Rocket Mortgage: Rates And Fees

Rocket Mortgage advertises daily refinance and purchase rates for 15-year loans, 30-year loans, VA loans, and FHA loans. These rates can change every day and are based on a few assumptions, such as that your credit score is higher than 720 and your debt-to-income ratio is under 30%. So everyone wont be able to qualify for the lowest rates.

Also, be sure to pay attention to the fees and APR because the advertised rates can include discount points. A discount point, or mortgage point, is an optional upfront fee you pay in exchange for a lower interest rate. Typically, a discount point costs 1% of the loan balance and reduces your rate by .25%. So if you want to avoid paying the additional fees, youre likely to get a higher mortgage rate than advertised.

The minimum credit score required by Rocket Mortgage varies depending on the type of loan. Most loans, such as conventional loans and VA loans, require a score of at least 620. For FHA loans, your credit score can be as low as 580. While these are the minimum credit scores you need to qualify, only those with the highest credits scores will qualify for the best mortgage rates.

Rocket Mortgage has no application fees or prepayment penalties for any of its loans. There can be late fees, which vary depending on how late the payment is. For a complete breakdown of the closing costs, including lender fees and discount points, youll need to submit an application.

What Are The Minimum Requirements

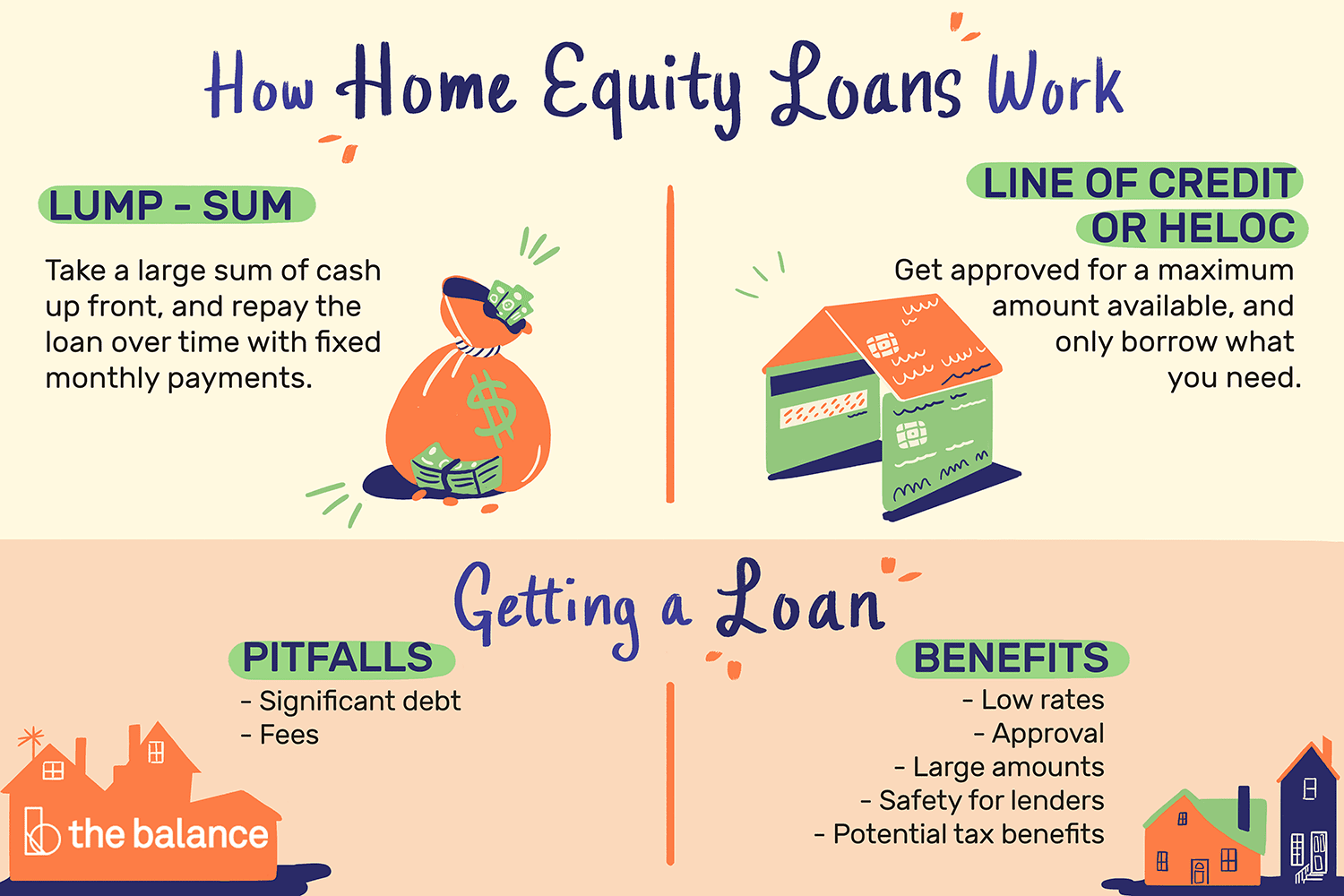

Many lenders have fixed LTV ratio requirements for their home equity loans, meaning you’ll need to have a certain amount of equity in your home to qualify. Lenders will also factor in your credit score and income when determining your rate and eligibility.

Minimum requirements generally include a credit score of 620 or higher, a maximum loan-to-value ratio of 80 percent or 85 percent and a documented source of income.

How Does A Second Mortgage Work

The equity you have in your home is a valuable asset, but unlike more liquid assets like cash, it isnt typically something that you can utilize.

A second mortgage, however, allows you to use your homes equity and put it to work. Instead of having that money tied up in your home, its available for expenses you have right now. This can be a help or a hindrance, depending on your financial goals.

Specific requirements for getting approved for a second mortgage will depend on the lender you work with. However, the most basic requirement is that you have some equity built up in your home.

Your lender will likely only allow you to take out a portion of this equity, depending on what your home is worth and your remaining loan balance on your first mortgage, so that you still have a certain amount of equity left in your home .

