How Does Your Payment Method Determine How Much Youll Get Paid

On the surface, it doesnt seem like the payment method would affect how much you can get. However, getting paid out in one lump sum versus monthly payments could affect the principal amount of your loan. Keep reading to understand why.

Getting the entirety of your reverse mortgage amount all at once means you could be giving up some money in the future, whereas both the fixed monthly payment option and the line of credit option could pay out more to you over time if your home value goes up.

Where To Get A Reverse Mortgage

Two financial institutions offer reverse mortgages in Canada. HomeEquity Bank offers the Canadian Home Income Plan , which is available across Canada. You can get a reverse mortgage directly from HomeEquity Bank or through mortgage brokers. Equitable Bank offers a reverse mortgage in some major urban centres.

Shop around and explore your options before you get a reverse mortgage. Your financial institution may offer other products that might meet your needs.

Compare the costs of the following potential alternatives to a reverse mortgage:

- getting another type of loan, such as a personal loan, line of credit or credit card

- selling your home

- renting another home or apartment

- moving into assisted living, or other alternative housing

You may want to speak with a financial advisor and your family before getting a reverse mortgage. Make sure you understand how a reverse mortgage works and how it can affect your home equity over time.

How Do I Pay Back A Reverse Mortgage

A reverse mortgage is a way for a homeowner 62 or older to use her house to raise extra money. The owner takes out a cash loan secured by the value of her house and doesn’t have to pay the loan back, or the interest, until she moves, dies or sells the house. There’s no minimum income requirement for a reverse mortgage. The homeowner must pay closing costs on the loan, which can add up to thousands of dollars, even if the amount borrowed is small.

1

Pay back the loan early, before the interest has a chance to accumulate. If you take out a loan through the Federal Housing Administration’s Home Equity Conversion Mortgage program, you can prepay the debt with no penalty. Most states forbid prepayment penalties on non-FHA reverse mortgages, but in 2008 Rhode Island became the first state to specifically permit prepayment penalties, according to the “Providence Journal.”

2

Pay when you move. If you move out of your home, the reverse mortgage loan balance comes due, with a few exceptions: The Federal Trade Commission states that with an FHA mortgage, for example, you can live in a nursing home or other medical facility for 12 months before the mortgage must be paid back. If your financial circumstances have changed enough that you have the resources when you move out, you can just write the lender a check.

3

References

Read Also: How To Get A Million Dollar Mortgage

How Does A Reverse Mortgage Works

As a mortgage progresses, home equity increases as the loan balance decreases. As homeowners take out reverse mortgages or the equity of their homes decreases, they owe more and more to the lender.

The homeowner gets to choose which payments they prefer and only pays interest on the money used. If the homeowner moves or passes away, any money gained from selling the home pays back to the lender who provides a reverse mortgage.

Can You Pay Off Your Mortgage Early

In most cases, you can pay your mortgage off early without penalty but there are a few things to keep in mind before you do.

First, reach out to your loan servicer to find out if your mortgage has a prepayment penalty. If it does, youll have to pay an additional fee if you pay your loan off ahead of schedule. This can affect whether paying your mortgage off early is financially viable for you.

Second, make sure there arent any restrictions on how and when you can make additional payments. Some loans have terms that encourage you to follow the payment schedule, and its important to ensure that whatever extra payment you make goes to the principal and not interest.

Recommended Reading: Can You Refinance Mortgage Without A Job

How To Repay The Money You Borrow

You don’t need to make any regular payments on a reverse mortgage. You have the option to repay the principal and interest in full at any time. However, you may have to pay a fee to pay off your reverse mortgage early.

You have to repay the amount left owing when:

- you sell your home

- you default on the loan

You could default on a reverse mortgage by:

- using the money from the reverse mortgage for anything that is illegal

- being dishonest in your reverse mortgage application

- letting your home fall into a state of disrepair that would lower its value

- not following any conditions in your reverse mortgage contract

Each reverse mortgage lender may have their own definition of defaulting on a reverse mortgage. Ask your lender what could cause you to default.

When you die, your estate has to repay the entire amount owing. If multiple individuals own the home, the loan has to be repaid when the last one dies or sells your home.

The amount of time that you or your estate has to repay a reverse mortgage may vary. For example, if you die then your estate may have 180 days to pay back the mortgage. However, if you move into long-term care, then you might have one year to pay it back. Make sure you ask your lender for information about the timing for paying back a reverse mortgage.

