What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

The Buyer Lost Income Or Piled On Debt

A home buyers ability to repay its mortgage gets based on Debt-to-Income. DTI is the amount of debt a buyer has compared to their income.

Mortgage approvals cap a buyers debt-to-income ratio near 50 percent.

If the buyers debt rises but their income stays the same, the pre-approval may get revoked at the point of purchase.

Things To Know Before Getting A Mortgage

The United States’ mortgage debt totaled more than 15.5 trillion in the first quarter of 2019, making it the most substantial debt for American households. Conventional wisdom tells us mortgages are good debt because homes typically appreciate in value, but that doesn’t mean you should get a mortgage without careful research. Make sure you understand the following points before buying a home.

Recommended Reading: How To Lower Your Mortgage

What Property Tax Amount Should I Input Into This Mortgage Pre

The property tax owing for any property will be based on the municipality where you live. If you are unsure of the amount to include, then leave it at $1,000 for your first calculation.

Once you see the purchase price, that you could potentially qualify for, then change the property tax to 1% of that amount.

Every city is different, if a lender doesnt know what the property taxes will be, then they will assume 1% of the purchase price. Thats a fair number to use for these purposes.

Is Mortgage Preapproval Worth It

Mortgage preapproval comes with several benefits. First, it gives you an idea of how much you can borrow, which will help narrow down your search to houses in your price range. But remember that just because youve been preapproved for an amount doesnt mean you have to borrow the maximum. In many cases, its probably a good idea that you dont. Thats because many mortgage lenders use your gross monthly income as a factor in determining how much you qualify for.

Your lender generally doesnt consider your daily living expenses things like groceries, utilities, childcare, healthcare or entertainment or monthly debts in its calculations. Its up to you to review your budget to make sure youre comfortable with the loan amount. Dont rely on your lender to tell you what you can afford.

The preapproval process could also uncover potential issues that would prevent you from getting a mortgage, so you can work them out before setting your heart on a house.

Lastly, a mortgage preapproval lets sellers know you have the borrowing power to back up an offer you make to buy their home, which could make your offer more competitive. It tells real estate agents, who typically work on commission, that spending time on you could well pay off with a transaction. And it alerts lenders that youre a savvy borrower who may soon be taking out a mortgage loan.

In short, getting preapproved for a mortgage signals that youre a serious buyer.

Don’t Miss: What Does Qc Mean In Mortgage

Why Is It Important To Get A Mortgage Pre

Again, neither lenders nor buyers require mortgage approvals in Canada. However, they do offer some significant benefits. Of course, the most obvious is that they help you define your housing purchase budget. However, a mortgage approval also provides you with some leverage as a buyer. It removes a step, expediting the home buying process. You will go into negotiations knowing you have already secured a mortgage loan which could win you concessions from a buyer. Finally, shopping around for pre-approvals allow you the time to focus on getting the best mortgage loan package. You can compare rates, terms, and other details without the added pressure of an impending sale. And again, you will have a guaranteed rate for a specific period that can protect you, particularly from rising rates.

