How Closing Costs And Interest Rate Affect Apr

While some lenders may advertise a no-closing-cost loan, its important to understand that those costs are still there, but instead of paying them upfront, theyre absorbed into the loan. A common way to do this is by adjusting the opposing levers on interest rates and APR: in exchange for a higher interest rate, you may be able to lower your upfront closing costs and your total APR.

On the other hand, paying more in closing costs will usually result in a lower loan interest rate and a higher total loan cost, or APR.

As a general rule of thumb, interest rates and APRs have an inverse relationship:

- A low closing cost or no-closing-cost loan with higher interest rate = lower APR

- When paying loan closing costs, including paying points for lower interest rates = higher APR

Of course, if youre purchasing a home and your seller is offering a generous amount in closing cost concessions, then you may be able to benefit from both a low rate and low out-of-pocket closing costs.

How Apr Is Determined

Its important to remember that, unlike interest rates, APR is set by individual lenders in the sense that they choose how much to charge for additional fees on top of the interest rate. For example, some lenders charge more for closing fees than others. As a result, two lenders offering the same nominal interest rate might actually offer different APRs.

Because APR rolls variable costs and fees into a single figure, its often a more useful way to compare mortgages than interest rates. Essentially, without APR, it would be much more difficult to assess the true cost of a loan, because borrowers would have to manually calculate fees and APR. Fortunately, the Truth in Lending Act of 1968 requires lenders to disclose APR to borrowers. This ensures greater transparency in lending and a clearer sense for what a borrower can expect to pay.

What If My Mortgage Rate Can Change

When looking at your interest rate on the first page of the loan estimate, check the right-hand column: Can this amount increase after closing? If it says Yes, then youre taking out an adjustable-rate mortgage.

With an ARM, your interest rate can change following an initial fixed period, which means the APR wont reflect the maximum interest rate of the mortgage.

Your loan estimate should explain how your interest works in the Projected Payments table on page 1. Heres what your loan estimate might look like for an ARM:

There are also a couple of tables on page 2 the Adjustable Payment table and the Adjustable Interest Rate table that provide additional details on your ARM. Heres an example of what these tables look like:

Check Out: How to Find the Best Mortgage Lender

Recommended Reading: Can You Take Out Two Mortgages

About Mortgage Interest Rates

The interest rate on your mortgage is simply the amount of interest youll payit does not reflect any fees or any other charges you may incur to obtain the loan. The rate is determined by various factors including prevailing rates, your credit score, loan-to-value ratio, property type and loan type . The interest rate is also what you use to determine your monthly mortgage payment.

Webpage 3 Associated With The Loan Estimate That Lenders Have To Provide You With Once You Submit An Application For A Home Loan Shows The Loans Apr

Nevertheless, many borrowers shouldnt make use of APRs as an assessment device because many of us dont obtain a single home loan and ensure that it stays until its repaid. Instead, we offer or refinance our houses every several years and end up getting a mortgage that is different.

If youre evaluating two loans plus one has a diminished interest but greater costs, in addition to other has an increased rate of interest but reduced charges, you may find that the mortgage because of the greater APR is obviously cheaper if youre maintaining the loan for the shorter term, since the table below illustrates.

Youll need certainly to work with a calculator and perform some mathematics in the real offers loan providers are providing you to make this contrast for the very own situation to see that provide benefits you the absolute most, given just how long you anticipate to help keep your loan. Take into account that financial and life circumstances can transform, and you also may not find yourself going or refinancing in a couple of years also if its your plan now.

You May Like: Is Biweekly Mortgage Payments A Good Idea

Mortgage Apr = More Accurate Representation Of Loan Cost

- The APR is a more accurate representation of how much the home loan will cost you

- Because it factors in points and other lender fees you might pay

- This is why its important to look beyond just the interest rate offered

- But its not perfect either

As noted, the mortgage APR is basically the true cost of the loan, or at least a bit more accurate than a simple interest rate. Ill explain why with a basic example.

Lets look at an example of interest rates and APR:

Mortgage Rate X: 4.50%, 4.838% APR Mortgage Rate Y: 4.75%, 4.836% APR

The advertised mortgage rate X is 4.50%, but requires that two mortgage points be paid it also has $2,000 in additional closing costs, which pushes the APR to 4.838%.

Meanwhile, advertised mortgage rate Y is offered with no points and just $1,000 in closing costs, so the APR is 4.836%, just below that of mortgage rate X.

So even though one advertised mortgage rate might be lower than another, once closing costs are factored in, it could actually end up costing you more.

Thats why its very important to consider both the APR and interest rates.

At the same time, the monthly mortgage payment on mortgage rate X will still be cheaper each month because of the lower interest rate.

For example, if the loan amount in our example is $200,000, the monthly principal and interest mortgage payment would be $1,013.37 on mortgage rate X versus $1,043.29 on mortgage rate Y.

