How To Use The Existing Loan Calculator

Follow these steps:

You May Like: How Much Income For A 250k Mortgage

What Are Property Taxes

Property taxes are fees collected from homeowners by your local council or city. These taxes fund essential services like garbage collection, snow clearing, and your local fire and police departments. Are school taxes included in your mortgage property taxes? Sometimes â Toronto for example has a specific line item in their municipal tax for schools.

Property taxes are calculated as a percentage of your homeâs assessed value. Theyâre paid on a quarterly, semi-annually, or annual basis, depending on the municipality. Your municipality may also break your property taxes down into several different rates. For example, Toronto breaks property taxes down into three parts: city tax, education tax, the city building fund.

Hereâs an example of the annual property tax you might pay on a home with an assessed value of $400,000 in Toronto.

| Line Item | |

| 0.61477% | $2,459.08 |

The exact of property tax you owe will fluctuate based on your homeâs value and the municipalityâs tax rate.

Why Cant I Just Pay Property Taxes Myself

Including your property tax payments in your mortgage payments allows your lender to protect himself. If a homeowner is forced into foreclosure, his lender will likely have to pay the remaining property tax amount. Thats why failing to pay property taxes is considered an event of default, allowing your lender to foreclose on your property.

While some homeowners would rather pay property taxes themselves, rolling your tax payment into your mortgage payment allows you to avoid shelling out large amounts of money to tax collectors once or twice a year. Some lenders might even offer to lower your interest rate when you choose to pay your property taxes through an escrow account. Besides, youll probably only be able to pay your own property taxes if your loan-to-value ratio is low .

Also Check: Does Rocket Mortgage Service Their Own Loans

Calculate The Balance Remaining On Any Mortgage

This mortgage balance calculator will figure the remaining balance of yourshow instructions

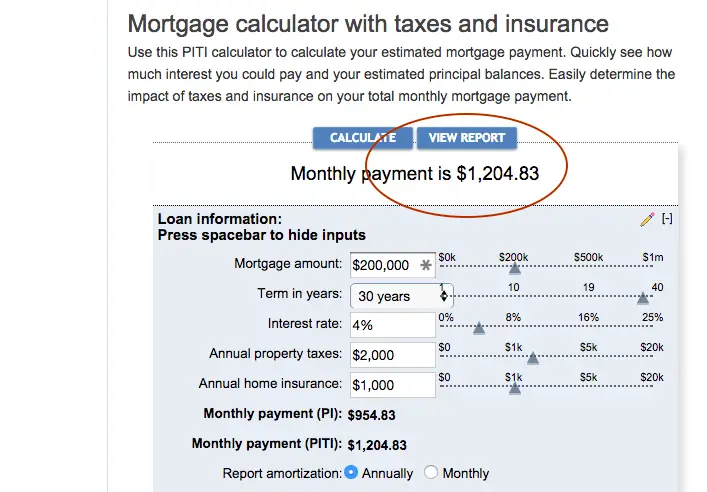

To use this calculator just enter the original mortgage principal, annual interest rate, term years, and the monthly payment. Then choose one of the three options for calculating the number of mortgage payments made to determine the remaining balance.

Note: this mortgage balance calculator is only for fixed rate mortgages where the terms are constant. Dont use for any mortgage where the terms will vary over time .

Dont Miss: Can You Get A Mortgage With Less Than 20 Down

Costs To Expect When Buying A Home In Nevada

One of the first times youll open your wallet during the home-buying process is when you pay your home inspector. When you make an offer on a house, you usually have a time period to complete any home inspections youd like before continuing with the contract. Its your chance to get an inside look at the condition of the home.

Most Nevada home inspections cost between $250 and $500. The pricing is generally based on square footage and number of outbuildings. A regular home inspection covers most structural and easily observable components, such as roofs, basements, plumbing and electrical, but doesnt include specialty tests. If youd like a mold, radon or water quality test, you can generally add those inspections on for an additional cost.

