What Happens If I Pay An Extra $100 A Month On My Mortgage

In this scenario, an extra principal payment of $100 per month can shorten your mortgage term by nearly 5 years, saving over $25,000 in interest payments. If you’re able to make $200 in extra principal payments each month, you could shorten your mortgage term by eight years and save over $43,000 in interest.

Make Extra Payments Every Quarter

Best if: Your cash flow is irregular

Biweekly mortgage payments can be logical for people who get a steady paycheck every two weeks. But if youre a small business owner or independent contractor, your income can vary a lot in the short run.

Making an extra mortgage payment each quarter instead of every two weeks might better align your income with your expenses while still allowing you to save on interest and pay off your mortgage sooner.

Lets Look At An Example Of A Do

Loan amount: $200,000Mortgage rate: 4.25% Regular monthly mortgage payment: $983.88 1/12 of that amount: $81.99 New combined payment : $1,065.87

Total savings: $30,205 in interest Mortgage term: 309 months

Be sure that you note the extra amount is to go toward the principal balance!

If you dont make this clear, some lenders will return the surplus money, apply it to your next payment, or perhaps apply it your escrow account. Its important that this is 100% clear so the money goes to the right place.

This free biweekly mortgage method actually works in your favor for several reasons. First, you dont pay any extra junk fees to have someone do it for you.

And second, because you make an extra payment to principal each month, your loan balance is reduced each month and home equity is accrued faster.

This reduces the total amount of interest due throughout the life of the loan. So you pay less interest in a shorter amount of time. Amazing.

Additionally, its easy to execute. Youre still making 12 payments per year, so it doesnt require any extra work like actual biweekly payments.

Recommended Reading: How To Calculate Mortgage Credit Score

Consider Your Other Debts

Lets say your mortgage interest rate is 4% and your other debts include an auto loan at 2%, a student loan at 6% and a at 16%. Putting extra money toward your mortgage wont save you as much as putting extra money toward your student loan or credit card which have higher interest rates. Retiring those debts faster will likely have a greater financial benefit in the near term.

Make A Lump Sum Payment

![Biweekly mortgage calculator with extra payments [Free Excel Template] Biweekly mortgage calculator with extra payments [Free Excel Template]](https://www.mortgageinfoguide.com/wp-content/uploads/biweekly-mortgage-calculator-with-extra-payments-free-excel-template.png)

Best if: You want to apply a large lump sum to your mortgage principal

Instead of recurring payments, you can make one large payment toward your principal and ask your lender to recast your mortgage. The lender will recalculate your monthly principal and interest payments based on the new, lower principal balance and youll receive a lower monthly payment without having to refinance.

Tip:

You wont pay off your mortgage faster, because your loan term will stay the same, and your interest rate will stay the same. But youll save money on interest because you owe less principal.

Some lenders require a minimum lump-sum payment amount before theyll recast a loan. Your lender may also charge a few hundred dollars to recast your mortgage, but refinancing usually costs several thousand dollars.

Learn More: How to Pay Off Your Mortgage Early

You May Like: How Do You Get A 2nd Mortgage

Things To Watch Out For

Making biweekly payments is a handy tool, but be careful of scams or special programs that claim they can do this for you. Some companies offer to convert your monthly mortgage payment into biweekly payments for a one-time fee. Avoid those offers. It shouldnt cost you anything to make extra payments on your loan.

Make sure that making biweekly payments fits your budget. If you’re typically paid once per month, you might be used to paying all of your bills at once instead of spreading them out. If you’re paid weekly, make sure you’re holding enough cash in reserve each week to make your next biweekly payment once it comes due.

Check that you’re signing up for a true biweekly mortgage schedule, not a bimonthly mortgage. That schedule involves two payments per month, but doesn’t offer the advantage of the extra payment each year.

Finally, make sure there isnt a penalty for prepaying your mortgage. Most mortgages these days do not have a prepayment penalty, but there are still some out there that will penalize you for trying to pay off your mortgage early. Just be sure that you wont be doing more harm than good by making extra biweekly payments.

