How Much House Can I Afford

One of the key metrics lenders look at to determine how much house you can afford is your debt-to-income ratio the percentage of your gross monthly income that goes toward paying your monthly debt payments. A low DTI demonstrates that you have a good balance between debt and income, while a high DTI signals that your debt may be too high for your income.

In general, 43% is the highest DTI you can have and still qualify for a mortgage. Most lenders, however, prefer DTIs that are no higher than 36%, with housing expenses representing no more than 28% of that debt .

Another factor that determines how much house you can afford is the amount of money you have available to make a down payment and cover closing costs. Though a larger down payment might mean a bigger mortgage , make sure you’ll have money left over to furnish the home and live in it.

Of course, just because a lender approves you for a loan doesn’t mean you have to borrow the entire amount. A smaller loan payment provides some wiggle room each month, which might come in handy in an emergency or if something unexpected comes up . A lower payment also makes it easier to save for other goals and work on your retirement nest egg.

What Percentage Of Your Income Can You Afford For Mortgage Payments

Modified date: May. 31, 2021

These questions often come up among first-time home buyers:

- What percentage of my monthly income can I afford to spend on my mortgage payment?

- Does that percentage include property taxes, private mortgage insurance , or homeowners insurance?

Today we tackle these questions to help make your home buying experience a little easier.

Whats Ahead:

How Much Can I Afford To Spend On My Mortgage

A mortgage payment can take a major bite out of your paycheck. To decide how much mortgage you can afford, you must look beyond the total income you and your partner earn each month. Most mortgage lenders will decide how much mortgage you can afford based on a percentage of your income, so you should start there as well.

TL DR

A good rule of thumb when considering how much of your income should go toward your mortgage is 28 percent of your gross income.

Read Also: What’s The Average Mortgage Payment

What Factors Help Determine ‘how Much House Can I Afford’

Key factors in calculating affordability are 1) your monthly income 2) cash reserves to cover your down payment and closing costs 3) your monthly expenses 4) your credit profile.

- Income Money that you receive on a regular basis, such as your salary or income from investments. Your income helps establish a baseline for what you can afford to pay every month.

- Cash reserves This is the amount of money you have available to make a down payment and coverclosing costs. You can use your savings, investments or other sources.

- Debt and expenses Monthly obligations you may have, such as credit cards, car payments, student loans, groceries, utilities, insurance, etc.

- Your credit score and the amount of debt you owe influence a lenders view of you as a borrower. Those factors will help determine how much money you can borrow and themortgage interest rateyoull earn.

More:

For more information about home affordability, read about thetotal costs to consider when buying a home.

What Half Your Income Means

Determine exactly what half of your monthly income means. Mortgage lenders use your gross monthly income, the amount before taxes or any other deductions, to make their calculations. If you have a two-year history of receiving bonuses or commissions, lenders will consider this as income when approving your loan. If you are thinking of using half of your net income to pay a mortgage, which is your income after taxes and other deductions, your payments are more likely to be manageable.

Also Check: How To Get Out Of Mortgage Insurance

Realize That Other Expenses May Come Up

Even if your mortgage doesn’t stretch your budget, an unexpected job loss or other event could cause you to struggle to make your mortgage payments. The more affordable a home is in the first place, the better chance youll have of recovering.

Building up an emergency fund is easier if you limit your mortgage payment to 25 percent of your take-home pay. The more cash you have on hand, and the lower your monthly obligations, the better chance youll have of staying afloat if difficult times strike.

The Traditional Model: 35%/45% Of Pretax Income

In an article on how the mortgage crash of the late 2000s changed the rules for first-time home buyers, the New York Times reported:

If youre determined to be truly conservative, dont spend more than about 35% of your pretax income on mortgage, property tax, and home insurance payments. Bank of America, which adheres to the guidelines that Fannie Mae and Freddie Mac set, will let your total debt hit 45% of your pretax income, but no more.

Lets remember that even in the post-crisis lending world, mortgage lenders want to approve creditworthy borrowers for the largest mortgage possible. I wouldnt call 35% of your pretax income on mortgage, property tax, and home insurance payments conservative. Id call it average.

