Refinance With A Shorter

A shorter term on the mortgage means it goes away sooner, but at the cost of a much higher monthly payment and perhaps some out of pocket closing costs. Examine the loan closely.

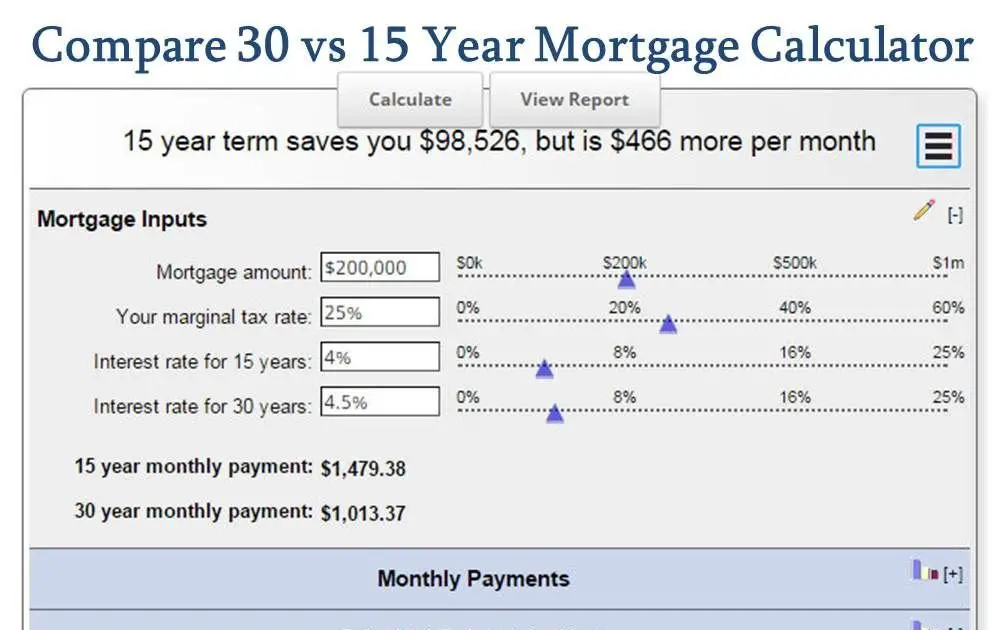

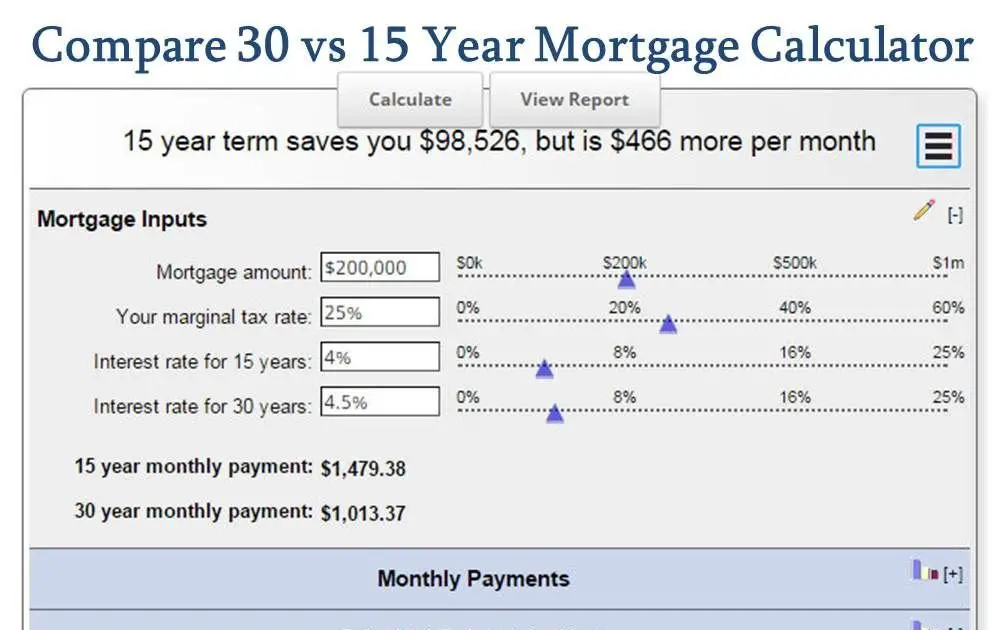

The monthly payment on a 30-year, $200,000 mortgage at 2.5% would be $790 a month.