How To Calculate Air Vs Apr

Remember, the Annual Interest Rate is the percentage of the loan principal that a lender charges you yearly to borrow funds from them. Annual Percentage Rate is similar, in that it uses the total amount of interest that you have to pay each year, only it encompasses all costs involved with the loan. Here are a couple of basic examples:

Calculating AIR

As mentioned, your Annual Interest Rate is calculated by taking the total yearly interest your lender charges you, dividing it by your loan amount, then dividing that number by the length of your repayment term. Lets say that you have:

- $5,000 of interest on a $50,000 personal loan, with a 2-year term

- $5,000 ÷ = 0.05 or 5.00% AIR

Keep in mind that this is just a simplified way of calculating someones Annual Interest Rate. When your lender actually assigns your AIR, their decision will be based on other factors, like your income, . The better your financial health is overall, the less risk you have of defaulting on your loan payments in the future. As a result, the lender may offer you a larger loan with a lower AIR and a longer term.

Calculating APR

To give you a better idea of how Annual Percentage Rate works, lets apply the formula shown above to the same example , only this time well add a 1% origination fee to make it more realistic:

Formula: ÷ ÷ x 365) x 100

- ÷ $50,000 ÷ 730) x 365 x 100 = 5.55% APR

- According to these figures, your monthly payment should be $2,206

You May Like: Is Citizens Bank Good For Mortgages

What Is A Mortgage Interest Rate

The interest rate is the annual cost you pay to take out a loan, and it’s expressed as a percentage. For example, a 4% interest rate means you’ll pay 4% of your loan’s total balance in interest each year. Your loan’s principal balance decreases as you pay it down, and the amount of interest you need to pay each month goes down as well.

A mortgage interest rate can be fixed or variable. A fixed interest rate is the same rate over the life of the loan. A variable rate can change over time.

The interest rate a lender charges depends on market factors and on your financial situation. Things such as your , income, assets, debts and other considerationslike occupancy and property typemay affect the interest rate a lender will offer you.

Generally, the greater risk a borrower poses to lenders, the higher their interest rate. Different lenders might also offer different rates, so it’s important to shop around before choosing a bank or a broker.

The Difference Between Interest Rate And Apr

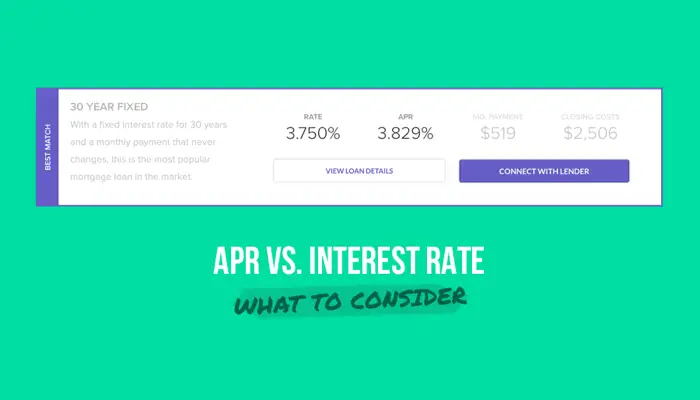

The difference between an APR and mortgage interest rate is relatively straightforward. Heres a quick breakdown of how the two costs differ:

- Interest rate: Annual cost you pay to borrow money

- Annual cost you pay to borrow money, plus other charges

In short, think of the APR as your interest rate plus other charges youll have to pay to get that loan. While the difference between the two might seem small, it can have a significant impact on your total costs.

Comparing APRs across loan offers can give you a better idea of what youll pay on a home loan.

Tip:

- Title or abstract fee

- Appraisal

Credible helps give you a better sense of what youll pay in total for a home loan from one of our partner lenders by displaying the APR. This makes it easier to compare loans and lenders as some have more fees than others.

If youre shopping around for a home loan, let Credible help you can see what mortgage rates you prequalify for in just a few minutes.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Don’t Miss: How To Apply For A Home Mortgage

Watch Out For Apr On Adjustable

- Because the fully-indexed rate is merely estimated

- Using a fixed margin and a variable index that may change

- Disclosures often read APR may increase after loan consummation due to changes in the index

If youre shopping for an adjustable-rate mortgage, you may see that the .

This is essentially because lenders calculate the fully indexed rate by combining the margin and associated mortgage index.

And since mortgage indexes are so low at the moment, they assume youll have a lower rate than your original start rate once the loan adjusts, which may or may not be the case.

A lot can change in a few short years and the fully-indexed rate may indeed be higher.

Dont bank on the fully-indexed rate being lower because rates are historically close to rock-bottom and probably wont stay that way for long.

Of course, most homeowners only hold onto adjustable-rate mortgages for a handful of years before refinancing or selling, so it might not matter too much. That monthly payment might be more important.

When it comes to fixed-rate mortgages, lenders will have a more difficult time making the math favorable, which is why youll typically see APR that exceeds the interest rate unless its a no cost refinance.

