Access Cash For Your Repairs And Home Improvements

If the hot water heater broke and the roof needs replacing soon, taking cash out of your home with a refinance can make more sense than putting these bills on a credit card with a much higher interest rate.

Your home is likely your largest single asset and if you want to keep it appreciating in value, youll need to keep it in good repair and up-to-date. On the bright side, the money you spend on capital improvements will not only help you keep up with the real estate market. It will also be added to your cost basis in the home typically the propertys purchase price and could help you save on capital gains taxes when you sell.

Planning For Closing Costs

According to a government website, its not unusual to pay 3 percent to 6 percent of your outstanding principal in refinancing fees.

Here are some of the charges to expect:

- Application fee. Be prepared to pay an application fee, which covers the costs of processing the loan, as well as the credit report. You must pay this fee even if your loan is denied.

- Mortgage points. A point is a fee equal to 1 percent of the loan. For a $100,000 mortgage, each 1-point charge would equal $1,000. There are two types of points:

- Discount points. These are prepaid interest charges on the mortgage and typically reduce the interest rate on the loan. If you dont plan to stay in the house a long time, however, you may not get the benefits of having paid down the interest rate.

- Origination Points: These fees are charged by the bank to cover the cost of making the loan and are usually tax-deductible if used to obtain the loan and not to pay other closing costs.

They range from 0 to 1.5 percent of the loan principal.

Although these fees pile up, many of the requirements also protect you as a homeowner. Some lenders may advertise no-cost refinancing, when in fact they are offering no out-of-pocket fees. At some point all these fees need to be paid, and you will probably see them rolled into your new loan.

Can I Buy A House Anonymously

Enter anonymous real estate purchases. In theory, you can own real estate anonymously without having to register the ownership of the purchased real estate, as this is not a technical requirement by law. However, this makes it difficult to sell the property, so this is probably not the route you would normally take.

Also Check: How Much Are Monthly Payments On A 200 000 Mortgage

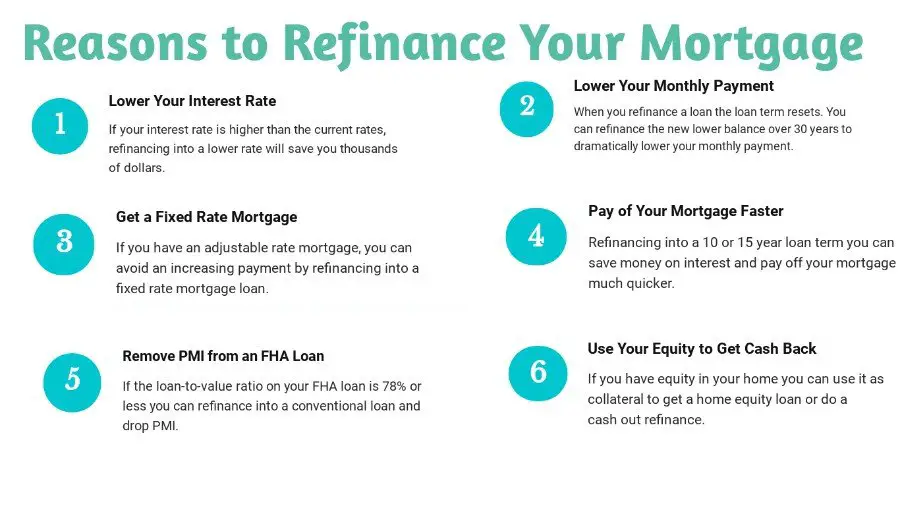

To Access Equity In Your Home

By refinancing your mortgage, you may be able to access the equity in your home. You could potentially access up to 80% of your home’s value, less any outstanding debt. Thats extra money for investment opportunities, home renovations, or your childrens education. There are several ways to access this equity including breaking your mortgage, taking on a home equity line of credit , or blending and extending your mortgage with your current lender.

How To Calculate The Break

The break-even point on a mortgage refinance occurs when savings equals costs, explains Jared Maxwell, vice president of consumer direct lending at Embrace Home Loans.

