Conventional Loan Limits Explained

Most conventional loans are conforming loans, meaning they conform to certain requirements set by the Federal Housing Finance Agency .

Among those requirements are loan limits, or the maximum amount for which a lender can approve a borrower in a given area.*

The FHFA sets limits according to the median home price in an area, so you can actually see serious differences even within the same state.

For instance, a home near Los Angeles is eligible for a higher conventional loan than in northern California’s Humboldt County. Thatâs because home prices are different in these areas.

Any time youâre buying in an expensive market, such as Los Angeles, San Francisco, Denver, or other major metropolitan areas, loan limits could be higher.

The FHFA sets loan limits annually, which means that if home prices go up, so will the limits.

And in 2022, loan limits went up more than they have in any time in history. Read or play to learn more.

Specifics Of The New Loan Limits

The maximum loan limit is based on the size of the property. Fannie Mae and Freddie Mac both allow financing of single-family homes as well as multi-unit buildings. Here is a chart of the loan amounts based on the size of the building

- Single unit home $726,200

- 2-unit building $929,850

- 3-unit building $1,123,900

- 4-unit building $1,396,800

These are in effect for the majority of areas across the country.

High-cost areas, like New York City and Los Angeles, enjoy an even bigger boost in loan limits. Websites for both Fannie Mae and Freddie Mac have lists of the designated areas available for the higher cost loans.

Here is the breakdown by units for high price locations.

- Single unit home $1,089,300

- 2-unit building $1,394,775

- 3-unit building $1,685,850

- 4-unit building $2,095,200

Can A Second Mortgage Eliminate Pmi

A loan option that is rising in popularity is the piggyback mortgage, also called the 80-10-10 or 80-5-15 mortgage.

This loan structure uses a conventional loan as the first mortgage , a simultaneous second mortgage , and a 10% homebuyer down payment. The combination of both loans can help you avoid PMI, because the lender considers the second loan as part of your down payment. A piggyback loan can make homeownership accessible for those who may not yet have saved a down payment.

For an in-depth look at these loans, see our piggyback loan blog post.

You May Like: How To Check Daily Mortgage Interest Rates

Minimum Down Payment For A Conventional Loan

Its a common myth that you need a 20% down payment for a conventional loan. You can actually get one with as little as 3% down.

All told, there are six major conventional loan options that can range from 3% to 20% down.

Conventional loan down payment requirements:

From the 10% down piggyback loan to 3% down HomeReady and Conventional 97 loans, low-down-payment options not only exist but are extremely popular with todays conventional loan borrowers.

So, how do you qualify for a conventional loan? Simply by meeting requirements set out by Fannie Mae and Freddie Mac.

Once you do that, you can join the club of conventional loan homeowners who make up the majority of the market.

Who Can Qualify For A Conventional Home Loan

In general, any borrower with solid credit and some money for a down payment will satisfy conventional loan qualification requirements.