Can I Prepay My Reverse Mortgage

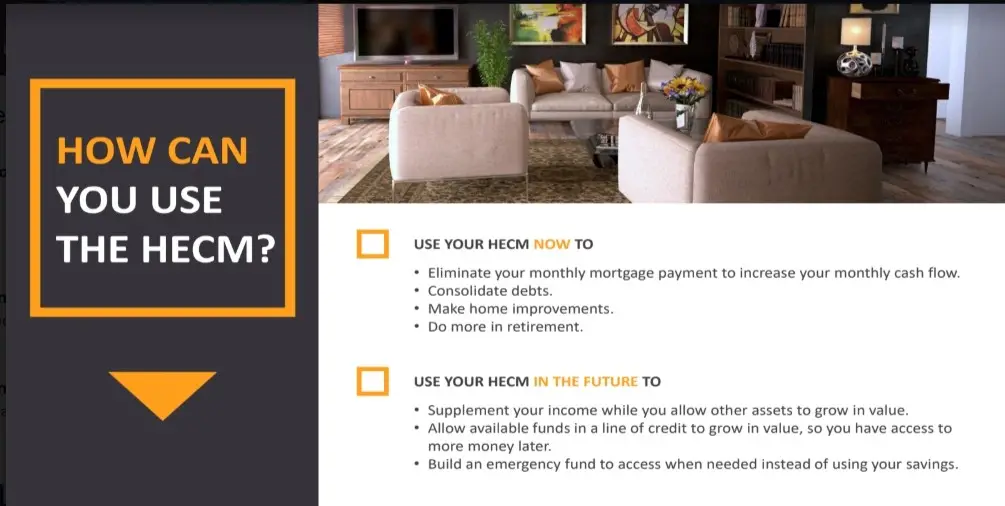

Most seniors who receive a Home Equity Conversion Mortgage intend to make payments only when the loan comes due. After all, one of the primary benefits of a HECM is that you dont need to start making payments immediately as long as you still adhere to obligations of the loan, such as maintaining your home, paying property taxes, and keeping homeowners insurance. But as seniors with different goals discover the utility of a HECM, many choose to pay back the loan sooner rather than later. Not only is it possible to pay back a reverse mortgage early, but it is also favorable in many scenarios. Lets explore the pros and cons of reverse mortgage prepayment as well as a few of the common strategies for payment that many seniors employ.

Also Check: How Much Is A 180k Mortgage Per Month

Reverse Mortgage Payoff How Does It Work

Before getting into the details on reverse mortgage payoffs and how they work, it can be helpful to understand what a reverse mortgage is and why a loved one might get one. The primary reason to get a reverse mortgage is that it allows them access to their home equity to help fund retirement. Traditional banks offer little to no help because the property is typically in the decedents name, not the heir seeking financial help.

If and when a reverse mortgage borrower moves out, sells their home, or passes on, the loan becomes due. When the beneficiaries wish to keep the property, they must pay off the loan balance in full within the first six months.

Repaying this loan can be tricky if one doesnt have the funds readily available. Fortunately, there are reverse mortgage payoff lenders that provide private capital loans to families that may need more than 6 months to sort through the next steps during an already difficult time.

How Much Does A Reverse Mortgage Pay And How Much Does It Cost

For those who are at least 62 years old, taking out a reverse mortgage is one way to supplement your income in your retirement years. As long as you live in the home and have a decent amount of home equity, you are likely to be eligible.

However, these programs can be complicated and are not right for everyone. Thats why you should understand all the details before you make a decision.

Below, we explain how a reverse mortgage works, including how much it pays and how much it costs.

Read Also: How To Shave Years Off Your Mortgage

Reverse Mortgage Heirs Responsibility

Reverse mortgage heirs are not responsible to pay the loan balance or pay back the loan. If the loan balance is more than the appraised value of the home, the heirs are not held responsible to pay the difference or making the monthly payments.

This is because a reverse mortgage is a non-recourse loan and the FHA insurance absorbs the loan balance. The borrower pays this insurance during the loan closing as well as each month.

When the borrower dies, the heirs can keep the home by financing the HECM loan. They may sell the home and keep the remaining proceeds that dont go toward the reverse mortgage loan repayment. Alternatively, heirs may walk away without any negative effect on their credit histories or sign a Deed-in-Lieu of Foreclosure to satisfy the loan.

Heirs are advised to process a reverse mortgage loan quickly after it becomes due. Sell your home can be done if the heirs are unable to use the property.

A reverse mortgage can be paid off early by refinancing it with a traditional loan or paying the difference between how much was borrowed and how much is owed on the home.

The borrower may also make monthly payments, which will shorten how long they have left in their life before getting a HECM.

Fifth Generation Struggles To Retain Maryland Roots

Reverse mortgages came with no income or credit requirements a decade ago, leading a wave of brokers to write loans to borrowers who turned to them as a financial last resort, to pay for home repairs or pay off debts.

Servicing disputes that emerge after the death of a borrower sometimes reveal that loans should not have been issued in the first place.

USA TODAY’s analysis of reverse mortgage lending patterns and foreclosures found clusters in African American urban communities evidence of predatory practices, according to industry watchdogs. The work was a partnership with Grand Valley State University, with support from the McGraw Center for Business Journalism. In recent years, the U.S. Department of Housing and Urban Development has mandated stronger financial assessments of seniors before a loan is issued.

When Gatewood-Young’s grandfather died in 2016, the family was surprised to discover that his rural Maryland home on 10 acres had a reverse mortgage lien against it. He had drawn down about $150,000 with his reverse mortgage a sum that had to be paid back for the property to be transferred to his family.

The executor of his estate was my aunt, and explained that Wells Fargo had already communicated that if we did nothing, it would go into foreclosure, Gatewood-Young said. I said, Absolutely not.

