When Will You Break Even After Buying Mortgage Points

To determine if it’s a good idea to pay for points, compare your cost in points with the amount you’ll save with a lower interest rate and see how long it will take you to make your money back. If you can afford to pay for points, then the decision more or less boils down to whether you will keep the mortgage past the time when you break even. After you break even, you’ll start to save money. The break-even point varies, depending on your loan size, interest rate, and term.

Example. As in the example above, let’s say you get a 30-year loan of $300,000 with a 3% fixed interest rate. Your monthly payment will be $1,265. However, if you buy one point by paying $3,000, and your rate goes down to 2.75%, the monthly payment becomes $1,225. So, divide the cost of the point by the difference between the monthly payments. So, $3,000 divided by $40 is 75, which means the break-even point is about 75 monthsmeaning you’d have to stay in the home for 75 months to make it worth buying the point.

As you can see, the longer you live in the property and make payments on the mortgage, the better off you’ll be paying for points upfront to get a lower interest rate. But if you think you’ll want to sell or refinance your home within a couple of years , you’ll probably want to get a loan with few or no points. Check the numbers carefully before you pay points on a loan because you might not recoup the cost if you move or refinance within a few years.

Are Mortgage Points Tax Deductible

Because the cost of discount points represents prepaid interest, points are deductible for taxpayers who itemize. Though, the loan must be secured by your main home and meet some other criteria. You generally have to deduct them over the life of the loan though sometimes, you can deduct the points in the year you pay them. But you can usually only deduct points paid on up to $750,000 of mortgage debt .

Example. Say you take out a $1,000,000 mortgage loan and purchase one point for $100,000. You’ll only be able to deduct $75,000 the remaining $250,000 isn’t tax-deductible.

In some cases, the seller will agree to pay for points to incentivize a buyer. Points are deductible in this situation, too.

According to the IRS, origination fees are also tax-deductible, but points paid for items that are usually listed separately on the settlement sheet such as appraisal fees, inspection fees, and attorney fees, aren’t.

Should You Buy Mortgage Points

Whether you should buy points depends mostly on how long you plan to stay in the home.

Points can cost thousands of dollars upfront, adding to the cost of getting your mortgage. But because your interest rate is reduced, the money you save on monthly payments can eventually make up for the initial cost. After youve covered the cost of the points you paid at closing, all additional savings from the lower interest rate is extra cash in your pocket.

To figure out if buying points makes sense for you, calculate how long it will take you to cover the upfront cost based on how much you might save.

Say you want to borrow $200,000 for a house, with the upfront cost of a point at $2,000. Divide $2,000 by the amount you save each month thanks to reducing your interest rate to see how many monthly payments it will take for you to break even.

Since the specific amount you save varies based on your lender, youd need to calculate what your rate and monthly payment would be both with points and without. Lets look at an example.

Read Also: Do Any Mortgage Lenders Use Fico Score 8

Pay Attention To The Numbers

Because youre paying more up front, the reduced interest rate will only save you money over the long term. The longer you plan to own your new home, the better the chance that youll reach the break-even point where the interest you’ve saved compensates for your initial cash outlay. If you have a shorter-term plan, have limited cash, or would benefit more from a bigger down payment, paying points may not benefit you.

Your mortgage loan officer can help you decide whether paying points is an option for you.

Additional Ways To Lower Interest Rates Or Costs On Your Loan

Buying mortgage points isn’t the only way to lower your mortgage’s interest rate or how much you pay in interest overall. Here are some additional options you’ll want to look into:

- Shop lenders and loan types. It can pay to get offers from multiple mortgage lenders, as each lender may have its own method for determining the interest rate it will offer you. Additionally, your rate could depend on the type of mortgage you get and whether it has a fixed or adjustable rate. Shop around to see which ones you’ll qualify for and which will be best.

- Increase your down payment. While you’ll need to come up with extra cash for a large down payment, doing so could lead to a smaller loan amount and lower interest rate. Putting at least 20% down can also help you avoid paying for mortgage insurance, which can lower your monthly payment.

- If you can’t afford a higher upfront cost but could take on a larger monthly payment, a shorter repayment term can lead to a lower interest rate.

- Find a less expensive home. Buying a cheaper house is another way to reduce your monthly payment and down payment amount.

Once you have a mortgage, you may be able to refinance to get a lower interest rate. Or, if your lender allows it, you could make bimonthly payments to decrease how much interest accrues overall.

Recommended Reading: How To Get Approved For A Higher Mortgage

What Are Origination Fees

Why do so many lenders quote an origination fee? To get a true no point loan, they must disclose a 1% fee and then give a corresponding 1% rebate. Wouldnt it make more sense to quote a loan at par and let the borrower buy down the rate?

The reason lenders do it this way is because of the disclosure laws in the Dodd-Frank Act. If the lender does not disclose a certain fee in the beginning, it cannot add that fee on later. If a lender discloses a loan estimate before locking in the loan terms, failure to disclose an origination fee will bind the lender to those terms.