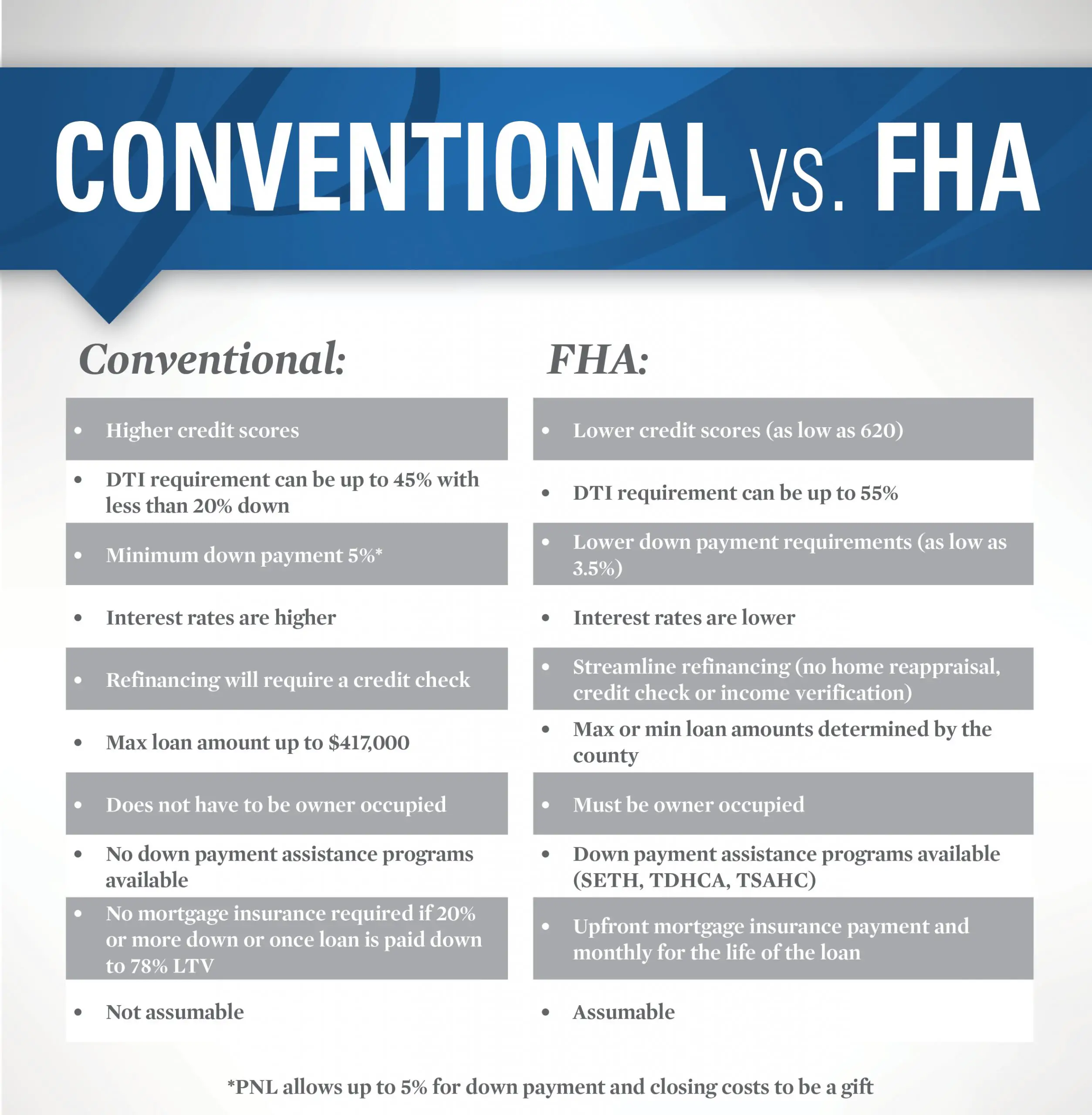

However, because conventional loans arent insured or guaranteed by the government, their eligibility requirements for borrowers are usually tougher to meet than the requirements for government-backed mortgages. These include FHA loans, which are insured by the Federal Housing Administration VA loans, guaranteed in part by the Department of Veterans Affairs and USDA loans, the program run by the U.S. Department of Agriculture.

Also keep in mind that conventional lenders are free to enforce requirements that are stricter than the guidelines set by the FHFA, Fannie and Freddie. If youre applying for a conventional mortgage after foreclosure or bankruptcy, for example, you might have more trouble qualifying.

Don’t Miss: How Do I Get My Mortgage Fico Score

How Much Can I Borrow

One of the most common questions asked by buyers when starting the home buying process is “How much of a mortgage can I afford?” Obviously, the answer to this question will directly impact the price range of homes that you can consider when searching the market. The answer to this question is not set in stone, though, as it only takes into account your current circumstances. Interest rates or house prices could fall, or you could get a promotion and a pay rise, which could vastly increase the amount you are able to borrow. However, there are guidelines that you can follow in order to figure out how much of a mortgage you can afford and qualify for, which is where the Maximum Mortgage Calculator comes in. There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. These are your monthly income and your monthly obligations .

Total monthly income from all sources. All income should be entered before taxes.

