How Does Credit Affect Mortgage Affordability

A crucial factor in calculating your monthly mortgage payment is the loan’s interest rate. To help determine what your interest rate would be, lenders review your credit report and credit score in addition to other factors.

In general, borrowers with higher credit scores can secure lower interest rates because they’re able to show that they’ve managed their debts well in the past. In the lender’s eyes, this positive payment history lessens the risk that the borrower will default on their monthly mortgage payments.

On the flip side, a low credit score could result in a higher interest rate or even the outright denial of an application. The minimum credit score for a mortgage loan can vary based on the lender and the type of loan you’re applying for.

Finding The Right Lender

One place to start is with , a site that allows you to get quotes from three lenders in only three minutes. Theres no obligation, but if you see a rate you like for your mortgage or refinancing your mortgage, you can progress to the next step of the application process. Everything is handled through the website, including uploading documents. If you want to speak to a loan officer, you can, of course, but it isnt necessary.

As you shop for a lender, remember that every dollar counts. Youre committing to a monthly mortgage payment based on the rate you choose at the very start. Even small savings on your interest rate will add up over the years youre in your house.

is another great place to get started since they allow you to shop and compare multiple rates and quotes with minimal information, all in one place. Youll input the amount of the loan, your down payment, state, mortgage product type, and your credit score to get mortgage quotes from multiple lenders at once.

In the market for a house sometime soon? Use our resources to target your searchand know well in advance what you can afford:

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

Recommended Reading: How Much Money Should You Spend On Mortgage

Oh Perfect That Was Easy Off To Go Take Out A Mortgage Now Bye

Woah, slow down! Were just getting started here. Remember? We said this was supposed to be painful, laborious and even depressing. Lets continue:

There are two things that you need to consider when figuring out the answer to how much mortgage can I afford. First, theres how much debt you are willing to take on and the second is how much debt a lender is willing to extend to you. The former is definitely important but the latter is what were going to discuss here.

So we are trying to determine how much your lender thinks you can afford. After all, theyre the one taking the risk by loaning you the money. Theyre going to be very concerned about your job, how much money you make in a year, how much money you can put down up front, your credit score and more.

Your lender is going to take all your information and come up with two figures to guide them: your back-end ratio and your front-end ratio.

The Debt To Income Ratio

Lenders use the debt-to-income ratio to determine if you are able to take on another debt given your current income and you are able to repay this debt in the future.

There are two ways to calculate this DTI ratio. There is the front-end, which takes into account your total housing costs divided by your gross monthly income. Then theres the back-end or total ratio which is all debt obligations including housing costs relative to your gross monthly income.

In the case of mortgages, lenders will focus more on the front-end ratio. In calculating this ratio, they will include future payments on the mortgage youll be taking on.

Also Check: Who Has The Best Mortgage Loan Rates

Personal Approach To Debt

Some people are uncomfortable with debt and choose to carry minimal amounts and work hard to pay them off quickly. Other people are comparatively very comfortable with debt, seemingly having no problem carrying high balances on credit cards or maxing out home purchases at the top of their budget. How comfortable you are with debt and how much debt you currently have will determine how much home you can afford.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Does My Husband Have To Be On The Mortgage

Look Closely At All Your Expenses

You’ve got to put food on the table, clothes on your back and gas in your car-and have a little fun now and then. You also need to be prepared for emergencies as well.

Your mortgage specialist will help you make sure you have money left over to pay for the necessities of life, as well as some of your lifestyle choices. The following calculations are used by most lenders as a guide to help determine the maximum you should spend on housing costs and overall debt levels:

If your monthly housing and housing-related costs don’t leave you enough money for your other expenses, then you have a few options.

You and your mortgage specialist may also need to factor in expenses or changes that you know are on the horizon. Maybe you’ll need to replace your car within the next year. Or if you’re expecting your first baby you may need to consider the impact of a maternity or paternity leave on your budget in addition to expenses related to having a baby.

