What Happens If You Cant Prove This

Those who cannot prove their income reliably over the past 2 years will be ineligible for a mortgage but can reapply once that information becomes available. If you find yourself in this category you have a few options. The simplest answer is you can choose to wait and reapply.

If a piece of real estate is necessary now, ome buyers have two options:

Verify that you have provided all sources of income. If you receive Social Security benefits, any type of interest income, have a second job or if you have a side hustle with income that can be verified, you can use these to help you qualify.

Consider applying for a mortgage with a spouse, family member or even a friend. Adding another person to your application may increase your chances of qualifying, as lenders will take both parties credit scores and incomes into consideration. Better chances of qualifying, splitting the costs of becoming homeowners and having another borrower helping you through the process are all benefits of owning a home with another person.

Having the right documentation can be the difference between qualifying for a mortgage and purchasing your own home or not. Before beginning your application, make sure you have the last 2 years W-2 forms, tax returns, pay stubs and any other proof of compensation, and verification from your employer that youll be employed next season.

The Future Of The Stress Test

Many applicants have already felt the wrath of the stringent rules of the mortgage stress test and have had their purchasing power reduced. As a result, the mortgage stress test rules have come under great scrutiny over the last year, and as such, there is mounting pressure on the OSFI to ease the rules.

While the intention of the rules was to ensure borrowers arent increasing their risk of defaulting and to slow down the housing market to ease skyrocketing prices, opponents suggest that the rules are simply too harsh.

Since the introduction of the new stress test rules, markets have certainly cooled down in many markets and interest rates have started to rise. Such a situation has prompted the OSFI to review the rules surrounding the stress test.

Loans Canada Lookout

How Much Income Do You Need For A Mortgage

To get mortgageapproved, its not just your job that matters your income matters, too.

However, the methods most mortgage lenders use to calculate income can put some borrowers at a disadvantage. This is because not all income may be counted as qualifying income.

Heres how most lenders view different types of income when it comes to mortgage qualifying:

| Type of income |

| Two years’ history of working both jobs simultaneously |

How salary is calculated for a mortgage

When your income is an annual salary, your lender divides your annual gross income by 12 months to determine your monthly income.

In general, you do not need to show a twoyear history especially for jobs which require specific training or background.

How bonuses are calculated for a mortgage

When you bring home an annual salary plus a bonus, your lender calculates your income in two parts.

First, your lender divides your annual salary by 12 months to determine your monthly income.

Then your lender looks at bonus income separately.

If you have received bonus income for at least two years, and the employer indicates that bonus income will continue, lenders can consider it qualifying income.

Underwriters normally divide your last two years of bonus income by 24 months to arrive at a monthly total.

However, as withany income, if lenders see that it has been dropping year-over-year, they maychoose to discount or even ignore this income.