Through Your Mortgage Servicer

Check your mortgage servicers website for information about biweekly payment options. They may require you to be one month ahead on your mortgage before enrolling in a biweekly payment plan.

On top of that, your loan servicers plan may not even apply the payments to your account every two weeks. For example, Caliber Home Loans states that the only benefit of enrolling in a biweekly payment program is that your 13th and 26th payments each year will be applied to your principal balance, reducing what you owe faster.

Tip:

Whats worse, trusting these third parties with your money sets you up to get scammed and fall behind on your mortgage.

You May Like: How Much Of Gross Income Should Go To Mortgage

Determine What Your Ideal Down Payment Amount Should Be

A down payment is a portion of the cost of a home that you pay up front. It demonstrates your commitment to investing in your new home. Generally, the more you put down, the lower your interest rate and monthly payment. There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers. Use this down payment calculator to help you answer the question how much should my down payment be?.

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down-payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate of 3.946%.1

How To Pay Down Your Principal

Buying a home is an exciting experience. Theres nothing like receiving the keys to your home, especially after youve worked so hard to save for a down paymentand qualify for a loan. But there are many responsibilities that come along with owning a home. At the top of this list is your monthly mortgage payment.

Like many homeowners, your mortgage payment can be your largest monthly expense. The thought of paying hundreds or thousands of dollars a month for decades can be overwhelming. Paying your mortgage principal faster can reduce the amount of interest you pay and also help you pay your loan off sooner.

Read Also: What Is A Good Ltv For Mortgage

What Is The Best Payment Frequency For A Mortgage

The most common way of paying a mortgage is with monthly payments typically on the 1st of every month. This is easy to remember if you are used to paying rent. Most lending institutions will let you make payments on a different date if that is more convenient for you for example the 15th day of every month.