After the home inspection, youll usually move forward with the offer and your mortgage lender. Prepare to open your wallet again. This time, youll be paying a number of fees to various entities. These charges are collectively known as closing costs. Nevada closing costs generally range from 1.68% to 3.75% of a home’s value.

Don’t Miss: Chase Recast Mortgage

Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

Today’s Mortgage Rates In Nevada

| Product |

|---|

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Total Monthly Payment

Based on a $350,000 mortgage

Based on a $350,000 mortgage

| Remaining Mortgage Balance |

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Read Also: Reverse Mortgage On Condo

It Is Not Uncommon For Monthly Mortgage Payments To Change During The Term Of The Loan This Can Happen For Two Main Reasons:

- There are changes in your property tax, tax assessment, insurance premium or association fees

- You have an adjustable-rate mortgage and the rate changes

When you take out a mortgage, you can choose a fixed-rate or an adjustable-rate mortgage. On a fixed-rate mortgage, the principal and interest will remain the same. On an adjustable-rate mortgage, the interest rate can change periodically.

Whether the loan is on a fixed-rate or an adjustable-rate mortgage, the mortgage payment can change due to changes in property taxes and insurance premiums. The taxes and insurance portion of your mortgage payment is held in an escrow account until the bills are due at which time they are paid on your behalf. Each year, the loan servicer will perform an escrow analysis and will provide a written notification of changes to the amount of the mortgage payment.

To Accurately Determine If You Can Afford That Dream House Take The Following Upfront Costs Into Consideration:

- Origination fees for a new loan application, which can cost around one percent of the sale price.

- Points or lender credits, which work the same way but in reverse. Points lower your interest rate in exchange for paying an upfront fee. Lender credits lower your closing costs but come with a higher interest rate.

- Closing escrow fee paid to the title or escrow company to oversee the closing.

- Appraisal fee paid to the appraisal company to confirm a homes fair market value.

- Recording fees charged to record the change of ownership with the city or county.

- Attorney fees paid at closing to the attorneys who oversee the legal process.

You May Like: Rocket Mortgage Conventional Loan

When To Use A Mortgage Calculator

Buying a house will probably be the most important investment youll make. Use a house payment calculator as a research tool before house hunting. It will help you set your price range and determine how much house you can afford based on your monthly income.

Some mortgage calculators will even tell you how much income you need to earn to qualify for a home loan.

These figures will help you decide if you can afford your target home price. Knowing how much of your monthly household budget you can realistically spend on your dream house is a smart and responsible start toward your financial goals.

Have More Questions About Your Property Taxes

Trying to understand how much you owe in property tax can be tricky, especially since the numbers are different in every county. The good news is you dont have to figure it out on your own!

Our friends at Churchill Mortgage can give you a clear picture of how property taxes affect your monthly mortgage payments. Not only that, but they can also help you get a mortgage that will put you on the path to debt-free homeownership.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

