Good Mortgage Rates Look Different To Everyone

What is a good mortgage rate? Thats a tricky question. Because many of the rates you see advertised are available only to prime borrowers: those with high credit scores, few debts, and very stable finances. Not everyone falls into that category.

Of course, you can look at average mortgage rates. But how reliable are those as a guide?

On the day this was written, Freddie Macs weekly average rate for a 30-year, fixed-rate mortgage was 2.99%. But the daily equivalent on Mortgage News Dailys website was 3.13%. So theres clearly a lot of variance across the market.

How Does A Mortgage Work

A mortgage is the binding agreement of a loan to buy a home. The mortgage is between the lender and the homeowner. In order to own the home, the borrower agrees to a monthly payment over the payment period agreed upon. Once the homeowner pays the mortgage in full the lender will grant deed or ownership.

Your monthly mortgage payment includes a percentage of your loan principal, interest, property taxes and insurance. Keep in mind, your mortgage will include your annual percentage rate to include a full breakdown of your lender fees and other costs included in your payments.

Most mortgage loans last between 10, 15 or 30 years and are either fixed-rate or adjustable-rate. If you choose a fixed-rate mortgage, your interest rate will stay the same throughout your loan. But if your mortgage is adjustable, your mortgages interest rate will depend on the market each year, meaning that your monthly payment could vary.

The consequences of not repaying your mortgage loan can be pretty stiff. If a homeowner doesnt make payments on their mortgage, they could face late fees or other credit penalties. The mortgage also gives the lender the right to take possession of and sell the property to someone else, and the homeowner can face other charges from the lender. All in all, mortgages are a great, affordable option for purchasing a home without the worry of paying in full upfront.

Will Current Mortgage Rates Last

Mortgage rates have been in a holding pattern for a little over a month. The rise of the Delta variant of the COVID-19 virus has put a damper on the economic recovery and counteracted some of the positive developments that could have pushed rates higher the last few weeks.

This pattern may soon change, however, as COVID infections seem to be plateauing. On the economic front, retail sales, which had been expected to decline, saw a nearly 1% increase in August, which is good news for the economy. On the other hand, Inflation, meanwhile, was a little lower than expected last month.

Why does this matter?

The Federal Reserve has based decisions around tapering its accommodative monetary policy on the strength of the labor market and the economic recovery. The Fed’s position has been that inflation, which is currently over 5% and above the central bank’s target rate of 2%, is temporary. If inflation continues to slow down and other economic indicators, such as employment and retail sales, continue to improve, it could push the Fed to a more aggressive stance on its policy. For now, all eyes will be on the Fed’s upcoming September meeting.

“The fact that interest rates havenât moved much in recent weeks indicates that investors are still waiting for more certainty,” said Matthew Speakman, senior economist at Zillow. “All told, thereâs a good chance that mortgage rates will move notably in the coming weeks, but the juryâs still out on which direction theyâll head.â

Read Also: What Is The Grace Period On A Mortgage

What Is A Discount Point

A discount point is a fee you can choose to pay at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

Whats The Difference Between Variable Vs Fixed Mortgage Rates

A fixed-rate mortgage will have the same rate locked in for your entire contract, while variable-rate mortgages can change over the course of your term. Variable rates will change alongside your lenderâs prime rate.

To account for the risk of a rate rise, variable mortgages normally have lower rates than fixed mortgages at the start of a mortgage term. Fixed rates, though higher at the start of a term, are a great option if you want predictable mortgage payments.

In Alberta, fixed rates are more popular, used on the overwhelming majority of mortgages. In Calgary and Edmonton in particular, around 80% of mortgages use fixed rates. .

Learn more by reading our guide to fixed and variable mortgages.