This may sound like a good thing. If rates rise during the loan process, it can force you to take a higher rate. Suppose you applied for a loan when the rate was 3.5%. When you are ready to lock in, the rate is worse. Your loan officer says you can get 3.625% or 3.5% with the cost of a quarter of a point . If no points or origination charges show up on your loan estimate, the lender wouldnt be able to offer you this second option. You would be forced to take the higher rate.

Are Mortgage Points Tax

Mortgage discount points, which are prepaid interest, are tax-deductible on up to $750,000 of mortgage debt. Taxpayers who claim a deduction for mortgage interest and discount points must list the deduction on Schedule A of Form 1040.

That generally isnt a problem for homebuyers, as interest on your mortgage often is enough to make it more beneficial to itemize your deductions rather than taking the standard deduction, says Boies.

However, unless you can meet a host of IRS requirements, you cant take a deduction for all of the points you paid in the same tax year. Each year, you can deduct only the amount of interest that applies as mortgage interest for that year. The points are deducted over the life of the loan, rather than all in one year.

Origination points, on the other hand, are not tax-deductible.

Points that are not interest but are charges for services such as preparing the mortgage, your appraisal fee or notary fees cant be deducted, says Boies.

Consult a tax professional if youre not sure what home-buying expenses are tax-deductible.

You May Like: How To Calculate Upfront Mortgage Insurance Premium

How To Buy Mortgage Points

You can buy mortgage points by making an arrangement with your lender before the loan closes. The fee for the points will be paid directly to the lender as part of your closing costs.

When you receive the Loan Estimate document for your mortgage, you’ll see the mortgage points separated as a line-item cost on the top left of page two. If your Loan Estimate shows that you’re paying points and you didn’t expect or want to, ask your lender about other options. They may be able to offer you a mortgage without points, but expect a higher interest rate in exchange.

Key Facts About Mortgage Points

The terms around buying mortgage points can vary significantly from lender to lender so consider the following carefully.

-

The lender and marketplace determine the interest rate reduction you receive for purchasing points so its never fixed.

-

Mortgage points and origination fees are not the same things. Mortgage or discount points are fees paid in addition to origination fees.

-

You can potentially receive a tax benefit from purchasing mortgage points. Make sure to contact a tax professional to learn how buying points could affect your tax situation.

-

Mortgage points for adjustable-rate mortgages usually provide a discount on the loans interest rate only during the initial fixed-rate period. Calculate the break-even point to determine if you can recoup what you paid for in points before the fixed-rate period expires.

-

Crunch the numbers if youre on the fence on whether to put a 20% down payment or buying mortgage points. If you choose to make a lower down payment, you may be required to carry private mortgage insurance so factor this additional cost because it could offset the interest savings earned from purchasing points.

Recommended Reading: How To Calculate What Mortgage You Can Qualify For

Want To Crunch The Numbers

Find out more about approaching the home buying process with confidence.

This content does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

About Mortgage Discount Points

Discount points are a common feature of mortgages, but they can be confusing for many borrowers. Just how do they work?

Discount points are a type of pre-paid interest. So by paying part of your interest up front, you can get a lower rate. And what you save in interest over the long haul can be a lot more than what you paid for the points up front. The question is, will you save enough to make it worth the initial cost?

The key is to calculate the break-even point how long it will take for your interest savings from a lower mortgage rate to exceed what you paid for your discount points. If you can recoup your costs in five years or so, that’s often a good deal.

A big consideration is how long you expect to have the mortgage. If you sell the home or refinance the mortgage before reaching your break-even point, you’ll have lost money. Or if you do so only a year or two after reaching it, your savings might not be enough to make it worthwhile.

Discount points work best for someone who expects to stay in their home and not refinance for a long time. Over 20-30 years, the savings can be substantial in the tens of thousands of dollars. However, if it takes a long time to reach your break-even point, say 10-15 years, you have to ask yourself whether the small savings you’ll realize each month are worth the trouble, even if you expect to stay in the home longer than that.

Also Check: What Changes Mortgage Interest Rates

Bottom Line: Mortgage Points

There are a lot of factors that go into whether or not you should purchase mortgage points to beat down the interest you pay over the life of the loan.

Before settling for one, you should do the math, assess your financials and future housing plans before you close on the mortgage.

More importantly, you should find out your break-even point and the possibility of you staying in the house up to or more than the break-even period.

Keep Reading:

What Are Mortgage Points And Should You Pay Them

Mortgage points, also referred to as discount points , are additional funds you can pay at closing to lower your interest rate. But while a lower interest rate may sound good, you want to make sure you have all of the necessary information before making this decision. Bryan Sutton, sales manager for SunTrust Mortgage, talks about when paying points could be helpful and when it might be better just to leave the rate as advertised.

Also Check: Can I Have A Co Signer On A Mortgage

Mortgage Discount Points Are Tax

If you do end up purchasing discount points, you can actually deduct their costs from your annual tax returns as long as you itemize deductions.

You can deduct them for either the year you purchase the home or deduct them incrementally across your loan term, depending on various factors .

- The home you took out the loan to purchase or build must be your primary residence.

- The points werent more than the general average for your area.