Jumbo Loan Limits By State

Jumbo loan limits dont always vary by state they vary by the counties within those states. To determine whether you need a jumbo loan, start by looking at the state where you want to buy.

Keep in mind that what qualifies as a jumbo loan might look very different in the county just a few miles away, with the exception of Hawaii and Alaska, where the jumbo loan limit is the same no matter where you go.

Read Also: Why Is Interest So High On Mortgage

Also Check: Is Citizens Bank Good For Mortgages

Applying For A Conventional Loan In Texas

Applying for a conventional loan in Texas is simple once you have the right documents and personal information collected.You can fill out an applications at most banks and credit unions. These days, many lending institutions also allow you to apply online. Regardless of how you apply, you will need to prove you meet the minimum standards to qualify for the loan.In most applications, you will prove your loan worthiness by a mixture of your credit score, your down payment amount, and your financial ability to repay the loan.The lender will determine your financial ability with pay stubs to showing consistent employment, up to two years of bank statements, a list of assets, and a list of any debts you currently owe.You do not need to supply a credit report as the lender will request their own. However, it is highly recommended you pull a credit report ahead of time. This allows you to correct any misinformation before applying for a loan.Each lender often has different standards and fees regarding their loans.Compare and research various lenders to ensure youre getting the best offer for your financial situation.

Jumbo Vs Conventional Loans

Are you looking to buy a house? Before you start daydreaming about your new home, you need to consider which type of mortgage you’re going to use to buy it. You could opt for a regular conforming mortgage. But what if you want to buy an expensive home? For that, you probably need a jumbo mortgage.

Jumbo mortgages are large loans that fall above the federal loan limit. These loans are typically harder to qualify for than conforming loans, but they can offer competitive interest rates. Theyre also a convenient way for borrowers to secure the money they need to purchase expensive homes.

You May Like: Who Pays Mortgage Broker Fees

Fha Mortgage Loan Limits

Loans that are guaranteed or insured by the Federal Housing Administration also have mortgage loan limits. Even though the FHA is not related to Fannie Mae or Freddie Mac, they usually use the same loan limit amounts.

As of January 2023, the new loan limit for FHA mortgages for properties in San Diego County is $977,500. This is $97,750 higher than the 2022 limit of $879,750. To check the limit outside of San Diego County, you can check the FHFA list of 2023 conforming loan limits.

FHA mortgage loan limits vary widely, as low as $726,200 in most areas, and as high as $1,089,300 in other areas.

How Many Conventional Loans Can I Have At One Time

The obvious answer to this question is as many as you can reasonably afford, but you can technically have up to ten conventional mortgages in your name. If youre interested in real estate investing, you may be able to use alternative financing methods to purchase several properties without having to apply for multiple conventional loans.

Read Also: How Does Refinancing Mortgage Affect Credit Score

Why Are Conventional Loan Limits Important

2023s Conventional Loan Limit increase to $726,200 continues a 7 year trend. In fact, prior to 2017s ice breaking loan limit hike, Conventional loan limits stalled at $417,000 .

This re-established higher loan amount trend supports healthy Real Estate. In fact, 2023s $726,200 limit is the strongest signal of that in years. This matters as most consumers do not pay cash for their home AND JUMBO loans are harder to qualify for than Conventional.

According to the National Association of Realtors88% of all recent buyers used a home loan to buy their home. NAR also found that 97% of recent home buyers under age 38 mortgaged their home purchase.

88% of recent buyers financed their home purchase. 97% of buyers 38 years and younger financed. 61% of all buyers used conventional loans to finance their home.

National Association of Realtors Research Group, April 2019

Rising home values synced with Conventional loan limits grant more home-buyers greater access to affordable Conventional home loan products. Conventional home loans offer lower down payment options and more flexible underwriting than JUMBO mortgages .

Recommended Reading: What Is A 10 Year Arm Mortgage

Loan Limits For Florida Alabama Tennessee And Texas Have Increased

2023 loan limits are on the rise, but its not the same maximum mortgage amount for all programs. In fact, USDA, VA, FHA, and Conventional loan programs each have their own limits and qualifying parameters.