The monthly payment on a 15-year, $200,000 mortgage at 2.25 % would be $1,310.

Thats another $520 a month to finish paying off your mortgage 15 years sooner.

| 30 Years of Payments |

|---|

| $235,830 |

| *For a $200k mortgage |

The bottom line on this decision is the bottom line: Can you afford the higher monthly payment of a 15-year loan, or are you better off contributing extra each month when you can to a 30-year payment?

What The Mortgage Payoff Calculator Tells You

The Summary Results section has two subheadings:

How to reach your goal describes how much you would have to pay in principal and interest every month to meet the payoff goal. It lists the original principal-and-interest payment, and how much you would have to add to the minimum monthly payment to meet your goal.

Loan comparison summary describes the total cost of the mortgage in principal and interest payments, the original monthly principal-and-interest payment, the total cost in principal and interest if you pay it off early, and the new monthly principal-and-interest payment to reach your payoff goal.

“New monthly P& I” and “Original monthly P& I” comprise only the principal and interest portions of your monthly payments. Your full monthly payment will include principal and interest, plus the other monthly costs, such as taxes, homeowners insurance and mortgage insurance .

The early mortgage payoff calculator also lets you enter different numbers into the “In how many years from now do you want to payoff your mortgage?” box to see how those changes affect your total savings.

For more information about how the process of gradually paying off a mortgage works, see this explanation of mortgage amortization.

When To Consider Loan Recasting

In some cases, if you make a large enough mortgage payment, your lender might offer to recast your loan. If youre not aware of this, you may actually ask your lender for recasting.

Mortgage recasting is when you pay a large amount toward your principal balance, which is then reamortized to reflect the remaining balance. Basically, your lender recalculates the remaining balance into a new amortization schedule. You might want to consider recasting if you happen to have large funds from inheritance pay or a windfall from a side-business.

Under the law, only conforming conventional loans can be recasted. This excludes government-backed loans such as FHA loans, USDA loans, and VA loans. Majority of jumbo loans also do not qualify for recasting. To be eligible for recasting, you must have a pristine record of timely mortgage payments and enough lumps sum funds.

Homeowners usually recast their loan to reduce their monthly payment. Like refinancing, recasting decreases overall interest charges. However, it retains your original repayment schedule and interest rate. This means if you have 25 years left to pay, your monthly payment will be lower, but your loan term will still be 25 years. It does not actually shorten your payment term. But its worth it to have lower monthly payments.

To give you a better idea, heres an example below. Lets say you received an inheritance payment worth $200,000. If you happen to have a new loan worth $300,000, you can try recasting.

Read Also: Reverse Mortgage For Condominiums

Put Down A Large Down Payment

Some mortgage companies draw people in by promising mortgage approval with a very low down payment, sometimes as low as 3-5% of the purchase price of the residence.

Although this may seem attractive initially , it really is a poor financial decision to obtain a mortgage in which you put down a small amount. In reality, you should scrape together as much as you possibly can to make the payments smaller and get you closer to paying off your home faster.

If you were to offer a 20% down payment, you can avoid PMI private mortgage insurance. PMI is a type of insurance that protects the mortgage lender if a homeowner defaults on the mortgage. So, with PMI, a portion of your mortgage payment goes towards an insurance premium that is put aside to give the beneficiary protection if you should default on your loan.

If you put down 20%, you avoid PMI altogether, which results in major savings for you. You could use that PMI amount to pay down your mortgage even faster.

Why Is Amortization Important

Remember, an amortization schedule shows you how much of your monthly payment goes toward principal and interest. It helps you see a full view of what itll take to pay off your mortgage.

As with any type of goal setting, an amortization table gives you a game plan and the confidence to take on the mammoth task of paying off your house.

You May Like: Chase Recast Calculator

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Factors To Consider When Paying Off The Mortgage Early

Living without any debt is an exciting goal, but paying off your mortgage needs to be done right. Here are some important considerations:

- Will you incur penalties for overpaying your mortgage?Some mortgage lenders have prepayment penalties or other loan terms designed to prevent you from prepaying. Make sure to contact your lender and read the fine print in your mortgage contract to determine if this applies to you.

