Home Seller And Buyer Laws

In Oklahoma, a husband and wife can hold real estate as:

- Joint tenants. When one owner dies, the other will automatically become the sole owner of the property.

- Tenants in common. Each spouse owns an interest in the property as if he or she is a sole owner. One spouses share of the property is not passed automatically to the other spouse when one dies.

- Community property. This form of ownership is only available to married couples who purchase a property during their marriage. Each spouse owns 50% of the property and can dispose of his or her interest in the property or will it to someone else.

- Escrow state. In some states, a lawyer is required to represent a buyer during the course of a home purchase, and that person may also prepare mortgage documents and assist with clearing title work. Oklahoma, however, is an escrow state, which means that an independent escrow officer can oversee closing details and the signing of a purchase agreement.

Manage Your Mortgage From Anywhere

Whether at home or on-the-go, it is easier than ever to manage your mortgage, make payments and get detailed account information right at your fingertips. You can also see details on how you can pay off your mortgage faster, your home’s estimated current value and access to unique educational content created by our mortgage experts.

What Is A Mortgage Rate

One of the most important factors in deciding which mortgage is best for you is to compare mortgage rates. A mortgage rate is the rate of interest charged on your mortgage.

For instance, if you take out a mortgage for $250,000, youll pay back not only the initial $250,000 you borrow but also the interest, which is determined by your individual interest rate.

A low mortgage rate can save you from paying tens of thousands in interest over the lifetime of your mortgage. You likely want to be able to secure the best rate possible so its a good idea to first understand how lenders determine your individual mortgage rate.

Read Also: Recasting Mortgage Chase

Mortgage Options In Oklahoma

Loan programs and rates can vary by state. To set yourself up for success and help you figure out how much you can afford, get pre-qualified by a licensed Oklahomalender before you start your home search. Also check Oklahoma rates daily before acquiring a loan to ensure youre getting the lowest possible rate.

If you already have a mortgage and are considering a refinance, get customized rates for your unique circumstances. The APRs on this page are for purchasing mortgages, which are typically similar to refinance rates. Though, refinance rates can be higher.

A lot of lenders will require an appraisal during the mortgage process to determine thefair market value of a property. This ensures youre not paying more for a home than its worth on a purchase transaction and verifies the amount of equity available on a refinance transaction. Home values are constantly changing depending on buyer demand and the local market. Typically, home values increase over time.Contact a Oklahoma lender to learn more about local requirements for mortgages.

Oklahoma Jumbo Loan Rates

Oklahoma county conforming loan limits are all $647,200, a nod to the affordability of buying real estate in the state. That means that if you need to take out a home loan that is bigger than $647,200, you will be taking on what is known as a jumbo loan. If you are weighing whether a jumbo loan is right for you, it is important to be aware that they are accompanied by higher interest rates as compared to standard or conforming loans . Note that jumbo loan rates in Oklahoma are currently about even with fixed rates.

The average 30-year fixed jumbo loan rate in Oklahoma is 3.25% .

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

Whats The Weokie Difference

At WEOKIE, we are a not-for-profit Oklahoma-based credit union, not a bank. That means that instead of focusing on earning a profit for shareholders, were dedicated to providing the best possible financial services for our members. It allows us to offer lower fees, better interest rates, and unparalleled service.

When you join the WEOKIE family, youre more than just a member, youre a part-owner of our Oklahoma credit union! That means youre eligible for low loan rates, exclusive discounts, financial education resources, and state-of-the-art online banking services.

Refinancing Your Mortgage In Oklahoma

Mortgage refinance rates are at all-time lows right now, so it could be a good idea to switch your current mortgage for one with a better interest rate especially if the new rate would be significantly lower.

You may decide to refinance with the same lender that gave you your initial mortgage, but it’s not always the best idea. A different lender may offer you a better deal the second time around. Shop around for a company that will offer the best interest rate and charge relatively low fees.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

What Our Customers Are Saying

“Great people to work with. Very helpful through the process.”“I would gladly refer anyone I know to Bank of Oklahoma for their mortgage needs. I was extremely pleased with the service provided. Thanks again to all for everything!”“We were first-time home buyers, with very little knowledge of the processes to close. Karen did an amazing job of being both patient with us and extremely responsive. I would recommend Karen to anyone looking for a loan!”

