Is Pmi Worth It

The answer to that question largely depends on how quickly home prices are rising in the area where you want to purchase. What PMI essentially buys you is the ability to cash in on appreciating values before youve saved the lump sum needed for a 20% down payment.

Of course, it brings other homeownership benefits, too. But, from a financial standpoint, its that early ability to benefit from home price inflation thats key. Suddenly, you see rising real estate prices as a plus, rather than something to watch with dread.

Pmi Return On Investment

Home buyers often try to avoid PMI because they feel its a waste of money.

In fact, some forgo buying a home altogether because they dont want to pay PMI premiums.

That could be a mistake. Data from the housing market indicates that PMI yields a surprising return on investment.

Imagine you buy a house worth $233,000 with 5% down.

The PMI cost is $135 per month according to mortgage insurance provider MGIC. But its not permanent. It drops off after five years due to increasing home value and decreasing loan principal.

Remember, you can cancel mortgage insurance on a conventional loan when your mortgage balance falls to 80% of your homes purchase price.

The homeowners snapshot at the end of year 5 looks like this:

- Current value: $276,000

- Principal remaining: $200,000

In five years, the home has appreciated $43,000, and the final PMI cost is $8,100. Thats a 5-year return on investment of 530%.

Its nearly impossible to make that kind of return in the stock market, retirement account, or another financial instrument.

PMI, then, can be viewed as an investment a very sound one and not a waste of money.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Don’t Miss: Are Mortgage Discount Points Worth It

What Is Private Mortgage Insurance

Private mortgage insurance is designed to protect a lender in case of a default on the loan. It is generally required by the creditor in case the borrower has less than 20% down payment percent from the home price, which means it is mandatory when the loan amount divided by the property value is greater than 80.00%.

Our PMI calculator takes account of the LTV ratio explained below.

You May Like: Where To Buy Mortgage Insurance

Cost Versus Benefit Of Private Mortgage Insurance

Todays homeowners are building wealth like few times in history.

According to the Federal Housing Finance Agency , home values in the third quarter of 2020 were up more than 7% from the same period one year prior.

The typical U.S. homeowner is earning $13,000 per year.

Whats more, home value appreciation is nothing new. FHFA says home prices have increased by about 5% per year since 2012. And home values have increased every quarter dating back to 2011.

That means a renter who bought the average home four years ago has gained more than $40,000 in home equity to date. Some have earned much more six figures in some cases.

Whats surprising, then, is advice saying you should buy a home only when you have a 20% down payment.

Putting 20% down is less risky than making a small down payment, but its also costly.

Even strong opponents of mortgage insurance find it hard to argue against this fact: PMI payments, on average, yield a huge return on investment.

PMI return on investment

Home buyers avoid PMI because they feel its a waste of money.

In fact, some forego buying a home altogether because they dont want to pay PMI premiums.

That could be a mistake. Data from the housing market indicates that PMI yields a surprising return on investment.

Imagine you buy a house worth $233,000 with 5% down.

Remember, you can cancel mortgage insurance on a conventional loan when your mortgage balance falls to 80% of your homes purchase price.