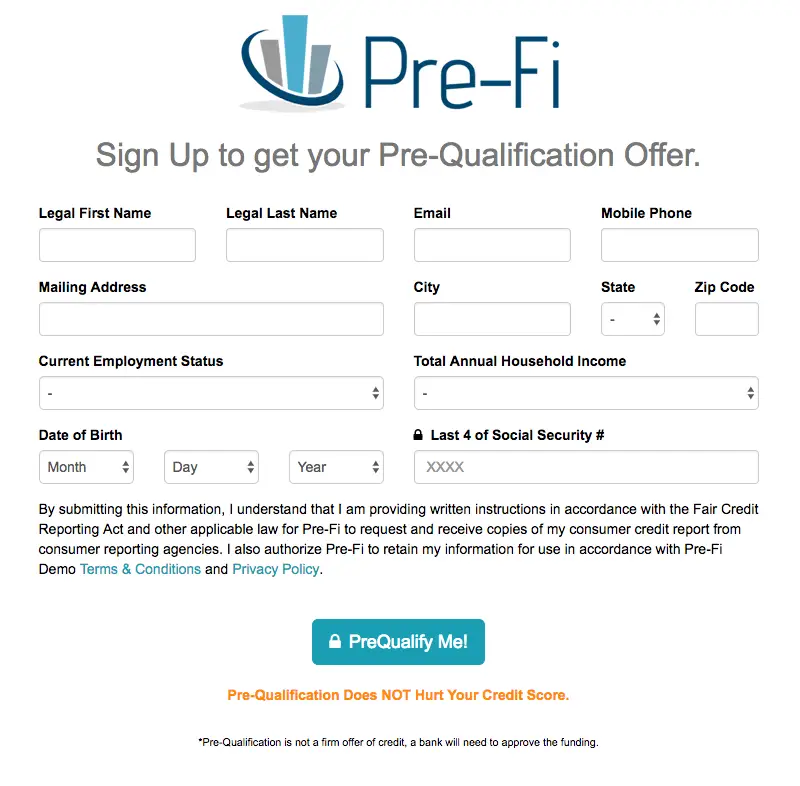

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

Read Also: Can I Add My Husband To My Mortgage

What Are The Advantages Of Getting Mortgage Pre

Obtaining mortgage pre-approval is the best way to prove to sellers that you are serious about buying a home. It demonstrates that you have gone through the steps necessary to determine how much you can afford in a home and you have the necessary paperwork to show for it. There are some real estate agents who will not work with buyers until they obtain mortgage pre-approval. After all, what is the point of looking at houses youre not sure you can afford?

Mortgage pre-approval sets you apart from buyers who have only completed pre-qualification and have not yet been pre-approved for a mortgage. This shows that you are serious about buying a home and gives you an advantage over the buyers who are just shopping for homes.

Calculating The Income Required For A Mortgage

Youve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of whats affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they dont just take into account what the mortgage payments will be, they also look at the other debts youve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

Thats the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders dont want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. Thats the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowners insurance and, if applicable, mortgage insurance and condominium or homeowners association fees.

Don’t Miss: Are Home Equity Loan Rates Lower Than Mortgage Rates

Why Apply For A Mortgage Pre

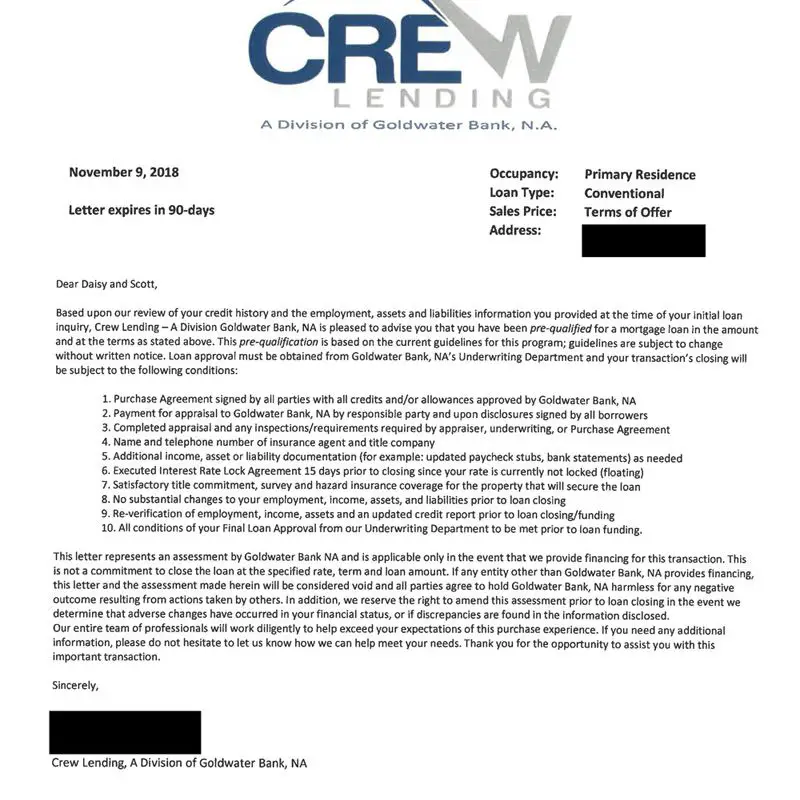

A mortgage pre-approval is an important part of the home buying process. If you are pre-approved, it means that a lender has stated that you qualify for a mortgage loan based on the information you have provided, and subject to certain conditions. A mortgage pre-approval often specifies a term, interest rate and principal amount. Although not a required step, it is helpful as it can give you a clearer picture of how much house you may be able to afford.