Fha Loan Limits For Oklahoma

FHA Loans are government insured mortgages from the Federal Housing Administration and are an attractive option for homebuyers with small down payments or who have less-than-stellar credit. An FHA-backed loan can also be attractive to homeowners who want to refinance.

FHA mortgages are backed by a self-insuring pool to limit risks for the lenders who make these low downpayment loans. Homebuyers or homeowners looking to refinance can borrow with as little as a 3.5% downpayment or equity stake.

Don’t Miss: Can You Refinance A Mortgage Without A Job

Mortgages To Fit Your Needs

- View More Mortgage TypesView Fewer Mortgage Types

- Conventional Home Loan If you are looking for a traditional home loan with options for a low down payment then our conventional home loans could be for you.Get Started

- FHA Loan First time homebuyer? Not-so-perfect credit? Large down payment not an option? An FHA Home Loan might be for you.Get Started

- Jumbo Home Loan If you’re looking to finance a larger real estate loan, the Jumbo Home Loan program offers flexible loans up to $3 million.Get Started

- The Lock and Build Program

If you’re looking to build your dream home from scratch, the Lock and Build Loan Program might be your best option.

- Military Home Loan If you’re active in or retired from the military, or if you’re the spouse of someone in the military, you may qualify for this loan program.Get Started

- Native American Home Loan

If you’re a member of a federally recognized Native American tribe, this might be the right loan program for you.

- USDA Rural Home Loan

If you live in a rural area and need financing assistance to purchase a home this government backed program may be right for you.

How To Get A Low Interest Rate On Your Mortgage

Here are some tips for landing a good interest rate on your mortgage:

- Save more for a down payment. With a conventional loan, you may be able to put down as little as 3%. But lenders reward a higher down payment with a better interest rate. Mortgage rates should stay low for a while, so you may have time to save a bigger down payment.

- Increase your credit score. Many lenders require a minimum credit score of 620 to receive a mortgage. But you can land a better interest rate with a higher score. The most important factor for boosting your score is to pay all your bills on time.

- Lower your debt-to-income ratio. Your DTI is the amount you pay toward debts each month, divided by your gross monthly income. Most lenders want to see a DTI of 36% or less for a conventional mortgage, but a lower DTI can result in a lower rate. To improve your DTI, pay down debts or consider opportunities to increase your income.

- Choose a federally backed mortgage. If you’re eligible, you might consider a USDA loan , a VA loan , or an FHA loan . These loans typically come with lower interest rates than conventional mortgages. As a bonus, you won’t need a down payment for USDA or VA loans.

Improving your financial situation and choosing the right type of mortgage for your needs can help you get the best interest rate possible.

Recommended Reading: Chase Mortgage Recast

Ohfa Homebuyer Down Payment Assistance

The Homebuyer Down Payment Assistance program helps first-time homebuyers in Oklahoma by offering 3.5 percent of the loan amount toward the down payment and closing costs. Through OHFA, homebuyers can obtain the down payment assistance and a 30-year, fixed-rate mortgage, which can be a:

- Conventional loan

- USDA loan

- VA loan

The down payment assistance is available only to first-time homebuyers in certain areas and all other buyers in other targeted locations.

The maximum purchase price varies, but can be as high as $453,100, depending on where the home is located and the type of loan. You must have a credit score of 640 or higher and be able to meet household income requirements.

There are also special mortgage interest rates and terms available for first-time buyers in occupations that serve the public good, including teachers, first responders and Oklahoma state employees.

OHFA 4TEACHERS You must have a current teaching certificate from the Oklahoma State Department of Education and a contract with any accredited public school or private school in the state to qualify.

OHFA SHIELD This program assists homebuyers who are working in jobs that serve the public welfare of Oklahoma citizens. For 2020, the purchase price limit is $294,600 and the home must be a primary residence. Down payment assistance of 3.5 percent of the mortgage amount is available.

