How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

What Mortgage Rates Can I Get

Mortgage interest rates vary widely based on several factors, including your credit score, the amount of debt you want to refinance, your homes value, and more. That said, interest rates for refinancing are typically very competitive among lenders, which is a good thing for you.

Source YCharts

Keep in mind that the lowest rate isnt always the least expensive loan when it comes to refinancing. There are fees associated with the refinancing process that could run into thousands of dollars. These charges stem from the appraisal process, application fees, and title insurance. Its a good idea to compare the five-year cost of new mortgages when shopping around for lenders to get a sense of what youll end up paying.

Loan Origination Fee Faq

To get the big picture outlook of whether youre getting a good deal on your loan, make sure youre not just comparing the origination fees but also factoring in the interest rate. Lenders are required to give you the APR of your loan, which includes all costs of borrowing including origination fees and interest rates. The lower your APR, the less your loan will cost over time.

Origination fees are usually charged as a percentage of the total amount borrowed, but it can sometimes show up as a flat fee instead. If your lender charges you a percentage of the money you borrow, simply multiply that percentage by your total loan amount. For example, if youre charged a 1% fee on a $5,000 personal loan, youd pay an additional $50 for the origination.

Read Also: How To Get Approved For Mortgage With Low Income

Maximum Loan Origination Fees

- Many mortgages today are capped in terms of what lenders and third parties may charge

- While this could potentially limit how much youll pay at the closing table

- It can still be up to 3% of the loan amount in most cases so these restrictions may mean very little

Most types of mortgage loans dont cap the fees lenders may charge borrowers.

However, many of todays mortgages, especially those backed by Fannie Mae and Freddie Mac, are so-called Qualified Mortgages, which afford lenders certain protections.

In order to meet this definition, total upfront points and fees may not exceed 3% for loan amounts of $100,000 or more.

This essentially limits what a lender can charge in the way of fees, though its still fairly accommodating.

If lenders dont care to meet the QM rule, they can charge whatever upfront fee theyd like.

The U.S. Department of Housing and Urban Development used to limit the maximum loan origination fee to 1% for FHA mortgages, but eliminated that rule for loans originated on or after January 1st, 2010.

The move aligned with changes to the Real Estate Settlement Procedures Act , which required the sum of all fees and charges from origination-related services to be included in one box on the Good Faith Estimate .

HUD assumed the new consolidated figure representing all compensation to the mortgage lender and/or mortgage broker for loan origination would likely exceed the specific origination fee caps previously set for government programs.

Advantage Of Paying Origination Fees Upfront

Weve already mentioned the choice you can make between:

But lets dig a bit deeper.

If at all possible, its often a good idea to pay more upfront and make significant savings over the lifetime of your loan. When youre borrowing this much over decades, even a slightly lower interest rate can leave you thousands better off over time.

But that mostly applies to those buying forever homes. Most homebuyers move every seven years or so. If thats you, the money you invest in buying yourself a lower mortgage rate wont have as much time to pay you back. Often, those planning to stay put for only 5-7 years find it better to live with a higher mortgage rate rather than pay more on closing.

Nows the time to use a mortgage calculator to model your loan options so you can make an informed decision. The Mortgage Reports has a whole suite of them for refinances and different sorts of mortgages. See how much your upfront investment in closing costs will save you in lower monthly payments over the number of years you think youre likely to remain in residence. So you can then decide whether the pain is worth the gain.

Recommended Reading: How To Reduce My Monthly Mortgage Payment

What Is A Loan Origination Fee And How Does It Work

A loan origination fee is charged by the lender and can also be referred to as an application, processing or underwriting fee. Its purpose is to cover the costs of preparing documents, processing and underwriting your loan and any third-party fees that are incurred along the way.

How much your loan origination fee will cost depends, in part, on the type of loan youre applying for. In some cases, you may be able to reduce the amount you pay or waive the fee entirely. Keep reading to learn what to expect in origination fees for different loan types.

In this guide, youll find

What Is An Origination Fee And How Much Does It Cost

In the seemingly never-ending mortgage lexicon of home buying and selling, one term in particular stands out as a source of confusion: the origination fee. What is an origination fee? Its something every homeowner needs to understand. And the good news is that its not actually that complicated.

In basic terms, an origination feesometimes referred to as a discount feeis money that a lender or bank charges a client to complete a loan transaction. An origination fee can encompass a variety of different fees added together, says , owner and broker with ABLEnding, based in California and Arizona. It can include underwriting fees, administrative fees, processing fees, discount fees , and any other fee charged by the lender and/or broker to the borrower.

Don’t Miss: What Is Tip In Mortgage

Mortgage Rates Where You Live

Mortgage or refinance rates depend on different factors, including where you live. To better understand what rates you may qualify for, including what the average mortgage or refinance rate is in your area, take a look at Credit Karmas mortgage rate marketplace and our latest state-specific guides.