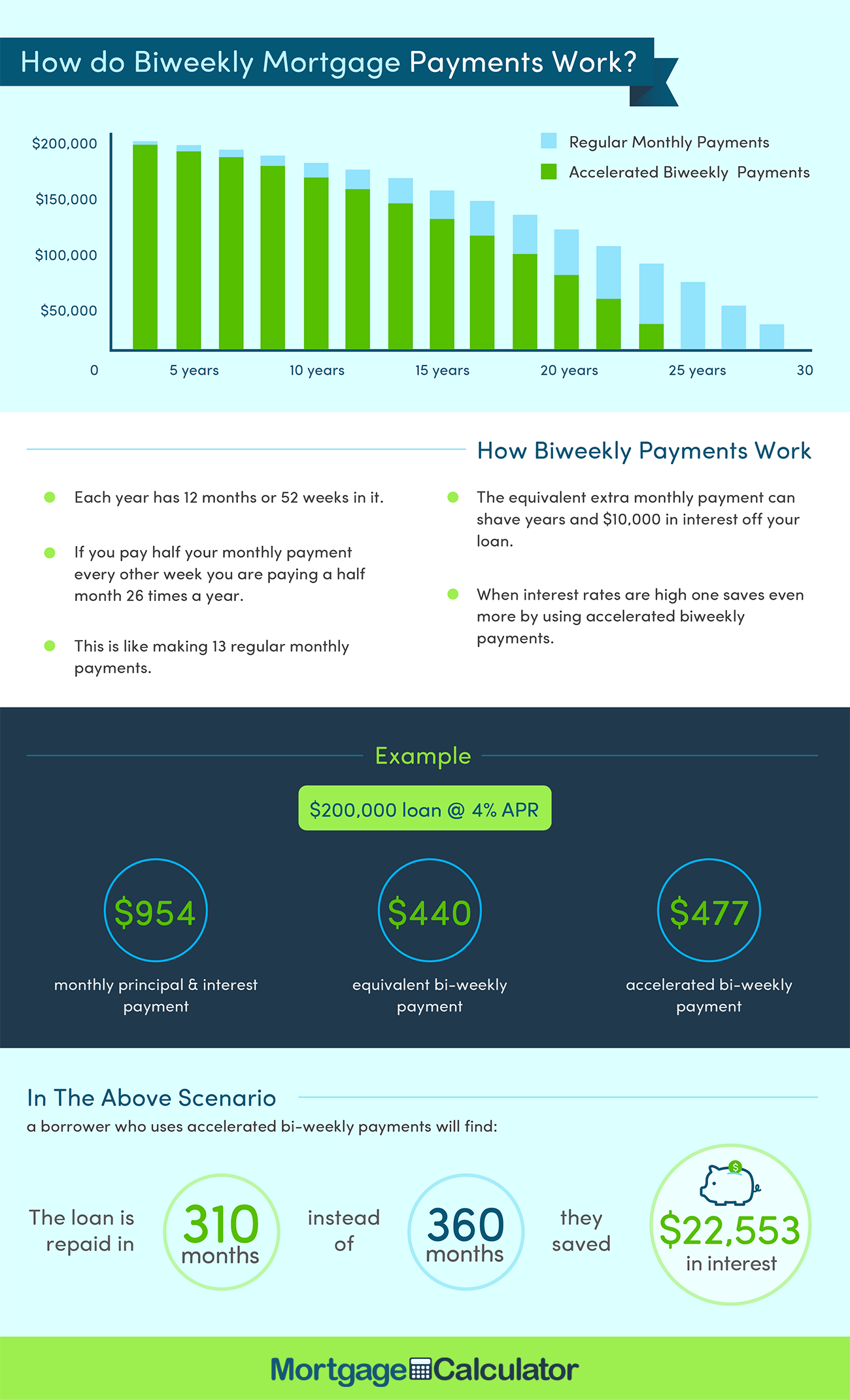

All About Biweekly Mortgage Payments

Mortgage loans are typically set up the same way. Once youve chosen your loan term , your lender will establish a set monthly payment. You will make this payment once a month every month until the loan is satisfied, for 12 equal payments a year.

With biweekly payments, however, youll make a partial payment every two weeks instead. Simply divide your standard mortgage loan in half and thats your biweekly payment.

Don’t Miss: Will My Mortgage Payment Go Down

Setting Up Biweekly Payments

Because the whole payment isnt there in time. So my recommendation is one, you can do this yourself. Set it up with your bank to where youre going to send in half the payment every time you get paid, which if youre biweekly is 26 times a year, but make an extra payment first so youre one payment ahead. This way you dont ever get late fees. Because sometimes the timing can get hinky.

Well, these companies figured out that they could sell the service of helping you do biweekly payments. So instead of you doing it yourself, you sign up with this company and you pay them fees. Then they will draft your bank account every two weeks for you, for this fee, which is pretty expensive, too.

Through A Lender Program

These days, most lenders offer the ability to easily make additional payments online. Log in to your servicers online portal to see the payment options available to you.

- In addition to making a monthly payment, setting up autopay, and making additional payments, there may be an option to pay biweekly.

- For any extra payment/biweekly payment option online, make sure the entire payment is applied directly to your principal balance.

Youll also want to be wary of any third-party payment providers offering to make biweekly payments on your behalf. Pay special attention to their terms and conditions. These services often charge fees thatll eat into your interest savings.

