How Do Lenders Calculate Your Mortgage Rate

Would you believe it if we told you that the biggest determinant of your mortgage rate has nothing to do with your own financial situation? That is a surprise to many who hear about it. But it is true. Here we explain what that factor is and then talk in detail about all the other major factors.

We have been hearing a very common question lately: The Fed has dropped the mortgage rates to zero. Will my mortgage rate go down as well? Its a very obvious question to ask. Mainly because from past experience, people have observed that the two do move together, at least somewhat.

What many may not know is how the two are related and connected. Additionally, people also wonder why their mortgage rate is higher while someone else they know is getting a lower rate, even though both have approximately the same credit scores.

The truth is that there are so many factors that go into how your mortgage rate is calculated that it often becomes complicated for one to understand. Lets take a closer look and understand how it all works.

And How Much More Would The Mortgage Rate Be

Well, that depends on a lot of factors. At the end of the day, the lender mostly cares about getting his money back and earning the interest he asked for. We also call that as a borrowers ability to repay.

The three major factors that govern your ability to repay are:

Debt-to-income ratio This is the ratio of your total monthly debt payments to your total monthly income, in short also called as DTI. Debt includes home loan, auto loan, education loan and any other kind of loan you may have.

Lets say two individuals have the same monthly income of $8,000. If the first one has to make a total debt payment of $1,500 while the other has to pay $6,000 in debt every month.

The risk with the first guy is less because he has more breathing room in case something goes wrong, such as a loss of job. He can always adjust his life-style to still be able to make his payments, while the other one does not have as much cushion.

Loan-to-Value ratio This is the ratio of the amount you took as loan to buy the home vs the market value of the home, popularly known in the industry as LTV.

Say suddenly the economy goes south, people lose jobs and home prices decrease in value significantly. Fewer people will be able to make their payments and some might default on their payment.

In a situation like that, if the bank has to foreclose and sell the home, their chance of recovering their investment is higher when the loan amount is lower.

The Mortgage Insurance Premiums And The Total Fha Loan Amount

Currently, the Upfront Mortgage Insurance rate for all FHA loans is 1.75%. To calculate how much you can expect to pay for your total loan, get the Upfront Mortgage Insurance rate and add it to the base loan amount.

You obtain the Upfront Mortgage Insurance rate by multiplying 1.75% by the base loan amount. For example, using the earlier scenario, get 1.75% * $579,000 = $10,132.50. Then, add $579,000 + $10,132.50 = $589,132.50 which is the total loan amount.

The Upfront Premium usually isnt included in the calculation of the monthly installment. Instead heres how you go about it. Take the base loan amount and multiply it by the mortgage insurance rate.

The figure you get here will be an annual amount, so to get the monthly installment due, divide the figure by 12. For instance, assume that the FHA loan of $579,000 that you saw earlier with the 3.5% down payment has a mortgage insurance rate of 0.75% .

To get the annual premium, calculate: $579,000 * 0.75% = $4,342.50. Then divide this annual premium by 12 to get the value of each monthly instalment: $4,342.50/12 = $361.88.

Don’t Miss: Is Quicken Loans A Mortgage Broker Or Lender

Factors That Determine If You’ll Be Approved For A Mortgage

Thinking about buying the home of your dreams? Consider these key financial factors before applying for a mortgage loan.

- 02/07/2019

- 1183

If you want to buy a home, chances are good you’ll need a mortgage. Mortgages can come from banks, credit unions, or other financial institutionsbut any lender is going to want to make sure you meet some basic qualifying criteria before they give you a bunch of money to buy a house.

The specific requirements to qualify for a mortgage vary depending on the lender you use and the type of mortgage you get. For example, the Veterans Administration and the Federal Housing Administration guarantee loans for eligible borrowers, which means the government insures the loan so a lender won’t face financial loss and is more willing to lend to risky borrowers.

In general, however, you’ll typically have to meet certain criteria for any lender before you can get approved for a loan. Here are some of the key factors that determine whether a lender will give you a mortgage.

Its Not What You Can Borrow Its What You Can Afford

In some respects, the mortgage lending industry is working against your best interest. If you are deemed a qualified borrower, a lender is prone to approve you for the maximum it believes you can afford. But in some cases, that amount may be too generous.

Buying a home always means dealing with big numbers. And the impact to your budget may seem to be a stretch, particularly in the beginning. The challenge is buying a home that meets your current and future needs, without feeling like all of your money is in your home leaving you without the financial freedom to travel, save for other priorities and have a cash flow cushion.

Now that the NerdWallet How much can I borrow calculator has given you an idea of your buying power, you may want to gut-check the number by:

-

Run affordability scenarios. You can get another view of your home-buying budget by running some what-ifs through the NerdWallet home affordability calculator.

-

Talk to more than one lender. You are more likely to get a better interest rate by comparing terms offered by multiple lenders, and it might be illuminating to see the loan amounts different lenders will qualify you for.

-

Consider all homeownership expenses. Its not just whats built into your monthly payment such as insurance, taxes and the rest but the other having-a-home expenses, like structural upkeep, new furniture, maybe even yard maintenance equipment.

Don’t Miss: When Do You Pay Pmi On A Mortgage

Save For A 20% Down Payment

You dont need to pay for private mortgage insurance when you put 20% down on your loan. PMI can add quite a bit of money to your monthly payment, so avoiding it can significantly reduce what you pay each month. You may also be able to avoid paying for mortgage insurance if you have a VA loan and pay the funding fee upfront.

