Is A Variable Rate Mortgage For Me

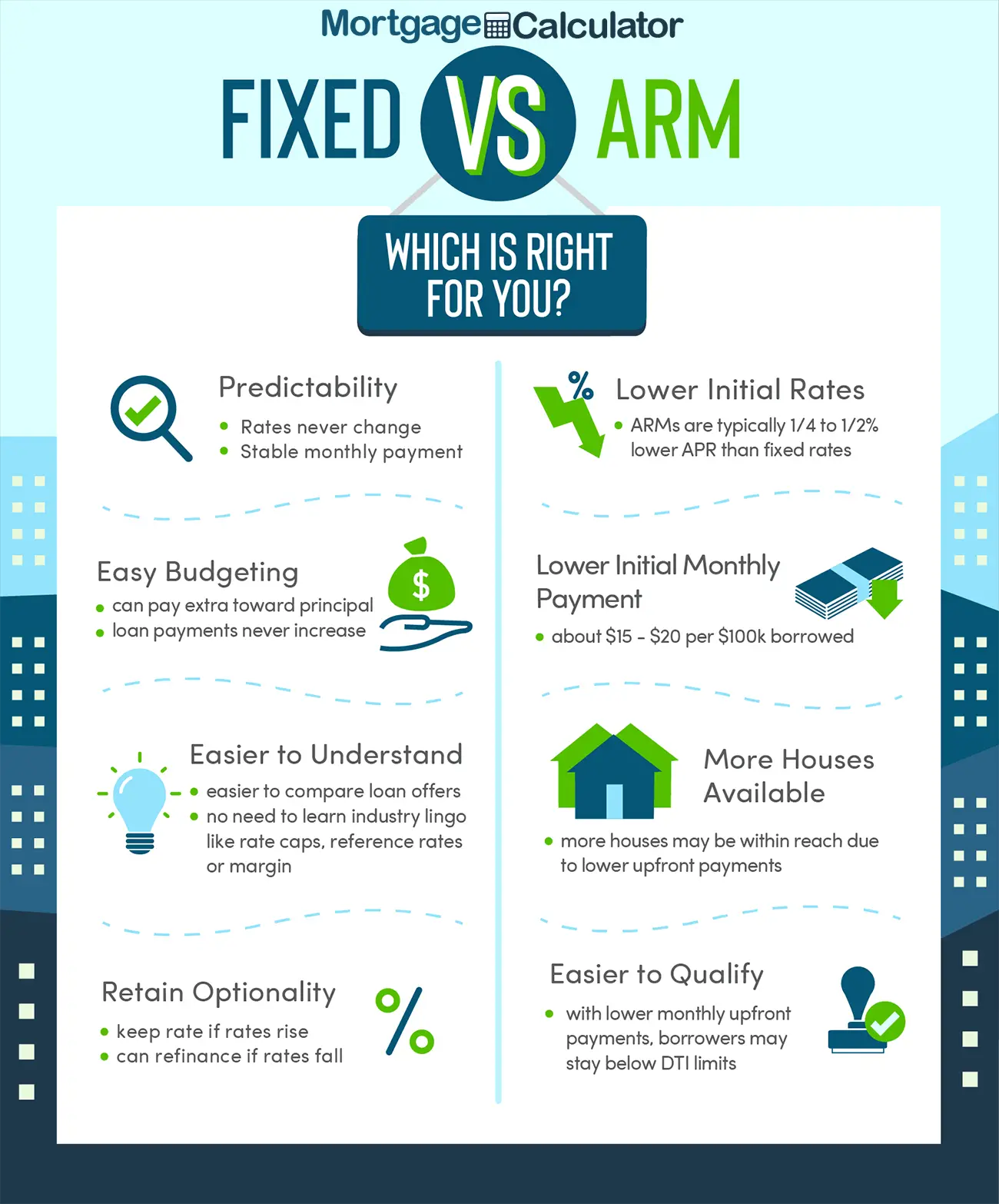

The answer to this question depends on how comfortable you are with fluctuations in your monthly budget. If interest rates increase, do you have the funds or income to pay a higher monthly mortgage fee on an ongoing basis? If the answer to this is yes, then you could probably select a variable rate mortgage. If you say no because you feel uncomfortable with changes to your budget, or that you couldnt afford a mortgage payment increase, then a fixed rate mortgage is the best choice for you. Unlike a variable rate mortgage, a fixed rate product means you wont be unpleasantly surprised by sudden increases in your monthly mortgage fee. This is because with a fixed rate mortgage the interest rate is set and fixed at the time you take out the product. It will not increase or decrease regardless of what happens to the Bank of Canada prime rate.

