How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Is It More Important To Pay Off Debt Or Build My Savings

The answer to this question is specific to you, but there are a few guidelines that can help in making this choice.

Why Should I Use A Mortgage Calculator

You May Like: How To Build A Mortgage Business

Tips For Buying An Affordable Home

Suppose you qualify for a large home loan. Does that mean you need to borrow the entire amount your lender is willing to loan you? Of course not.

Assessing how much mortgage you can handle requires a bit of a look into your current and predicted future financial situation. Before you take on the maximum loan you can get and start looking at more expensive houses, consider these tips.

How Much House Can I Afford On My Salary

Want a quick way to determine how much house you can afford on a $40,000 household income? $60,000? $100,000 or more? Use ourmortgage income calculatorto examine different scenarios.

By inputting a home price, the down payment you expect to make and an assumedmortgage rate, you can see how much monthly or annual income you would need and even how much a lender might qualify you for.

The calculator also answers the question from another angle, for example: What salary do I need to buy a $300,000 house?

Its just another way to get comfortable with the home buying power you may already have, or want to gain.

Also Check: What Portion Of Your Income Should Be Mortgage

Summary: Deciding How Much House You Can Afford

Ultimately, how much home you can afford depends on your financial situation and preferences. It requires a more comprehensive decision than just how much money you want to spend on mortgage payments each month.

Evaluate your full financial situation, your ability to pay off a mortgage and where you need to save for other things.

Once youve done all that, its time to go after that perfect home. Get started with Rocket Mortgage®.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

