Mortgage Insurance Vs Life Insurance

Mortgage life insuranceis an optional insurance policy that you can purchase from your mortgage lender that protects your mortgage balance. If you pass away, a death benefit will be paid to your mortgage lender to pay off some or all of the mortgage balance. If you get a critical illness, disability, or lose a job, youll receive a payout that helps cover some or all of your monthly mortgage payments. In all of these cases, your lender is the one that receives the insurance payouts.

With life insurance, youre purchasing a policy with a beneficiary that you get to choose. You can also choose to purchase a policy with a certain payout benefit, rather than having it tied to the balance of your mortgage.

Mortgage life insurance premiums are based on the borrowers age and the balance of their mortgage. Premiums are charged as a certain rate per $1,000 of mortgage balance. Mortgage life insurance in Canada is completely optional. A lender cant force you to purchase mortgage life insurance, no matter your down payment. However, if you make a down payment less than 20%, your lender can require you to purchase mortgage default insurance.

Mortgage life insurance can be easier to obtain, but having a potential insurance benefit that gradually decreases as you make mortgage payments means that the benefit gets smaller while your insurance premiums stay the same.

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate is guaranteed to remain unchanged for the length of your mortgage term.

- A variable interest rate can change during your mortgage term. This will not affect your mortgage payment for the duration of the term, but adjusts what percentage of your payment goes to paying off the mortgage principal.

How Much Income Do I Need For A 600k Mortgage

You need to make $184,575 a year to afford a 600k mortgage. We base the income you need on a 600k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $15,381.

You may want to be a little more conservative or a little more aggressive. Youre be able to change this in our how much house can I afford calculator.

You May Like: How Does Rocket Mortgage Work

Should I Choose A Fixed Or Variable Rate

A variable rate lets you benefit from decreases in market interest rates, but it will cost you more if interest rates rise. Fixed rates are a better option if interest rates will rise in the future, but it can lock you in at a higher rate if rates fall in the future.

Of course, its not possible to exactly predict future interest rates, but a2001 studyfound that variable interest rates outperform fixed interest rates up to 90% of the time between 1950 and 2000. If youre comfortable with taking on risk, a variable mortgage rate can result in a lower lifetime mortgage cost.

How To Use This Mortgage Payment Calculator

Our mortgage payment calculator computes payments based on your home value, equity, mortgage term and amortization.

To calculate your mortgage payment:

- Select your mortgage type: purchase, refinance or renewal

- Input the province, home value, down payment / mortgage amount and amortization period

- Choose your desired mortgage term and rate type

The calculator will update the calculations each time you change a number.

Tip: If youre renewing or refinancing your mortgage, select the Renewal/Refinance tab to estimate your potential mortgage payments without having to input a down payment.

You can even compare two rates side by side to see which saves you more.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

Can I Cancel My Mortgage Life Insurance

Canadas major banks all allow you to cancel your mortgage life insurance at any time, and to receive a refund if you cancel your plan within the first 30 days. This 30-day free look or 30-day review period is important as it lets you change your mind should you decide that mortgage life insurance isn’t right for you.

To cancel, you can call your lender’s insurance helpline, complete a form at a branch, or send a written request by mail.

You May Like: Chase Mortgage Recast Fee

Land Transfer Tax In Ontario

Ontarios land transfer tax is calculated as a percentage of the propertys value, using the purchase price as an estimate. The LTT is a marginal tax with rates varying from 0.5% to 2.0% of a homes value depending on its purchase price. For detailed information on rates and calculations see our Ontario land transfer tax page.

Whats The Fastest Way To Pay Off My Mortgage

The fastest way to hammer down your loan principal is with big lump-sum prepayments.

Barring that, opting for accelerated mortgage payments is the next best thing.

How do lump-sum payments affect my mortgage?

About 900,000 borrowers made a total of $23 billion in lump-sum mortgage prepayments in 2019, according to MPC.

A lump-sum mortgage payment is a one thats applied directly towards your mortgage principal. Depending on your lender, you may be allowed to prepay up to 5%, 10%, 15%, 20%, 25% or 30% of the original principal amount of your mortgage each year.