Also Check: Does Rocket Mortgage Sell Their Loans

Recommended Reading: How To Become A Mortgage Loan Officer In Arizona

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

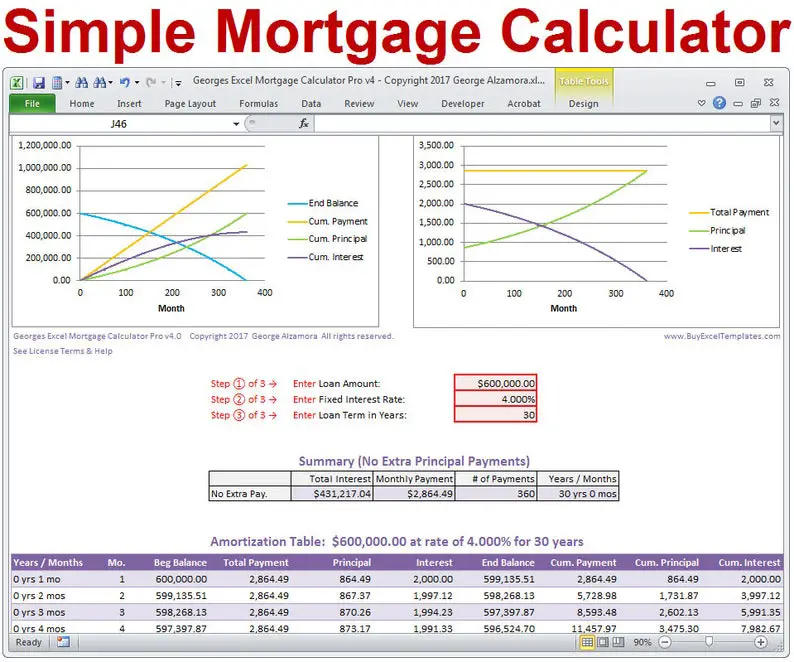

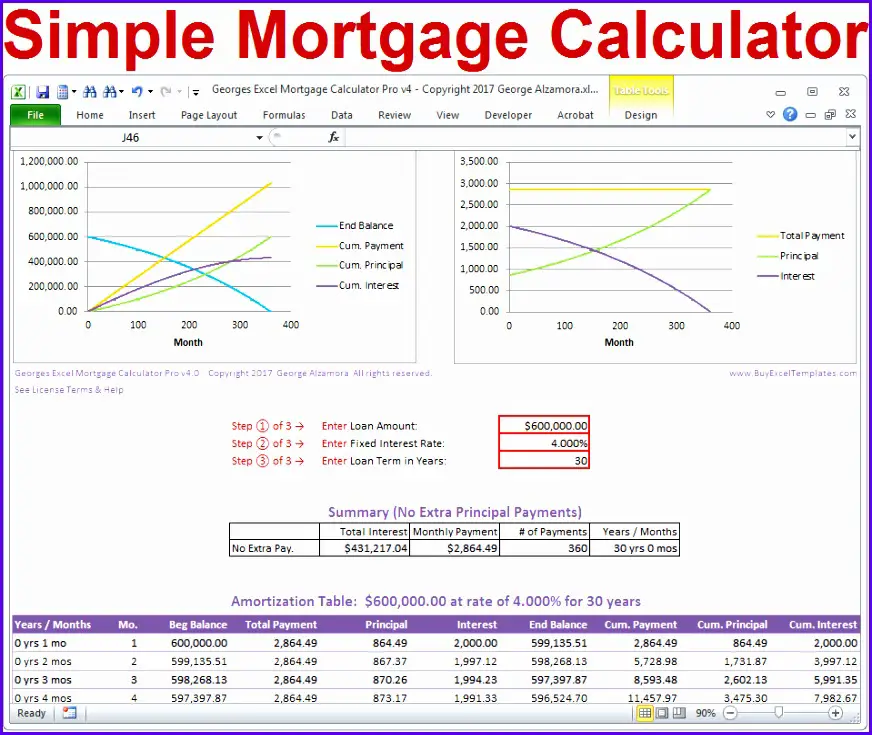

How To Figure Out Your Entire Mortgage Insurance Payment

The key figure you need to know before signing a mortgage loan agreement is how much your total monthly payments will be.

Youll have to allow more for maintenance and repairs. And you may need to add some additional monthly costs, such as homeowners association fees and extra insurances if the property is susceptible to flooding, earthquakes, hurricanes or other special risks.

But, for most homebuyers, the costs they need to know are:

- Principal and interest

- Homeowners insurance

Luckily, The Mortgage Reports has a suite of mortgage calculators that will give you a monthly payment breakdown. You can even add in your HOA dues manually. Theres one for conventional loans and three others specifically for FHA, USDA and VA loans, as well as a refinance calculator.

Read Also: Do Usda Loans Have Mortgage Insurance

A Guide To Private Mortgage Insurance

Katie Miller is a consumer financial services expert. She worked for almost two decades as an executive, leading multi-billion dollar mortgage, credit card, and savings portfolios with operations worldwide and a unique focus on the consumer. Her mortgage expertise was honed post-2008 crisis as she implemented the significant changes resulting from Dodd-Frank required regulations.

Its a myth that you need to put down 20% of a homes purchase price to get a mortgage. Lenders offer numerous loan programs with lower down payment requirements to fit a variety of budgets and buyer needs. If you go this route, though, expect to pay for private mortgage insurance . This added expense can drive up the cost of your monthly mortgage payments and, overall, makes your loan more expensive. However, its almost unavoidable if you dont have a 20% or more down payment saved up.

Private Mortgage Insurance

How To Calculate Your Pmi Cost

The PMI calculator starts by asking for the price of the home you want to buy and your anticipated down payment amount to calculate a down payment percentage. If this percentage is under 20%, its likely that youll have to pay for private mortgage insurance.

With this and other loan details, the calculator estimates your monthly PMI cost. The calculator also estimates the total amount youll pay for mortgage insurance until you have 20% equity and can get rid of PMI.