To be approved for a second mortgage, youll likely need a credit score of at least 620, though individual lender requirements may be higher. Plus, remember that higher scores correlate with better rates. Youll also probably need to have a debt-to-income ratio thats lower than 43%.

Don’t Miss: Chase Recast Calculator

Can You Pay Off A Heloc Early

Yes, you can pay off a HELOC early. There are no associated prepayment penalties with these loans.

The best time to pay off the principal of your loan is during the draw period. You are only required to pay the interest during this time, but paying extra toward your principal as well during this period can help you avoid paying more during the repayment period.

Accessing Your Funds With A Heloc

- You may be given an access card

- An option to transfer funds online to your bank account

- A physical checkbook where you can write checks

- Or a bill pay option to make specific payments

Once your HELOC is open, youll have a variety of options to access the funds up to your pre-determined credit limit.

Most banks and mortgage lenders will provide you with an access card that works kind of like an ATM debit/credit card. You can make purchases with it and/or withdraw cash at a branch location.

You may also be given the option to transfer funds to a linked bank account, or be given checks that can be written to anyone for any purpose, which are deducted from your credit line.

There may be a bill pay option if you want to use the funds to pay bills, or an option to transfer funds over the phone or via mobile banking.

In any case, it should be pretty easy and convenient to access your money.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

Think About Loan Terms

As weve mentioned, cash-out refinances extend the length of your existing mortgage loans, while HELOCs add a second loan to your current time frame and therefore an additional monthly payment. So, if you cant reasonably commit to the additional monthly expense, the cash-out refinance is probably a safer option.

Getting A Second Mortgage If You Have Bad Credit

Although second mortgages are often difficult to qualify for with bad credit, its not impossible. Obtaining a second mortgage with a low credit score likely means that youll be paying higher interest rates than those with good credit. However, this loan can be beneficial in helping you pay off high-interest credit card debt or increasing your homes value through home improvements.

In order to qualify for a second mortgage with less-than-perfect credit, you must meet the following qualifications:

- You have a credit score of 620 or higher

- You have a DTI lower than 43%

- You have 15 20% equity in your home

- You have proof of on-time monthly mortgage payments

- You have a strong income history

Before applying for a second mortgage, make sure that youre able to meet all of these qualifications. If not, you may want to consider boosting your credit score before applying. However, you may still be able to qualify now if you are able to use a co-signer on the loan.