In todays post, we will quickly review the 2023 Mortgage Loan Limits for USDA, VA, FHA, and Conventional loan.

Plus, in order to help you stay organized, weve created a FREE Loan Comparison Chart for you to download. It compares each loan programs side-by-side and is contained in one simple chart

You May Like: How To Refinance A Seller Financed Mortgage

Summing Up 2023 Conforming Loan Limits

Thankfully the economy of the United States has been on an upward climb for several years. Wages are increasing and unemployment is really low, leading to more demand for houses. This demand has increased home prices and kept mortgage rates low. The new loan limits should open the doors of owning a home to many more borrowers and hopefully keep the economy chugging along.

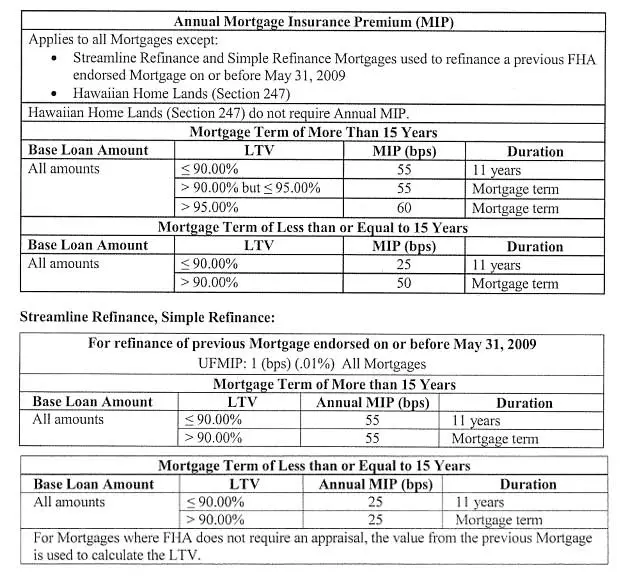

The following will compare an FHA loan vs Conventional mortgage, not to show that one is better than the other, but to highlight the strengths of each mortgage.

What Are Conforming Loan Limits

One big rule mortgages must follow in order to be conforming is the conforming loan limit, a cap placed on how large a loan can be. The maximum dollar amount FHFA guidelines allow you to borrow for a residential mortgage adjusts each year based on the median home value in each U.S. county and varies depending on the propertys location.

The 2023 conforming loan limit for one-unit properties in most of the U.S. is $726,200, but can go up to just over a million $1,089,300 in high-cost areas.

Read Also: Which Bank Is Best For Mortgage

S New Conventional Loan Limit: $726200

FHFA announced new conforming loan limits for 2023, and most buyers can borrow up to $726.2K without a jumbo loan and its over $1M in some areas.

WASHINGTON Fannie Mae and Freddie Mac which back a majority of U.S. home loans have a new lending cap in 2023.

The Federal Housing Finance Agency announced that the conforming loan limit values for mortgages to be acquired by Fannie Mae and Freddie Mac in 2023 will go up $79,000 to $726,200 in most areas of the U.S for one-unit properties. The cap in those areas this year is $647,200.

The cap varies by county, however. FHFA says two U.S. counties will have a lower cap, and additional areas will have a higher cap that, in 2023, will rise about $1 million for the first time up to $1,089,300 for one-unit properties. FHFA says about 3.3% of counties 100 out of more than 3,000 are considered high-cost markets.

In Florida, the higher conforming cap largely applies only for some Monroe County residents.

The higher cap applies in areas where 115% of the local median-home value exceeds the baseline conforming loan limit. The Housing and Economic Recovery Act of 2008 includes a calculation to create a higher cap in those areas. In addition, special statutory provisions create different loan limits for Alaska, Hawaii, Guam and the U.S. Virgin Islands. In these areas, the baseline loan limit will also be $1,089,300 for one-unit properties.

Can The Seller Contribute More Than Actual Closing Costs

No. The sellers maximum contribution is the lesser of the sales price percentage determined by the loan type or the actual closing costs.

