Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5/1 ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

Things That Could Change Your Home Affordability Calculator Results

-

Your credit score

Your measures your current and past history of managing credit. A credit score above 740 usually helps you snag the lowest rate and monthly payment, which means you can potentially afford a more expensive home.

-

Your monthly income

Lenders look for a stable monthly income, which means a salary or hourly wage will give you a home affordability number you can count on. If youre self-employed or receive variable commission income, youll need to average out your income based on your tax returns for the past two years.

-

Your total monthly debt

Lenders take a look at how much debt you have now, and how much youll have with your new mortgage payment. They take both of these sums and divide them by your gross monthly income to determine two types of DTI ratios:

- Your front-end DTI ratio. This figure divides your new house payment by your income, and most lenders prefer that it doesnt exceed 28%.

- Your back-end DTI ratio. Lenders add all your debt to your new house payment and then divide it by your income, and most prefer a DTI ratio of about 43%.

Your loan term

Youll be able to afford a bigger home with a longer repayment term, such as 30 years. However, a shorter term can save you thousands in interest charges, if the higher payment doesnt strain your monthly budget.

Td Bank Mortgage Affordability

Before you get a mortgage from TD Bank, it is important to know how TD calculates your mortgage affordability. TD takes into account the following factors:

- The location of your future home

- Whether your future home is a detached home or condo

- Your household income

- Your down payment

- Your monthly bills and expenses including groceries, transportation, shopping, and insurance.

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

Your location and property type are used to provide estimates for your potential property taxes, utilities, and condo fees.

TD calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 39% and a maximum total debt service ratio of 44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to TD, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

You May Like: Does Bank Of America Do Mortgage Loans

Which Type Of Home Loan Is Best

There are multiple loan options for home owners. Probably the most popular is the conventional loan, which can offer attractive rates, flexible loan terms and multiple down payment options. There are two loan types that you may sound fimiliar, they are adjustable rate mortgages and fixed rate mortgages. Deciding which loan type is best depends on your circumstances and there are lots of articles online that discuss the pros and cons of fixed and adjustable rate loans.

How Much Can I Borrow If Im Self

This will vary between lenders. When using our calculator, aim to get as close to what you think your monthly salary would be.

Some lenders will expect to see at least three years worth of accounts. If youve got an accountant, then your accountant should be able to provide you with the necessary paperwork. If not, youll need to provide a solid record of your accounts yourself.

If youre self-employed, it could be helpful to use a mortgage broker. A broker will be familiar with what evidence lenders need in terms of business accounts, tax returns and the number of tax years youll need documentation for.

Brokers are also likely to have insights into what kind of calculations mortgage providers make, when considering the maximum mortgage theyll lend, and who is more willing to lend to self-employed people. Some lenders calculate the amount you can borrow based on several years income. Others base it on your previous year of trading.

Get more information about mortgages and the self-employed.

Also Check: How Much Mortgage Do You Pay A Month

How Much Mortgage Can You Afford

There are many rules of thumb for mortgage affordability. A mortgage lender might determine a home loan is affordable if your debt-to-income ratio is 43% or lower. Others set the maximum DTI at 36% or 50%. But affordability is a personal decision. How much are you comfortable spending on a mortgage? Lenders dont consider your goals, family plans or lifestyle when evaluating your loan application.