About the author:

Read More

Saving On Your Origination Fees

If you can afford it, the most cost-effective strategy is to pay your origination fee and other closing costs upfront. This way, you know exactly what youre spending, plus youll get a lower rate as no additional interest payments are involved.Paying fees to lenders at all is largely unavoidable. Still, even if you cant pay everything in one go, there are ways you can reduce spending by making savings on your mortgage origination fees and closing costs.

You May Like: Does Rocket Mortgage Use Fico 8

How Does An Origination Fee Work

An origination fee is charged based on a percentage of the loan amount. Typically, this range is anywhere between 0.5% 1%. For example, on a $200,000 loan, an origination fee of 1% would be $2,000.

One important thing to note is that in the same area where you’ll see the origination fee, you may also see a charge for mortgage discount points. One prepaid interest point is equal to 1% of the loan amount, but these can be bought in increments down to 0.125%. These points are paid in exchange for a lower interest rate.

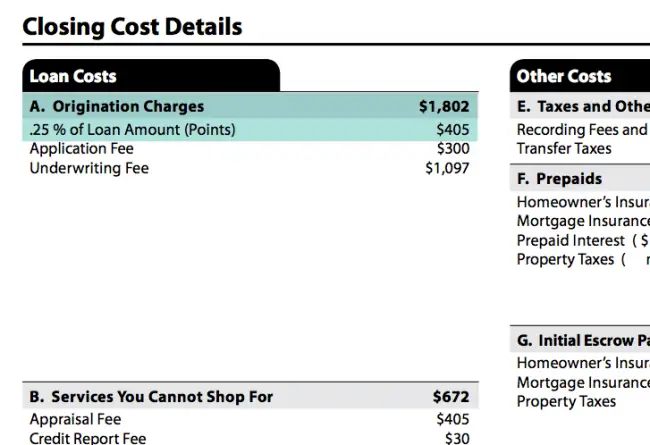

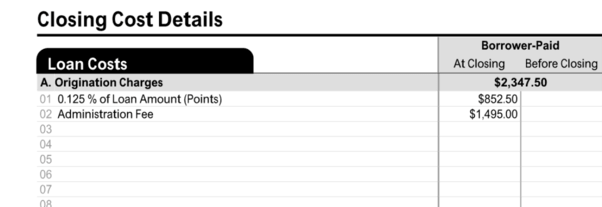

The points, together with any origination fee, will be included on the Origination Charges section of your Loan Estimate.

You may see a loan advertised as having no origination fee. However, if youve been around the block at all, you understand that theres no such thing as a free ride.

The lender makes its money by charging a slightly higher interest rate, which can fetch more money when the loan is sold to mortgage investors. Making money off a higher interest rate is referred to as having a bigger yield spread premium.

With a no-origination fee loan, youll pay less upfront in closing costs, but youll pay more in interest over the lifetime of the loan. It comes down to whats important to you.

Assuming you do end up with an origination fee, its paid at closing along with other fees such as your down payment and title costs. Its important that you budget for these items early on.

What Are Mortgage Origination Services What Is An Origination Fee

An origination fee is what the lender charges the borrower for making the mortgage loan. The origination fee may include processing the application, underwriting and funding the loan, and other administrative services. Origination fees generally can only increase under certain circumstances.

Origination fees are listed in section A of page 2 of your Loan Estimate. Origination fees generally cannot increase at closing, except under certain circumstances. The final charges are listed in section A of page 2 of your Closing Disclosure.

Note: You wont receive a Loan Estimate or Closing Disclosure if you applied for a mortgage prior to October 3, 2015, or if you’re applying for a reverse mortgage. For those loans, you will receive two forms a Good Faith Estimate and an initial Truth-in-Lending disclosure instead of a Loan Estimate. Instead of a Closing Disclosure, you will receive a final Truth in Lending disclosure and a HUD -1 Settlement Statement. Origination charges are listed in Block 1 on your Good Faith Estimate and Line 801 of your HUD-1 settlement statement. If you are applying for a HELOC, a manufactured housing loan that is not secured by real estate, or a loan through certain types of homebuyer assistance programs, you will not receive a GFE or a Loan Estimate, but you should receive a Truth-in-Lending disclosure.

Don’t Miss: How To Understand Mortgage Payments

Average Mortgage Lender Fees

Lender fees amount to an average of $1,387 based on our results from the four largest banks. These include the origination fee and the cost of any discount points required on your mortgage rate, which moves down according to the number of points you purchase. Not all banks provided estimates for all fees.

| Bank of America | |

|---|---|

| $995 | $1,387 |

Since the amount you spend on discount points mostly depends on your individual preference, we focused on the differences in origination fee among the banks we surveyed. Most of these large institutions charge a flat fee of $1,000 or more for their origination services, although Chase charged a much lower $595. While these lenders all used a flat fee for origination, other lenders sometimes set this fee at 1% of the total loan amount.