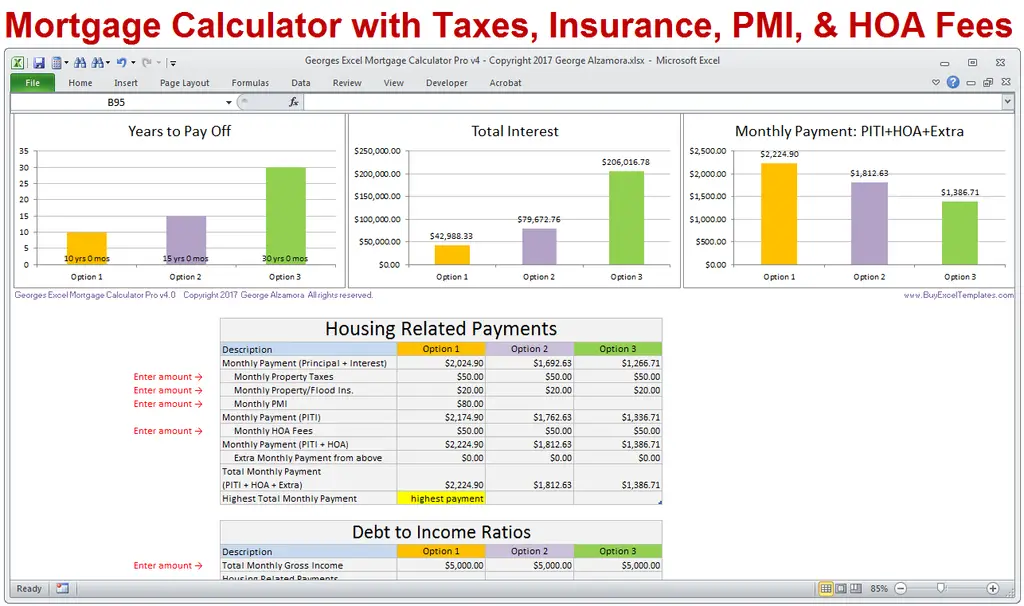

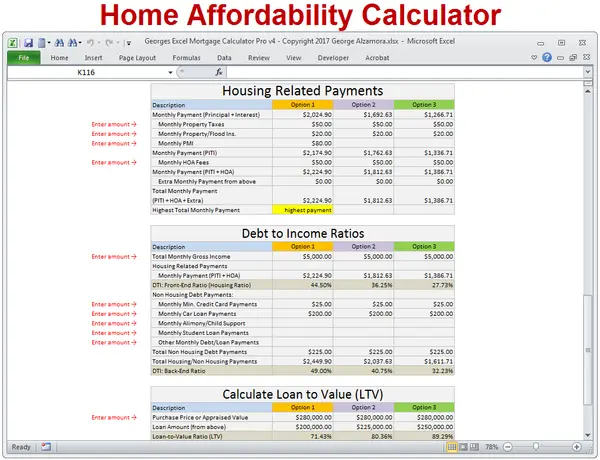

Find Out Whether You Need Private Mortgage Insurance

Private mortgage insurance is required if you put down less than 20% of the purchase price when you get a conventional mortgage, or what you probably think of as a “regular mortgage.” Most commonly, your PMI premium will be added to your monthly mortgage payments by the lender.

The exact cost will be detailed in your loan estimate, but PMI typically costs between 0.2% and 2% of your mortgage principal.

Oftentimes, PMI can be waived once the homeowner reaches 20% equity in the home.

Understanding A Usda Loan

This is exactly a fantastic concern. The last thing a lot of people imagine when they listen USDA was a mortgage choice with no deposit. Usually, visitors consider steakUSDA Prime, USDA solution, etc. luckily, the variety on the U.S. office of farming provides both.

Now, USDA debts arent for all. There is certainly small factor to obtain all excited and gung-ho over a home loan that you may well not be qualified. But should you see their unique criteria, thrills are warranted. USDA debts require no advance payment, usually bring most aggressive rates, has decreased upfront and yearly financial insurance premiums than FHA loans, and well state it again no down-payment.

MENTION: Any time you or your partner qualify for veterans value, VA financing in addition do not require a deposit and may become a better choice. Test the VA mortgage calculator evaluate payments.

Furthermore, if youve receive your dream house nonetheless it comes outside an eligible room or your revenue try above allowable USDA limits, although your installment is higher, an FHA financing might cut your day.

USDA financing are not any down-payment mortgage loans guaranteed from the U.S. Department of Agriculture . For homeowners in eligible places just who meet up with the income demands, these include a delightful alternative.

You May Like: Recasting Mortgage Chase

How To Use The Mortgage Repayment Calculator For Overpayments

Simply enter your details into the overpayment mortgage calculator.

We work out how much interest your mortgage deal is likely to charge over the remaining term if you dont make any overpayments. We then compare this with the interest you could pay if you make the overpayments entered. Using this information, we can then show you how much you would save in interest by making those overpayments.

We also calculate how long it would take to pay off your mortgage if you overpay. Comparing this to your remaining mortgage term lets us show you how much sooner you could pay off your mortgage balance.If you dream of achieving an early mortgage payoff, this calculator could help you get on the right track.