And while interest rates are generally low on FHA loans, the effect of the required upfront MIP and annual mortgage insurance can make the APR skyrocket in a hurry. In other words, they arent as cheap as they appear.

Whats A Mortgage Interest Rate

When you take out a mortgage loan, the loan comes with a mortgage interest rate. The interest rate is, in a nutshell, how much it costs to borrow the principal loan amount, not counting the cost of added interest over time.

Interest rates can be variable or fixed, meaning they vary based on market factors, credit scores, and other elements, or they remain the same throughout the loans duration. Mortgage interest rates are expressed as a percentage of the principal amount.

When you get your mortgage bill every month, you are not only required to pay the minimum loan amount for that billing cycle. A certain proportion of the remaining balance will be added to the total loan amount this is the interest rate. Because of this, most people try to pay their mortgages by including both the minimum payment amount plus a certain amount of interest.

Over time, interest can dramatically increase the amount of money a borrower pays over the course of a mortgage loan in total. Interest rates are necessary because they are the primary way that lenders, such as banks or other financial institutions make money by lending money to borrowers.

Recommended Reading: How To Know How Much Mortgage I Can Afford

Loan Estimates Aprs And 5

Your loan estimate accounts for the possibility that you wont keep your loan for its full term by showing how much the loan will cost you in principal, interest, mortgage insurance and loan fees over the first five years. If you dont think youll keep your loan forever, comparing five-year costs can be more useful than comparing APRs. The five-year cost also appears on Page 3 of the loan estimate, right above APR.

If you do use APR to compare mortgage offers, make sure youre comparing offers for the exact same type of mortgage. Dont compare the APR on a 15-year fixed-rate mortgage to the APR on a 30-year fixed-rate mortgage, or to the APR on a 5/1 ARM, because the comparison wont tell you anything.

That said, one situation where comparing APRs on slightly different mortgage types can be useful is when comparing a conventional 30-year loan to an FHA 30-year loan. The APR can give you an idea of how much more expensive the FHA loan may be due to its upfront and monthly mortgage insurance premiums.

How To Compare Mortgage Interest Rates And Aprs

When you review your loan estimates and evaluate your options, remember not to compare a mortgage rate to an APR because thats not an apples-to-apples comparison. Instead, always compare rates to rates and APRs to APRs.

Its important to compare rates because the interest you pay is a big part of your monthly payment. With a lower rate, youll pay less interest over the life of the loan.

Its important to compare APRs because interest isnt the only cost youll pay for your loan.

Never compare an APR for a loan with mortgage insurance to an APR for a loan without mortgage insurance. Mortgage insurance protects your lender if you dont repay your loan. You may have to pay for it if your down payment isnt at least 20% of your homes purchase price.

A loan with mortgage insurance will have a higher APR than the same loan without mortgage insurance because the insurance is a cost thats included in APR.

You May Like: What Is Loss Mitigation Mortgage

When To Use Apr Vs Interest Rate

Be cautious not to overvalue the APR number. APR is most useful if you plan to keep the loan for its entire term.

If you are purchasing a home with plans to move or refinance within 5 to 10 years, it makes more sense to pay attention to interest rates so that you can keep your monthly payments lower, says Auen.

Remember, too, that lenders dont include exactly the same costs in their APR calculations.

Thats why you should ask specifically what is included in your APR so that you can make an accurate assessment when comparing offers, Auen notes.

If you only plan to stay in the home for a few years, comparing the 5year cost of each loan might be more helpful than APR.

The 5year cost projection can be found on page 3 of your Loan Estimate, directly above the APR. It shows the real cost of your loan after 5 years, including loan principal, interest, and upfront costs.

This number will be more realistic for a shortterm borrower than APR, which spreads loan costs over the full loan term often 30 years.

Here’s How Discount Points Work

One discount point costs 1% of your loan amount. While one point will typically reduce the interest rate by less than 1%, even a small interest rate reduction can lower your monthly payment and the amount of interest you pay over the life of a fixed-rate loan. Discount points may also be tax deductible .

Before buying discount points, consider:

- How much money you can pay upfront – make sure you have enough money to make a down payment, pay closing costs, and still be able to manage other expenses for your new home.

- How long you plan to stay in your new home – the longer you stay in your home, the more you may be able to benefit from buying discount points.

- How much can you pay each month – if you dont have a lot of money to pay upfront and can handle a slightly larger monthly payment, you might be better off not buying points.

Don’t Miss: What Is A Mortgage Rate Lock

What Is The Nominal Interest Rate

The nominal interest rate is the only interest charge on loan, and it does not contain any other expense. It is the rate on the loan that has to pay by the borrower from where they take a loan, and it is also expressed as a percentage. If interest rates are reduced, then people take more loans for their business or any other investment. And an increase in interest rates makes borrowers discourage investing. The interest rate can be calculated for less than one year or more than one year as well. The interest rate can vary widely. For calculating the yearly interest, you have to multiply the annual percentage rate by12.