You could also consider looking into alternative financing options to help pay for your home improvements or debt consolidation. Both personal loans and cash-out refinances are good options to use if you have trouble qualifying for a second mortgage.

Read Also: Rocket Mortgage Launchpad

Quicken Loans Mortgage Review 2021

- Top three mortgage lender in the U.S.

- Operates in all 50 states

- YOURgage mortgage lets you customize your payment terms

Cons

- In-person mortgage application is not possible with Quicken Loans

- Quicken Loans doesnt offer any banking or investing services so you cant bundle your mortgage with other financial accounts you have

Quicken Loans has a reputation as a heavy-hitter in the mortgage space. Quicken, which was founded in 1985, announced in Feb. 2018, that it became the nation’s largest residential mortgage lender with a total loan volume of $83.4 billion. Headquartered in Detroit, Quicken Loans has provided more than two million American families with mortgages.

Quicken Loans is the largest online retail mortgage lender, according to National Mortgage News. Its parent company is Rock Holdings, Inc. Quicken provides only mortgages and loans – it doesnt offer any banking, investment or other financial products. It does, however, offer a range of mortgage products, including fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans and jumbo loans. You can also use the companys YOURgage feature to customize your loan terms.

Qualification Requirements For Helocs

HELOCs have their disadvantages and advantages, so consider your financial needs for your investment or venture.

These requirements may adjust depending on your lender, but you typically need:

- Reliable income: Many lenders will need proof of income to confirm youll be able to pay off your loan payments.

- Good credit: A credit score above the mid-600s will likely approve you for a loan. A credit score above 700 is considered ideal.

- Qualifying amount of equity in your home: You should have at least 15 20% home equity.

- Responsible payment history: Lenders may evaluate your previous payment history to make sure you havent made any late payments in the past.

- A low debt-to-income ratio : The lower your DTI, the better. Discuss with your lender what their qualifying DTI ratios are to potentially receive a loan.

Get approved to refinance.