Also Check: What Does A Fixed Rate Mortgage Mean

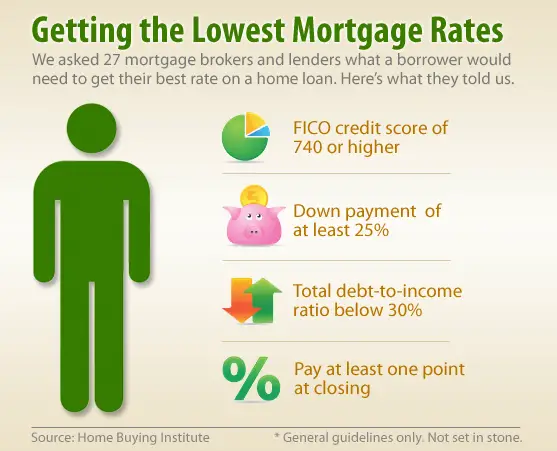

How To Qualify For The Lowest Mortgage Rate

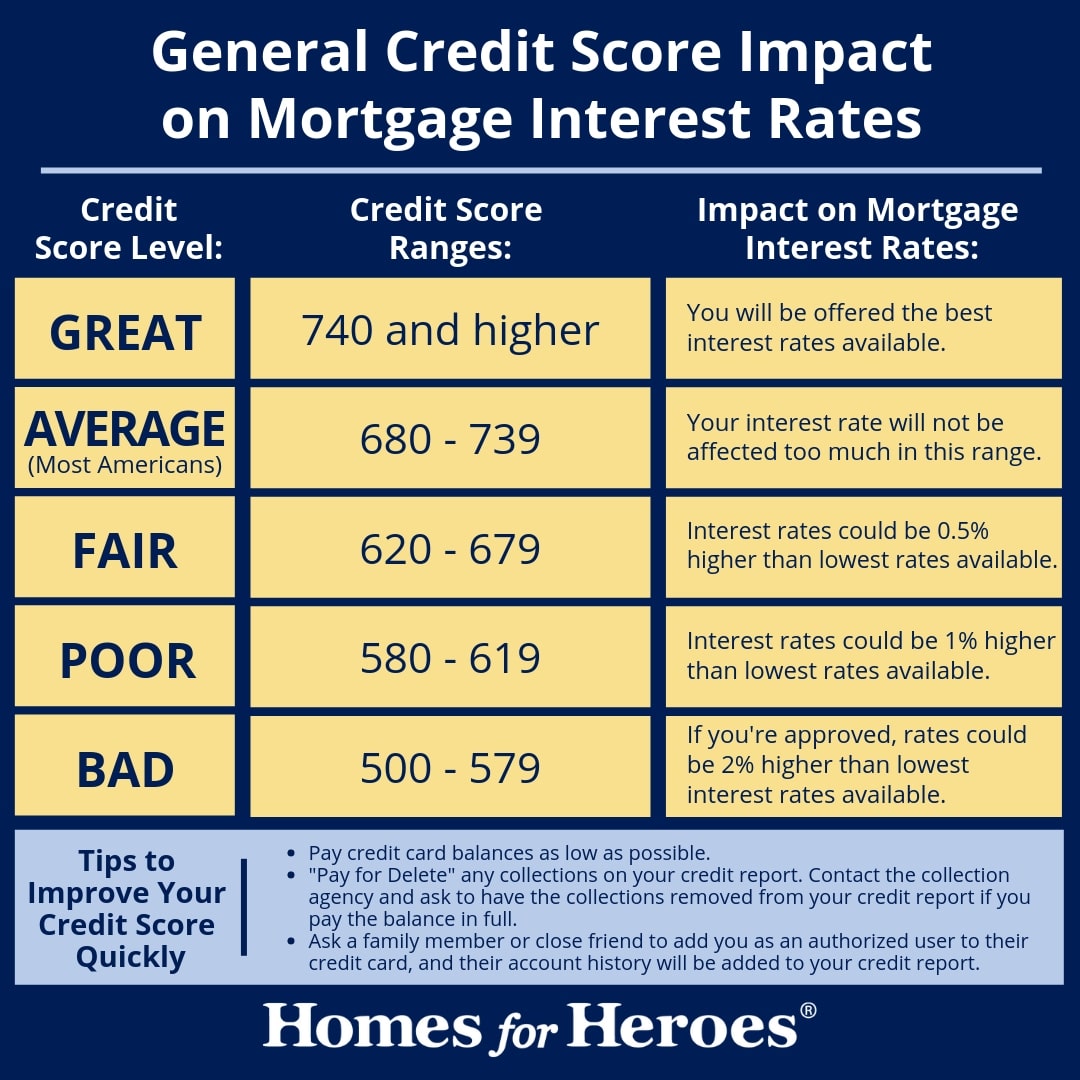

Your credit score, and loan-to-value ratio , and are the most important factors lenders use to calculate your mortgage rate.

To get the lowest interest rate, youll need a credit score between 700 to 800. Having a credit score above 800 is nice, but will likely have a minimal impact on your rate.