To determine the break-even point on your refinance, divide the closing costs by the amount youll save each month with your new payment.

Lets say that refinancing will save you $150 per month, and the closing costs on the new loan are $4,000:

$4,000/$150 = 26.6 months

So, if you were to close your new loan today, youd officially break even just over two years and two months from now. If you live in the home for an additional five years after that point, the savings really start to add up $9,000 total.

You can use Bankrates refinance break-even calculator to figure out how long it will take for the cost of a mortgage refinance to pay for itself. If you think you might sell the home before your break-even point, refinancing might not be worth it.

Don’t Miss: Will Mortgage Pre Approval Hurt Credit Score

Reasons Not To Refinance Your Home

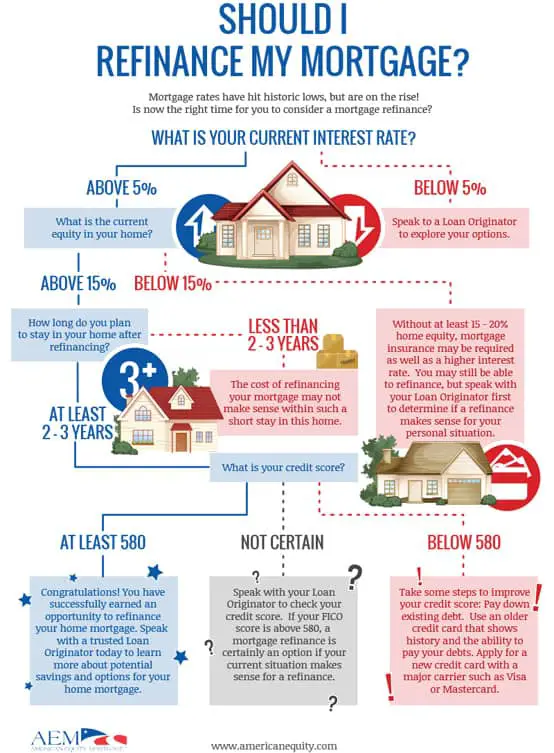

Refinancing your home is not always the best option. Your personal situation should be the biggest factor to consider. Some reasons not to refinance your home are:

- You Do Not Plan To Stay in Your Home For Long

When you are considering refinancing your home, one of the major things to note is how long it takes to recover the new loan closing costs. This is known as the break-even period. It is after this period that you start to save money on your new mortgage. You need to know the closing costs and the interest rate on your new loan to calculate the break-even point. If you plan on moving before the break-even period ends, refinancing your property is not a good option for you.

- You Can’t Afford Closing Costs

If you cannot afford to pay the closing costs out of pocket, it is not a good idea to refinance your mortgage. There is an option to add the closing costs to your loan and pay it back monthly. Doing this could make your monthly payments so high that you dont end up making any savings.

- Higher Long-term Costs

Consider what the long-term cost of refinancing is if most of the payment you’ve made on your 30-year mortgage covers the interest. Refinancing into a shorter-term mortgage could increase your monthly payments and make it unaffordable for you. Refinancing into another 30-year mortgage would reduce your monthly payment, but the long-term cost could remove any savings you hope to make.

Costs Of Refinancing Your Mortgage

The cost to refinance your mortgage depends on the strategy you use to access equity or lower your interest rate. No matter which strategy you use you will always incur legal costs, as a lawyer must change the financing on title. The good news is if your mortgage balance is greater than $200,000, many brokers and/or lenders will cover this cost.

If you are breaking your mortgage in the middle of your term to access equity or lower your interest rate, your lender will charge you a prepayment penalty. For fixed mortgage rates this penalty is the greater of three months interest or the interest rate differential payment . For variable mortgage rates this is simply three months interest.

Don’t Miss: When To Refinance Your Mortgage Dave Ramsey

Your Credit Rating Rose

The interest rates you get for your mortgage depend mainly on your credit score. While your credit score may not usually change quickly, it could surge after clearing disputed charges or paying off large debts. Also, the more time that passes after a bankruptcy, the less of an effect the event has on your credit. Talk to your lender if your credit score has risen significantly since you took out your home loan to see if you can qualify for lower rates through refinancing with your new, better credit score.