Also Check: How To Figure Mortgage Payment

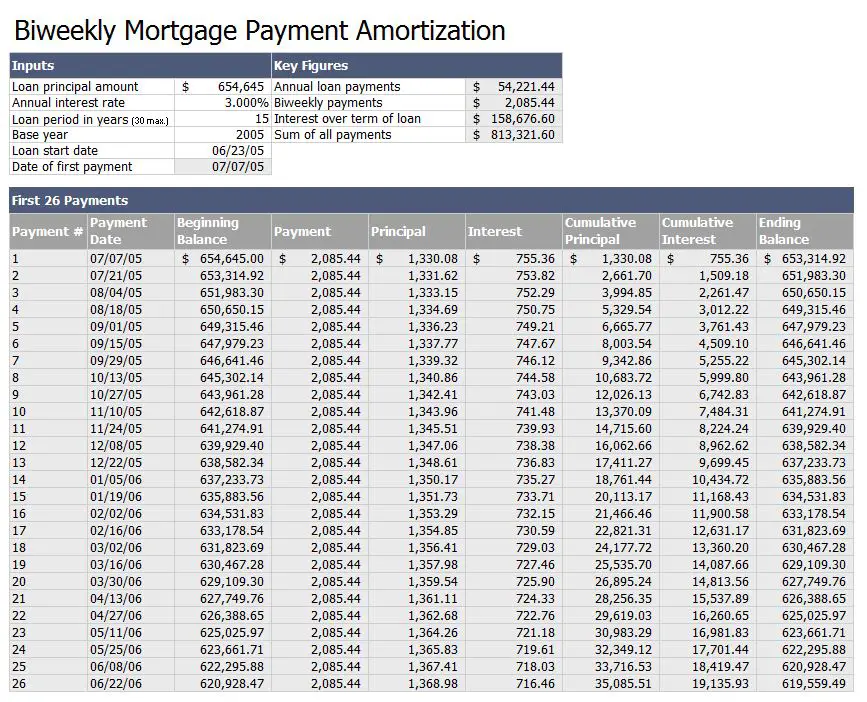

How Do I Create My Own Biweekly Mortgage Payment Plan

Once you confirm your lender or servicer allows biweekly mortgage payments and doesnt charge fees or prepayment penalties, calculate your biweekly mortgage payment to ensure you pay the correct amount every two weeks. Additionally, instruct your lender to apply the extra payments to the principal instead of interest.

How To Make Biweekly Mortgage Payments To Save Money

Whether you’ve been a homeowner for 15 minutes or 15 years, paying off your mortgage faster could help you free up cash for other financial goals. Your mortgage is likely your largest single monthly expense, and each payment is due on a specific day and for a minimum amount. But switching from monthly to biweekly payments could provide substantial financial benefits.

Read Also: How To Calculate Principal And Interest For Mortgage

The Downfalls Of Making Payments Biweekly

It might sound like a perfect plan to pay your mortgage off early just by making payments twice per month rather than once. It doesnt cost you any more money and you cut years off your term. However, there is a catch. Not all lenders credit half payments. If they receive half of your mortgage payment, they may hold onto it until they receive the other half in two weeks. This bypasses the benefit of these extra payments. You dont cut your principal down and you pay the same amount of interest.

Another downside of biweekly payments is the charges some lenders make you pay. Some consider it a service to offer the option to pay biweekly. They get away with it by requiring automatic withdrawal from your bank account for the payments. This way they can charge you for the service. This takes away from the money you save and may not make the extra payments worth it.

The Benefits Of Paying Your Mortgage Biweekly

On top of paying your mortgage in half payments, biweekly mortgages offer a number of additional benefits that make this repayment strategy worth considering. Below are some of the biggest pros that you can enjoy if you start paying your mortgage every other week.

Pay Off Your Home Quicker

That extra payment every year goes a long way in the life of your loan. It can actually cut years off of your repayment timeline if youre making an extra payment every year by switching to a biweekly payment program, youre building equity in your home quicker than when you were making monthly payments, effectively paying your home off faster.

Lets put some numbers to this scenario. Say your loan is $200,000 on a 30-year fixed-rate mortgage with a 4.125% interest rate. Well take a look at it from both a monthly and biweekly payment perspective.

Biweekly payments mean you pay off your loan 4 years and 3 months early by making the equivalent of one extra payment per year.

Save Thousands

Not only will switching to biweekly payments save you time on the life of your loan, but it can also save thousands in payments and interest.