Dont Get Preapproved Too Far In Advance

When you receive your preapproval letter, it will probably say its good for 30 to 90 days. Since thats a relatively short period, youll probably want to wait to get preapproval letters until youre ready to start seriously shopping for a home. And remember, a preapproval is only a conditional approval. If you rack up more debt, change jobs or reduce your savings, you could get denied when you go to get final mortgage approval.

Also Check: Can You Borrow Extra Money On Your Mortgage For Renovations

When Should You Get Prequalified For A Mortgage

The key distinction of prequalification is how quick and easy it is. Since you supply the information used to create the estimate, however, your lender cannot verify the accuracy of that estimate, so brokers and agents don’t often see prequalification as a particularly valuable data point when considering you as a borrower or client.

This means the best use of prequalification is early in your home buying journey. It can help you get started on your budget and find a price range for potential homes before you’re ready to commit to the next level of home buying.

What’s The Difference Between Mortgage Preapproval And Prequalification

Mortgage preapproval and prequalification are similar steps in the homebuying process. They’re both ways for lenders to tell you what the terms of your mortgage could be, but they have some key differences.

When you apply for prequalification, you’ll tell a lender information such as your income and credit score. But you don’t have to provide any official documents, and the lender won’t perform a hard credit inquiry .

Mortgage prequalification isn’t as thorough of a process as preapproval, so your results won’t be as precise. Once a lender gets hold of your financial records and credit score through a preapproval, they can give you more accurate numbers.

Prequalification takes place before preapproval in the homebuying process. You’ll probably apply for prequalification if you’re just starting to consider buying a home, and you’ll apply for preapproval once you’re ready to shop for homes.

That preapproval requires official documentation and a hard credit inquiry, which affects your score. Preapproval letters are only valid for two or three months, so if you’re still a ways out from buying, start with prequalification to get a general idea of what buying a home could mean for your finances.

Many homebuyers apply for prequalification, then preapproval, then approval.

Read Also: What Percentage Of Mortgages Are Fannie Mae And Freddie Mac

What Is Prequalification

Prequalification is quick and cheap, if not free. It can usually be done online or over the phone, and the whole process is often over in less than a day. You typically supply your bank or lender with some basic financial information in the form of a verbal or written approximation, and they give you an estimate of how much you can likely borrow.

How Can I Start The Pre

Pre-approval allows prospective buyers to search for a home with an accurate estimate that they can afford. This reassurance not only helps home buyers shop with confidence, but will also go a long way in avoiding potential interruptions to the sale down the line.

Do you want to compete with cash offers and get the pre-approval process off to a fast start? Supercharge your offer with PowerBid Pre-Approval from Guaranteed Rate and let us help you find your new home.

Recommended Reading: How Big A Mortgage Can I Get With My Salary

The Higher Your Credit Score The Better

Lenders are cautious about lending money since the subprime mortgage crisis of 2007, so your now more than ever. Buyers with lower credit scores have higher interest rates, so they pay more for their mortgage over time. And if your credit score is less than 620, you may not be able to get a loan.

The higher your credit score is, the better your chances of securing a low-interest mortgage. Get a copy of your credit report and make sure its error free. Clear up any issues you find before you apply for a mortgage.

You can boost your credit score by paying off outstanding debts, including credit card balances and personal loans, and by making your payments on time, every time. If you have collections on your credit report, it’s worth asking the collection agency if they’ll agree to a “Pay-for-Delete” arrangement. In these cases, they’ll delete the collection from your record if you pay the outstanding balance in full.

Opening new accounts also lowers your credit score. Until you get your mortgage, hold off on getting new credit cards or personal loans or anything else that calls for a credit check, such as switching phone carriers.