Here are the eligibility requirements for each category of first responder:

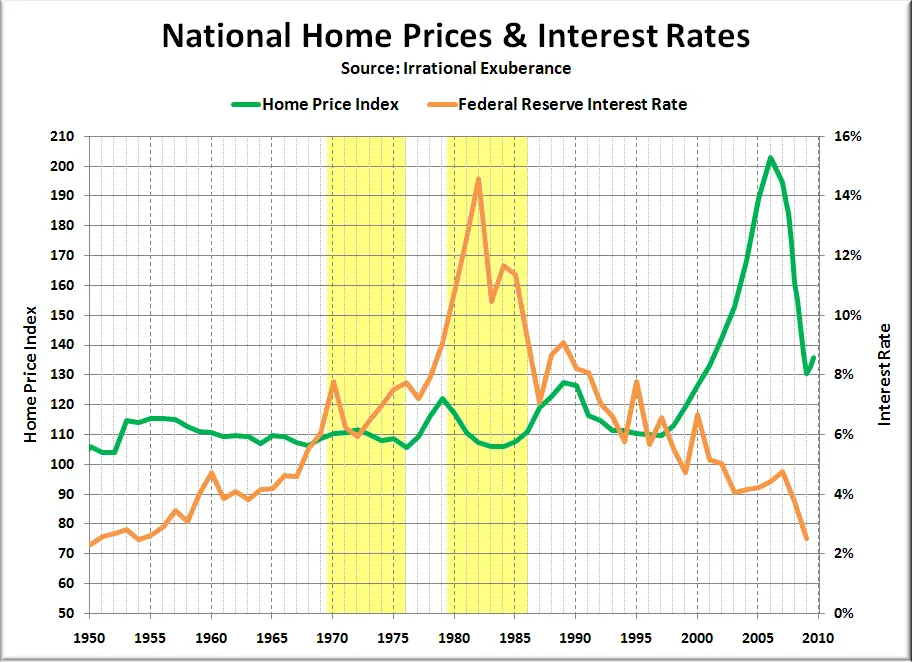

Historical Mortgage Rates In Oklahoma

Oklahoma Mortgage Rates Quick Facts

- Median Home Value: $147,000

- Loan Funding Rate: 53.89%

- Homeownership Rate: 71%

- Median Monthly Homeownership Costs: $1,234

Home to plains, mountains, forests and even lakes, Oklahoma is full of stunning vistas. Oklahomas capital, Oklahoma City, houses the National Cowboy & Western Heritage Museum, along with a vibrant dining and nightlife scene.

Homebuyers will find that Oklahoma mortgage rates are historically above the national average.

A financial advisor in Oklahoma can help you plan for the homebuying process. Financial advisors can also help with investing and financial plans, including tax, retirement and estate planning, to make sure you are preparing for the future.

Read Also: 10 Year Treasury Vs 30 Year Mortgage

Financing Your Dream Home

The mortgage process can be confusing and intimidating. Let us show you how the process works and get you on your way to the home of your dreams.

- Bank of Oklahoma® is a trademark of BOKF, NA. Member FDIC. Equal Housing Lender . & copy 2022 BOKF, NA. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Ohfa 4teachers / Ohfa Shield

The Oklahoma Housing Finance Agency offers two mortgage programs that can make owning a home more affordable. OHFA 4Teachers is available to borrowers who have a current Oklahoma State Department of Education teaching certificate and who are currently under contract with any accredited Oklahoma public, private or parochial school. Meanwhile, the OHFA Shield program is available to:

- Borrowers who are either currently employed as a firefighter with a fire department for an Oklahoma municipality or represent a volunteer department as a volunteer firefighter.

- Borrowers who are currently employed in law enforcement by an Oklahoma municipality or serve as volunteer law enforcement officers or reserve law enforcement officers.

- Borrowers who are currently employed either as emergency medical technicians or as paramedics for an emergency medical services provider.

Both OHFA programs offer qualified first-time buyers a quarter-percent reduction off the daily published interest rates. However, to qualify for either program, a property cant cost more than $276,100. Also, maximum income amounts apply per county and are based on family size. For government-backed loans, borrowers cant have a debt-to-income ratio that is greater than 45%, or 50% for conventional loans. They also need a credit score of 640 or more.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

Compare Mortgage Rates In Oklahoma

Historically, Oklahoma mortgage rates have been consistently above national average mortgage rates. Check the table below for a look at the most up-to-date mortgage and refinance rates in the state. All the rate information listed here is taken from Americas top lenders.

Todays Mortgage Rates In Oklahoma

All listed home mortgage and refinance rates may change without prior notice. Your actual rate may vary depending on your financial circumstances and other factors.

Use the calculator above this page for personalized Oklahoma mortgage rate estimates based on your financial information.