When Does It Make Sense To Refinance

In general, refinancing will likely make sense when it makes sense for your finances. But part of that depends on your financial goals. For instance, do you want a lower monthly payment? Are you trying to save in total interest paid? Do you need to extract cash from your home with equity youve built?

Here are five situations to think about before you refinance.

You May Like: How To Get Pre Approved For A Mortgage Chase

I Just Refinanced Should I Refinance Again

5 MINUTE READ

So you just refinanced your home or investment property. A few months later you see interest rates have dropped to all-time lows, and you are thinking to yourself Why couldnt this have happened sooner? You start wondering if you should refinance again, or if you even can refinance again. If you can relate to this situation or something very similar, we are here to help. An argument can be made both for and against refinancing again.

Weve all heard, No you absolutely should not refinance again if you just refinanced. But how true is this? In cases where you just refinanced, its important that youre able to justify the refinance and why it would make sense for you to do it again.

Consider Working With One Lender For Both Mortgages

The benefit of doing both loansrefinancing and obtaining a new mortgageis that you can deal with a single loan officer and provide most of your documents only once.

You can also optimize your loan balances and your monthly payment to a degree by doing both loans with the same lender, says DiBugnara.

If you need to work with two different lenders, both need to be aware of the other loan.

Read Also: What Is A Mortgage Inspection

Cost To Break Your Mortgage Contract

The cost to break your mortgage contract depends on whether your mortgage is open or closed. An open mortgage allows you to break the contract without paying a prepayment penalty.

If you break your closed mortgage contract, you normally have to pay a prepayment penalty. This can cost thousands of dollars.

Before breaking your mortgage contract, find out if you must pay:

- a prepayment penalty and, if so, how much it will cost

- administration fees

- appraisal fees

- reinvestment fees

- a mortgage discharge fee to remove a charge on your current mortgage and register a new one

You may also have to repay any cash back you received when you got your mortgage. Cash back is an optional feature where your lender gives you a percentage of your mortgage amount in cash.

Does Your Mortgage Have A Prepayment Penalty

A prepayment penalty is a fee your lender can charge you if you pay your loan off early. A prepayment penalty can be expressed as a percentage of the principal balance or a specified number of months interest. This can result in an additional fee of thousands.For example, if you have a 3% prepayment penalty and a principal balance of $200,000, the prepayment penalty would be $6,000.

Prepayment penalties are limited for mortgages that donât meet certain standards by a new law effective January 2014 in accordance with the Dodd-Frank Act of 2010. But the law is not retroactive. If you refinanced before 2014, you may still havea prepayment penalty.

Also, the new law doesnât apply to all mortgage types. If you have excellent terms on your mortgage, you may still be subject to a prepayment penalty if you financed after 2014 and your new mortgage meets all the following requirements:

- The loan rate is not higher than The Average Prime Offer Rate . The Average Prime Offer Rate changes constantly and is basedon average interest rates, fees and length of loan terms offered to highly qualified borrowers.

- The loan is a Qualified Mortgage. A Qualified Mortgage has better terms such as a loan period of no more than 30 years and no risky features such as interest-only payments.

- The loan rate will not increase such as a fixed-rate loan.

Read Also: How Much Income To Qualify For 200 000 Mortgage

What Should A Realtor Do To Sell Your Home

How should real estate agents represent the best real estate agents? Properly valuing your home is probably not the most important thing you can do as a real estate agent. Sell ââthe devil for sale. Marketing is one area where your real estate agent has to prove himself. Communicate well. Make sure the buyer meets the requirements. Discuss the best terms. Visit a home inspection to represent the seller.

What Are The Credit Requirements For A Cash Out Refinance

The reason for the lower loan requirements to refinance withdrawals is because your current mortgage has been paid off and the new loan with additional money contains up to 80% of the home’s LTV ratio. So there is only one payment per month. The minimum credit required to refinance depends on several factors, including the lender you work with.