How hourly income is calculated for a mortgage

You May Like: Rocket Mortgage Vs Bank

What To Provide To Your Lender Or Mortgage Broker

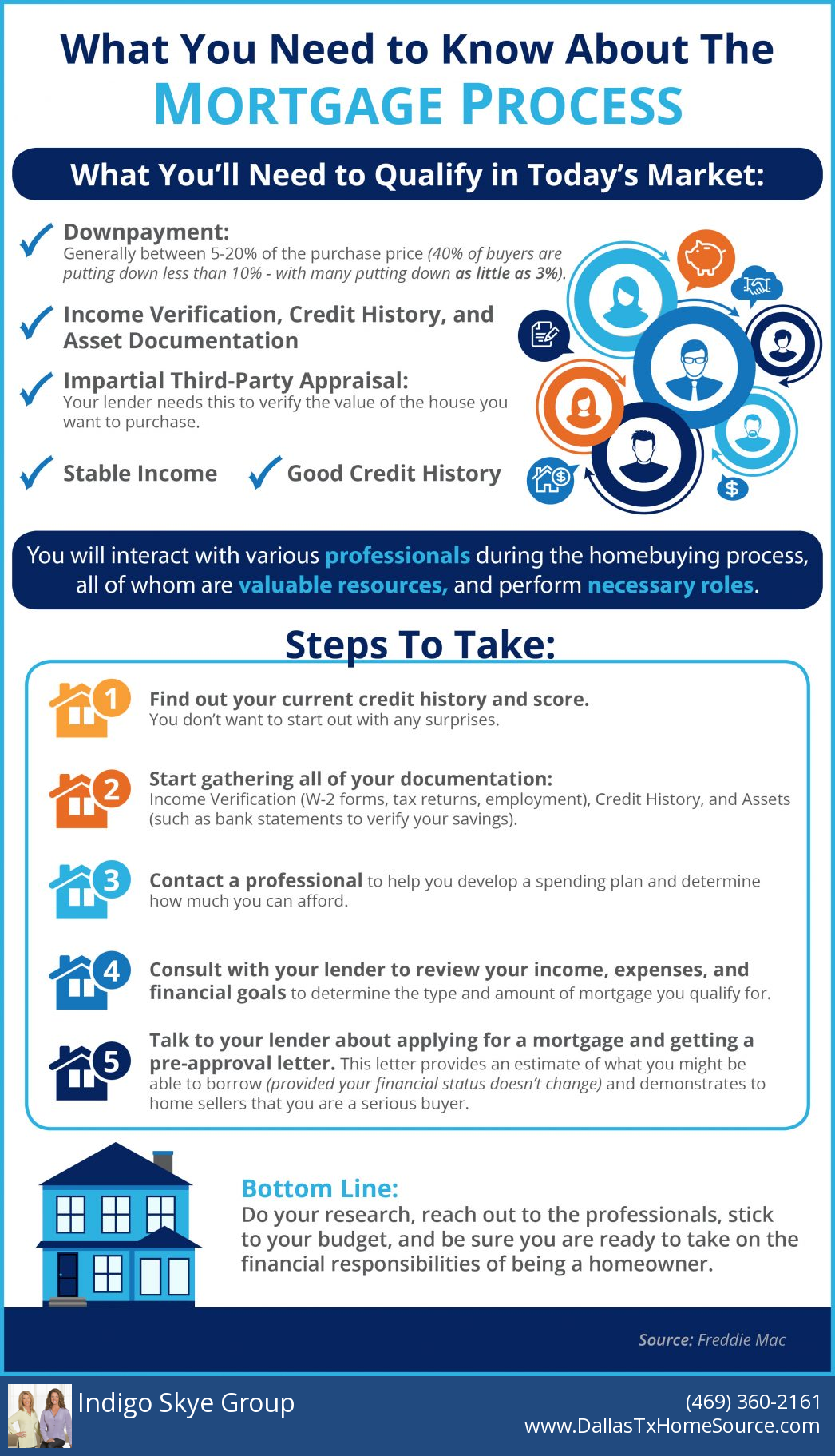

Before preapproving you, a lender or mortgage broker will look at:

- your assets

- your income

Youll need to provide the following:

- identification

- proof you can pay for the down payment and closing costs

- information about your other assets, such as a car, cottage or boat

- information about your debts or financial obligations

For proof of employment, you may have to provide:

- a proof of your current salary or hourly pay rate (for example, a recent pay stub

- your position and length of time with the employer

- notices of assessment from the Canada Revenue Agency for the past 2 years, if youre self-employed

Your lender or mortgage broker may ask you to provide recent financial statements from bank accounts or investments. This will help them determine if you have the down payment.

Your debts or financial obligations may include your monthly payments for:

Choosing A Closed Versus Open Variable

Variable-rate mortgages can be open or closed. The main differences between closed and open variable-rate mortgages are cost and flexibility. With an open mortgage, you can make additional mortgage payments without the fear of a prepayment penalty, but you pay for this flexibility with a higher interest rate. In contrast, closed mortgages often have a lower interest rate, but in exchange for the more favourable rate, your prepayment options will be more limited.

If you plan to stay in your home for at least five years and dont expect a financial windfall or huge income increase in the foreseeable future, a closed mortgage with a variable rate may be a good option. If youre not likely to come into lots of money , its worth taking advantage of the savings youd get with a closed variable-rate mortgage.

You May Like: Does Rocket Mortgage Sell Their Loans

Tips For Qualifying For A Mortgage

If youre considering a home purchase in 2022, heres a brief recap of which programs may be the best fit for your finances:

Qualifying for a conventional loan may be your best bet if:

- You have high credit scores

- You can make at least a 20% down payment

- You are eligible for the HomeReady or Home Possible loan programs

Qualifying for an FHA loan is a good choice if:

- You have credit scores between 500 and 619

- You have at least a 3.5% down payment and a 580 credit score

- You want to buy a two- to four-unit home with a 3.5% down payment

Qualifying for a VA loan may be a good option if:

- Youre an eligible military borrower

- You dont want to make a down payment

- You want to avoid mortgage insurance

Qualifying for a USDA loan is a good fit if:

- You havea low-to-moderate income

How Much Work History Do I Need For A Mortgage

4.5/5mortgageneedwork historyneededhistory

Likewise, how many years of work history do I need for a mortgage?

two years

Additionally, do you have to have two years work history to get a mortgage? Yes, there is a standard within the mortgage industry that borrowers should have at least two years of employment and income history. And yes, lenders frequently make exceptions to this requirement. It’s more of an industry norm something that most lenders adhere to most of the time.