Fixed And Variable Rate Home Loans

- Variable rate home loans tend to be more flexible, with more features fixed rate home loans typically do not.

- Fixed rate home loans have predictable repayment amounts over the fixed term, variable rate home loans do not.

- If you get out of a fixed rate home loan term, you will usually be charged significant extra costs.

What Else Do I Need To Know

Mortgage deals offering the cheapest rates usually come with fees attached. You can opt to pay these upfront or add them to the loan. To factor in the cost of the fee, order your the results by initial period cost .

Alternatively, you can order results by initial rate, lowest fee or monthly repayment even by the lenders follow on rate that the deal will revert to at the end of the term.

The very cheapest are reserved for bigger deposit amounts, usually of 60% of the property value or more. And, in all cases, you will need a sufficient income and clean credit history to be accepted for a mortgage.

If you want to see what your monthly mortgage payments might look like in different scenarios while overlaid with household bills, our Mortgage Calculator will crunch the numbers.

Also Check: How Soon Can I Refinance My Fha Mortgage

How Long Should I Fix My Mortgage For

If you have a low loan-to-value then you could almost certainly benefit from fixing, as you will be able to secure a low fixed-interest rate.

The longer your fixed term, the longer you are locked into a lower interest rate. Although there is no limit to how many times you can remortgage if you opt for a long fixed-term period you may have exit penalties and early redemption fees if you want to repay your mortgage or move. In addition, if the BOE base rate is cut you won’t benefit either. These factors have to be traded off against the cost of exiting your current deal and the certainty that a fixed-term mortgage provides.

A recent development in the market has been the introduction of longer-term fixed-rate mortgage deals, including a 40-year fixed-rate from Kensington Mortgages and Habito. These attract a higher rate, but give certainty over the amount you will have to pay over the long term. It also removes the cost and effort of having to remortgage every few years. There are more details in our article “Which are the best long-term fixed rates mortgages – and should you get one?“

What To Expect Moving Forward

In the first half of 2022, Canadas central bank has already raised its overnight rate by 1%, in an effort to cool inflation. According to Statistics Canada, the countrys inflation rate reached 6.8% in May 2022, the highest level in more than 30 years. As a result, the Bank of Canada has stated that it will continue to use the overnight rate to manage inflation and keep it between 1% and 3%.

In fact, Ian Lee, an associate professor at Carleton Universitys Sprott School of Business, told CTV News that he expects the Bank of Canada to keep raising its policy interest rate to more than 3% by the end of 2023. As a result, he said it may be worth considering a fixed-rate mortgage since these borrowers are sheltered from any rate hikes until their mortgage is up for renewal.

Also Check: Who Should You Get A Mortgage From

Variable Rate Home Loans

A variable rate home loan typically offers more flexibility than a fixed rate home loan. It generally comes with a range of features which may help you react to changes in your life or financial circumstances.

For example, many variable rate home loans let you make additional repayments to pay off your loan faster, and then let you redraw these additional funds if you need them in the future. Many variable rate home loans also have an offset account feature, which could help to reduce the amount of interest you pay.

A potential drawback of a variable rate home loan is that interest rates can change at any time. This means they can go up and down. It’s a good idea to consider whether you can afford higher loan repayments if interest rates were to go up.

What Is Better A Fixed Rate Or Variable Mortgage

There is no straight answer to this question. Since 2009 the base rate of interest set by the Bank of England has been continuously dropping to record lows. Financial experts are not expecting them to rise again until 2016 at the earliest. This means that in theory this may be a good time to take out a variable rate mortgage. However there is still some risk involved because nobody knows exactly what is going to happen with interest rates after this time. There are some who think that they could rise quite sharply, which would mean that your payments could start getting a lot higher. There are others who think that the increase to interest rates could be a much more gradual process, this would mean that your payments would not go up that much over this time.

Recommended Reading: How Do I Get A Mortgage Credit Certificate

Pros & Cons Of A Fixed Mortgage Rate

A fixed rate is beneficial for budgeting purposes and offers financial stability, given that mortgage payments always remain the same for the mortgage term. On fixed rates, you can lock your rate and payment for a given period your term which can usually range from 1 to 5, 7 or 10-year terms.

