How Closing Costs And Interest Rate Affect Apr

While some lenders may advertise a no-closing-cost loan, its important to understand that those costs are still there, but instead of paying them upfront, theyre absorbed into the loan. A common way to do this is by adjusting the opposing levers on interest rates and APR: in exchange for a higher interest rate, you may be able to lower your upfront closing costs and your total APR.

On the other hand, paying more in closing costs will usually result in a lower loan interest rate and a higher total loan cost, or APR.

As a general rule of thumb, interest rates and APRs have an inverse relationship:

- A low closing cost or no-closing-cost loan with higher interest rate = lower APR

- When paying loan closing costs, including paying points for lower interest rates = higher APR

Of course, if youre purchasing a home and your seller is offering a generous amount in closing cost concessions, then you may be able to benefit from both a low rate and low out-of-pocket closing costs.

What Is A Price Reduction Level

A discount aim also referred to as a home loan place is an upfront costs remunerated at closing to reduce their financial price. Some point is equal to 1per cent of the amount you want. In case youre borrowing $300,000 like, one point would set you back $3,000.

Each mortgage loan level can lower your rate 12.5 to 25 factor points, which is equal to 0.125percent to 0.25per cent.

So Whats A Personal Apr

When you apply for a loan, its likely that the rate you receive will be based on your personal circumstances. It will take into account your credit history and finances, as well as the loan amount and length of your borrowing. This is your personal APR.

Its important to realise this before you apply particularly if youre shopping around based on the representative APRs you see advertised.

The representative APR is a useful comparison tool, but not necessarily the rate youll receive. Indeed, its likely that customers will get a personal APR even if they are in the 51% who receive a rate that is the same as, or lower than, the representative APR.

You might not know your personal rate until after youve applied for a loan, and simply applying could affect your credit rating.

This is because lenders will usually check your financial background with a credit reference agency before deciding whether to make you a loan offer, and the checks will be recorded on your file. Once you take out a loan, the lender has to update your credit file.

If you bank with us, we might be able to tell you what your personal loan rate could be up front before you apply, with no impact on your credit score.

You May Like: How To Find Mortgage Payment

What Does The Mortgage Payment Include

Mortgage payments consist of principal and interest. The principal amount is the amount you borrowed. The interest is a specific percentage that you accepted before signing your loan, and this goes directly to the lender. When you make additional principal payments , this reduces the amount of interest you owe.

Mortgage interest rates are fixed or adjustable. While fixed rates remain the same throughout the loan period, an adjustable rate mortgage can increase or decrease throughout the length of your loan. When your rate adjusts, your payment changes too. ARMs have rate caps that limit the amount the interest rate can change each year and over the life of the loan. Most ARMs also have an initial fixed rate period before the rate can start to change. For example, homeowners with ARMs might have a fixed rate of 4% for five years, then it may change each year if the index changes..

The rate lenders offer depends on several factors, including:

- The amount you want to borrow

- How much you plan to put down on the loan

- The length of the loan you want

- Your on-time payment history

- The type of loan you want

- Your location

Mortgage Apr = More Accurate Representation Of Loan Cost

- The APR is a more accurate representation of how much the home loan will cost you

- Because it factors in points and other lender fees you might pay

- This is why its important to look beyond just the interest rate offered

- But its not perfect either

As noted, the mortgage APR is basically the true cost of the loan, or at least a bit more accurate than a simple interest rate. Ill explain why with a basic example.

Lets look at an example of interest rates and APR:

Mortgage Rate X: 4.50%, 4.838% APR Mortgage Rate Y: 4.75%, 4.836% APR

The advertised mortgage rate X is 4.50%, but requires that two mortgage points be paid it also has $2,000 in additional closing costs, which pushes the APR to 4.838%.

Meanwhile, advertised mortgage rate Y is offered with no points and just $1,000 in closing costs, so the APR is 4.836%, just below that of mortgage rate X.

So even though one advertised mortgage rate might be lower than another, once closing costs are factored in, it could actually end up costing you more.

Thats why its very important to consider both the APR and interest rates.

At the same time, the monthly mortgage payment on mortgage rate X will still be cheaper each month because of the lower interest rate.

For example, if the loan amount in our example is $200,000, the monthly principal and interest mortgage payment would be $1,013.37 on mortgage rate X versus $1,043.29 on mortgage rate Y.