Read Also: Can I Get A Reverse Mortgage On A Condo

How Hybrid Helocs Work

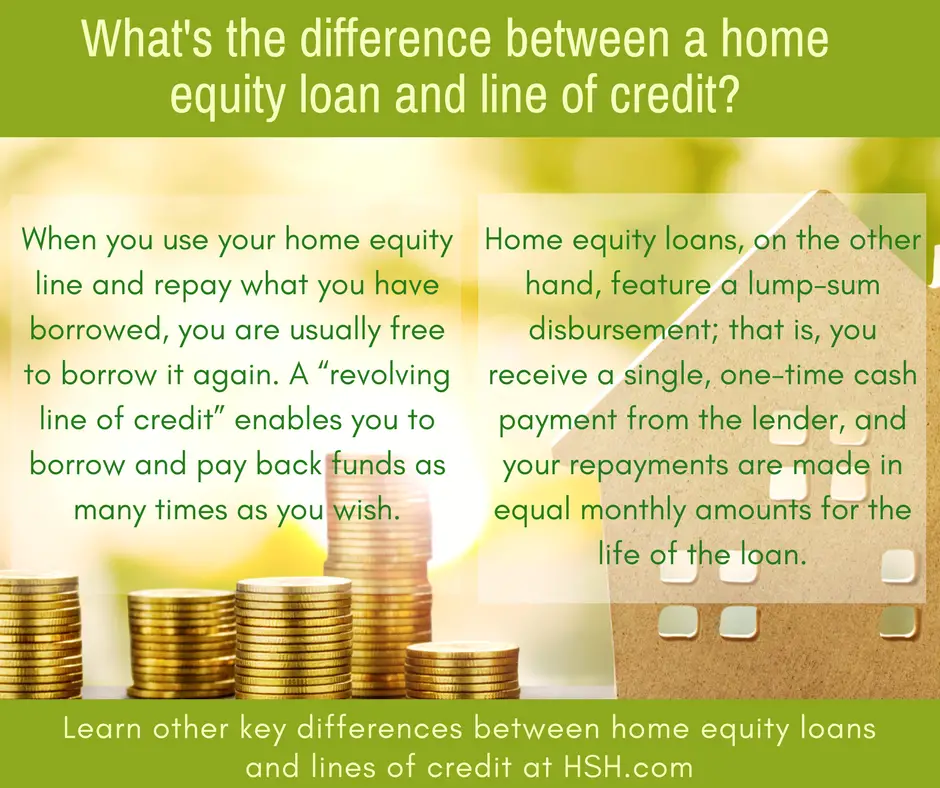

The fixed-rate HELOC is considered a hybrid. It sits somewhere between a traditional HELOC and a home equity loan. So, you can withdraw the amount of money you need from your credit line and then convert it to a fixed interest rate.

You may be able to get a fixed-rate HELOC or a hybrid that allows you to convert the entire loan or a portion of it from a variable rate to a fixed one. However, these loans can come with restrictions on their withdrawal terms, which may influence your decision.

Generally, HELOCs function on a 30-year term basis. Often, a fixed-rate HELOC comes with a draw period of 10 years and a 20-year repayment period. Borrowers are allowed to convert their debt at the closing of or during the draw period. Some lenders may also allow you to switch back to a variable rate.

Second Mortgage Vs Refinance: Whats The Difference

A second mortgage is different from a mortgage refinance. When you take out a second mortgage, you add an entirely new mortgage payment to your list of monthly obligations.

You must pay your original mortgage as well as another payment to the second lender. On the other hand, when you refinance, you pay off your original loan and replace it with a new set of loan terms from your original lender. You only make one payment a month with a refinance.

When your lender refinances a mortgage, they know that theres already a lien on the property, which they can take as collateral if you dont pay your loan. Lenders who take a second mortgage dont have the same guarantee.

In the event of a foreclosure, your second lender only gets paid after the first lender receives their money back. This means that if you fall far behind on your original loan payments, the second lender might not get anything at all. You may have to pay a higher interest rate on a second mortgage than a refinance because the second mortgage lender is taking on increased risk.

This leads many homeowners to choose a cash-out refinance over a second mortgage. Cash-out refinances give you a single lump sum of equity from a lender in exchange for a new, higher principal.

Learn more about the difference between a second mortgage and a refinance.

Recommended Reading: Rocket Mortgage Qualifications

Restrictions On Your Loan

Lenders will rarely allow you to borrow 100% of your equity for a home equity loan. The maximum amount you can borrow varies depending on the lender, but its usually between 75% and 90% of the value of the home. As with a cash-out refi, the amount you can borrow will also depend on factors like your credit score, debt-to-income ratio and loan-to-value ratio .

Which Is The Best Way To Tap Into Your Home Equity

The best form of tapping into your home equity probably depends more on what you will need the money for than anything else. Of course, your credit score and financial situation matter too, but they will be a factor regardless of which option you choose.

A home equity line of credit, also known as HELOC, is a line of credit that can be used for things like large purchases.

You May Like: Chase Recast Mortgage

Home Improvement Or Repairs

If youre going to be using the money to improve or even increase the value of your home, it can make sense to tap into your homes existing equity using a HELOC.

Some improvements are more valuable than others. While you may think that a full kitchen renovation will give you a dollar-for-dollar return on your investment, thats not always the case. Youll likely get more bang for your buck with something that increases your homes square footage, such as finishing your basement.

You can also see good returns by making changes to your homes exterior to increase its curb appeal, such as upgrading your landscaping.

Would You Qualify For A Quicken Loans Mortgage

If you opt to apply for a mortgage with Quicken Loans youll need a minimum credit score of 580 to qualify for an FHA loan. This is lower than the 600 minimum that most lenders require for FHA loans. 580 is the lowest score that falls into the fair .

Youll need a minimum credit score of 620 if you want a shot at getting approved for a conventional loan from Quicken Loans. The higher your credit score the higher your chances of approval. But your credit score isnt the only important stat that Quicken Loans will consider. Your income, debt levels and down payment savings will also affect your ability to score a Quicken Loan.