The fixed interest rate being offered to you most often during the market cycle, or historically, will be higher than a variable rate for your situation. Even though the fixed rate will provide you with a stable and predictable mortgage payment for years, it will come with a more significant interest rate differential penalty.

A convertible option with a variable-rate mortgage lets you early renew your variable-rate mortgage to a fixed-rate mortgage without penalty at any time during your term. Reciprocally this option does not exist, as you cannot renew a fixed-rate mortgage to a variable-rate mortgage. It is impossible to switch from a fixed to a variable without paying the penalty.

Variable Vs Fixed Rate

When you are buying a home or refinancing your mortgage, you are faced with the question of whether to go with a fixed rate or a variable rate. While both offer low interest rates, fixed rates are generally better, mainly because you know what youre paying for and dont have to worry about your rate going up.

A variable rate will allow you to get a lower interest rate, but youll need to make an adjustment to your payments to accommodate the change. For example, if your interest rate goes up by 1 percent, your mortgage payment increases by $359, while your monthly income decreases by $39.

Variable rates tend to be a lot lower than fixed rates, and they can also be a bit more flexible. You can switch from a fixed rate to a variable rate, but you will pay a larger penalty if you do.

When comparing a variable rate to a fixed rate, you will want to consider your personal risk tolerance. If youre conservative, youre better off with a fixed rate. However, if youre looking to take advantage of a high return, you may be more interested in a variable rate.

Generally speaking, variable rates are more sensitive to changes in the prime rate. Prime is the Bank of Canadas overnight lending rate, and its directly affected by the Canadian economy.

Don’t Miss: Can I Get A Mortgage Loan After Chapter 7

If Youre Feeling Uncertain Seek Out Personalized Advice From Professionals

For new homebuyers making a mortgage decision right now, there are many things to take into account in light of the shifting real estate market. Consider your financial ability to pay off a loan in the long term and the type of lender youd like to leverage. Its also helpful to ask yourself some orienting questions, such as:

- Whats my risk tolerance?

- Can I pass the mortgage stress test?

- Can I afford a mortgage that ebbs and flows with the market?

- What’s my minimum, median, and/or maximum monthly payment threshold?

- Can I afford to pay a premium for a fixed interest rate?

- What type of lender do I want to work with?

- Do I prefer paying the same amount monthly, or am I okay with fluctuations?

If youre thinking about buying or selling this year, and are looking for more advice on how to navigate upcoming market changes, Properlys housing experts can help.

However you proceed, do your due diligence, know your financial situation inside out, and consult your trusted financial advisor in depth before moving confidently forward. When it comes to mortgage options in this fluctuating market, its your move, and one size does not fit all.

Questions To Ask When Choosing A Variable Rate

Questions you should ask yourself if choosing a variable rate how aggressive do you think that the BoC and the US Fed are likely to be in their goal of driving down inflation? What are the risks to your goals if rates keep increasing? Do you have the financial stability to weather more increases? Will it give you peace of mind to lock in now? The solution is different for everyone so is the impact if the rates keep moving up or start heading down.

Before the supply and demand issue created by COVID-19 and those additional ones from the war in Ukraine, inflation and prime rate was historically low. We can expect rates to settle down if the central bank overcomes the current inflationary challenges. However, there is no guarantee of this happening, so it is prudent to review your risk with one of nestos commission-free mortgage experts to find the most suitable mortgage solution for you.

Don’t Miss: Can You Get A Conventional Mortgage On A Manufactured Home

Did You Know Theres A Third Type Of Mortgage: Static/adjustable

If you want to take advantage of low rates but also crave predictability, a combination of fixed- and variable-rate mortgages might be your ideal option.

Some banks offer a fixed-payment variable rate, where the monthly payment amounts stay the same for the next 5 years. But, if the rate fluctuates behind the scenes, the bank maintains your payment amount by adjusting how much goes toward interest versus your principal investment .

While this seems to be the best of both worlds, and theres no material impact at the mortgage renewal stage, terms for each loan could be different, and therefore more challenging to manage during the renewal process. You may also face significant challenges if you decide to renew with a different lender.

PROPERLY POINTER: Breaking down A lenders, B lenders, and private lenders

What are A lenders?

A lenders are highly-regulated, traditional institutions that tend to lend to people with predictable incomes and solid credit scores. These lenders can include banks, credit unions, and other institutions that are subject to federal regulation. If youre applying for a loan from an A lender, a mortgage stress test is a must.

What are B lenders?