Recommended Reading: Can You Write Off Points On A Mortgage

/1 Arm Vs 5/1 Provide

A 10/1 adjustable-rate financial offers an extended, initial fixed-rate duration than a 5/1 ARM. Youd love a steady interest for that earliest 10 years and have a fluctuating rate for the continuing to be two decades. An 10/1 ARM my work right for you if you plan to market your household or apply and qualify for a refinance vendor fixed-rate years stops.

Mortgage Interest Rate Vs Apr: Whats The Difference

August 13, 2020 By JMcHood

Shopping for a mortgage involves making many decisions. How long do you want to have the mortgage? What type of interest rate do you want fixed or adjustable? What monthly payment is most affordable? These are just a few of the questions people go through to figure out which mortgage is right for them. Another factor, though, that you need to consider in many cases is the APR or Annual Percentage Rate. Many people do not understand this term and therefore ignore it. In reality, you should compare the mortgage interest rates against the APR when comparing loans either from the same or different lenders.

You May Like: How To Get Approved For Mortgage With Low Income

How To Calculate Air Vs Apr

Remember, the Annual Interest Rate is the percentage of the loan principal that a lender charges you yearly to borrow funds from them. Annual Percentage Rate is similar, in that it uses the total amount of interest that you have to pay each year, only it encompasses all costs involved with the loan. Here are a couple of basic examples:

Calculating AIR

As mentioned, your Annual Interest Rate is calculated by taking the total yearly interest your lender charges you, dividing it by your loan amount, then dividing that number by the length of your repayment term. Lets say that you have:

- $5,000 of interest on a $50,000 personal loan, with a 2-year term

- $5,000 ÷ = 0.05 or 5.00% AIR

Keep in mind that this is just a simplified way of calculating someones Annual Interest Rate. When your lender actually assigns your AIR, their decision will be based on other factors, like your income, . The better your financial health is overall, the less risk you have of defaulting on your loan payments in the future. As a result, the lender may offer you a larger loan with a lower AIR and a longer term.

Calculating APR

To give you a better idea of how Annual Percentage Rate works, lets apply the formula shown above to the same example , only this time well add a 1% origination fee to make it more realistic:

Formula: ÷ ÷ x 365) x 100

- ÷ $50,000 ÷ 730) x 365 x 100 = 5.55% APR

- According to these figures, your monthly payment should be $2,206

How Does Someone Seal In A Home Loan Rates

When payday loans near me Wichita Falls youve picked your loan company and are usually animated throughout the financial application process, everyone financing specialist can discuss your very own finance fee fasten solutions. Rates locks lasts between 30 and 60 days, or maybe more if for example the funding doesnt nearby before your own rates lock expires, anticipate paying a rate secure expansion costs.

Don’t Miss: How To Sell A Mobile Home With A Mortgage

Definition Of Note Rate

Note Rate is also referred to as nominal rate, and this is the original rate borne by a loan. This type of loan agreement specifies the rate of interest payable over the loan period. It is the general interest rate quoted by banks when offering loans. Continuing from the above example,

E.g., If the loan of $300,000 is taken out for the interest of 6%, then the annual payment will be $18,000. This excludes any other costs attached to the borrowing

Unsure Where To Look Next

Future Finance specialises in fair and flexible loans for students such as yourself. Whether youâre an undergraduate currently studying or a recent graduate, we make sure to provide you with terms and conditions that are clear and transparent from the start. Discover how Future Finance can help you and donât forget to follow or to get regular updates like this!

Ready to go? Rise to your potential with Future Finance.

Don’t Miss: How To Select A Mortgage Lender

/1 Supply Vs 5/1 Supply

A 10/1 adjustable-rate mortgage features a longer, original fixed-rate period than a 5/1 ARM. Youd really enjoy a well balanced monthly interest your 1st ten years and also a fluctuating speed when it comes to continuing to be 2 decades. An 10/1 provide could work effectively for you if you intend selling your household or implement and be eligible for a refinance ahead of the fixed-rate time edges.

