Is It Better To Get A 15year Or 30year Mortgage

For many, a 30year fixedrate mortgage loan is the ideal product. Thats because, quite simply, it allows for more affordable monthly payments. The downside is, it can take longer to accumulate equity and pay off your loan.

Thats why some homeowners opt for a shorter loan term in the form of a 15year mortgage.

You can pay off the loan twice as quickly, over the life of the loan you pay much less in interest, and you grow home equity at a much faster rate, says Robert Johnson, professor of finance at Heider College of Business, Creighton University.

That doesnt mean that a 15year loan is always the best choice, however.

The main drawback to a 15year mortgage is that monthly payments are much higher since you have to pay off the same amount in half the time. As a result, many homeowners simply cant swing the monthly payments.

Its up to you and your loan officer to compare the costs and potential savings of a 15 vs. 30year mortgage, then chose the right one for your financial situation.

Can I Refinance To A 10

Yes, its possible to refinance your mortgage loan to an even shorter term and set your repayment plan for 10 years rather than 15 or 30. However, the more aggressive a repayment plan you establish for your refinance, the more strain its going to put on your finances in the shorter term, so its crucial to do the math and feel certain that you can handle the financial demands before pursuing a 10-year refinance.

The Advantages Of A 30

The 30-year mortgage is the most popular option for homeowners in the US for many reasons. But one of its main advantages is that the payments are stretched out over a period thats twice as long as a 15-year mortgage, which means 30-year mortgages have lower monthly payments. Those lower payments make it easier to afford a home, or to buy a larger home and still stay within your budget.

According to Juan Carlos Cruz, founder of Britewater Financial Group in Brooklyn, New York, a 30-year mortgage is ideal when the loan amount is large and amortizing it over 15 years makes the payments too much to handle, or the buyer wants more purchasing power on a greater home that they can pay off over the 30-year mortgage.

With a lower monthly payment, youll have more money to spend on other household expenses, or you can even use the extra cash to turn around and make more money.

If your money can make a 10-year annual average of 8% in the market with a diversified portfolio minus fees of investment advisors and hidden mutual fund fees why would you hurry and pay your 3% mortgage loan? asks Carolyn Mescher, a CPA, and principal at Magnolia 313 Accounting Services in San Luis Obispo, California.

Invest the additional cash youre saving with a 30-year mortgage versus a 15-year term, and the 5% difference between the 8% youre earning and the 3% interest youre paying would then compound over 30 years, explains Mescher.

More flexibility in payback terms

Larger tax deduction

You May Like: How Much Is Mortgage On 1 Million

What Are The Benefits Of Refinancing To A 15

The biggest advantage of refinancing from a 30- to a 15-year mortgage is paying off your mortgage faster. If youre looking to fast-forward to the point where you own your property outright and can realistically afford the added financial strain of an increased monthly payment, a refinance to a 15-year can absolutely be worthwhile. Not only will you gain full ownership of your home sooner, but youll also likely end up saving money on the interest payments youll no longer have in the long term.

Money Saving Tip: Lock

How much money could you save? Compare lenders serving Los Angeles to find the best loan to fit your needs & lock in low rates today!

Easily Adjust Your Loan Settings to See How They Impact Your Monthly Payments

Filters at the top of the rate table allow you to adjust your mortgage settings. By default refinance rates are displayed. You can adjust your loan settings to change away from a 30-year $250,000 fixed-rate loan on a $312,500 home located in Los Angeles to a purchase loan, a different term length, a different location, or a different loan amount. As you change the loan amount be sure to change the home price as well as some lenders only loan up to a specific LTV value & different lenders will show the best rates for different loan scenarios.

The rate table below is automatically configured to show the details for your second loan scenario, which was a 15-year $250,000 fixed-rate loan on a $312,500 home.

Also Check: Are Discount Points Worth It

Best For Monthly Affordability: 30

A 30-year mortgage may be best if youre seeking stable and affordable monthly payments or wish for more flexibility in saving and spending your money over time. The longer loan term may also be the better option if you plan on purchasing property you couldnt normally afford to repay in just 15 years.

Which Loan Term Should You Choose

The right mortgage term for you depends on your monthly budget as well as your age, earnings, savings, and financial goals.

Jake Maier, a senior mortgage banker with American Bank of Missouri, says that good candidates for a 15year mortgage are those who:

- Can comfortably afford the higher monthly payments

- Want to pay off their home sooner

- Want to build equity more quickly

- And have the cash flow to support the debt load and the additional costs of homeownership

John Li, cofounder and CTO of Fig Loans, adds that older adults closer to retirement may want to choose a 15year mortgage and make aggressive payments so that their home is paid off or closer to paid off at retirement.