These secondary, less-regulated lenders serve customers with less predictable income, and/or who may require fewer barriers to securing a mortgage loan. Because theyre servicing clients who have a weaker credit history or unpredictable cash flow, B lenders offset this risk with higher interest rates.

What Are The Advantages Of A Variable Rate Mortgage

A variable rate mortgage can work in your favour for many reasons such as:

- Your rate can drop: The main advantage to a variable rate mortgage is that your payments can decrease. This means over the lifetime of your mortgage, you could actually pay less than what you initially thought you would.

- You want a medium or long-term mortgage: A fixed rate mortgage can come with a heavy price once the term ends in the form of a reversion rate. This is something you avoid when you take out a variable mortgage. If you take out a long mortgage on a variable rate, your payments could decrease or only rise slightly over the course of the mortgage.

Don’t Miss: What’s The Going Mortgage Interest Rate

Things To Consider About A Fixed Rate Home Loan

A fixed rate home loan is not as flexible as a home loan with a variable rate. This may be worth keeping in mind if you think your financial situation is likely to change in the future.

Key points:

- With CommBank Fixed Rate home loans you can only make up to $10,000 in additional repayments per annum without incurring an early repayment adjustment

- You cannot redraw any additional repayments youve made during the fixed rate period

- There may be an early repayment adjustment for paying your loan out early

- You wont benefit from any future interest rate falls

- Doesn’t provide access to our Everyday Offset account

- No access to features like top-ups.

Why Fix Your Mortgage Rate

At the heart of the should you fix your mortgage question is a worry that interest rates will continue heading higher. The attraction of fixing your mortgage rate is the certainty it brings to your mortgage monthly repayments. The interest rate on a fixed-rate mortgage is fixed for a specific period of time and will remain at this rate regardless of changes to the interest rate in the marketplace. Once the fixed period expires then the rate will normally convert to the lender’s standard variable rate , or another fixed rate if available. Lenders frequently charge a fee – early repayment charge – if a borrower wishes to terminate or switch to another deal within the fixed term.

People who are currently paying their lenders SVR are vulnerable to interest rate rises. If interest rates go up then so will their monthly mortgage payments. Similarly, tracker and variable rate mortgages have interest rates which reference the Bank of England base rate, currently at 3.5%. However, while tracker mortgages will move in step with the base rate lenders can often move their standard variable rates with no defined link to the base rate.

So, if you are on the lenders default SVR, which around 70% of mortgage borrowers now are, then check the terms and conditions. Some lenders have SVRs which will always be at a maximum of, say, 2% above the BOE base rate.

Recommended Reading: How To Sell Reverse Mortgages

How The Prime Rate Affects Variable Mortgage Rates

Canadas prime rate is the interest rate that most Canadian major banks charge their best customers. The prime rate varies with performance of the Canadian economy and inflation forecasts.

With a variable-rate mortgage, the interest rate you pay is tied directly to the prime rate and will move up and down with the prime rate.

If the prime rate falls, more of your payment goes towards to the principal. This means, you pay off your mortgage faster.

However, if the prime rate rises, more of your payment goes towards the interest, and less to the principal, meaning it could take you longer to pay for your home. If the prime rate increases to a specific percentage or trigger point , your lender may increase your payments to ensure you pay off your mortgage by the end of the amortization period.

If you have a tight budget, an increase in your mortgage payment may impact your ability to make your mortgage payment or take care of other household expenses.

Slow Going In The Rate Market

Its a grind out there, but we did make slight progress in rates this week.

The lowest uninsured one- and three-year fixed mortgage rates improved 10 basis points. Albeit, many will still find them unpalatable at 5.74 and 5.24 per cent respectively.

All we can do is hope that rates dont get uglier before inflation gets better.

On the insured side, rates remain much lower. A one-year insured term at the current rate leader, QuestMortgage, will run you 4.64 per cent. Thats 110 basis points lower than if you didnt purchase default insurance. That wide spread is quite unusual and a reflection of how much lenders value government-backed default insurance when lending out their money.

Looking ahead, remember that bond yields generally lead fixed mortgage rates. Once economic data confirm that inflation risk is meaningfully subsiding, bond yields will drift lower.

Problem is, short-term yields will fall slower than longer-term yields. Thats an annoyance for borrowers who want to lock in for just a year and then ride rates lower in 2024. For at least the next six to 12 months this phenomenon should keep one-year fixed rates high relative to longer-term fixed mortgages.

Recommended Reading: What Would The Payment Be On A 100 000 Mortgage