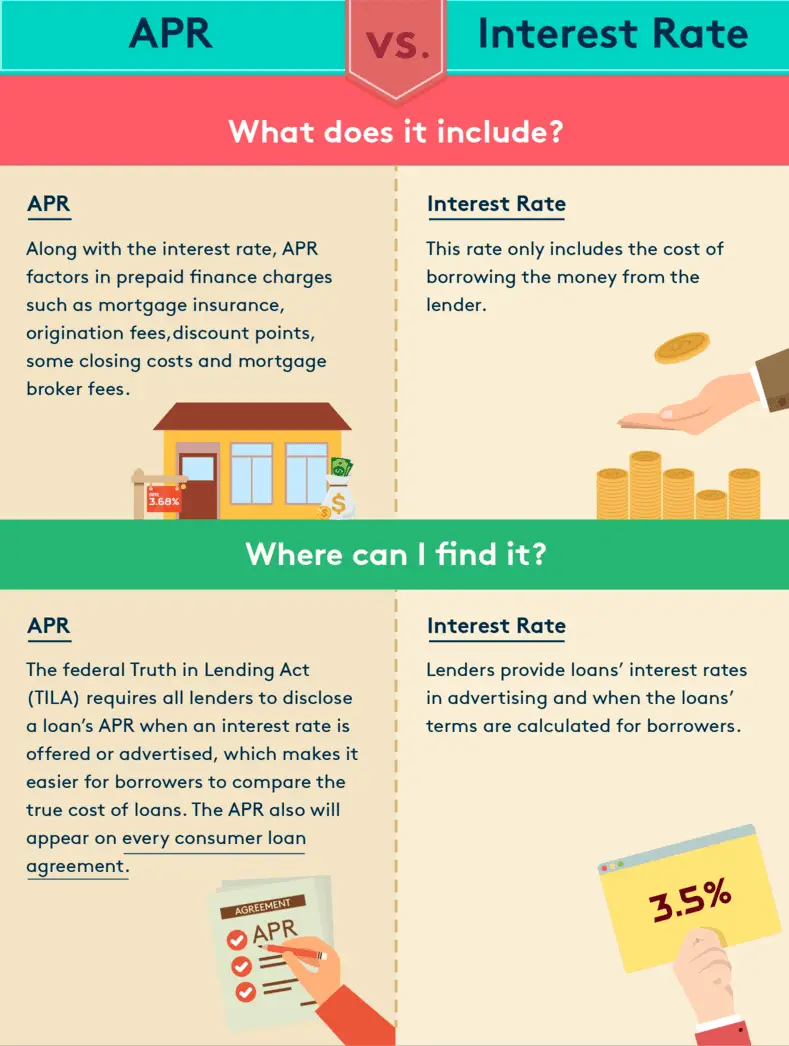

What Is Annual Percentage Rate

Annual percentage rate reflects the interest rate, but it also takes into account additional fees.

It can help you understand the compromise between interest rate and additional fees. Due to other fees included, your APR is higher than your interest rate, and its also expressed as a percentage.

Once youve applied for your mortgage and have a ratified contract with a property address, your lender is required to provide a Loan Estimate within three business days. Lenders are required by law to disclose both the interest rate and the APR.

Whats included in an APR?

-

Interest rate

-

Closing costs

-

Origination fees

-

Broker fees

-

Any lender fees

You can use the comparisons section of your Loan Estimate to get an idea of how your loans APR stacks up against loans from other lenders.

You May Like: Can You Refinance Mortgage With Poor Credit

How To Get The Best Interest Rates And Aprs

Now that you understand the difference between interest rate and APR, let’s talk a little about how to find the best options for your loans.

- Do your rate shopping in a short window of time. Hard credit checks can lower your credit rating, but multiple inquiries count as a single inquiry if they’re close enough together. The time allowed ranges from 14 to 45 days.

- Remind a potential lender that you understand the difference between APR vs. interest rate, and ask them to spell out all fees included in their APR.

- The Consumer Financial Protection Bureau investigates complaints about financial services like loans, credit cards, and debt collection. If you believe a financial institution has violated TILA — including trying to mislead consumers about APR vs. interest rate — you can file a complaint with CFPB.

It’s important to note that APR can also benefit you. Let’s say you open a certificate of deposit . APR represents the amount the bank will pay in interest on that financial instrument. The same principle applies when you open a money market account .

Don’t be shy. Let lenders know that you understand APR vs. interest rate and ask about the fees they include. It’s your money, and you have the right to keep as much of it as possible.