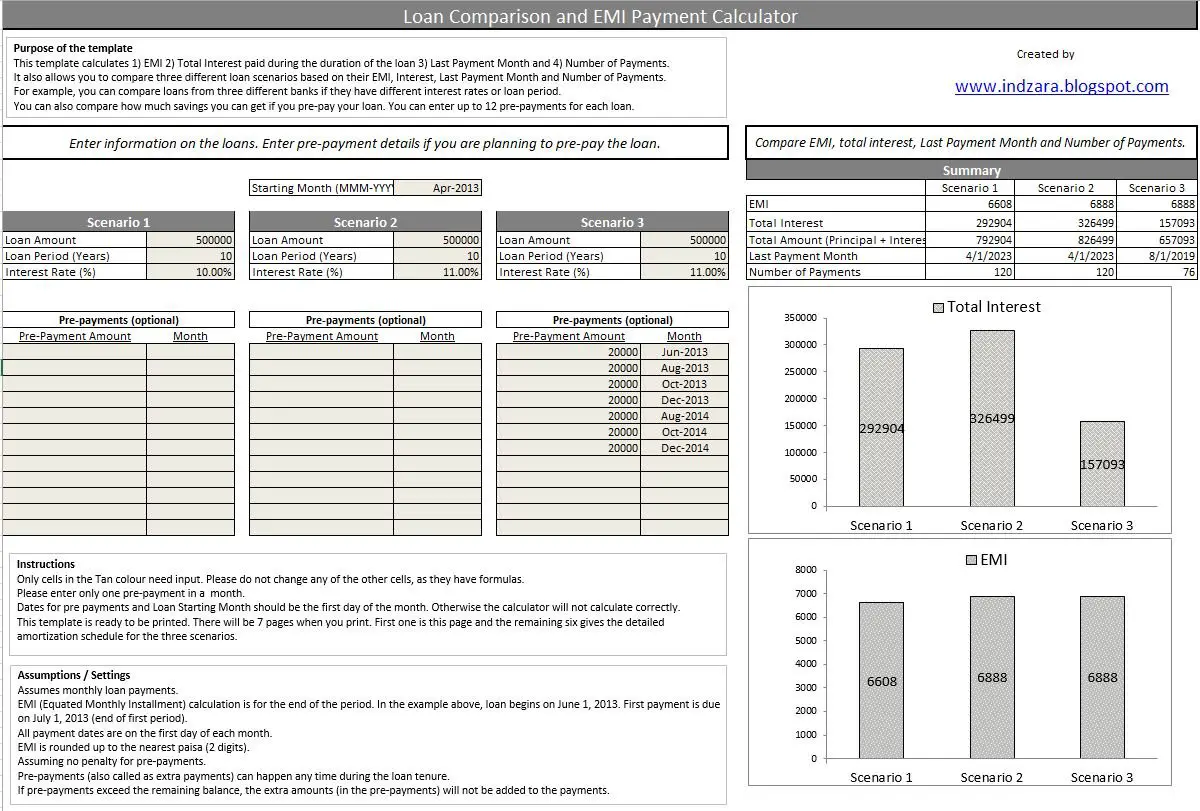

How To Use This Calculator

The Experian Mortgage calculator can help you understand how differences in rates and repayment terms affect the amount of your monthly payment and the total cost of a home over time. It requires just a few pieces of information to get started. If you add a few more details using the calculators optional Advanced Options, you can get an even clearer idea of what your monthly mortgage payment might look like for different loans.

Read Also: Are Mortgage Discount Points Worth It

Mortgage Legal Issues In California

One benefit of buying a property in California is its buyers protections. The state was at the forefront of abandoning the caveat emptor rule, also known as buyer beware, in real estate transactions. This means that sellers are required to disclose any issues or defects with the property on an extensive transfer disclosure statement that both the seller and real estate broker are required to sign. California, unlike many other states, has these rules backed by law. Its not an optional disclosure, its mandatory.

The state also runs the Department of Consumer Affairs Bureau of Real Estate. This entity was created to protect public interest and increase consumer awareness in real estate transactions. You can visit its website to read information on the homebuying process, loan modification or foreclosure prevention, verify a real estate license, find answers to frequently asked questions and find who to call for complaints.

When a judicial foreclosure occurs , the process is much slower as the court is involved. The benefit to this process is that the homeowner has the right of redemption. This right allows the homeowner to buy the property back up to one year after the auction. However, with a judicial foreclosure, a lender can get a deficiency judgement which allows the lender to pursue the full mortgage amount from the borrower.

Have A Question About Our Mortgage Calculators

What is a mortgage calculator?

Its a tool that gives you an estimate of how much you could borrow from us or what your monthly repayments and other costs might be, for a mortgage in the UK.

We have different calculators that can help you in different ways each calculator does something slightly different.

Who is a mortgage calculator for?

Its for you if youre a first time buyer, youre looking to remortgage, move or buy an additional home, or youre a buy-to-let landlord.

What information do I need to use a calculator and how do you decide what I can afford?