For instance, a homebuyer has $5,000 in closing costs and the maximum seller contribution amount is $10,000. The maximum the seller can contribute is $5,000 even though the limits are higher.

Seller contributions may not be used to help the buyer with the down payment, to reduce the borrowers loan principal, or otherwise be kicked back to the buyer above the actual closing cost amount.

Read Also: What Is The Current National Mortgage Interest Rate

Read Also: Do You Have To Pay Fees To Refinance A Mortgage

What Are The Conforming Loan Limits For 2023

The conforming loan limit for 2023 is $726,200 in most parts of the US, a $79,000 increase from the previous year’s baseline limit.

In high-cost areas, conforming loan limits may go up to a maximum of $1,089,300. This is the first time the conforming loan limit ceiling has risen above $1 million. If you live in a high-cost area, you can use the county-by-county guide on the FHFA website to see what the limit is in your city.

In Alaska, Hawaii, Guam, and the US Virgin Islands, the baseline conforming loan limit is $1,089,300.

These are the borrowing limits for single-unit homes, but you can borrow more for two-unit, three-unit, and four-unit homes.

Conventional Loan Limits Faqs

Will conventional loan limits increase in 2022?

Yes, 2022 conforming limits increased on November 30, 2021. Limits are set annually based on national home prices, which skyrocketed in 2021. As a result, the base nationwide loan amount increased nearly $100,000, or 18%, the largest dollar increase in history. The FHFA compares home prices reported in its House Price Index during the third quarter versus the third quarter of the previous year. In 2021, home prices had increased more than 18% compared to 2020, which lifted conforming limits by $98,950. There could be additional increases in 2023, based on home price appreciation during 2022.

Did 2022 conventional loan limits recently increase to $625,000?

No. Many lenders started offering conforming loans up to $625,000 starting in late-2021 in anticipation of a large increase for 2022. The official limit was still $548,250 when lenders began rolling out temporary higher limits. Lenders planned to hold these loans on their books until January, as they predicted that they could sell them to Fannie Mae or Freddie Mac after the official loan limit announcement in November 2021.

What is a conforming loan?

A conforming loan is a conventional mortgage that adheres or conforms” to loan limits and other guidelines set by the Federal Housing Finance Agency . These loans must meet the underwriting requirements of Freddie Mac and Fannie Mae, the government-sponsored enterprises that insure conforming loans.

Recommended Reading: What Is The Difference Between Mortgage Interest Rate And Apr

Characteristics Of A Jumbo Loan

Dont see jumbo loans as a workaround for mortgage issues. Compared with conforming or government-backed loans, they often come with:

Because you usually negotiate your deal individually, you may be able to create some wiggle room for these. For example, if youre putting down 50% of the homes market value, you might get some leeway on your credit score or DTI.

The Bottom Line: Remember Loan Limits If Youre Purchasing A High

If you plan on purchasing your home with a mortgage and have a sizable home buying budget, its important to understand what the maximum loan limits are in your county. While other loan types, such as jumbo loans, can remove the barrier of having to stay within a certain price limit, that means forgoing the benefits of getting a conforming loan.

If youre wondering what your own personal loan limit should be, check out our advice on how to determine how much house you can afford.

Find out if a Jumbo loan is right for you.

See rates, requirements and benefits.

Recommended Reading: What Is The Mortgage Pre Approval Process

Jumbo Vs Conventional Mortgages: An Overview

Jumbo mortgages and conventional mortgages are two types of financing borrowers use to purchase homes. Both loans require homeowners to meet certain eligibility requirements including minimum , income thresholds, repayment ability, and down payments. Both are also mortgages issued and underwritten by lenders in the private sector, as opposed to government agencies like the Federal Housing Administration , the U.S. Department of Veterans Affairs , or the USDA Rural Housing Service .

Though they may serve the same purposeto secure a propertythese two mortgage products have several key differences. Jumbo mortgages are used to purchase properties with steep price tagsoften those that run into the millions of dollars. Conventional mortgages, on the other hand, are smaller and more in line with the needs of the average homebuyer. They also may be purchased by a government-sponsored enterprise such as Fannie Mae or Freddie Mac.