Don’t Miss: How To Get A Second Mortgage To Buy Another House

What Percentage Of Your Income Should Your Mortgage Be

Calculating the percentage of income for your mortgage payments will help you understand exactly how much you can afford to spend. Buying real estate via a mortgage is the largest personal investment that most people make in their lifetime.

For this reason, working out how much you can comfortably borrow depends on several factors. Its not just a question of how much the bank is willing to lend you. Factors such as the mortgage percent of your net income , finances, priorities, and preferences are all part of the equation.

As a general rule, most prospective homeowners can finance a property that costs anywhere between two and two-and-a-half times their gross annual income . Now, lets imagine that you earn $100,000 per year. This would mean that you can afford a mortgage between $200,000 and $250,000. However, this calculation is only a general guideline.

Ultimately, when you consider buying a property, there are several essential factors to consider. Primarily, you need to have a good idea of the amount your lender thinks you can afford . Next, it helps to take a personal inventory and think about the type of home where you would like to live. If you plan to live in your new home for many years, what sort of things will you be willing to trade-offor notto afford your dream home?

How To Get A Lower Monthly Mortgage Payment

If youve got more debt, you might need to take on a lower monthly payment to keep your DTI ratio at 43%. Thankfully, there are a few strategies you can use to lower your monthly payment.

Although there are many tips and tricks to lowering your monthly mortgage payment, the top three are highly recommended and also effective: improving your credit score, taking a longer mortgage term and saving up for a 20% down payment.

Also Check: How Much Second Mortgage Can I Afford

Examples Of Mortgage Payment Percentage

Now, lets look at some examples of mortgage payment percentages so you can work out how much you can afford to borrow from a lender and what percentage of income you need for your mortgage.

What value of property can you afford on a $60,000 a year income?

As mentioned above, the rule of thumb is that you can typically afford a mortgage two to 2.5 times your yearly wage. Thats a mortgage between $120,000 and $150,000 at $60,000 per annum. However, youll have to be able to afford the monthly mortgage payments.

What are the payments on a $200,000 mortgage?

Lets imagine a $200,000, 30-year mortgage with a 4% interest rate. This would set you back about $954 per month.

What are the monthly payments on a $300,000 mortgage?

With a 4% fixed interest rate, monthly mortgage payments on a 30-year mortgage would total around $1,432.25 a month. However, if you opt for a 15-year plan, it could cost up to $2,219.06 a month.

Home Affordability Begins With Your Mortgage Rate

You will probably notice that any home affordability calculation includes an estimate of the mortgage interest rate you will be charged. Lenders will determine if you qualify for a loan based on four major factors:

If lenders determine you are mortgage-worthy, they will then price your loan. That means determining the interest rate you will be charged. Youryoull get.

Naturally, the lower your interest rate, the lower your monthly payment will be.

You May Like: When You Sign A Mortgage You Are

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property that costs between two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

How Does Your Down Payment Affect Mortgage Affordability

Your down payment plays a big role in your mortgage’s affordability. The size of your down payment affects the amount of the monthly payment you’ll be making to cover the rest of the mortgage amount a bigger down payment decreases your monthly payment and vice versa. So, if you’re worried about your DTI affecting your mortgage eligibility, coming up with a larger down payment can help you qualify.

For example, if you’re buying a $250,000 home with a 4% interest rate over 30 years, a $20,000 down payment would give you a monthly principal-and-interest payment of $1,098. But if you put down $40,000, your monthly payment would drop to $1,003and you’d also save nearly $35,000 in interest over the life of your loan.

While a 20% down payment is a standard recommendation from mortgage experts, it’s not a requirement. In fact, many lenders allow down payments as low as 3% or 5% of the loan amount.

If you don’t have a lot of cash for a down payment and you’re a first-time homebuyer, there are several programs and grants that can provide you with down payment assistance or even loans with no down payment requirement.

Consider more than just your monthly payment as you decide how much money to put down. For example, if you drain your savings for a down payment, you could experience some difficulties if you have a financial emergency in the near future.

Recommended Reading: How Long Does It Take To Do A Reverse Mortgage

Your Credit Is Key When Buying A House

There are a lot of moving parts in the mortgage process, and lenders will review a lot of variables to determine whether you qualify for a mortgage and how much you can afford. Your credit score is one of the most important of these variables, so it’s crucial that you take time to improve it before you apply for a mortgage loan.