When you apply for a mortgage or use our calculator, well ask you for information like

- How many people are applying

- Your income

- How much you regularly spend on things like your credit or store cards, loans, overdrafts, maintenance and pension

- Why youre applying for example, buying your first home, moving home, or buying a second home

We wont ask about groceries, utility bills or travel.

How much can I afford to borrow?

Our calculators give you a idea of what you might be able to borrow from us to buy a home, and what your monthly and total mortgage payments could be, for different types of mortgages.

Which mortgage calculator is right for me?

The most popular place to start is our borrowing calculator or our affordability calculator.

Read Also: What Is Tip In Mortgage

How Much Mortgage Can You Afford In 2021

Before shopping for a new home, use this Canadian mortgage affordability calculator to determine your maximum purchase price. Comprehensive and accurate, this affordability calculator takes into account the latest and most up-to-date Canadian mortgage rules. No need to worry about that! Any changes you make gives your results in real-time! No waiting!

Local Economic Factors In Texas

Its no mystery what industry Texas dominates. With well over $100 billion generated each year by oil and gas extraction, Texas is the nations leading energy producer. In addition to growing industry jobs, Texas also increased its total population by 2.7 million from 2010 to 2016. In comparison, the largest U.S. state, California, only increased by 2 million residents in the same time period. Texas December 2020 unemployment rate was 7.2%, according to the Bureau of Labor Statistics, compare this to a national average of 6.7% during that time.

Texas economy remains robust thanks to some of the largest public and private companies calling Texas home. On top of industry giants such as ExxonMobil, Valero and Phillips 66, Texas is also host to AT& T’s headquarters as well as Sysco, Halliburton and American Airlines.

Don’t Miss: What Documents Do I Need To Get A Mortgage

Re: Accurate Mortgage Calculator

I have not seen the calculator on this site. The one I use only gives me the P& I payment. I prefer that because I am looking at properties both inside and outside the city limit along with short sales. The calculators can’t take into consideration the tax variables. I find it easiest to use the calcs for P& I and then look the properties tax value up on the county govts website. This way I have the most accurate payment. Insurance I just estimate based on my experience. You could always call your local agent to get an estimate on how insurance runs in your area.

Here is the calc used here:

How Much House Can I Afford

Asking yourself this question involves thinking about more than just what you can pay each month based on your income.

If youre not careful in your planning, you could easily find yourself in a situation where your monthly payments eat up most of your income. When youre house poor, its a lot harder to make progress toward your other financial goals or afford your homes upkeep.

Heres what we recommend.

Before you start looking at real estate listings, sit down and make a detailed monthly budget to identify a reasonable number for your total housing-related costs. Remember to include any other savings goals, such as retirement or your kids education. Many people recommend keeping housing expenses to 30% or less of your income.

Next, figure out how much home maintenance and repairs might cost you. These costs wont be included in your monthly payment, but its a good idea to set a certain amount aside each month in a high-yield savings account. That way, youll be able to afford repairs and even upgrades when theyre needed. One common recommendationthe 1% ruleadvises setting aside 1% of the homes value for annual maintenance and repairs. For a $300,000 home, thats $3,000, or $250 per month.

Finally, deduct the monthly maintenance amount from the amount you budgeted for housing costs. The amount left over is what you can reasonably afford to pay as a monthly mortgage payment.

Don’t Miss: How Much Would A 70000 Mortgage Cost

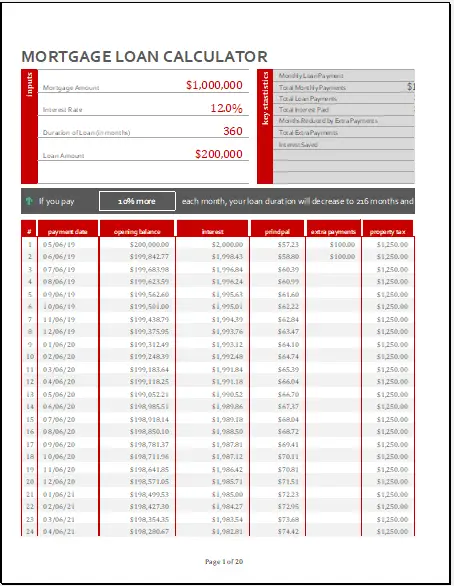

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price, then select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youll need for closing costs. You can also use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up, and show what your outstanding balance will be over time.