That said, Johnson cautions against picking a 15year mortgage unless you are in a strong financial position to fund other life goals such as retirement accounts and childrens educational funds.

If committing to a shorter mortgage would not allow you to fund these other life goals, then a 30year mortgage is likely the better choice, Johnson says.

Younger adults with plenty of working life ahead are also probably wise to select a 30year mortgage, especially if theyre just beginning their career and earning entrylevel salaries, adds Li.

One final thought to consider: You can always take out a 30year mortgage loan and, at any time you choose, either refinance to a 15year term or make extra payments toward principal balance .

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

Most Homeowners Benefit From A ‘super

Adcock’s point of view isn’t actually unpopular. Financial experts agree that the flexibility of lower monthly mortgage payments is important for many homeowners.

“I’ve explained it to clients this way,” says Mark La Spisa, a certified financial planner and president of Vermillion Financial Advisors in South Barrington, Illinois. “If you had a 15-year mortgage and a 15-year super-duper flexible mortgage, which one do you think you would choose?”

Most them then ask what a “super-duper flexible” mortgage entails. “If you need cash, the payments can drop 20% if you want any time you want,” he says, “and the rate is only about a quarter of a point higher” than the typical 15-year loan.

The punchline, La Spisa says, is the “15-year super-duper flexible mortgage” is a 30-year mortgage that, like Adcock suggested, you pay back more quickly as your finances allow.

When your financial situation allows, you can put extra money toward your balance and pay off the loan faster as Adcock put it, turning it into a 15-year. But when money is tight, then you can take advantage of the 30-year’s lower payments and use the difference to help with other bills, says Greg McBride, chief financial analyst for Bankrate. You’re not locked into that large payment.

“Money in the bank will pay the bills home equity will not,” McBride says.

Considerations When Choosing A 15

When youre trying to buy a house, you think choosing which home to purchase will be the hard part. But thats just a small piece of the decision puzzle yet to come. Who will do your inspection? Who will be your mortgage lender? When should you lock your rate? Who will be your home insurance company? The list goes on and on. One of those decisions you must make is whether to choose a 15-year or 30-year mortgage.

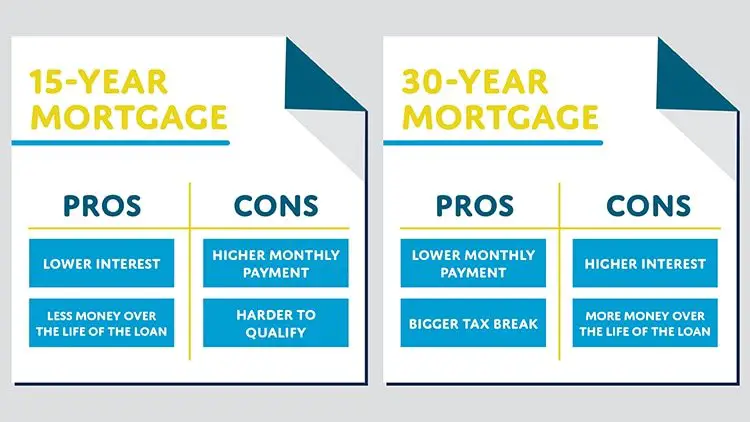

Mortgage Bankers Association reported that 86% of people applying for mortgages in February 2015 chose 30-year loans. But does that mean its the right choice for you?The main differences between a 15-year and 30-year mortgage are fairly simple. The decision, however, may not be. A 15-year mortgage will cost you more in monthly payments. That may make this shorter loan seem like a less affordable option, but youll pay less interest. Therefore, youll pay significantly less over the life of the loan. A 30-year mortgage will have lower monthly payments, but youll pay more in interest, meaning youll pay more for the house over the life of the loan.

In short, a 15-year mortgage means higher monthly payments, but a smaller total payment. A 30-year mortgage means lower monthly payments, but a larger total payment.

Mortgages are not one-size-fits-all, and choosing a 15-year versus 30-year option should be determined based on your unique financial situation. So lets explore the options further.

You May Like: What Do I Need To Become A Mortgage Broker

Don’t Miss: Rocket Mortgage Launchpad

What Can You Afford

First, consider the amount of the mortgage in my example above of $244,000. That is the average amount of national mortgage originations. $244,000 could easily help you get into a 3,000 square ft home in my part of Tennessee, but in many areas of the country that same amount wouldnt even get you into 900 ft condo. Therefore, a 15-year mortgage fitting into your budget will vary depending on where you live. To satisfy your housing needs in certain areas the 30-year may be the better option.