Lets continue with that same scenario of a $200,000 loan amount. By switching to a biweekly payment program, you can see in the table above that you save more than $24,000 in interest over the life of your loan.

Want to see your savings for yourself? Check out our amortization calculator and see how much you can save.

Also Check: How To Shop Around For Best Mortgage Rates

Biweekly Vs Bimonthly Mortgage Payments

Bimonthly mortgage payments could also be an option, but they differ from biweekly payments. Thats because youre making a payment twice per month, which equates to 24 bimonthly payments, or 12 full payments total the same amount of payments as the monthly option. You may get paid bimonthly, and it may be more convenient to arrange your automatic payments around that schedule, but it wont shave time off your mortgage repayment term.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

You May Like: How Much Is A Mortgage On A 500k House

How Much Faster Do You Pay Off A 30 Year Mortgage With Biweekly Payments

Biweekly payments accelerate your mortgage payoff by paying 1/2 of your normal monthly payment every two weeks. By the end of each year, you will have paid the equivalent of 13 monthly payments instead of 12. This simple technique can shave years off your mortgage and save you thousands of dollars in interest.

How The Math Works

If the math is a little tough to follow, it works like this: Biweekly payments are equal to 13 monthly payments in a year where making traditional monthly payments are equal to 12 payments each year.

But do you have to make biweekly payments to do that? You could divide the amount of one month’s payment by 12 and add that amount to your monthly mortgage payment.

If you’re paying $1,500 per month, divide 1,500 by 12 and make your monthly payment $1625. Talk to your mortgage company first to make sure there isn’t something more you have to do to make sure it is applied to the principal amount of your loan.

Read Also: What Kind Of Mortgage Loan Should I Get

Are Biweekly Mortgage Payments A Good Idea

When you buy a house, you typically make monthly payments for an agreed-upon number of years to pay off the loan. Most commonly, this is based on a 30-year mortgage agreement. But what if you could pay your home off faster and pay less money using biweekly mortgage payments? With this payment schedule, you end up paying down more of your loan each year and saving yourself potentially tens of thousands of dollars in interest. Lets get into it!

How To Change To Biweekly Mortgage Payments

Some lenders have to grant permission before you can switch to biweekly payments. If approved, there are two things to keep in mind. First, your biweekly payments won’t be applied to your account until you’ve reached your full monthly payment amount. Also, during your first month of enrollment, youll likely need to pay both your regular monthly payment plus your two half payments.

Some lenders charge fees to change payment agreements, while others do not. When you talk to your lender, find out if fees are associated with making the switch.

If your lender does not agree to the biweekly payment terms that you propose, simply pay extra every month to get the same benefits. You can also save up and make an extra payment every year, rather than every month. When you make any kind of extra mortgage payment, make sure it’s being applied to your loan principal rather than the interest.

Its important to note that certain mortgages don’t permit early payoffs. When early payoffs aren’t allowed, lenders may charge fees known as prepayment penalties. These fees may equal the amount of interest youre eliminating. If you aren’t sure if your mortgage allows early payoffs, look over your contract or talk to your lender.

Recommended Reading: How To Make Mortgage Lenders Compete

Pro : Pay Off Your Mortgage Faster

For example, if youre buying a $100,000 home and you put 20% down, youll have an $80,000 mortgage. With a 30-year mortgage, it will normally take you 30 years to pay this off. But if you make biweekly mortgage payments, you will be making what equates to 13 monthly payments each year. Assuming a 6.5% interest rate and biweekly payments of $252, you would pay off your mortgage in a little over 24 years, or about six years early.

Should You Switch To Biweekly Mortgage Payments

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Most mortgage payments are structured to be paid monthly, but switching to biweekly mortgage payments can reduce how much interest you pay over the life of your loan and even shrink your repayment term. However, simply making payments every two weeks doesnt guarantee these results reaping these benefits ultimately depends on how your lender handles biweekly mortgage payments.

Also Check: Can I Get A Mortgage Loan After Chapter 7