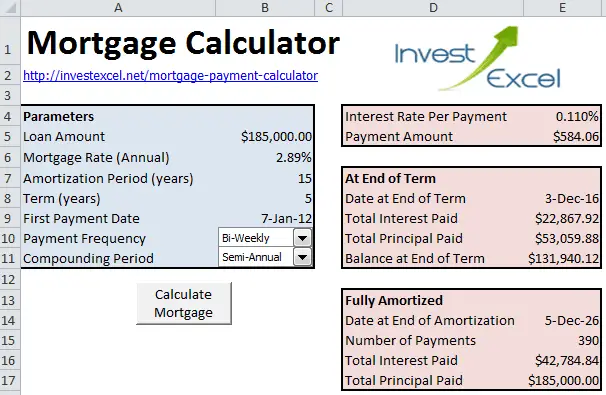

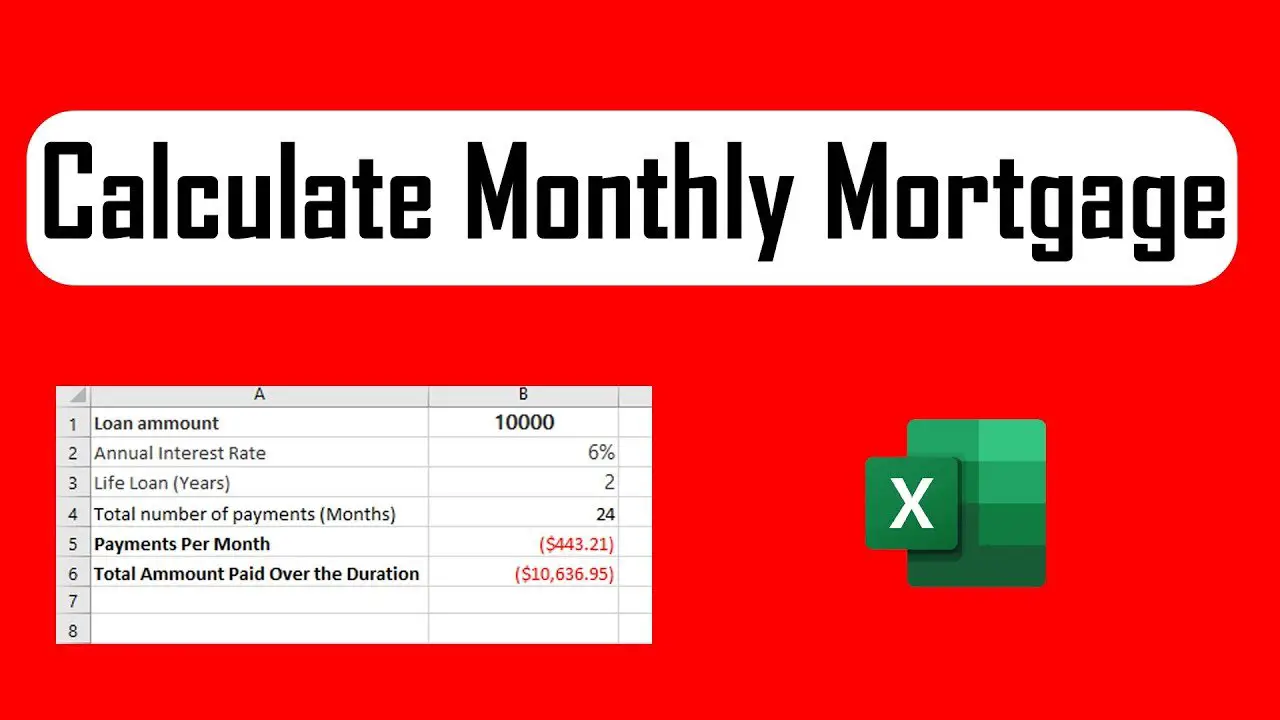

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

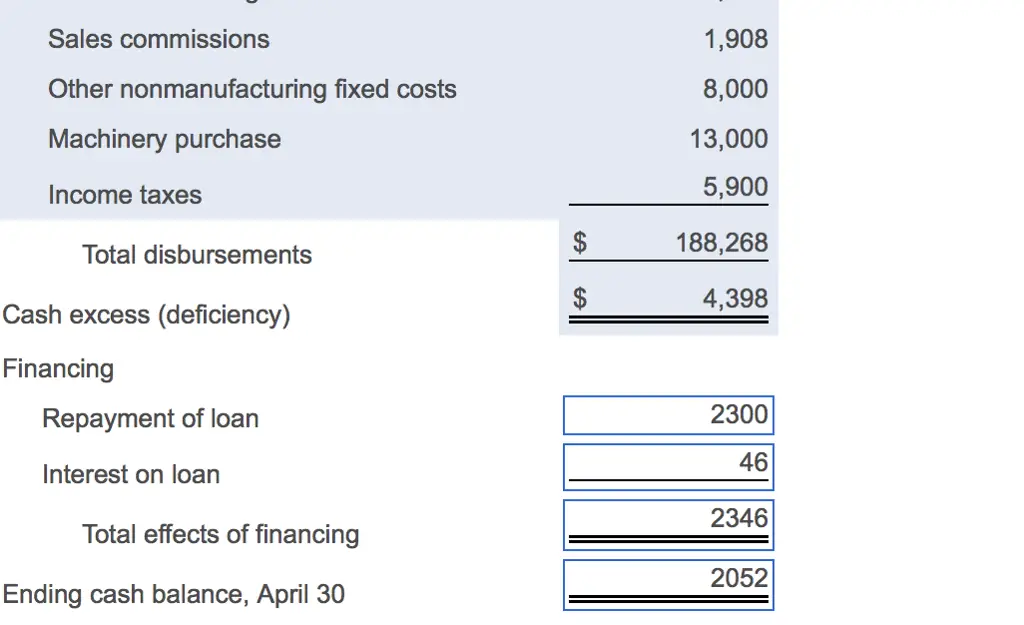

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

Don’t Miss: What Is A Non Qm Mortgage Loan

How Much Should I Have Saved When Buying A Home

Lenders generally want to know you will have a cash reserve remaining after youâve purchased your home and moved in, so you donât want to empty your savings account on a down payment.

Having some money in the bank after you buy is a great way to help ensure that youâre not in danger of default and foreclosure. Itâs the buffer that shows mortgage lenders you can cover upcoming mortgage payments even if your financial situation changes.