Even if you pay small amounts, the effect is magnified over time, reducing your interest expense every month until the mortgage is paid off.

Lump-sum prepayments also help increase your home equity faster. If necessary, that allows you to use your equity for further borrowing someday, such as adding a HELOC.

The average lump-sum prepayment in 2019 was $19,100, reports MPC.

You May Like: Can You Get A Reverse Mortgage On A Condo

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loans amounts established by the Federal Housing Finance Administration .

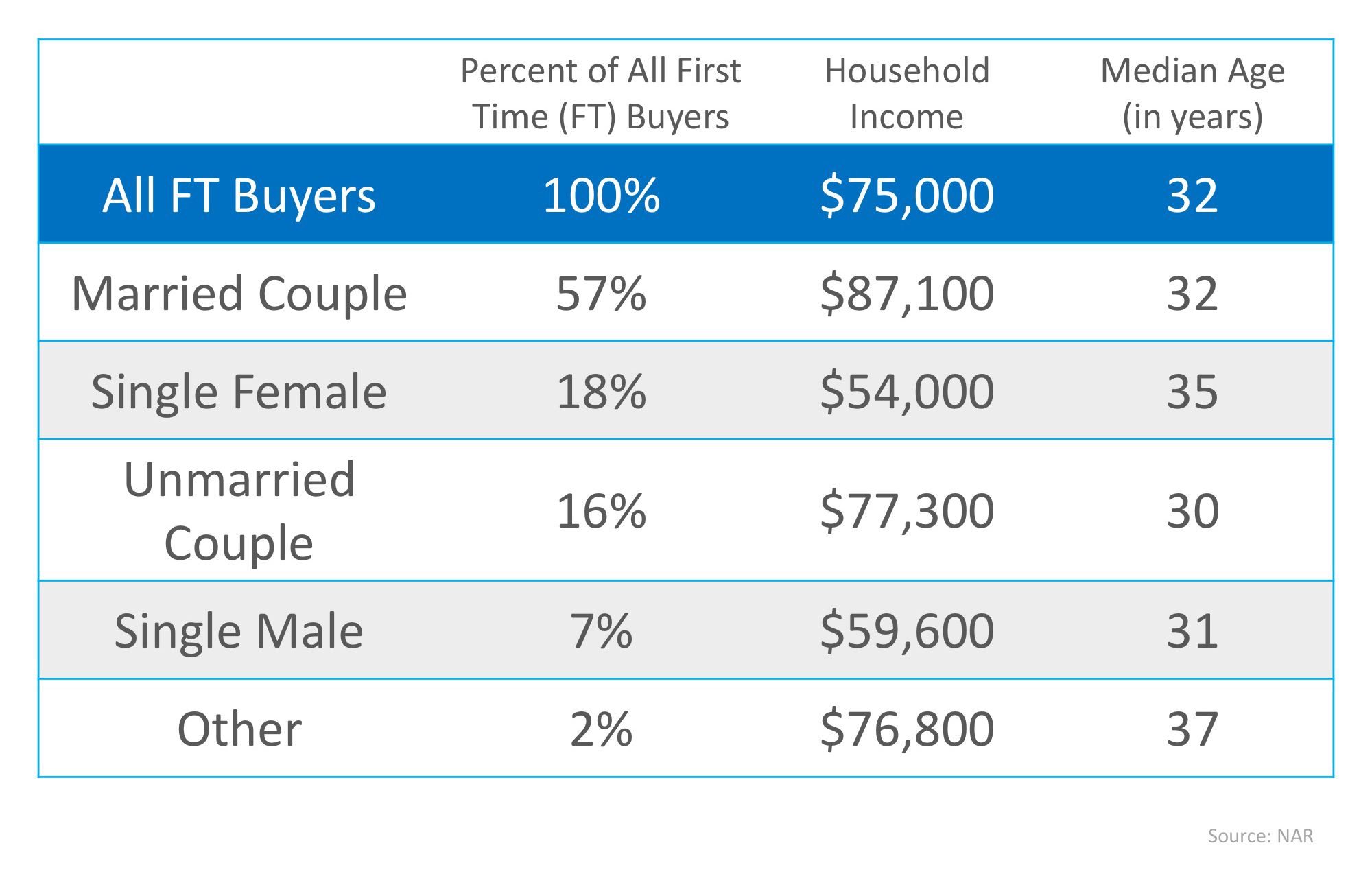

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

What Amortization Period Should I Choose

Here are some general guidelines for choosing an amortization period for your mortgage:

- Most mortgages in Canada have an amortization period of 25 years. Unless you require a longer amortization period due to cash flow concerns, or you can afford to shorten your amortization, a 25 year amortization works well in most cases.