Get The Best Home Loans In Oklahoma With Weokie Federal Credit Union

Buying property should be one of the most exciting moments of your life. However, it can be a pretty complicated process. From applying for a loan to finding the right location, theres a lot to consider. Fortunately, the professionals at WEOKIE are here to help.

Whether youre looking for your first house or searching for a new house to keep up with an expanding family, WEOKIE Federal Credit Union can help you secure a loan and purchase the home of your dreams with a low monthly payment. At WEOKIE, we offer affordable, local financing with a range of fixed and variable mortgage rates to make your home buying experience stress-free. We even offer first-time homebuyer loans with lower initial rates than competitors, and monthly predictable payments so you can easily budget for your future. No matter what type of Oklahoma mortgage or home loan youre looking for, WEOKIE can help.

You May Like: Requirements For Mortgage Approval

Oklahoma Arm Loan Rates

An ARM, or adjustable-rate mortgage, is what its name implies. That is, it is a mortgage which has an interest rate that can adjust or change over the life of the loan. An adjustable-rate mortgage usually comes with a lower interest rate than a fixed-rate mortgage for an introductory period. That initial period lasts for one, three, five, seven or 10 years, depending on the loans terms. After that time frame, the interest rate is free to change, meaning it typically increases. It is not hard to see how a buyer might fall behind on payments with an ARM.

It is important to note however, that an ARMs terms will list an interest rate cap, meaning it will specify the highest possible level that the interest rate can reach. This protects you from having your interest rate jump to sky-high levels overnight. It is very important to assess the interest rate cap on an ARM to make sure that it is something you can afford to pay. While lower than usual, ARM rates are still higher than both jumbo loans rates and fixed rates.

The average rate for a 5/1 ARM in Oklahoma is 2.94% .

What Factors Impact Your Mortgage Rate

You can quickly search typical mortgage rates by lender, area or mortgage type but there are a set of factors beyond that set of data that goes into determining your mortgage rate. Knowing more about these factors can help you recalibrate your expectations or improve key areas before applying for a mortgage.

- In general, your mortgage rate will be determined by your credit history. Typically, the higher your credit score, the lower your rate, and vice versa. Its a good idea to know your score and work on improving your credit prior to applying for a mortgage.

- Loan-to-value ratio: Another major factor in determining your score is your loan-to-value ratio, or LTV. This term refers to the amount you borrow compared to the value of the home. For instance, lets say you buy a home worth $200,000 and put down $15,000. You would look for financing for the remaining $185,000. Your LTV ratio would be determined by dividing $85,000 by $200,000 , giving you 0.925, or 92.5.

Typically, the higher your LTV, the riskier your loan. Therefore, putting down a larger down payment can often help reduce your mortgage rate.

Find out more about mortgage types and how they can impact your mortgage rate below.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

Mortgage Rates In Oklahoma

Are you intending on buying a home in Oklahoma? Its essential to ensure you are getting the best mortgage rate possible. Your mortgage rate will depend on different factors, including your income, how much you can deposit for a down payment, credit-score, and debt-to-income ratio.

To help yourself get the best mortgage rate in Oklahoma, do the following: check your credit for errors, get your documentation ready, and finally get preapproved by a creditable mortgage lender.

Heres a quick look at current Oklahoma mortgage rates:

| Loan Program |

|---|

Data source: ©Zillow, Inc. Use is subject to the Terms of Use

Oklahoma Home Equity Loans

As mentioned above, Oklahoma home equity loans fall into two main categories: traditional and home equity line of credit . Both are secured by the equity in your home, meaning you have to have equity to qualify. A general rule of thumb is that you should have at least 20 percent home equity remaining after you take out the loan lenders may allow you to go lower, but expect higher costs if you do.

Money obtained through a home equity loan or line of credit can generally be used any way you wish in most cases you don’t have to show how you plan to use the money or justify your reasons for doing so. But some of the more common uses are as a home improvement loan, for educational or medical expenses, and to invest in a small business.

Just like a primary mortgage, you can lose your home to foreclosure if you don’t keep up your payments on a home equity loan. If that happens, the primary loan gets completely paid off before the home equity loan receives a cent that’s why they’re called second liens or second mortgages, because they get paid second in a default which is also why their rates are higher than on primary mortgages.

Don’t Miss: 10 Year Treasury Yield Mortgage Rates