Start by checking your and to see where you stand and which areas you need to address. Then start taking the necessary steps to do so.

This may include getting caught up on past-due payments, paying down credit card debt, disputing inaccurate credit report information and more. Use your credit report as a guide to decide how to build your credit score.

The 30% Rule Is Outdated

The 30% rule has roots in 1969 public housing regulations, which capped public housing rent at 25% of a tenants annual income . Rather than looking at what consumers should be spending on housing, however, the government selected the percentages because thats what consumers were spending.

This is what one did on average in the past, and as such become absorbed into public policy, says Bieri, who has written several papers on the subject.

Bieri sees two problems with making 30% the de facto personal finance rule for renters: First, averages, by definition, do not take into account the huge variations of what individuals do. Second, the balance sheet and financial obligations of todays consumers are vastly different than those of the 1960s on whom this rule is based. Americans back then, for example, didnt contribute to 401 plans or have high student debt.

Read Also: Can You Refinance Mortgage Without A Job

Analyze Your Monthly Expenses

When estimating what you can afford, its also important to have a clear view of your monthly expenses. These can be hard to track and will likely vary based on the size of your household and your spending habits. According to the Bureau of Labor Statistics, the average individual has monthly expenditures that include:

- Food: $644

- Internet: $47

- Cell phone: $120

For an individual, these expenses add up to a monthly total of $2,463. Some of these items are discretionary and will fluctuate based on your lifestyle, city, the size of your home, and the size of your family. The goal is to estimate how much money youll need to spend each month after you pay your mortgage and other debts.

Look Closely At All Your Expenses

You’ve got to put food on the table, clothes on your back and gas in your car-and have a little fun now and then. You also need to be prepared for emergencies as well.

