, if not more to have access to a wider range of mortgage deal and may face a maximum lending cap. Some borrowers may look to lengthen their mortgage term to thirty years help make monthly payments more affordable.

Read Also: How Much Mortgage Can I Afford On 200k Salary

Increase Your Credit Score

Conventional loans often come with riskbased pricing, which means if your credit score is lower than 740, youll pay a higher interest rate on your loan.

Mortgage insurance costs also increase as your credit score decreases. These rising costs chip away at your housing price range.

Take steps to raise your score. It could mean you can lower your interest rate and therefore your monthly mortgage payments. And it could mean you qualify for a larger loan amount.

Youll also have a better chance of qualifying for a loan program with a higher debttoincome ratio if your score is higher.

My Result Shows I Can Afford My New Home What Should I Do Next

First of all, congratulations! You are now one step closer to owning the home you desire. The next step is to reach out to our team of top-notch mortgage lenders and get started on securing yourself the perfect deal.

Click Get FREE Quote, answer a few simple questions about yourself and the loan you are seeking to obtain personalized rate quotes from lenders doing business in your area. This service is totally FREE of charge and makes it easy to comparison shop for your best deal on a home loan. Take your next step today – it couldnt be simpler!

Don’t Miss: Is It Better To Use A Mortgage Broker

A Higher Credit Score Could Increase What You Can Borrow

Your has a big part to play in how much you can borrow. In the most extreme cases a low credit score could prevent a mortgage lender from even considering you or, more likely, a low score could mean that the lender uses a lower multiple of your income to decide how much you can borrow.

Thats why youll want to make sure your credit score is up to scratch before you even consider applying for anything. Our guide on improving your credit rating will be able to help you with this.

How Much House Can I Get Approved For

how much housecanshould

This rule says that your mortgage payment should be no more than 28% of your pre-tax income, and your total debt should be no more than 36% of your pre-tax income.

Similarly, what do I need to qualify for a $300 000 mortgage? Example Required Income Levels at Various Home Loan Amounts

| Home Price | |

|---|---|

| $80,000 | $7,176.77 |

Similarly, it is asked, how much can I borrow for a mortgage based on my income?

Four components make up the mortgage payment, which are: interest, principal, insurance, and taxes. A general rule is that these items should not exceed 28% of the borrower’s gross income. However, some lenders allow the borrower to exceed 30% and some even allow 40%.

How much income do you need to qualify for a $200 000 mortgage?

More Tools

| Max Allowable Monthly Debt Payment Amount : | $1,588.89 |

Also Check: How Do Mortgage Appraisals Work

How Much Mortgage Payment Can I Afford

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a down payment. As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

While your household income and regular monthly debts may be relatively stable, unexpected expenses and unplanned spending can impact your savings.

A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of some unexpected event.

What Affects Your Borrowing Power

When determining how much youâll be allowed to borrow, your bank or lender will take into account a number of factors. These include:

- Your income.

- Your employment stability

- Your expenses

- Whether you’re a single applicant or couple. If there are two of you, each earning $50,000 and year, that put your combined income at $100,000, which may give you more borrowing power.

Recommended Reading: Will Mortgage Pre Approval Hurt Credit Score

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

Try A 3%down Conventional Loan

Its possible to get a conventional loan one backed by Fannie Mae or Freddie Mac with a down payment as low as 3% of the purchase price. Whats more, that down payment can often be covered with a down payment assistance grant or gift funds from a family member.

Just note that to qualify for a 3%down conventional loan, most lenders require a credit score of at least 620 or 640. For those with lower credit, an FHA loan might be more appealing.

You May Like: When You Sign A Mortgage You Are

How Your Income And Debt Affect Your Mortgage

Mortgage lenders dont just want to know your salary. They want to know how much discretionary income you have the amount left over after your fixed expenses are taken care of.

Thats why income for mortgage qualifying is always viewed in the context of your debt to income ratio or DTI.

If you have any existing debt like a car payment, student loans, or a credit card payment lenders will subtract those costs from your monthy income before calculating how large a mortgage payment you qualify for.

The more debt you have, the less youll be approved to borrow for a mortgage.

Conversely, if you keep your debt low, you might be able to borrow as much as 6 times your salary for a mortgage. Heres how.