While maintaining a debt-to-income ratio under 36% protects you from minor changes in your finances, a cash reserve protects against major ones.

At a minimum, itâs a good idea to be able to make three monthsâ worth of housing payments out of your reserve, but something like six months would be even better. That way, if you experience a loss of income and need to find a new job, or if you decide to sell your house, you have plenty of time to do so without missing any payments.

How Much Is Homeowners Insurance And What Does It Cover

Homeowners insurance is a combination of two types of coverage:

- Property insurance: protects homeowners from a variety of potential threats such as weather-related damages, vandalism, and theft.

- Liability insurance: protects homeowners from lawsuits or claims filed by third parties for accidents that happen within the home.

In 2019, the average annual cost of homeowners insurance was $1,083 nationwide. The cost of homeowners insurance policy will vary depending on the type of property being insured and the amount of coverage the owner desires. Lenders require that buyers obtain homeowners insurance in order for the insurance premium to be included in the monthly mortgage payment.

Recommended Reading: What Does Qc Mean In Mortgage

Down Payment Should Dictate The Purchase

Generally, lenders want homebuyers to be able to pay at least 20% of the purchase price in cash. If they can only make a down payment below that amount, they can still get a mortgage, but often must also shoulder the extra expense of private mortgage insurance . Paying PMI means their monthly mortgage payment will go up by anywhere from 0.5% to 1% of the loan amount.

How much you pay in PMI will depend on the size of the home, your , and the potential for the property to appreciate, among other things. If you can’t swing $60,000 down on a $300,000 home, shoot for at least 10%. The more down payment, the less interest you’ll pay over the life of the loan, and the smaller your monthly mortgage payment will be, even if you are hit with mortgage insurance.

The amount you saved for the down payment should also influence the house you buy. If you have enough to put 20% on one home but 10% on another, the cheaper home will give you more bang for your buck.

Buyers also need to set aside closing costs, which can amount to between 2% and 5% of the purchase price, depending on which state you live in. If you are purchasing a $200,000 home, you could pay between $4,000 and $10,000 in closing costs alone. The less you have to finance in the loan, the lower interest you will pay over the life of the loan, and the sooner you’ll see a return on your investment.

Can My Fha Monthly Payment Go Up

Yes. Here are a few instances when your monthly payment can go up, even after youve closed the loan and moved in:

-

If you have an adjustable-rate mortgage, your interest rate can rise after your initial fixed-interest rate term ends.

-

Escrow items built into your monthly payment, such as property taxes or homeowners insurance premiums, are likely to go up over time. While you can’t do much about property taxes aside from moving to a different area you can always shop around for a new homeowners insurance policy.

-

If you run behind on making a monthly payment, you can expect a late payment fee.

You May Like: What Is The Rate For A 15 Year Mortgage

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

Recommended Reading: Who Does 100 Percent Mortgages

How To Calculate Annual Income For Your Household

In order to determine how much mortgage you can afford to pay each month, start by looking at how much you earn each year before taxes. Consider all your earnings for the year, which could include salary, wages, tips, commission, etc.If you have a spouse or a partner that has an income which will also contribute to the monthly mortgage, make sure to include that as well into your gross annual income for your household. Then take your annual income and divide by 12 to determine your monthly income.

Follow the 28/36 debt-to-income rule

This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income against all debts, including your new mortgage. Keeping within these parameters will ensure you enough money left over for food, gas, vacations, and saving for retirement.Example: Lets say you and your spouse have a combined monthly income of $5,000. Applying the 28/36 rule, you wouldnt want to spend more than:

$1,400 on house related expenses

$1,800 on total debt

Homeowning Expenses Beyond The Mortgage

Getting preapproved for a home loan is an important first step in the homebuying process, but it is only one consideration. A mortgage isn’t the only recurring expense: homeownership comes with a lot of other ongoing costs, which buyers need to anticipate. These include homeowners’ insurance, utilities, repairs, and maintenance costs. Maintenance alone can add up: The lawn needs to be cut, the snow must be shoveled, and the leaves raked. Buyers also need to consider property taxes.