Follow these steps to use the calculator.

Enter the amount you plan to spend on a home. For the most accurate results, enter the amount for which youre already pre-qualified or been preapproved, but you can also enter your best guess of how much you can afford.

Enter a down payment amount. This is the amount of cash you plan to pay upfront for the home.

Enter an interest rate. If you dont yet have a personalized interest rate quote from a lender, click the link underneath the entry field to see todays average mortgage rate and use it as an estimate.

Enter a mortgage insurance rate. When shopping lenders, ask for their typical PMI rates. If youre not sure what your mortgage insurance rate will be, choose a rate somewhere in the middle of the typical range 0.58% to 1.86%.

Enter a loan term. The 30-year term is the most common, especially among first-time home buyers. With a 15-year mortgage, you’ll pay off the loan faster and pay less interest, but have higher monthly payments.

Lenders usually require

Also Check: How Much Of Your Salary Should Your Mortgage Be

What Is Pmi Or Private Mortgage Insurance

PMI is a type of mortgage insurance that protects the lender in case you default on your mortgage.

Homebuyers who use a conventional mortgage with a down payment of less than 20 percent usually are required to get private mortgage insurance. This is an added annual cost about 0.3 percent to 1.5 percent of your mortgage balance, although it can vary.

According to Freddie Mac, each month, borrowers generally might pay between $30 and $70 in PMI for every $100,000 of loan principal. How much you pay depends on your credit score, your mortgage and loan term, and the amount of your down payment. Your PMI is recalculated each year based on the current size of your loan balance, so the premium will decrease as you pay down the loan.

Private mortgage insurance protects the lender from the elevated risk presented by a borrower that made a small down payment, says Greg McBride, CFA, Bankrates chief financial analyst. Once the borrower has a sufficient equity cushion, the PMI will be removed.

PMI doesnt apply to all mortgages with down payments below 20 percent. For example, government-backed FHA loans and VA loans with low or zero down payment requirements have different rules. Private lenders sometimes offer conventional loans with small down payments that dont require PMI however, there are typically other costs, such as a higher interest rate, to compensate for the higher risk.

How To Stop Paying Mortgage Insurance

Homebuyers can often forgo paying private mortgage insurance. How? Avoid PMI altogether by making a downpayment of at least 20 percent of the purchase price. Review your savings and consult a lender to determine the largest affordable down payment. If unable to meet the 20 percent mark and PMI is required, the good news is that it does not last forever.

Following are multiple ways to reduce or even remove PMI payments over time:

Read Also: How To Calculate Dti Ratio For Mortgage

Calculate Your Equity To Get Rid Of Pmi

Iâll be right up front with it. PMI is the biggest ripoff in real estate⦠but not necessarily for the reason youâd think. PMI itself makes sense. If you canât pay for a standard 20% down payment, your bank will make you pay for PMI to insure their loan against default. So, PMI is a reasonable concept overall, but itâs still a huge ripoff.

After the price appreciation since 2012, millions of homeowners have more than 20% equity in their home and could have their PMI removed or refinance into a new loan without PMI. But⦠theyâre still paying it. Use this PMI removal calculator to see if you can remove yours.

If one of the bars turns green and says âYesâ, you should be able to remove your PMI. If they are both red, youâll see how much more equity you have to build before it can be removed. Here it is, the remove PMI calculator, or more accurately, the âWhen can I get rid of PMI calculatorâ.

Hopefully, you can remove your private mortgage insurance PMI? Or, refinance into a loan without PMI? Or, at least you have some better context for when does PMI go away? Or, when PMI will be eliminated based on the current value of your home. Iâll let you know how to actually go about removing your mortgage insurance premiums below, but I wanted to add a little context from my mortgage insurance experience first.

Fhas Mortgage Insurance Premium Through The Years

The FHA has changed its MIP multiple times in recent years. Each time the FHA raised its MIP, FHA loans became more expensive for borrowers. Each increase also meant some prospective borrowers werenât able to qualify for or afford the higher monthly mortgage payments due to the MIP.

In January 2015, the FHA reversed course and cut its MIP to 0.85 percent for new 30-year, fixed-rate loans with less than 5 percent down. The FHA projected that this decrease would save new FHA borrowers $900 per year, or $75 per month, on average. The actual savings for individual borrowers depends on the type of property they own or purchase, their loan term, loan amount and down payment percentage.

Changes in FHAâs MIP apply only to new loans. Borrowers whoâve closed their loans donât need to worry that their MIP will get more expensive later.