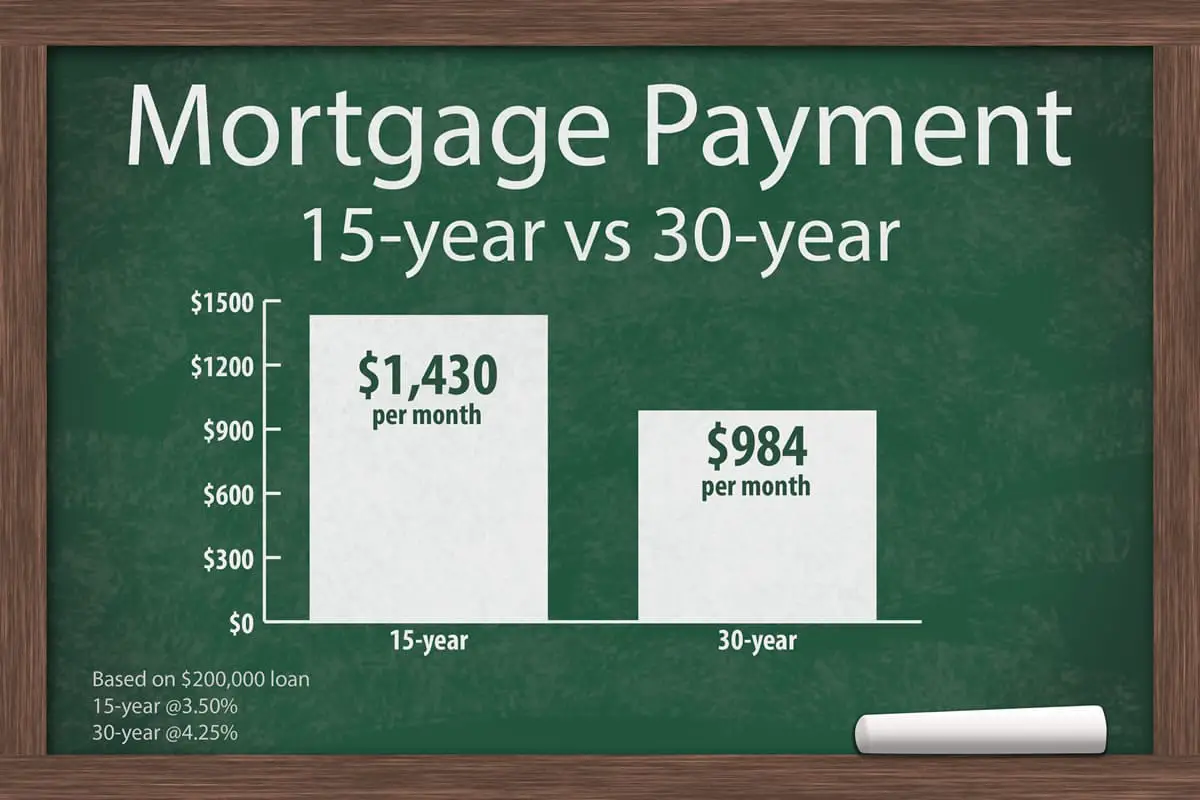

Monthly Mortgage Payments For 15 Vs 30year Loans

Mortgage payments on a 15year loan will likely be several hundred dollars more than for a 30year loan.

Imagine you take out a $250,000 loan over 15 years at 2.50%, says Tom Trott, branch manager with Embrace Home Loans. Your monthly principal and interest payments will be $1,667.

On the other hand, A 30year mortgage on the same loan amount at 2.99% will trigger monthly payments of $1,053 $614 less, he explains.

Of course, the exact payment amounts will depend on your credit score, down payment, interest rate, and other factors. So its worth comparing both loan types before you buy to see how your options break down.

Also Check: Will Mortgage Pre Approval Hurt Credit Score

Vs 30year Mortgage Overview

Most borrowers choose a 30year fixedrate mortgage, which gives them three decades to pay off their home.

You could also opt for a shorter loan term, such as a 15year mortgage. This will pay off your loan debt in half the time and likely save tens of thousands in interest. But your monthly payments will increase substantially.

So which is the best choice for you: a 15 or 30year mortgage? That depends on several factors, including your financial situation, life goals, and what you can afford.

Dont Forget About Retirement

Hows your retirement fund? Check on this and see if youre currently contributing enough. Instead of refinancing to a 15-year mortgage, you may be better off putting more money toward a 401 plan or an IRA account.

You also want to make sure youre maximizing your tax benefits in these and other types of programs, like health savings accounts and 529 college savings accounts. Compared to these plans, paying down a low-rate, potentially tax-deductible debt like a mortgage is a low financial priority.

You May Like: How Much Usda Mortgage Can I Qualify For

Also Check: Rocket Mortgage Payment Options

What Is Equity

Equity is the amount of your home that you actually own. Simply put, its the value of your home, minus the amount you owe on it. The less you owe, the more equity you have.