Read Also: Can Non Permanent Resident Get Mortgage

Why You Might Want To Refinance Quickly

Closing on a home loan can be a stressful event, and it often involves a lot of time and money. You may not want to go through the loan process again, but there are plenty of reasons for why you should consider refinancing.

For one, a mortgage refinance can help you save money. And because theres no limit to how often you can refinance a home, its worth exploring even if youve been down this road before.

You might want to refinance to:

- Lower your interest rate. If mortgage refinance rates have dropped substantially since you closed on the original home loan, you could save on interest costs by refinancing to a lower rate. Its also a good option to consider if a newly improved credit score qualifies you for a lower rate.

- If your financial situation has changed recently, a housing payment that was once affordable might not fit into your budget now. Refinancing into a longer-term mortgage can help lower your payments.

- Switch to a fixed rate. An adjustable-rate mortgage, or an ARM, offers a fixed rate for a set period. The rate becomes variable once that period ends, which means your payments may increase. You may decide to refinance into a 15-year fixed-rate loan if you notice interest rates are rising.

- Eliminate private mortgage insurance . You may have to pay private mortgage insurance if your down payment was less than 20% on a conventional mortgage. But if your homes market value has dramatically increased, then refinancing may help you eliminate PMI.

Do You Get Money When You Refinance Your Home Program

Will you get your money back if you refinance your home? The simple answer is yes! This is called a cash refinancing. Where you can replace your existing mortgage with a new one with a lower interest rate. This allows you to receive a one-off notional rental value. Part of this is the money you receive when you pay off your mortgage.

Read Also: What Is Apr Vs Mortgage Rate

Refinancing Your Mortgage Can Be A Smart Financial Move Potentially Saving You Money On Your Monthly Mortgage Payment Or On Total Interest Over The Life Of Your Home Loan

Before you apply, youll want to think carefully about when to refinance your mortgage. Youll also want to decide if refinancing makes sense financially by weighing any money youll save against the cost of refinancing the loan.

Well review some common scenarios to think through.

No Need To Worry About Refinancing Too Soon

Refinancing is worth it if you discover that you can save monthly or over the life of the loan.

Most mortgage shoppers arent at risk of refinancing too soon and can apply even shortly after their previous loan closes.

Check your refinance savings and dont miss out on lower housing costs.

Popular Articles

Step by Step Guide

Read Also: What Does Prequalification For A Mortgage Mean

Your Interest Rate Is No Longer Competitive

Mortgage rates have repeatedly hit record lows in 2020, so its possible that a refinance could save you thousands in interest over the long term. Just be sure your mortgage refi rate is more than 0.5% lower than your current interest rate, otherwise, your monthly savings may not be significant enough to justify paying for a refi, and itll take longer to reach your break-even point.

Lets look at an example, using a 30-year fixed-rate mortgage on a $200,000 home with a 20% down payment, resulting in a $160,000 loan amount. The original mortgage rate is 3.75% and the borrower was able to lock in a 3.25% rate on a new, 30-year loan.

| Original Mortgage | |

| $106,754.58 | $90,678.84 |

The monthly payment savings are just about $45 when the rate drops by 0.5%, which may not move you enough to go through with a refinance. But a bigger rate reduction perhaps 0.75% or lower can shrink your monthly payments and interest expenses.

To Take Advantage Of Lower Interest Rates

The first, and most obvious, reason homeowners refinance their mortgage is to take advantage of a lower interest rate. The drive behind this reason might be a change in finances, personal life or simply the desire to save money.

The accepted rule of thumb has always been that it was only worth refinancing if you could reduce your interest rate by at least 2%. Today, though, even a 1% reduction in rate should be reason enough to refinance.

Reducing your interest rate has several advantages. It can help you build more equity in your home sooner, decrease the size of your monthly payment and of course, save you lots of money overall.

Say you have a 30-year fixed-rate mortgage with an interest rate of 5.75% on a $200,000 home. Your principal and interest payment is $1017.05. If youd refinance that same loan at 4.5%, your monthly payment would drop to $894.03

Also Check: How To Figure Out Mortgage Interest