Gatewood-Young, the only heir interested in the property, got herself qualified for a traditional home loan and started the purchase process.

You May Like: How To Understand Mortgage Payments

Exercise Your Right Of Rescission

If you experience buyers remorse almost as soon as you sign the paperwork and find yourself asking how to stop a reverse mortgage, you could take advantage of the right of rescission period.

The right of rescission is a consumer protection that allows the borrower to change their mind for any reason, without penalty, up to three days after signing the loan agreement, explained Steve Irwin, president of the National Reverse Mortgage Lenders Association . Borrowers learn about this option early in the loan process during the required counseling session that takes place prior to completing the loan application. Theyre reminded of their right of rescission during the loan closing as well.

To cancel your reverse mortgage via this option, youll need to inform your lender in writing. The lender has to return any money youve paid for the financing within 20 days.

Alternatives To A Reverse Mortgage

While a reverse mortgage may not work for your situation, don’t give up hopeâit’s not your only option for generating cash or saving money. Here are four alternatives:

Read Also: What Documents Do I Need To Get A Mortgage

How Do You Pay Back A Reverse Mortgage Loan

You might have heard retirees referring to themselves as being asset rich but cash poor.This essentially means that while they have their own home, they could be struggling to make ends meet. Sometimes, even maintaining their home can become a financial burden.

Some retirees use reverse mortgages to gain access to an income stream. But, what is a reverse mortgage, and how do you pay back a reverse mortgage loan?

How A Reverse Mortgage Also Can Be Paid Off Early

The process of paying off a reverse mortgage is not very complicated. But it is advised that you contact a reverse mortgage specialist to avoid potential issues.

Step 1: Choose a date to pay off your reverse mortgage. Request your lender no further draws against the credit line of the equity and a payoff statement that includes the month when the mortgage is to be paid off.

The payoff statement lists all payments made over the course of the mortgage, accumulated interest, and costs associated with borrowing the loan.

Step 2: The statement may also include 34 days of interest, which provides padding if the payment is posted after the first of the month.

Since a reverse mortgage is backed by the Federal Housing Authority, the posting takes place on the first business day of the month, and a weekend could push it to the third day of the month.

Step 3: If you are selling the home, you may claim reimbursement if you had prepaid the insurance for an entire year. So let your insurance agent know the expected payoff day.

Step 4: It is worth letting your title closing agent handle the mortgage paperwork and the lien releases on your behalf. The process requires released for the lender and the FHA for the mortgage insurance premium.

On the other hand, if you handle the payoff on your own, send a cashier check for the money through overnight mail or wire transfer to the lenders bank. Follow up to make sure that the lender has received the funds.

You May Like: How To Know If I Should Refinance My Mortgage

Why Exclude Spouses From A Hecm

Until recently, a couple hoping to obtain the highest possible loan amount with a HECM reverse mortgage could effectively do so by excluding the younger spouse from the loan and the home’s title. Excluding a younger spouse increased the maximum loan amount because the youngest borrower’s age was a main factor in HUD’s calculation of the maximum allowable loan amount. The older the borrower, the higher the loan amount. The younger the borrower, the lower the loan amount. Putting only the older spouse on the home’s title and making the older spouse the sole reverse mortgage borrower allowed couples to borrow more.

Unfortunately, this strategy could backfire, and often did, if the borrowing spouse died before the non-borrowing spouse. Because the younger non-borrowing spouse was not listed on the home’s title or reverse mortgage loan documents, he or she could no longer reap the benefits of the reverse mortgage. The surviving spouse had to quickly find a way to pay off the loan balance or face eviction by the lender.

Reasons To Pay Off A Reverse Mortgage

The primary reason why people pay off a reverse mortgage is because it has become due and payable. This occurs after a maturity event, such as:

- The borrower moving out of the home

- The borrower selling the home

- In some cases, such as a violation of the terms of the loan, the property may be no longer eligible for a reverse mortgage

Can you pay off a reverse mortgage early? The short answer is yes. It just depends on your financial situation. There are some cases where a borrower may wish to begin repaying the reverse mortgage prior to its due and payable dates. Here are a few situations where this might be the case.

You May Like: Are Mortgage Discount Points Worth It

What Are The Cons Of A Reverse Mortgage

Remember that old saying if it seems too good to be true, it probably is? Well, that applies to reverse mortgages too. Some of the disadvantages of taking out a reverse mortgage are:

- Reverse mortgages can significantly increase the amount of debt you carry, which can result in you having less to leave to your family, or other benefactors of your will

- Reverse mortgage interest rates are much higher than typical mortgage rates

- As you borrow more and more equity, interest starts to accumulate faster and faster

- There are only two lenders that offer reverse mortgages in Canada

- Additional setup costs can also add up and are deducted from the amount youll receive

- The only way to get out of a reverse mortgage is to sell your home or pass away

- Youll be subject to a penalty if you sell the home or pass away within three years of taking out the reverse mortgage

- If you pass away, the amount you borrowed plus interest must be repaid within a limited period of time