People also ask, do I need 2 years of employment to buy a house?

There is a common misconception that the Department of Housing and Urban Development requires at least two years of steady employment, for all borrowers seeking an FHA loan. To be eligible for a mortgage, FHA does not require a minimum length of time that a borrower must have held a position of employment.

How many payslips do I need for a mortgage?

Lenders’ requirements for proof of income for mortgage applications will differ. Typically, earned income is evidenced in the following ways: Payslips: The standard requirements are three months’ payslips and two years’ P60s although there are lenders who will accept less than this.

Read Also: Can You Refinance A Mortgage Without A Job

Steady Salary Is What Matters

Kris Shenton, sales manager with Equity Prime Mortgage in Crofton, Maryland, said that a new job isn’t always a hurdle for borrowers. As long as the new job pays a salary, and isn’t based solely or largely on commissions, then an applicant should have little trouble qualifying for a mortgage, as long as that new salary provides a large enough income to support the borrower’s new monthly mortgage payments, Shenton said.

Complications can pop up when borrowers are relying on non-salary income, Shenton said. Borrowers who have gone from a salaried job to self-employment will need to show at least two years’ worth of tax returns to prove that their new income is stable and not likely to disappear any time soon. If they can’t provide these returns, lenders won’t consider these self-employment dollars as part of their qualifying income.

Borrowers who switch to a new job in a different field, might give lenders some pause. But most lenders are willing to overlook the job change as long, again, as the new job pays on a salary basis, Shenton said.

“If a borrower is switching a line of work, say the borrower was a scientist and is now a lawyer, then it’s case-by-case,” Shenton said. “Though typically, so long as it is a salaried position, you are fine to get a mortgage now.”

How To Prepare For The Mortgage Stress Test

Theres not much that can be done about the benchmark rate and the rate that your lender is charging you, but it would help to have a basic understanding of where you stand before you apply for a mortgage. Ideally, you should chat with a mortgage broker or real estate agent.

Lenders use a few key metrics when assessing borrowers to make sure theyd be able to pass the stress test and manage mortgage payments, including the gross debt service ratio and total debt service ratio .

Gross Debt Service Ratio

Your GDS represents the percentage of your pre-tax income thats required to pay all housing costs. Your lender will not only look at your stress-tested monthly mortgage payment, but the cost of all other monthly expenses, including condo fees , utility bills, and property taxes.

All of these costs will be added together and divided by your gross monthly income. Ideally, lenders want to see a percentage of no more than 32%.

Total Debt Service Ratio

All your debts will need to be factored into the equation as well, which is why lenders will also look at your TDS. This represents how much of your monthly income is needed to adequately cover your debts.

For more information about your debt service ratio, check this out.

That includes car payments, personal loans, student loans, credit cards, lines of credit, and so forth. When all of these are added up, your TDS should be no more than 42% of your gross monthly pay in order to get approved.

Pay Down Your Debt

Crunch Some Numbers

Don’t Miss: 10 Year Treasury Yield Mortgage Rates

How Much Interest Can Cost

Your interest rate and how its calculated affects your regular mortgage payments. A mortgage is usually a large amount of money. Therefore, small differences in the interest rate can have a significant impact on your costs.

Figure 1: Example of monthly mortgage payment for a mortgage of $300,000.00 with an amortization of 25 years at various interest rates

| Interest cost over 5 years | Interest cost over 25 years |

|---|---|

| 2.50% | |

| $73,097.91 | $233,738.23 |

Make sure your home is within your budget. Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, you may be overextending yourself.

Whats The Difference Between Part

Having part-time employment and receiving income from seasonal work might sound like the same thing because youre only working the job for part of the time, either based on the number of hours or times of the year. However, for the purposes of mortgage qualification, there can be a big difference.

A part-time job is defined as work you do for an employer throughout the year that happens to be less than a full-time, 40-hour work week. You can qualify for a mortgage with part-time work because the likelihood of receiving continuous income is high.