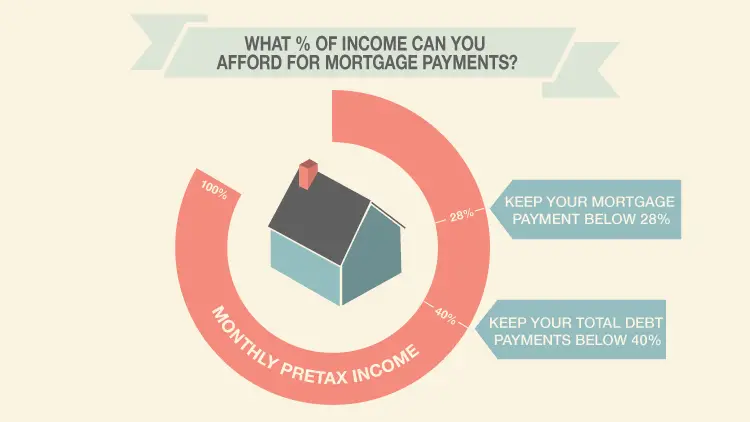

Percentage Of Income For Mortgage Payments

That explains why there are so many “rules” and recommendations regarding the percentage of income you should use for a mortgage. Let’s move on to talk about the two qualifying ratios lenders use when considering borrowers for a loan. As a borrower, you have two different debt-to-income ratios. One is a comparison between your income and your monthly mortgage expense. The other one takes all of your monthly debts into account.

Here’s the difference:

- Front-end DTI ratio. Your front-end ratio is basically the percentage of your income that goes toward your housing costs. In this context, your housing costs include everything that makes up your monthly mortgage payments . This is the ratio that applies to your question. We will talk more about front-end DTI limits below.

- Back-end DTI ratio. Also known as the total debt ratio, the back-end DTI is a comparison between monthly income and total monthly debts. This ratio shows the percentage of income you are using to cover all of your recurring monthly debts. It includes the mortgage payment, plus all other debts you pay each month, such as car loans, student loans, credit cards, child support and alimony, etc.

For an FHA home loan, lenders generally allow for a higher front-end debt ratio. The FHA program is managed by the Department of Housing and Urban Development . So let’s start with the minimum HUD guidelines.

Read Also: Does Pre Approval For Mortgage Affect Credit

Are You Ready To Buy A Home

Do you need help buying a home? Cadence Banks mortgage experts are happy to help. Contact us today to learn about our mortgages and the competitive rates we offer.

This article is provided as a free service to you and is for general informational purposes only. Cadence Bank makes no representations or warranties as to the accuracy, completeness or timeliness of the content in the article. The article is not intended to provide legal, accounting or tax advice and should not be relied upon for such purposes.

What Are Todays Mortgage Rates

Todays rates are still low, which is good news for home buyers. The lower your interest rate, the more real estate you get for your dollar.

Remember, theres no perfect amount to spend on your home loan. The decision is personal it depends on how much you make, how much you currently spend each month, and how large of a housing payment youre comfortable with.

So explore your options, check your rates, and pick the right mortgage amount for you.

Read Next

Read Also: What Is Mortgage Rate Vs Apr

Ok So Theyve Got My Information And Done Some Math Now What

From there, the lender will determine what length of loan and interest rate they feel comfortable giving you. To figure this out, theyll take a look at your credit score, which ranges from 300 to 850 . As youd expect, the higher your credit score, the lower the interest rate youll generally get, though the amount of your down payment also gets factored in.

Its difficult to say what constitutes an ideal credit score for taking out a mortgage , but a number between 700 and 740 seems to be a good range. In general 620 is considered the lowest acceptable score that will get you the green light.

If your credit score isnt where you want it, it might be useful to try to boost your number a bit before applying for a mortgage. The difference between a 3-percent and 5-percent rate might not sound huge, but all that interest adds up over the 15 or 30 years of the loan to some pretty significant money.

Find The Number Thats Right For You

Whether your situation is closer to that of John, Jane, or our couple in Houston, the great thing about the 50/30/20 rule is that it can adjust to fit your personal financial situation. Its an excellent guide to help you target a monthly dollar amount for rent, while also keeping you on track for your other financial goals. This 50/30/20 budget template might help you get started.

No matter where you are on your financial journey, budgeting and being aware of your monthly expenses will help you live within your means for a more a secure future. That means you can relax in your place, knowing youre paying a percentage of your income thats right for you.

You May Like: How Do You Refinance Your Mortgage

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

Mortgage Payments Arent Your Only Homeownership Cost

Theres more to homeownership cost than your monthly payment. More on that later. But what makes up your monthly payment itself?

Mortgage professionals use the acronym PITI to cover some of the main ones. That stands for:

- Principal: The amount by which you reduce the amount you borrowed each month.

- Interest: The cost of borrowing.