Lenders give the most substantial mortgage rate reductions to home buyers that are deemed less risky. A sizeable down payment is a signal to lenders that you are more committed and are less likely to stop making payments. A down payment of 20% or more will save you money in two ways: with a more favorable mortgage rate, and youll be able to avoid paying for private mortgage insurance .

At NextAdvisor were firm believers in transparency and editorial independence. Editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by our partners. We do not cover every offer on the market. Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors.

- A valid email address is required.

- You must check the box to agree to the terms and conditions.

Thanks for signing up!

Well see you in your inbox soon.

How Do I Pay For Cmhc Insurance

Your lender is actually the party responsible for payingCMHC insurancecosts. In the majority of cases, your lender will pass these costs down to you by adding the CMHC insurance premium to your mortgage loan amount. This will slightly increase your monthly or bi-weekly payment.

In some cases, your lender may allow you to pay CMHC insurance costs as a lump-sum, or not pass down the cost to you at all. Contact your lender for more details.

Also Check: How To Get A Million Dollar Mortgage

Record Low Mortgage Rates

Weve already seen mortgage rates hit record lows multiple times in 2021. The trend started in February of 2020 when investors turned to bonds and mortgage-backed securities as a safety net. It wasnt long after that rates plummeted to historic lows, and remains low as of September 2021.

Keep in mind that concern about the coronavirus is driving bond rates down significantly. When bond rates drop, so do mortgage rates. Its a major reason why rates dipped to new record lows in mid-May and again several weeks later.

Many homeowners are seeing this unprecedented time as an opportunity to save money. In fact, lenders havent seen this volume of refinance applications since the early 2000s. And there are still millions of homeowners who could benefit from a lower rate.

Shop Around To Find Your Best Interest Rate

Mortgage lenders personalize your interest rates based on your credit history and other details about your financial life. So you wont know for sure what your rate options look like until you apply and get pre-approved.

The first rate youre quoted may not be your best interest rate. Be sure to apply with several lenders so you can compare Loan Estimates and find your best deal.

Popular Articles

Resources

You May Like: Does Chase Allow Mortgage Recast

Apply For A Mortgage With Us

Applying for a mortgage can be a complicated process, since there are several things lenders will review. Knowing what lenders are looking for and making that as attractive as possible is one of the best steps you can take in getting a great mortgage rate. Luckily, you have us.

At Assurance Financial, well work with you, assessing your situation and doing all the heavy lifting for you. Contact one of our experts today and let us help you get the perfect mortgage rate!

Is The Lowest Ontario Mortgage Rate The Best Rate

Not always. The lowest rates usually come with more limitations. These restrictions can cost you much more than the small rate savings. Such terms are common with low frills mortgages and typically kick in when you try to port, break or increase the mortgage after closing. When comparing mortgage rates, dont be afraid to ask potential lenders questions to ensure you understand the terms and conditions of your mortgage.

Recommended Reading: How To Figure Out Mortgage Rates

How Much Mortgage Can I Afford

There are many ways to determine how big a mortgage you can afford. However, there are some guidelines Canadian lenders use when evaluating your eligibility for a mortgage.

Your down payment: How much you are able to put down upfront will inevitably impact how big a mortgage you can afford. This is because there are minimum requirements for a down payment in Canada, depending on the cost of the home.

On a home thats $500,000 or less, youre required to put down at least 5% upfront. On a home thats between $500,000 and $1 million, youre required to put down 5% of the first $500,000, and 10% of the rest of the principal. On a $1 million home, youre required to put down at least 20%.

Down payments that amount to less than 20% of a propertys value are called high ratio mortgages and homebuyers need to purchase insurance to guarantee their mortgage. The price of the insurance premium is added to the monthly mortgage payment. Down payments that are at least 20% or more are called conventional mortgages and not require insurance.

Having a down payment that exceeds 20% will help you pay off your loan sooner and save you money in the long run. However, interest rates on high-ratio mortgages tend to be lower than the rates on conventional mortgages. Thats because the added insurance reduces the risk of the bank losing its investment.

Summary Of Best Mortgage Lenders Of October 2021

| Lender | NerdWallet Rating NerdWallet’s ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service. |

Min. Credit Score

Minimum credit score on top loans other loan types or factors may selectively influence minimum credit score standards |

National / Regional |

|---|

Read Also: What Is Tip In Mortgage

What Are The Different Types Of Mortgages Available In Canada

In Canada, there are a number of different ways to structure a mortgage.