How To Calculate Mortgage Apr

- First take your full loan amount

- Then subtract out-of-pocket closing costs to get the net loan amount

- Next calculate the monthly mortgage payment using the full loan amount

- Finally input that full monthly payment with the net loan amount to get your APR

While probably not necessary, its always nice to know how things get calculated using real math, as opposed to using a completely automated loan calculator.

This way you can check your lenders math, if need be. And even impress or scare them along the way.

A simple way to calculate mortgage APR is by subtracting the loan costs from the loan amount because what youre paying for the loan effectively reduces what you have borrowed.

For example, if your mortgage is $100,000, but there are $2,000 in out-of-pocket loan costs, youre really only borrowing $98,000 from the bank.

Now grab a basic mortgage calculator and input the full $100,000 loan amount and the interest rate . That will generate a monthly payment amount of $599.55.

Next, change the loan amount to $98,000, but keep the monthly payment amount of $599.55. Also make sure the interest rate and/or APR box is empty. Some mortgage calculators will allow you to do this, some wont.

Hit calculate and you should see an APR of 6.189%. Its a two-step process, but not that hard to manage.

See, calculating the APR isnt so hard! Well, it gets a lot more difficult once we start talking about financing closing costs and tacking on mortgage insurance and the like.

Don’t Miss: How 10 Year Treasury Affect Mortgage Rates

Which Should You Compare: Apr Or Mortgage Rate

Both. However, the APR will be a more accurate estimate for what you will pay throughout a loans lifespan than the mortgage rate by itself. Because of this, most people like to compare APRs when considering two different loans from separate lenders.

Heres an example:

- Say that you can compare loan offers for a $200,000 house with a 30-year term limit. The first loan has an interest rate of 4.25%, including a 1% origination fee and $1000 in various other fees. All told, your total extra expenses add up to $3000

- You can alternatively opt for a different loan of $200,000 with an interest rate of 4%. It also includes a 1% origination fee and $1000 and other fees but also has an optional discount point worth $2000 you can purchase if you choose. The total costs for this loan are $5000 compared to $3000

As you can see from the example, the first loan has a higher interest rate of 4.25% and lower overall fees. The second loan has a lower interest rate of 4% but higher fees. You buy the discount point by paying $2000 to knock down the interest rate by 0.25%. This means that, over time, youll pay less money on the mortgage using the second loan compared to the first loan.

The second loan, when checked, will have a lower APR since youll pay less in total over the 30-year loan lifespan when you include the principalloan amount, the fees, and the interest rate.

So in this hypothetical example, the second would be a better choice.

How Mortgages And Aprs Work

Once you begin your homebuying journey, it helps to understand how mortgages and annual percentage rates work. A mortgage APR reflects the total cost of borrowing and includes costs, like mortgage loan interest, mortgage points and other lender fees. The mortgage loan APR will usually be higher than the interest rate because it includes costs and fees, as well as interest. Knowing how to differentiate between mortgage interest rates and APRs can help you select the best loan for your needs.

Read Also: Can A Locked Mortgage Rate Be Changed

How Banks Determine Your Interest Rate

Researching a lender’s interest charges is an important first step in comparing APR vs. interest rate. Lenders set their own interest rates and fees within legal limits. And because different borrowers get different rates, your interest rate might be different from a lender’s advertised rate.

The interest rates advertised online are reserved for customers with the highest credit scores. If that’s not you, the rate you’re offered will be based on a number of factors:

- Upfront fees

- Down payment amount

- Length of the loan

- The type of credit you apply for

That last point is especially important. For example, a normally carries a higher interest rate. Mortgage and auto loan interest rates tend to be lower.

Mortgage Apr: How Does It Affect Your Homes Cost

Your mortgages APR reflects the total cost youll pay to borrow the money expressed as an annual rate. It includes interest, lender fees, points, and more.

Edited byChris JenningsUpdated October 12, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

After you apply for a mortgage, youll see something called APR listed on your loan estimate. This number measures the costs you can expect to pay for the loan expressed as a yearly percentage rate. Because it reflects total costs and not just interest paid APR is a good way to compare mortgage offers from different lenders.

Heres what you should know about mortgage APR:

Don’t Miss: How Much Money Should You Spend On Mortgage