So youve lived in your house for eight years. How much do you still owe the bank?

Using an Amortization calculator, we find that with a 30-year mortgage we still have a balance of $269,000! With a 15-year mortgage we owe about $170,000.

Thats a pretty significant difference.

How To Decide

Homebuyers should look at more than just the bottom line of the mortgage amount. Its not simply the loan that the buyer will need to budget theyll also be paying for insurance, property taxes, utilities, home maintenance, homeowners fees, and more, just for the home.

Factoring in all other expenses, such as food, clothing, education, and automobile, a home buyer should be able to make a more educated decision about a 15-year versus a 30-year mortgage.

First, check with the lender and get a detailed idea of what each length of mortgage entails, including estimated additional costs in escrow. Knowing exactly what amount will be expected each month will help with the decision.

Also, examine what amount each month will go towards interest versus principal. Then look at all other expenses as they currently exist and what future expenses might occur. Some expenses, like medical or home repairs, might be unexpected but others, like children and automobiles, can be budgeted. Once home buyers have a good handle on their future expenses, they can better see what length mortgage will better fit in their lives.

Read Also: What Does Gmfs Mortgage Stand For

How To Get 15

One way to give yourself the flexibility of a lower payment over 30 years but with the intention of paying less interest would be to pay the same amount of a 15-year mortgage while signing up for a 30-year mortgage. This is also a helpful way to go about it if youre already in a 30-year mortgage and dont wish to go through refinancing.

Typically, 30-year mortgages have a higher interest rate, so it would cost a little more than the normal 15-year mortgage to do this, but again you keep the flexibility of the 30-year mortgage. If you paid the 15-year payment to the loan in the 30-year example, you would pay off the loan in 15 years and 10 months. The total interest over the life of the loan would be $97,000. In other words, youd pay an extra $16k over an extra 10 months for that flexibility.

To achieve these results you have to maintain a disciplined approach. One way to make sure the payments occur regularly is setting up an automatic debit from your checking to your mortgage. Also be sure to confirm those extra payments are being applied to principal and not just treated as early payments.

There Are Other Ways To Pay Down Your Mortgage Faster

If your goal is to pay down your mortgage faster, you can do that with a 30-year loan by simply making extra payments whenever youre able. If you make enough extra payments over your loan term, you can easily shave off time from your loan, even as much as 15 years.

The catch with this strategy is that youll still pay a somewhat higher interest rate on the 30-year mortgage compared to a 15-year note.

If you do make extra payments, make sure you indicate that these payments are to go toward your loan principal. Your Caliber Loan Consultant can show you how to do that.

Read Also: Can You Get A Reverse Mortgage On A Condo

The Main Downsides Of A 30

The most obvious disadvantage of a 30-year mortgage is that itll take twice as long for you to own your home outright, which means a longer duration until you have financial freedom from your housing payment.

But Nicole Rueth, producing branch manager at Fairway Mortgage in Denver, also points out that the lower monthly payment of a 30-year mortgage comes at an additional cost, with 30-year mortgages carrying higher interest rates. Combined with the longer term, that results in paying much more in total interest over the life of your mortgage.

According to a recent Bankrate mortgage survey, average interest rates on a 30-year fixed-rate mortgage are currently 3.05%, which is near a record low. But in the same survey, the average rate on 15-year mortgages was just 2.45%.

That means youre paying 0.6% more for a 30-year mortgage, which may not sound like a lot. But on a $200,000 home with a 20% down payment, youll pay a total of $31,358 in interest over the entire length of a 15-year mortgage at 2.45%, while the same home with a 30-year mortgage at 3.05% ends up costing a much higher $84,399 in total interest.

Why Is A 30

Realistic

To me purchasing a home is a much better choice compared to renting. There are arguments for this with the costs of home ownership. From air conditioners to roofs needing to be replaced every so many years, there is a cost. I would almost even go as far as saying depending on the home, area, and money put into it during a period of time may result in not coming out very far ahead. It is even possible that a homes value can depreciate.

Even with the costs involved in a home, there will typically be some money that can be taken away at the time of selling it in most cases. With renting there is no financial benefit when you leave. It may seem as though there are benefits when living in a rental with everything being taken care of, but you are paying for this.

Not everyone can afford to buy a home, but most should make it a goal. A 30-year mortgage makes it more attainable.

Flexibility and Cash Flow

A 15-year mortgage will almost always have a better interest rate. There is no denying this. But with a 30-year mortgage loan with no prepayment penalty, there is nothing stopping a person from paying off their home early. The 30-year term allows more flexibility for life events.

Also Check: How Much Does Getting Pre Approval Hurt Credit