Mortgages can vary depending on the term length, rate type and whether the mortgage is open or closed. Regardless of whether you have a fixed-closed, fixed-open, variable-closed or variable-open mortgage, term lengths can range from anywhere between one year and 10 years. The most common term length in Canada is five years.

Fixed-closed mortgage: A fixed-closed mortgage is a mortgage contract where the rate is fixed and the homeowners are not allowed to pay off their mortgage loan early without incurring a penalty.

Fixed-open mortgage: A fixed-open mortgage is a contract where the rate is fixed, but the homeowners are allowed to pay off their mortgage early without incurring a fee.

Variable-closed mortgage: A variable closed mortgage refers to a mortgage contract where the homeowners have a variable mortgage rate but cant pay off their mortgage early without incurring a prepayment penalty. This type of mortgage rate fluctuates with market conditions.

Variable-open mortgage: Lastly, a variable open mortgage allows homeowners to pay off their mortgage early without incurring a prepayment penalty. However, their rates will fluctuate with market conditions.

What Is A Mortgage

A mortgage is a type of secured loan provided by a financial institution to cover the cost of buying a home should you not have enough cash to pay for it upfront. You pay back the lender over an agreed-upon amount of time, including an additional interest payment, which you can consider the price of borrowing money.

Because a mortgage is a secured loan, it means you put your property up as collateral. Should you fail to make your payments over time, the lender can foreclose on, or repossess, your property. Learn more about how a mortgage works here.

Recommended Reading: How To Become A Mortgage Broker In Massachusetts

How Much Can I Save By Comparing Calgary Mortgage Rates

Getting a mortgage in Calgary is probably the biggest financial commitment youâll make in your life, so itâs important to get a great deal. Comparing mortgage rates from different providers is one of the best things you can do to get a lower rate.

So how much can you save with a lower rate? On a $500,000 mortgage with a 25-year amortization, paying 2.50% instead of 3.0% could save you around $126 a month. Overall, youâd pay $11,767 less in interest over a 5-year term. You can use our mortgage payment calculator to input your own figures, and work out how much you could save by comparing mortgage rates.

Are Interest Rates And Apr The Same

Interest rates and APR are not the same. An annual percentage rate reflects additional charges associated with your mortgage, which includes the interest. The interest rate reflects the cost homeowners pay to borrow money. These fees include charges such as origination fees and discount points, which is why the APR is typically higher than the interest rate.

Don’t Miss: How Long Does Fha Mortgage Insurance Last

How Big A Mortgage Can I Afford

In general, homeowners can afford a mortgage thats two to two-and-a-half times their annual gross income. For instance, if you earn $80,000 a year, you can afford a mortgage from $160,000 to $200,000. Keep in mind that this is a general guideline and you need to look at additional factors when determining how much you can afford such as your lifestyle.

First, your lender will determine what it thinks you can afford based on your income, debts, assets, and liabilities. However, you need to determine how much youre willing to spend, your current expensesmost experts recommend not spending more than 28 percent of your gross income on housing costs. Lenders will also look at your DTI, meaning that the higher your DTI, the less likely youll be able to afford a bigger mortgage.

Dont forget to include other costs aside from your mortgage, which includes any applicable HOA fees, homeowners insurance, property taxes, and home maintenance costs. Using a mortgage calculator can be helpful in this situation to help you figure out how you can comfortably afford a mortgage payment.

The Alberta Housing Market

The Alberta housing market varies significantly across the province. The two major cities of Calgary and Edmonton are more expensive than the rest of the province, though both cities are significantly cheaper than the Canadian average, Edmonton especially so.

| 2016 |

Source: Canadian Real Estate Association

Homeownership rates in Alberta differ significantly between the major cities and the rest of the province. In Calgary, 67% of families own their principal residence, while in Edmonton only 61% of families own their home. The rest of the province fares better, with 69% of families owning. This compares to the national average of 63% ownership.

Read Also: Could I Qualify For A Mortgage

How Do I Get The Best Mortgage Rate In Canada

The surest way to secure the best mortgage rate from lenders in your area is to compare the market. Most lenders wont offer you their best rates upfront, which can mean hours on the phone negotiating your contract. At LowestRates.ca, we aggregate the best rates from banks and brokers across the country and let them compete for your business. Get started by beginning a form with us.

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The 5-year fixed rate mortgage is the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wont have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

Read Also: Can A Mortgage Include Renovation Costs