Twenty percent is the norm for a down payment on a conventional loan, but you can put less money down if youre willing to pay private mortgage insurance. If you dont have the 20% down payment needed for a conventional mortgage without private mortgage insurance , you may be interested in Quicken Loans PMI Advantage option. With this option, you can get out of paying monthly private mortgage insurance by opting for a higher interest rate at closing, or by paying all your PMI in one lump sum at closing. The former option means youll pay more interest over the life of the loan . The latter option can be advantageous if the seller of the home youre buying is willing to pay your PMI to sweeten the deal.

You May Like: Mortgage Rates Based On 10 Year Treasury

Will I Owe Any Money On The Contract If I Cancel During The Three

If you cancel the contract, the security interest on your home is no longer valid, your home is no longer collateral and cant be used to pay the lender. You dont have to pay anything, and any amounts you paid must be refunded, including the finance charge and other charges, such as application fees, appraisal fees or title search fees, whether paid to the lender or to another company that is part of the credit transaction. The lender has 20 days after receiving your notice to return all money or property you paid as part of the transaction and to release their interest in your home as collateral, which they must do even though the security interest is no longer valid from the day the lender received your cancellation notice.

If you got money or property from the lender, you can keep it until the lender shows that your home is no longer being used as collateral and returns any money youve paid. Then, you must offer to return the lenders money or property. If the lender doesnt claim the money or property within 20 days, you can keep it.

Full Transcript Show 231 Think Twice Before Getting A Home Equity Line Of Credit

Doug: When I have Ted Michalos on this podcast, if I want to get him all fired up I mention the type of debt that is his pet peeve, payday loans.

Well today Ive got Scott Terrio on the podcast so Ill pull the same stunt with him and mention his debt pet peeve. Yeah, you guessed it, HELOCs.

So lets see how good a job I can do getting Scott all wound up. Scott is the manager of consumer insolvency here at Hoyes, Michalos and he is frequently quoted in the media, often about HELOCs. So Scott, welcome back to Debt Free in 30. Ready to talk HELOCs?

Scott: Thank you, Doug, I am, yes.

Doug: Well so lets start with the obvious question then. What is a HELOC?

Scott: Right. Great question. A HELOC is a home equity line of credit, and a lot of people have them.

Doug: Okay. So what does that mean then? What are the attributes of a home I mean a line of credit, I know what that is. I got to the bank and they give me money and I can borrow whenever I want. Whats the difference with that-

Also

Doug: And thats what you mean by no amortization period. So a typical mortgage theres a 25-year amortization period

Scott: Where its paid off.

Doug: So I know that in 25 years if I make all my payments its done.

Scott: Right.

Doug: Whereas with a HELOCs, so what am I paying in a HELOC then?

Scott: Interest only, mostly.

Doug: Interest only, okay.

Scott: And I think the latest figure in Canada is 25 or 30 percent of HELOC borrowers are paying interest only.

Doug: Wow.

Scott: Right.

Also Check: 10 Year Treasury Yield And Mortgage Rates

Getting The Best Heloc Rate

This ones on you: The more you research, the bigger your reward. As you look for the best HELOC rates, get quotes from various lenders. Check your primary bank or mortgage provider it might offer discounts to existing customers. Get a quote and compare its rates with at least two other lenders. As you shop around, take note of introductory offers like initial rates that will expire at the end of a given term.

» MORE:9 tips for getting the best HELOC rate

How Do I Determine The Third Business Day

You may get the disclosure and two copies of the right to cancel notice at your closing. In that case, Day One begins after the closing. But if you get the disclosure form and the two copies of the notice before or after the closing, Day One begins on when the last of the three things happened. So if the closing happens on a Friday, and if that was the last thing to happen, you have until midnight on Tuesday to cancel. But if you received your Truth in Lending disclosure form on Thursday and you closed on Friday, but didnt receive two copies of the right to cancel notice until Saturday, you have until midnight on Wednesday to cancel. For cancellation purposes, business days include Saturdays but not Sundays or legal public holidays.

During this three-day waiting period, the lender cannot directly or through another person take action related to the loan. The lender cant deliver the money for the loan , or begin performing services. If youre getting a home improvement loan, the contractor cant deliver any materials or start work. The lender can begin to accrue finance charges during the delay period.

Don’t Miss: Who Is Rocket Mortgage Owned By