These expenses can add greatly to your monthly outlays, making a home that seemed affordable on paper pricey in reality. So you should include all of these costs, as well as other regular expenses, when determining how much home you can afford. A $1,500-per-month mortgage payment may be palatable, but add $1,500 in monthly expenses, and suddenly your obligations have doubled.

Mortgage lending discrimination is illegal. If you think you’ve been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report to the Consumer Financial Protection Bureau or with the U.S. Department of Housing and Urban Development .

Don’t Miss: What Is The Mortgage Payment On 240k

How To Determine And Enter Monthly Savings

Emergency Fund: This is where you add your monthly contribution to your emergency fund. If you decided to include things like home or car maintenance here, remember to include enough to cover those.

Retirement: If you make separate contributions every month to a retirement fund out of your take-home pay, enter them here. However, if your retirement contributions come out of your paycheck before you take that check home, dont enter them again.

Investments: Use this line for any other kinds of savings you might need. If you make contributions to an individual investment account, for example, you can enter those here.

You can also use this line to contribute to any special fund youre investing in, like saving up for a wedding, for a car, or for a down payment on a new home.

Figure Out How Much You Can Afford For Monthly Principal And Interest

The loan amount you can afford depends on how much you can afford to pay back each month.

- If you havent already, on a total monthly home payment.

- Your total monthly home payment includes several costs of homeownership. Your principal and interest payment is the part of your total monthly payment that pays back your loan and is used to calculate your affordable loan amount. Make sure you understand the difference.

- Estimate how much you expect to pay monthly in property taxes and homeowners insurance. Browsing for-sale listings or talking with family, friends, or a real estate agent in your area is a good way to get a rough estimate.

- Subtract your estimated taxes and insurance from your target total monthly home payment to get the amount you can afford to pay monthly for principal and interest.

Also Check: What Is Verifiable Income For A Mortgage

Determine What Mortgage Is Right For You

When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget. Most borrowers opt for 30-year mortgages, but thats not the only choice. Typically, 15-year mortgages have lower rates but larger monthly payments than the more popular 30-year mortgage. Adjustable-rate mortgages usually have lower rates to begin with, but the downside is that youre not locked into that rate, so it can change over the life of your loan.

View Affordability From Two Perspectives:

- Your overall monthly payments which included household expenses, mortgage payment, home insurance, property taxes, auto loans and any other financial considerations

- How lenders determine what you can afford. Just like lenders, our Affordability Calculator looks at your Debt-to-Income Ratio to determine what home price you can afford.

Also Check: What Is Llpa In Mortgage

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

How To Look Beyond The Monthly Mortgage Payment

Given the how much house can I afford rule of thumb, you now know that you can afford a monthly mortgage payment of $970. But thats only so helpful. Youre still probably wondering how much house you can afford?

Well, the answer depends on how much money youve saved. When you buy a house, youre going to need money upfront for closing costs and a down payment.

Closing costs are the fees associated with finalizing your loan, including application, origination, appraisal, credit report, title and attorney fees. Closing costs typically run about 5% of the purchase price of your home.

When obtaining a mortgage, you also have a down payment on your house, which is the money you pay upfront. The good news is that this sum is subtracted from your total mortgage amount. The more money you set aside for your down payment, the less youll have to spend each month on mortgage payments.

The cost of your down payment will vary based on the purchase price of your home and the type of loan you obtain. Conventional loans require borrowers to pay a more significant percentage of the purchase price upfront than do government-backed mortgages.

Conventional loans typically require a down payment of 3 20% of the purchase price. Yet, if you put down less than 20%, your lender will require you to pay private mortgage insurance fees to safeguard the mortgage company in the event that you default on your loan.

You May Like: How Much Income To Qualify For 200 000 Mortgage