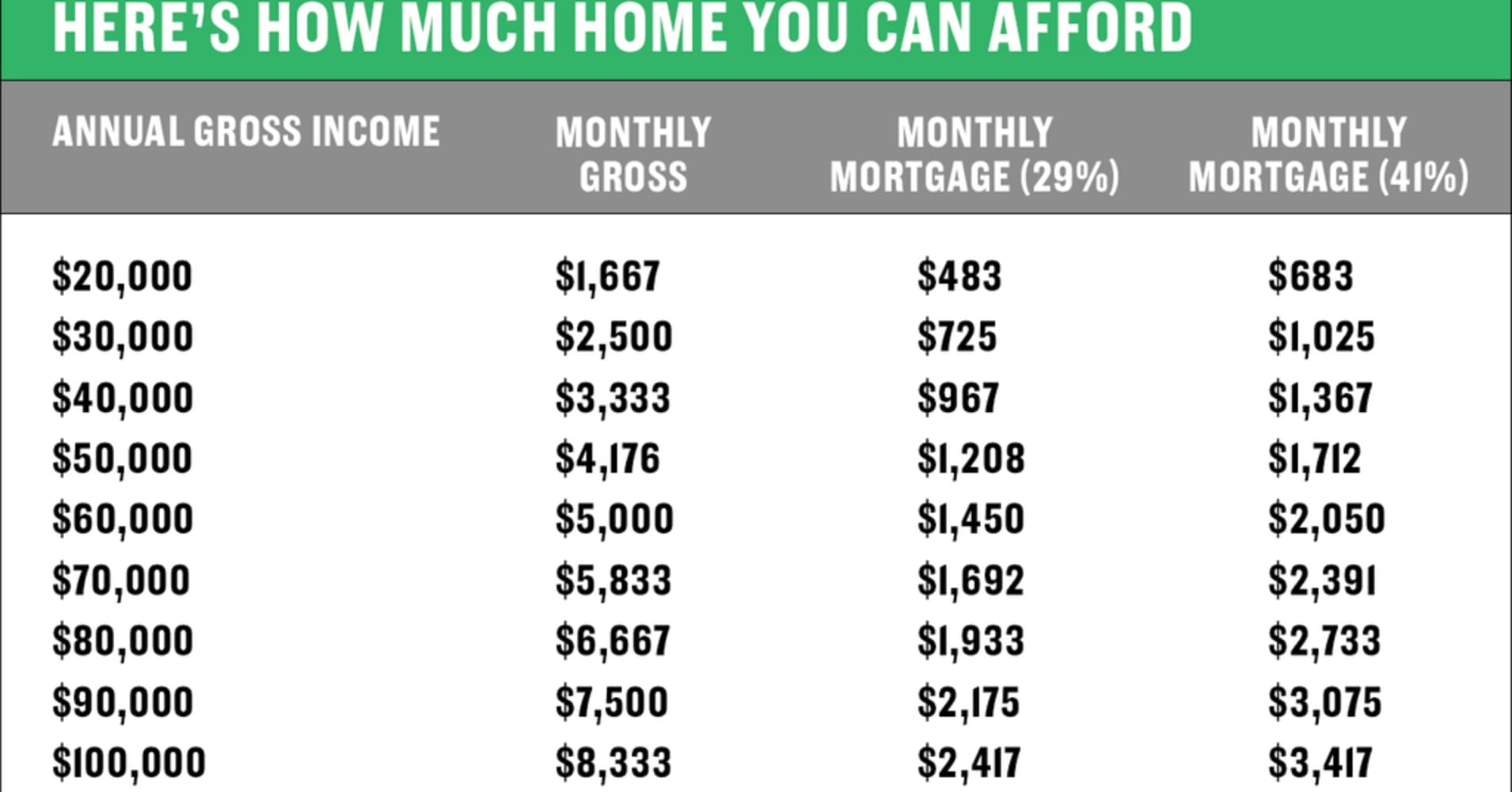

Your mortgage specialist will help you make sure you have money left over to pay for the necessities of life, as well as some of your lifestyle choices. The following calculations are used by most lenders as a guide to help determine the maximum you should spend on housing costs and overall debt levels:

If your monthly housing and housing-related costs don’t leave you enough money for your other expenses, then you have a few options.

You and your mortgage specialist may also need to factor in expenses or changes that you know are on the horizon. Maybe you’ll need to replace your car within the next year. Or if you’re expecting your first baby you may need to consider the impact of a maternity or paternity leave on your budget in addition to expenses related to having a baby.

Recommended Reading: How To Negotiate The Best Mortgage Rate

Home Affordability By Debttoincome Ratio

Your debttoincome ratio measures your total monthly debts including your mortgage payment against your monthly income. The higher your existing monthly debts, the less youll be able to spend on your mortgage to maintain a healthy DTI.

For example, say you make $50,000 a year and want to stay at a 36% DTI.

In that case, your total debts, including mortgage and any other debt payments cant exceed $1,500. Heres how that affects your home buying budget:

| Annual Income | How Much House You Can Afford |

| $50,000 | |

| $1,000 | $180,406 |

The examples above assume a 3.75% fixed interest rate and 3% down on a 30-year mortgage. Your own rate and monthly payment will vary.

How Much House Can I Afford On My Salary

Want a quick way to determine how much house you can afford on a $40,000 household income? $60,000? $100,000 or more? Use ourmortgage income calculatorto examine different scenarios.

By inputting a home price, the down payment you expect to make and an assumedmortgage rate, you can see how much monthly or annual income you would need and even how much a lender might qualify you for.

The calculator also answers the question from another angle, for example: What salary do I need to buy a $300,000 house?

Its just another way to get comfortable with the home buying power you may already have, or want to gain.

You May Like: How Much Interest Do I Pay On A Mortgage

This Number Gives Lenders A Snapshot Of Your Financial Situation

If youre applying for a mortgage, one of the key factors mortgage lenders will look at is your DTIor debt-to-income ratio.

That ratio, which shows the amount of your income that will go towards debt payments, gives lenders a snapshot of your entire financial situation. That helps them understand what you can comfortably afford in terms of a mortgage payment.

Save For A 20% Down Payment

You dont need to pay for private mortgage insurance when you put 20% down on your loan. PMI can add quite a bit of money to your monthly payment, so avoiding it can significantly reduce what you pay each month. You may also be able to avoid paying for mortgage insurance if you have a VA loan and pay the funding fee upfront.

Also Check: How Many Years Left On Mortgage