- Choosing a shorter amortization means that youll be paying off your mortgage principal balance faster. This will lower your lifetime interest cost, but it will also result in a higher monthly or bi-weekly mortgage payment.

- Insured high-ratio mortgages cannot have an amortization that is over 25 years. If you choose an amortization period of over 25 years, you must make at least 20% down payment.

Recommended Reading: What Does Rocket Mortgage Do

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

You May Like: Reverse Mortgage On Condo

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Refinancing Of A Mortgage Is Recommended When Quizlet

Category: Loans 1. Lesson 6 Personal Finance Flashcards | Quizlet Refinancing of a mortgage is recommended when What type of mortgage arrangement would reduce the monthly payment as a result of an interest rate subsidy Refinancing of a mortgage is recommended when. A) interest rates rise. B) interest rates fall.

Read Also: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

Paying Your Mortgage Weekly Vs Monthly

There isn’t a large difference between paying your mortgage weekly or monthly, if we’re looking at non-accelerated weekly payments. That’s because the total amount paid per year is the exact same for both payment frequencies. You’ll just pay a smaller amount with a weekly payment, but you’ll be making more frequent payments. The real difference is when you choose accelerated weekly payments. Accelerated payments can shave years off of your amortization, and can save you thousands of dollars.

Recommended Reading: Rocket Mortgage Loan Requirements

What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

Canadian Mortgage Regulations Taxes And Fees

Canada-wide mortgage regulations are set by the Ministry of Finance to help protect home buyers and lenders alike. These regulations include guidelines on minimum down payments, maximum amortization periods, as well as mortgage default insurance.

Here are the key regulations you need to be aware of, and that are included in the Ontario mortgage calculator above:

- The minimum down payment in Canada is between 5% and 10%, depending on the purchase price of the home.

- The maximum amortization is 25 years for down payments under 20% and 35 years for higher down payments.

- Mortgage default insurance – also called CMHC insurance – must be purchased for down payments between 5% and 20%. Visit our CMHC insurance page to learn more.

You May Like: Does Rocket Mortgage Service Their Own Loans

How To Become A Certified Mortgage Underwriter

Category: Loans 1. How To Become A Mortgage Underwriter Best-Selling Training Courses: · Mortgage Underwriter 101 The Essentials · Commercial Processing & Underwriting 101 · FHA/VA Underwriting For Underwriters · FHA Earn A Mortgage Underwriter Certification! The Certified Mortgage Underwriter is a certification program offered through the National Association

What Are Mortgage Statements

A mortgage statement outlines important information about your mortgage. Mortgage statements are usually an annual statement, with it being sent out by mail between January and March rather than once every month. You may also choose to receive your mortgage statement online.

For example, TD only produces mortgage statements annually in January, while CIBC produces them between January and March. If you have an annual mortgage statement, it will usually be dated December 31. You may also request a mortgage statement to be sent.

Information on a mortgage statement are up to the end of your statement period and include:

- Current interest rate

You May Like: Chase Recast Mortgage

My Monthly Payments Will Be

If you take out a $200,000 mortgage payment at 5.000% for 30 years, your monthly mortgage payment would be $1,073.64.

The payments on a fixed-rate mortgage don’t change over time. The loan over the repayment period. This means that the proportion of interest paid vs. principal repaid changes each month. As the loan amortizes, the amount of monthly interest paid decreases while the amount of principal repaid increases.

Note: Principal and interest are usually only a portion of the monthly payment made to your bank. Most lenders also require payments for and property taxes, too. Those payments get dropped into an escrow account so the bank can automatically make the annual insurance and property tax payments on your behalf when the bills come due.

What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

You May Like: Chase Recast