Seasonal workers do jobs that are only done at certain times of the year. For instance, if you provide seasonal help with farming or logging, or if you work at a retailer during the holiday rush, thats seasonal work. Its also seasonal work if youre a mall Santa or Easter bunny.

This is being written in the fall, so it seems appropriate to mention that work at haunted houses or cider mills counts. The key difference is that part-time work can be done year-round and seasonal work is only done at certain times.

Read Also: Chase Mortgage Recast Fee

Do You Need A Job History To Buy A House

Technically, yes, a two-year job history is required to buy a house. This can make mortgage approval difficult for first-time home buyers, or borrowers who had a recent job change.

The good news? There are a few ways around the two-year rule, said Simental on a recent episode of The Mortgage Reports Podcast.

When a lender is looking at your loan profile, they want to make sure that you are able to repay the loan, he explained. There are three main things that they look at: your credit, your income which includes your employment and your assets and what you have for a down payment.

In other words, lenders consider the full picture of your mortgage application. So its possible to make up for a shorter employment history by being strong in other areas, like your credit score or your assets.

The exact flexibility will depend on your specific situation, including your career path, your loan program, and the lender you choose. Lets dive into the details now.

Considering An Alternative Lender

If youre having trouble getting approved for a mortgage from a traditional financial institution or youre interested in avoiding the stress test, you may want to consider choosing an alternative lender. Loans Canada can help match you with a licensed mortgage specialist who can best meet your needs.

Also Check: Recast Mortgage Chase

Common Myths About Mortgages For Newcomers

Myth: Newcomers to Canada will not be able to obtain a mortgage from a large Canadian bank.

Fact: RBC understands that you and your family have unique needs and offers special mortgage programs designed for Newcomers.

Myth: Newcomers cannot qualify for a mortgage if they do not have a well-established credit history in Canada.

Fact: As long as you meet other eligibility requirements1, you may qualify for an RBC mortgage, even with limited Canadian credit history.

Myth: Newcomers canât qualify for a mortgage if they do not have at least two years of Canadian employment.

Fact: RBC offers special programs for Newcomers who are new to Canada and do not meet the traditional two-year employment tenure.

How Long Do I Have To Be In A Job To Get A Mortgage

Standard mortgage applications request a two-year work history. If youve been in your role for two years, then your mortgage process wont be impacted. But if youve been there for less than two years, then your lender will consider the following:

- Your qualifications and training

- Increases in pay and responsibility over time

- Work history within the same field

You should be prepared to explain to your lender why you changed jobs, and do list your qualifications for the new position.

Don’t Miss: Rocket Mortgage Loan Requirements

How Long Is Too Long

An extended absence is generally considered to be six months or more. This definition is used by the FHA, and thus is commonly used by lenders. In other words, a gap of less than six months may not significantly impact your loan application, whilst one of a year will likely cause problems.

Lenders will look at the two years before the gap to see if your employment was stable up until that point. Temporary disability is considered to be a gap, but lenders will look at your intent and ability to return to work. This also goes for maternity leave and similar.

How Many Years Of Income Do I Need To Get A Mortgage

By Brandon Cornett | March 24, 2014 | © HBI,

Reader question: I have heard that mortgage lenders typically want to see at least two years of steady income and employment for borrowers who are applying for a home loan. I have a small gap in employment, but I think I make plenty of money to qualify for a loan. The gap was due switching jobs, and it was only a couple of weeks. Aside from that, Ive been working steadily for more than ten years. How many years of income do I need to get a mortgage loan? Is there really a two-year rule, and if so are there any exceptions to it for well qualified borrowers?

Yes, there is a standard within the mortgage industry that borrowers should have at least two years of employment and income history. And yes, lenders frequently make exceptions to this requirement.

In fact, its not really a rule or requirement at all. Its more of an industry norm something that most lenders adhere to most of the time. It also varies from one lender to the next. So dont be discouraged by anything you read online. There are no hard-and-fast rules as to how many years of income you nee.

You May Like: How Does Rocket Mortgage Work

How Long After Starting A New Job Can I Buy A House

Even though starting a new job just before you apply for a mortgage might not be the best idea, it won’t always lead to automatic disqualification. Conventional mortgages and federal loan guarantee programs verify employment for the previous two years, but this doesn’t always require that it be with the same employer. In some situations, lenders also will overlook gaps in your employment history.