- The points werent used for anything like an appraisal fee, inspection, or another charge.

- You didnt borrow funds from your lender or broker to pay the points.

Your closing settlement statement will also need to clearly identify the points . Here is the full set of requirements from the IRS, but you should consult a tax professional if youre thinking of deducting your points.

How Much Do Discount Points Cost

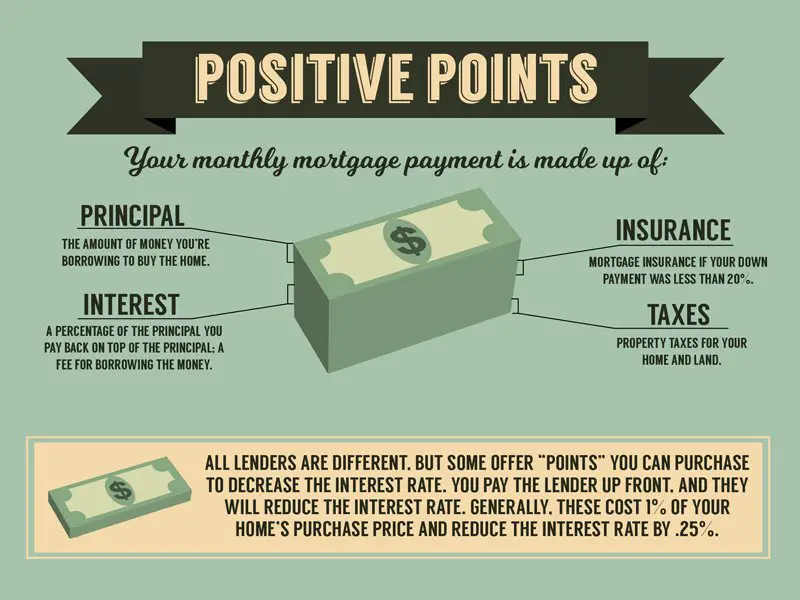

The price for discount points is always the same, regardless of lender: 1 percent of the loan amount for each point. That’s where the name comes from in financial terminology, 1 percent is commonly referred to as a “point.” So if you have a $300,000 loan, one point will cost $3,000.

How much a discount point will reduce your rate varies from lender to lender, but is often between one-eighth to one-quarter of a percent. So buying one point might reduce a 5 percent rate to 4.875 percent or 4.75 percent, for example.

You can buy multiple points, fractions of a point and even negative points . How many you can buy depends on the lender and your loan. Some lenders may let you buy 3-4 points others may limit you to only one or two. That’s something you want to check into when shopping for a mortgage and comparing offers.

You can pay for discount points up front if you wish, but they’re often rolled into the loan. So you start with a somewhat higher balance but the lower rate means your monthly payments are less.

Read Also: How To Figure Mortgage Payment

What Are Points

Points are a type of discount that allows you to buy down your mortgage interest rate. You buy points when you purchase your home. They increase your closing costs but ultimately reduce your monthly mortgage payment. They dont impact your loan-to-value ratio or your down payment they strictly impact your monthly payment.

When purchasing points, you will pay a certain percentage of your mortgage loan. The most common number of points associated with a mortgage are one and three points. Each point is a percent of your mortgage amount, so if you choose one point, you pay the lender 1% of the loan amount in order to get a lower rate. If you choose three points, you pay 3% of the loan amount.

If you’re in the market for a new home…

How We Got Here

To use the Should I buy points? mortgage calculator, type your information into these fields:

-

Desired loan amount

-

Interest rate without points

-

Number of points

-

Interest rate with points This shows what your rate would be if you paid for points. In general, lenders drop the interest rate by a quarter of a percentage point for each point purchased, up to a limit. But maybe a lender has offered you a rate thats different for buying this number of points. If so, type in that rate to ensure the accuracy of your results.

You May Like: How Much Mortgage On 200k

Where To Find Points And Credits On Your Loan Estimate** And How They Affect Your Loans True Cost

Points will be found under Section A on page 2 of your official Loan Estimate. Theyll be shown as a percentage of your loan amount and as the equivalent dollar amount youll pay upfront.

Lender credits are listed under Section J as a negative number. Thats the dollar amount thatll be taken off your upfront closing costs.

When calculating the true cost of your loan, its important to only factor in costs that are mortgage-related . The costs to include are listed in Section D , Section E, and Section J under lender credits.

Simply input information from your official Loan Estimate into the following formula to calculate your true loan cost:

Costs listed under section F and section G are non-mortgage related, and will occur whether you continue with the loan or not. For this reason, they should not be included in calculating the true loan cost.

Have more questions about points and credits, or need help deciding which is right for you and your loan? Were here to help.

*The rate table displayed above is for illustrative purposes only. It does not reflect any specific loan terms and is not a commitment to lend. Your loan terms will be different based on current market rates, property type, loan amount, loan-to-value, credit score, debt-to-income ratio and other variables.

**The Loan Estimated displayed in this article is for illustrative purposes only. It does not reflect any specific loan terms and is not a commitment to lend.

- More