Are Property Taxes Included In Mortgage Payments

Paying property taxes is inevitable for homeowners. The amount each homeowner pays per year varies depending on local tax rates and a propertys assessed value . If youre unsure of how and when you must pay real estate taxes, know that you might be paying them along with your monthly mortgage payments.

Check out our property tax calculator.

Read Also: 10 Year Treasury Vs Mortgage Rates

Mortgage Calculatoran Excellent Budgetary Tool

An accurate evaluation of your monthly mortgage payment structure is a key step when weighing your budgetary needs. A mortgage calculator helps you determine the monthly mortgage payments subject to the home price. Now, bearing in mind mortgage interest rates vary based on prevailing circumstances, this tool supports you when youre looking to compare several loan options.

What Affects The Amount Of Your Mortgage Payment

Four things have a big impact on the amount you might pay for a mortgage. The purchase price of the home. The size of the down payment, which affects the amount of money you need to borrow to buy the home. The interest rate the lender charges to loan you money. And the term of the mortgage or the number of years you have to pay the loan back.

When your mortgage has a longer term, your monthly mortgage payments can be lower because you are paying the money back over a longer period of time. You typically pay more money in interest when you have a mortgage with a longer term compared to a shorter term.

Our mortgage payment calculator considers purchase price, down payment, interest rate, and term when it estimates your monthly payment. Youll see these fields in the Basic section of the calculator. Change the numbers in these fields and see how the estimate of your mortgage payment changes too!

Read Also: Are Discount Points Worth It

Details Of Nevada Housing Market

Nevada, known not only for Las Vegas, but also for its gold and silver mines, ranks 33rd for population with 3.08 million residents, according to estimates by the Census Bureau. The Silver States population is also growing, as its 2019 growth rate is 1.71%, according to World Population Review. While Nevada is growing, its land-to-resident ratio is still rather low at an average of 29 residents per square mile, according to Statista. Compare that to a state such as New York, which boasts about 410 people per square mile.

Despite its size, Nevada still has a number of urban areas. Nevadas largest cities include Las Vegas, Henderson , Reno, the unincorporated town of Paradise, which is another Las Vegas suburb and the city of North Las Vegas. Carson City, 431 miles northwest of Las Vegas, is the state capital, yet it only has 55,414 residents. Close to 80% of Nevadas population resides in the 10 most populous cities, with very few residents living outside of urban areas.

The Silver State has the largest amount of land owned by the Bureau of Land Management. In fact, 63% of Nevadas land is owned by the federal government. Much of the state is an arid desert, which also contributes to why land ownership has stayed heavily with the government, rather than been passed down to farmers, which is the usual progression.

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Don’t Miss: Reverse Mortgage Manufactured Home

Other Expenses That Could Impact Your Monthly Payment

In addition to the principal and interest, there are other upfront and monthly costs to consider as part of the homebuying process:

- Down payment: Depending on your home loan type, a typical down payment is usually 20% — though some types of loans will let you put down less — and even, in some cases, nothing.

- Closing costs: When you close on your new home, your closing cost may range from 3% to 6% of the total mortgage amount. These costs include:

- Origination fees. These costs are charged by the lender for “originating,” or creating your loan. Other costs in this category include application fees, underwriting fees, processing fees and administrative fees.

- Points. If you decide to pay for points, you’ll pay more upfront in exchange for a lower monthly payment. One point equals 1% of the loan amount.

- Taxes and government fees. These are charged by your local government.

- Prepaid expenses and deposits. You’ll typically be required to make an upfront deposit into an escrow for your property taxes and homeowners insurance.

What To Do Next

- Get preapproved by a mortgage lender. If youre shopping for a home, this is a must.

- Apply for a mortgage. After a lender has vetted your employment, income, credit and finances, youll have a better idea how much you can borrow. Youll also have a clearer idea of how much money youll need to bring to the closing table.

| Loan Type |

|---|

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home