- Do you have credit card or any other debts? Many other types of debt, like credit card debt, have higher interest rates. It’s usually more advantageous to pay off any consumer debt before you pay off the mortgage.

- Have you set aside a sufficient emergency fund? It’s generally a good idea to set aside money in an emergency fund to cover expenses that are not included in your budget or to protect from a rainy day. Build a solid financial foundation first!

- Is your debt oppressing you? Some people feel debt rules their lives. If debt is stressing you out, use the Mortgage Payoff Calculator to calculate how much extra money you need to put toward your mortgage every month to get out of debt sooner.

Once you’ve determined that you’re ready to pay off your mortgage, it’s time to start reaping the benefits!

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

You May Like: What Does Gmfs Mortgage Stand For

How To Pay Off A 30 Year Mortgage In 15 Years

Houses are expensive. They cost so much that we have to break the payments down into smaller chunks to keep them manageable.

Typically, 30 years is an average amount of time to pay off a mortgage. But what if you dont want to be normal?

What if you want to own your house free and clear in half the time? You can, using these techniques for how to pay off a 30-year mortgage in 15 years.

First, you need to learn about the subject so you can succeed. Youll learn about everything from extra payments to terms you should know about mortgages.

The more you understand about house payments, the better off youll be, and the easier it will become to remove this debt from your life quickly.

This post may contain affiliate links. That means if you purchase an item through these links, I may earn a commission at no additional cost to you. Please read the full disclosure policy for more info.

Should You Payoff Your Mortgage Early

That depends and theres no cookie-cutter answer. It comes down to whether you prioritize eliminating debt or growing your investment portfolio.

If you receive a windfall and youre tempted to pay off your mortgage, you might be better off investing the money and sticking to your normal repayment plan.

However, if you prefer the peace of mind of eliminating debt, this freedom could win over potential gains from investments.

Also Check: Rocket Mortgage Conventional Loan

Make Larger Or More Frequent Payments

If you already have a mortgage, try making extra monthly payments. If you get paid twice per month, make a payment each time you get a paycheck. You could also make an extra lump-sum payment at the end of the year.

Another simple way to put more toward your mortgage is to round your payments. If each of your payments is $1,004, then pay $1,010 each time. As time goes on, maybe get more aggressive and round to the nearest $100. Regularly paying just a little extra will add up in the long term.

Was Paying Off Our Mortgage Actually Possible

When we first started thinking about it, we had a traditional 30-year mortgage, and the monthly mortgage payment was reasonable. We really had no trouble making the mortgage payment, but we certainly didnt have a ton of extra money lying around.

I was big into finance years ago, and I read about how much money you could save if you were to refinance your mortgage to a 15 year fixed rate. That would mean our mortgage would go up to possibly more than we would like to pay, but much more money would be going to principal rather than interest.

Well, about five years ago we did just that. We refinanced to a 15-year fixed-rate mortgage and decided we would do everything in our power to pay off our mortgage in 5 years or less. We decided to take on this lofty goal and eliminate our mortgage to pay for things that added value to our lives like more vacations!

We also made sure to keep track of every penny spent so we wouldnt spend any unnecessary cash. It wasnt easy at times because there are some expenses that arent necessarily necessary, but they add value to life.

Ruban Selvanayagam of UK sell house quickly company Property Solvers comments: its also worth remembering that inflation gradually erodes the value of the mortgage debt you have against your house, which is an added bonus!

Also Check: Rocket Mortgage Launchpad

Make Extra Principal Payments

Another way to pay off your home loan faster is to simply pay extra when youre able.

Most mortgage loans issued after Jan. 10, 2014, do not charge prepayment penalties.

This means you can pay extra money toward your mortgage balance each month or make a larger, lump sum payment on your principal each year without facing a penalty for paying off your loan early.

Many homeowners make extra payments on their loans principal when they get an income tax refund. Extra principal payments can have a big impact.

Heres an example.

- Lets say you took out a home loan for $300,000 on a 30year term and rate of 4%

- Thats a principal and interest payment of $1,370

- 360 payments of $1,370 per month means youll have paid $492,500 over the life of the loan thats $192,500 in interest payments over 30 years

Using the same numbers for the loan amount and interest rate:

- If you make extra principal payments of $250 per month, youd shave seven years and four months off your term

- And, youd save more than $59,000 total in interest payments

There are benefits aside from interest savings, too.