- Taxes: The property taxes you have to pay.

- Insurance: Homeowners insurance. Plus, depending on where you buy, possibly flood, earthquake or hurricane cover.

None of these is optional and if you fall far behind on any of them, youll be in breach of your mortgage agreement and subject to action by your lender.

Don’t Miss: Can You Get A Mortgage On A Foreclosed Home

The Conservative Model: 25% Of After

On the flip side, debt-hating Dave Ramsey wants your housing payment to be no more than 25% of your take-home income.

Your mortgage payment should not be more than 25% of your take-home pay and you should get a 15-year or less, fixed-rate mortgage Now, you can probably qualify for a much larger loan than what 25% of your take-home pay would give you. But its really not wise to spend more on a house because then you will be what I call house poor. Too much of your income would be going out in payments, and it will put a strain on the rest of your budget so you wouldnt be saving and paying cash for furniture, cars, and education.

Notice that Ramsey says 25% of your take-home income while lenders are saying 35% of your pretax income. Thats a huge difference! Ramsey also recommends 15-year mortgages in a world where most buyers take 30-year mortgages. This is what Id call conservative.

Learn About Your Mortgage Options

Home buyers can typically choose from two main types of mortgages:

- A conventional loan that is guaranteed by a private lender or banking institution

- A government-backed loan

When choosing a loan, youll want to explore the types of rates and the terms for each option. There may also be a mortgage option based on your personal circumstances, like if youre a veteran or first-time home buyer.

Conventional loans

A conventional loan is a mortgage offered by private lenders. Many lenders require a FICO score of 620 or above to approve a conventional loan. You can choose from terms that include 10, 15, 20 or 30 years. Conventional loans require larger down payments than government-backed loans, ranging from 5 percent to 20 percent, depending on the lender and the borrowers credit history.

If you can make a large down payment and have a credit score that represents a lower debt-to-income ratio, a conventional loan may be a great choice because it eliminates some of the extra fees that can come with a government-backed loan.

Government-backed loans

Buyers can also apply for three types of government-backed mortgages. FHA loans were established to make home buying more affordable, especially for first-time buyers.

Rate types

First-time homebuyers

Read Also: Which Credit Reporting Agency Do Mortgage Lenders Use

The Bottom Line: How Much Home Can You Afford

So, what percentage of your income should go toward your mortgage? The answer will vary depending on your income and how much debt you have. But your income is only one of the many factors that determine how much home you can afford. Lenders look at everything from your credit score to your liquid assets when they decide how much to offer you.

To learn more about how much of a mortgage loan you can afford to borrow, check out our home affordability calculator. If youre ready to get started, you can apply online or give us a call at 452-0335.

Account For Closing Costs And Fees

In addition to your down payment, you will also want to account for closing costs and broker fees. Borrowers have the option of paying up to 5 percent of the mortgage loan amount in closing costs. Therefore, on a loan of $180,000 that would be $9,000. As different lenders offer different programs, check with several lenders to see where you can get the best deal. Remember that your down payment and closing costs are not the only funds you will need. You will also be responsible for prepaid expenses, such as the mortgage interest charged on your loan after closing and title insurance.

Also Check: Can You Refinance Mortgage With Poor Credit

What Percentage Of Income Should Go To A Mortgage

Every borrowers situation is different, but there are at least two schools of thought on how much of your income should be allocated to your mortgage: 28 percent and 36 percent.

The 28 percent rule, which specifies that no more than 28 percent of your income should be spent on your monthly mortgage payment, is a threshold most lenders adhere to, explains Corey Winograd, loan officer and managing director of East Coast Capital Corp., which has offices in New York and Florida.

Most lenders follow the guideline that a borrowers housing payment should not be higher than 28 percent of their pre-tax monthly gross income, says Winograd. Historically, borrowers who are within the 28 percent threshold generally have been able to comfortably make their monthly housing payments.

This 28 percent cap centers on whats known as the front-end ratio, or the borrowers total housing costs compared to their income.

The 36 percent model is another way to determine how much of your income should go towards your mortgage, and can be used in conjunction with the 28 percent rule. With this method, no more than 36 percent of your monthly income should be allocated to your debt, including your mortgage and other obligations like auto or student loans and credit card payments. This percentage is known as the back-end ratio or your debt-to-income ratio.

Most responsible lenders follow a 36 percent back-end DTI ratio model, unless there are compensating factors, Winograd says.