Two Types Of Conventional Loans

- Conforming Conventional Loans: Conventional mortgages follow assigned loan limits established by the Federal Housing Finance Agency . In 2022, the maximum conforming limit for a single-unit home in the U.S. continental baseline is $647,200. If this is the maximum conforming limit in your area, and your loan is worth $600,000, your mortgage can be sold into the secondary market as a conventional loan. We publish maximum conforming limits by county across the country.

- Non-conforming Conventional Loans: Also called jumbo loans, non-conforming conventional mortgages exceed the assigned conforming loan limits set by the FHFA. These loans are used by high-income buyers to purchase expensive property in high-cost locations. The conforming loan limit for high-cost areas are 50% higher than the baseline limit, which is $970,800 for single-unit homes as of 2021. Jumbo mortgages have stricter qualifying standards than conventional loans because larger loans exact higher risk for lenders.

PMI on Conventional Loans

Private mortgage insurance or PMI is required for conventional mortgages when your down payment is less than 20% of the homes value. This is an added fee that protects your lender if you fail to pay back your loan. PMI is typically rolled into your monthly payments, which costs 0.5% to 1% of your loan per year. Its only required for a limited time, which is canceled as soon as your mortgage balance reaches 78%.

Recommended Reading: What Is A Conditional Approval For A Mortgage Loan

The Buyers Employer Or Job Title Changed

Changing jobs even for higher pay can ruin your pre-approved mortgage.

If you plan to make any of the following changes in your job or career, ask your mortgage lender before making the change:

- Becoming a partner in a company

- Starting a new business

- Switching from a salaried position to a salary + bonus position

- Changing industries

- Accepting payment in cryptocurrency

Its okay to make changes in your career. Be sure to speak with your lender to avoid unintended consequences.

The Importance Of Pre

In order to be taken serious by the seller as well as your real estate agent you will want to be able to produce a pre-approval letter. It assures these parties that you will be able to make the purchase, and not simply produce an empty offer. Should there be any competition for the property you intend to purchase a pre-approval will be an advantage over someone without one since the seller is assured that you will be able to get the money necessary to buy his house.

You May Like: Mortgage Recast Calculator Chase

You May Like: How To Get Mortgage To Build A House

How Long Will A Pre

Because pre-approvals are hard inquiries that impact a home buyers credit score, they can stay visible on their credit reports for up to two years, according to Experian.

Your credit score is one of the most important factors a lender considers. Your lender accesses the score and documentation through credit bureaus.

However, the impact on a home buyers credit score declines as time passes, and the hard inquiry becomes less relevant.

Depending on a home buyers financial history, a few points can impact their credit score. However, many variables make up a home buyers creditworthiness and can influence the impact of the inquiry.

Learn more about buying a home, even if you have bad credit.

Why Would You Want A Mortgage Pre

While a pre-approval doesnt guarantee youll get a mortgage, being pre-approved does have some advantages. Here are three reasons you might want a mortgage pre-approval:

Read Also: How Do You Calculate Points On A Mortgage

How To Apply For Mortgage Pre

Mortgage pre-approvals are available from a wide variety of lenders and mortgage brokers. Call or make an appointment to begin. You can often start the process online with many lenders and some brokers by answering a few questions. However, at some point, you will have to provide documentation of your credit history, including assets, liabilities and earnings, and your current wages and existing loans and accounts. You will also likely speak directly to a representative of the institution at some point in the process.

What Is Preapproval

Preapproval is usually more involved than prequalification, but not all lenders preapprove in the same way. You’ll need to check to make sure you know all the rules of your specific preapproval process. At Rocket Mortgage®, preapprovals are typically free of charge and remain valid for 90 days, but this can vary from lender to lender.

Don’t Miss: Do You Need Good Credit For Reverse Mortgage

How Good Is A Pre

Home buying is probably most enjoyable for people who have pre-approved mortgage loan letters in hand. However, pre-approved mortgage loan letters aren’t ironclad guarantees of mortgage funding for the buyers holding them. Still, pre-approved mortgage loan letters are generally reliable when it comes to receiving the mortgage loan you desire.