If youre buying a new home, its a good idea to use the calculator to determine what you can afford before you start looking at real estate listings. If youre renewing or refinancing and know the total amount of the mortgage, use the Renewal or Refinance tab to estimate mortgage payments without accounting for a down payment.

About The Mortgage Affordability Calculator

Every homebuyer has a different financial situation. Some have large capitals, while others have tighter budgets. By using our Mortgage Affordability Calculator, you can determine how much money you can borrow for your mortgage, fitting your financial situation.

This calculator will help you understand how much youll be able to afford. The calculator considers your annual income, any outstanding debts, and monthly living expenses when calculating a tailor-made mortgage amount for you.

The calculator is a crucial tool in your quest for a mortgage, but a meeting with your dedicated mortgage professional will further help you in the process. Your broker can address all your needs, providing you with an affordable mortgage and the best rates.

You May Like: Is 3.99 A Good Mortgage Rate

Why Use A Mortgage Calculator

Using a mortgage payment calculator helps you establish a budget before buying a home. Budgeting helps you head off problems and keeps you from getting in over your head financially. If your home purchase will increase your housing costs, for instance, you need to determine where youll find the extra money. What expense can you cut to make your home purchase affordable?

A mortgage payment calculator reveals the different components of a prospective mortgage payment. Those include more than just principal and interest. Youll be paying property taxes and homeowners insurance, and possibly other costs like private mortgage insurance premiums, homeowners association dues and flood insurance charges.

However, a simple mortgage calculator does not incorporate all homeownership costs. Maintenance and repairs often surprise first-time buyers. You can estimate potential expenses with one of two formulas: either 1% of the home price per year, or $1 per year for every square foot of space. To make costs more predictable, consider purchasing a home warranty. Additional hidden costs might include higher utility charges, lawn and yard services, higher cleaning costs and new furniture.

What Calculators Omit

Calculators often leave out important costs and provide inaccurate estimates of others, according to critics.

“Taxes, insurance, homeowner association dues or condo management fees, utilities and general maintenance are variables not accounted for in traditional mortgage calculators,” said Sonu Mittal, head of home mortgage lending for Citizens Bank in Providence, Rhode Island.

Property taxes are often the biggest omission. Many online calculators have only three input fields mortgage amount, interest rate and number of years. The resulting payment includes only principal and interest.

Yet monthly payments usually include a sizable contribution to an escrow fund for annual property taxes. Property taxes vary significantly depending on local tax rates, but can amount to thousands of dollars a year, adding hundreds a month to the mortgage payment.

Insurance is another important item often skipped. The costs of a homeowners’ insurance policy is usually also collected monthly into an escrow fund from which the annual premium is paid once a year.

Until you actually have a property, it’s difficult to get down into all the costs.Mark Burrageexecutive director of mortgage digital experience for USAA

“Not only property and casualty insurance but, depending where you live, it may require hurricane or flood insurance,” Harkson said. All told, insurance premiums may add hundreds of dollars a month to a monthly payment.

Also Check: What’s An Average Mortgage Interest Rate

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Details Of Texas Housing Market

Texas is the largest state by size in the contiguous U.S., taking up roughly 261,800 square miles. Its the second-largest state by population with an estimated 28.9 million residents.

Most of Texas population resides in Houston, San Antonio, Dallas, Austin and Fort Worth, which are the five largest cities in the state. Overall, Texas has three of the 10 largest cities in the U.S. by population. Texas also has one of the healthiest housing markets according to SmartAssets Healthiest Housing Markets study. The study was based on stability, affordability, fluidity and risk of loss. Texas number one spot is good news for potential homeowners, as it shows that its one of the best states to buy a home in. The overall median home value in the state is $200,400, according to the Census Bureau.

If youre hoping to live in Houston, youll likely have to have a bigger budget, as the median home value in Austin is $312,300, based on Census data. Austin has had one of the highest home value increases in the past few years, thanks to a number of tech companies moving to the capital city. Thinking about San Antonio? Median home values are lower there, at about $136,800 for a home in the seventh-largest city in the U.S.

Recommended Reading: Who Is Rocket Mortgage Owned By