Paying off your mortgage early lets you use the money you would have paid each month for other purposes, like investing.

Lets continue with the example above. Instead of paying $1,370 per month on the mortgage, you could put the same amount of money in an investment account.

Amortization Period Vs Mortgage Term

An amortization period tells you how long itll take to pay off your mortgage, while a mortgage term tells you how long you are locked into a specific mortgage contract with your lender.

For example, you could do a mortgage refinance to change your mortgage term. This would change things like your interest rate, monthly payment amount and amortization period.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

Live Off Less Than You Make

The biggest personal finance challenges that we face tend to be attitudes characterized by two acronyms: YOLO and FOMO . YOLO, or You Only Live Once, allows us to permit ourselves to be a little reckless with our finances. Do you want to buy that Porsche? Well, go for it! You only live once!

FOMO, the Fear of Missing Out is similar. All your friends are going on a cruise for your besties 50th birthday? Well, you HAVE to go you dont want to miss out!

Unfortunately, although these feelings are human nature, they certainly do not help our financial situation. We may think that we work hard, and we deserve to spend all the money that we have left after the bills are paid.

However, if your goal is to pay off your mortgage in five years, you may need to make some choices that allow you to live off less than you earn. WAY less than you make for a short amount of time. The best-case scenario is to live on 50% of what you bring home. Then you could use the other 50% for the extra principal.

You could either be super broke for a short amount of time to pay off your mortgage, or you could just be plain broke for the rest of your life. It certainly wont be painless, but you can live off much less than you think.

Try Refinancing From Fha Loan To Conventional Loan

Federal Housing Administration loans help millions of Americans secure affordable homes. FHA loans are backed by the government to help consumers purchase houses with low down payments . Loan rates are also typically competitive at the beginning of the term.

Conventional home loans only require property mortgage insurance if the loan balance is above 80% of the home’s value. As the homeowner pays down their loan the insurance requirement is dropped. FHA loans charge an annual mortgage insurance premium which must be paid for the entire life of the loan. MIP is around 0.80 to 0.85 percent of the loan value. This premium cannot be canceled and must be paid yearly until the end of the mortgage.

Is There a Way to Eliminate PMI?

Yes. You can get rid of the PMI cost if you refinance from FHA to a conventional loan. To do so, you must raise your credit score to qualify for refinancing. At the very least, you should have a 620 credit score to obtain a conventional loan. But the higher your credit score, the more favorable rates you can get . This helps lower your current interest rate once you shift to a conventional loan. But again, if you shorten your term to 15 years, be ready for higher monthly payments.

To learn more about when to refinance, read our feature on top reasons for refinancing.

Also Check: Rocket Mortgage Loan Types

Create A Monthly Budget

Do you have too much month at the end of your money? Do you ever look into your wallet and wonder where that money has gone? We have all had this experience at some time or another, and we dont ever want to again!

The best way to ensure that you know where your money is going is to create a budget. Most people think of the word budget as a restriction someplace to list all of your debts and bills that have to be paid with no regard for having a life. The best debt advice I ever received was to create a budget to see where my money was going each month.

It helps instead to view a budget as a spending plan. In a spending plan, you PLAN how you will allocate your take-home pay. Do you HAVE to spend $200 per month on ballroom dancing lessons? If the answer is yes, put that in your budget and find other places to trim down if you need to.

Creating a thoughtful, complete spending plan allows you to know exactly where your money is going each month so you can tackle that mortgage faster.

Contribute More To Retirement

Your years after working will be a lot more fun with more cash. If you havent maxed out your retirement accounts in the past, now is the time.

With no mortgage, you can easily contribute some of the extra to IRAs and other retirement vehicles. These have limits, but if you find its easy to max them out with no mortgage to pay for, you can always add to your other investments as well.

You May Like: Does Getting Pre Approved Hurt Your Credit

Payoff In 14 Years And 4 Months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

If Pay Extra $500.00 per month

| Remaining Term | 14 years and 4 months |

| Total Payments |

| 24 years and 4 months |

| Total Payments |

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options.