Are They Just Junk Fees

- Loan origination fees arent necessarily junk fees

- They are commissions paid out for helping you obtain a loan

- And just because you arent charged the fee directly doesnt mean its the better deal

- Look at the big picture to determine the best offer

The loan origination fee is not necessarily a junk fee seeing that many loan originators dont get paid salaries, as noted. So they need to get paid somehow.

But some lenders may not charge them and refer to them as unnecessary or excess charges as a result.

However, if they dont charge you directly, it just means theyre making money a different way, perhaps via a higher interest rate and/or by charging other lender fees.

Certain mortgage bankers can earn a service release premium after the loan closes by selling it to an investor on the secondary market.

This isnt a fee imposed on the borrower directly, though a higher-rate mortgage may fetch a higher SRP.

In any case, someone will be making money for originating your loan, as they should for providing a service.

So dont get fired up about it, just try to negotiate costs lower as best you can. Or go elsewhere for your loan if youre not impressed.

The reason its sometimes given junk fee status is that its often a fixed percentage, which means its not necessarily tailored to your specific loan or the amount of time/risk involved.

If these fees were based on a dollar amount instead, skeptics may not consider them junk. Or may think theyre less junky.

Don’t Miss: What Is The Lowest Fixed Rate Mortgage

What Closing Costs Are Negotiable

Closing costs are the fees and other costs that lenders and third-parties charge you for originating your mortgage and buying your home. Banks, real estate agents, lawyers, title research companies, credit reporting agencies and the government require various services during the closing process, including drafting and reviewing loan documents, checking and updating official records, reviewing your credit profile and brokering your loan and home sale.

Not every cost is negotiable. Any fee charged by the government is set in stone. Likewise, any service from a third-party provider will be difficult to negotiate with your lender. That means you wont have much room to negotiate your credit report fee, flood determination fee or appraisal costs. Lenders outline services you cannot shop for on page two of the loan estimate form.

| Fees you can negotiate | |

|---|---|

| Real estate commissions | Flood certification fees |

You have plenty of opportunities to negotiate for a better mortgage. Start by negotiating for lower interest rates, discount points and lower origination fees. Negotiating these fees may dramatically reduce the total cost of your loan.

Increase Your Credit Score

Your credit score is not only directly related to the interest rate a borrower will receive on a mortgage it will affect lender fees as well. The lower your score, the higher fees the lender will charge because the loan is riskier, and risky loans mean high lender fees.

There are several things borrowers can do to increase their credit score before selecting a lender. Paying down credit card balances is one of the most common ways to improve your score quickly. Read our article Tips to improving your credit score fast for more credit tips.

You May Like: Can You Mortgage A Condo

Smaller Home Loans May See Higher Fees Percentage Wise

- Because the loan origination fee is percentage-based

- It will be higher on smaller loan amounts, all else being equal

- This ensures the originator is paid adequately

- Since most home loans require a similar amount of work regardless of size

Also consider that for smaller loan amounts, a larger loan origination fee will need to be charged, seeing that its expressed as a percentage and wont go nearly as far as a similar percentage on a large loan.

For example, a $100,000 loan amount with a 1% fee is only $1,000, whereas a $400,000 loan amount with the same 1% fee would be $4,000. And both loans could require the same amount of work.

In fact, sometimes the smaller mortgages can be even more a burden to close. So consider the dollar amount as well.

With regard to Qualified Mortgages, a higher 5% max fee is allowed for loan amounts between $20,000 and $60,000.

Average Cost Of Origination Fees

Origination fees, generally quoted as a percentage of the total loan amount, vary widely. Federal student loan origination fees are set by Congress fees for most other loans vary depending on the lender, the type of loan you’re getting and your creditworthiness. For example, origination fees on a mortgage loan can be less than 1%, while origination fees on personal loans may be as high as 8% depending on your credit score.

While a lower origination fee may sound like a good deal, it’s not always your best option. Because origination fees help compensate lenders for making the loan, you might find that a loan with a lower origination fee makes up for it with a higher interest rate. Especially when taking out a large long-term loan such as a mortgage or student loan, a loan with a lower interest rate is usually a better bet, even if it has a higher origination fee. Even a small increase in your interest rate can add up to thousands of dollars over the life of a large loan.

Read Also: Can I Get A Mortgage Before I Sell My House

What Is Loan Origination Anyway

Before we dive into the fee itself, lets take a look at what loan origination is in the first place.

Simply put, loan origination is the multi-step process of getting a home loan. The process begins when you submit your financial information to a bank, broker, or lender to obtain financing for the purchase or refinance of real estate. The process ends when your loan is funded, and the funds are distributed.

In other words, loan origination is how a new mortgage is created.

How To Owner Financing

Category: Loans 1. The Ins and Outs of Seller-Financed Real Estate Deals Owner financing involves a seller financing the purchase directly with the buyer. It can offer advantages to both parties. An assumable mortgage is a type of Owner Financing · Loan Servicing Definition · Wrap-Around Loan Definition Jun 9, 2021

You May Like: How Long To Pay Off 70000 Mortgage