Recommended Reading: What Is Coe In Mortgage

Don’t Miss: How Much Of Your Monthly Income Should Go To Mortgage

When Is Pmi Necessary

Whether purchasing or refinancing a home, lenders mandate borrowers pay PMI if they cannot meet their financial benchmarks.

Most conventional lenders require a down payment of at least 20 percent of the purchase price when buying a home. If less than 20 percent, PMI is often necessary. To determine a down payment percentage, divide the estimated upfront payment amount by the property’s price.

When refinancing a home loan, most conventional lenders require an LTV ratio of less than 80 percent. If this percentage surpasses 80, the borrower may have to pay PMI. To determine the LTV ratio, divide the new mortgage amount by the home’s fair market value.

Cost Of Private Mortgage Insurance

The cost of your PMI premiums will depend on several factors.

- Which premium plan you choose

- Whether your interest rate is fixed or adjustable

- Your down payment or loan-to-value ratio

- The amount of mortgage insurance coverage required by the lender or investor

- Whether the premium is refundable or not

- Your credit score

- Any additional risk factors, such as the loan being for a jumbo mortgage, investment property, cash-out refinance, or second home

In general, the riskier you look according to any of these factors , the higher your premiums will be. For example, the lower your credit score and the lower your down payment, the higher your premiums will be.

According to data from Ginnie Mae and the Urban Institute, the average annual PMI typically ranges from .55% to 2.25% of the original loan amount each year. Here are some scenarios: If you put down 15% on a 15-year fixed-rate mortgage and have a credit score of 760 or higher, for example, you’d pay 0.17% because you’d likely be considered a low-risk borrower. If you put down 3% on a 30-year adjustable-rate mortgage for which the introductory rate is fixed for only three years and you have a credit score of 630, your rate will be 2.81%. That happens because you’d be considered a high-risk borrower at most financial institutions.

Read Also: How To Process A Mortgage Loan Training

Split Premium Mortgage Insurance

This mi program is a blend between the single plan and the monthly plan. There is a modest upfront charge and a reduced monthly premium. As with the single premium, the borrower is permitted to finance the upfront premium, or a third party can pay it. The monthly premium decreases as the upfront payment increases.

| Fixed-Rate 30-Year NON-REFUNDABLE For loans with level payments for the first 5 years |

|---|

| UPFRONT .75% |

How To Use Hsh’s Fha Mortgage Calculator

Comparing low-downpayment-mortgage options is at the heart of this calculator. To start, add in the dollar amount of the home you hope to buy in the field for “purchase price.” We supply a suggested interest rate for you, but if your rate is different, simply change it in the interest rate field.

Choose your downpayment from the dropdown. Using your downpayment percentage, the calculator returns the dollar amount you’ll need, which is based on the purchase price you entered.

For FHA programs, financing the up-front mortgage insurance premium is common to help buyers conserve funds. If you prefer, you can pay the up-front MIP out-of-pocket for about 1.75% of the loan amount you are borrowing. In the dropdown, select “Yes” to finance it or “No” to pay it out-of-pocket.

For “product choice,” please select among the five common options. Fixed-rate mortgages longer than 20 years should select “FRM 20.01+ yrs” this includes costs for 30-year FRM. For FRMs with terms of 20 years or less, select “FRM 20.01- yrs”. Three varieties of hybrid adjustable rate mortgages can also be selected, including those with 5-, 7- and 10- year fixed-rate periods. In each of the ARM options, the interest rate remains fixed for the initial loan period, say five years, then adjusts every year for the remainder of the 20-year loan period.

Once you’ve made your selections, costs for your FHA mortgage appear automatically on the right side of the screen.

Purchase price

Read Also: How Does Selling A Home With A Mortgage Work

Option : Reappraise Your Home If It Has Gained Value

In a hot real estate market, your home equity could reach 20 percent ahead of the loan payment schedule. In this case, it might be worth paying for a new appraisal. If youve owned the home for at least five years, and your loan balance is no more than 80 percent of the new valuation, you can ask for PMI to be cancelled. If youve owned the home for at least two years, your remaining mortgage balance must be no greater than 75 percent.

Appraisals for a single-family home typically cost between $250 and $500, depending on your area. Some lenders might be willing to accept a broker price opinion instead, which can be a substantially cheaper option than a professional appraisal. On the flip side, professional appraisals are highly regulated and provide an unbiased assessment.

Who this affects: Borrowers who live in areas that are particularly red-hot might have seen their home values shoot up in the last couple years. In fact, the value might have increased enough to bump you out of the PMI range. If this is the case, its time to talk with your lender about getting a new appraisal and potentially cancelling your PMI requirement.