The Down Payment And Base Loan Amount

A down payment is a monetary contribution towards a home purchase that is paid up front. It is calculated as a percentage of the homes purchase price. The FHA first does an appraisal of the home to determine its value.

In some instances, the appraised value may not match the market price of the home. When this happens, 3.5% down payment is applied to the appraised value of the home and not the market price.

Calculating the down payment is a straightforward process. Heres an example.

Say a home in Ashburn, Virginia has a purchase price of $600,000. The down payment is simply the value of 3.5% of the price of the home. This is equal to $21,000.

Next, take a scenario where the borrower has poor credit. Poor credit means they have of between 500 and 579. The borrowers would have to make a 10% down payment which in this case would require them to pay $60,000 up front.

If your credit score falls below the 500-floor, then you wont be eligible for an FHA loan let alone any line of credit for that matter. Aside from the credit score, the interest rate applied on a loan depends on other factors like your income and the outstanding debt obligations you may have.

The base loan amount definition is what youre left with after deducting the down payment from the purchase price of the home. So, at 3.5% down payment, the base loan amount would be $579,000 or with 10% payment, the FHA base loan amount would be $540,000.

Recommended Reading: What Salary Is Required For A Mortgage

Best Home Loan Option For You

Any good calculator will help determine what might be a good loan product for you based on what you might qualify for. Youll usually see several options.

Its worth noting that you must qualify, so dont take what the mortgage calculator says as gospel. A Home Loan Expert will better be able to tell you what you qualify for when they take a more detailed look at your financial history. However, it does give you a starting point in terms of things to think about.

How Do You Get Paid

This is the first question your loan officer will ask, how do you get paid? When you are asked this, basically, there are several things we need to know:

- Are you paid a straight Salary?

- Are you paid hourly? How many hours do you work?

- Are you full time or part time?

- Do you have a second job?

- Do you work overtime?

- Is more than 25% of your income from Commission?

- Are you self employed? What kind of business?

- Do you itemize your tax returns?

- Do you write off 2106 expenses?

- Do you own rental properties?

The answer to any one of these questions can change the way that your income is calculated.

You May Like: How To Calculate Your Mortgage

Amortization Of A Mortgage

If math is not your thing, your head might spin when thinking about mortgage calculations. If you plan on cutting down the length of your mortgage and reducing the amount of interest you accrue through additional mortgage payments, understanding how your interest is calculated will help you to develop the right strategy.

TL DR

Banks use the federal funds rate, your credit risk and the type of mortgage you are applying for when determining your interest rate.

One More Thing To Consider: The Trade

As you shop for a mortgage, youll see that lenders also offer different interest rates on loans with different points.

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs.

- Points, also known as discount points, lower your interest rate in exchange for an upfront fee. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

- Lender credits might lower your closing costs in exchange for a higher interest rate. You pay a higher interest rate and the lender gives you money to offset your closing costs. When you receive lender credits, you pay less upfront, but you pay more over time with the higher interest rate. Keep in mind that some lenders may also offer lender credits that are unconnected to the interest rate you payfor example, a temporary offer, or to compensate for a problem.

There are three main choices you can make about points and lender credits:

Learn more about evaluating these options to see if points or credits are the right choice based on your goals and financial situation.

Don’t Miss: How Much Of Your Income To Spend On Mortgage

Salary Is Just One Part Of The Mortgage Equation

Many home buyers want to frame their budget in terms of their income.

Its common to wonder how many times your salary you can borrow for a mortgage.

But mortgage lenders dont think that way. And thats because income is only one small part of the mortgage equation.

When all things are considered, like your debt, down payment, and mortgage rate, you might find you could borrow as much as 6 or 7 times your salary for a mortgage. Or your budget could be smaller.

The answer is different for everyone.

What To Do If You Want More Home Than You Can Afford

We all want more home than we can afford. The real question is, what are you willing to settle for? A good answer would be a home that you wont regret buying and one that wont have you wanting to upgrade in a few years. As much as mortgage brokers and real estate agents would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

The National Association of Realtors found that these were the most common financial sacrifices homebuyers made to afford a home:

These are all solid choices, except for making only the minimum payments on your bills. Having less debt can improve your credit score and increase your monthly cash flow. Both of these will increase how much home you can afford. They will also decrease how much interest you pay on those debts.

Consider these additional suggestions for what to do if you want more home than you can afford:

- Pay down debt, especially high-interest credit card debt and any debt with fewer than 10 monthly payments remaining

- Work toward excellent credit

- Ask a relative for a gift toward your down payment, especially if you can demonstrate your own efforts toward becoming an excellent candidate for a mortgage

Don’t Miss: How Much Is A Mortgage A Month

Money You Will Spend Beyond The Mortgage

When figuring out how much of a payment one can afford, there are other expenses that must be considered aside from the mortgage. These addition financial obligations can be:

- Home Maintenance: There will be some maintenance during ownership of the home. Appliances break down, carpet needs replaced, and roofing goes bad. Being overextended due to the mortgage can make repairs more of a burden.

- Utilities: These expenses keep the home heated, lit up, water running, and other items such as sewer, phone, and cable T.V. going.

- HOA Fees: If the community in which the borrower moves in has amenities, there may be Homeowners Association Fees that must be paid. The fees can vary based on what amenities the community is offering. Sometimes the price can be $100 per month or $100 per year.

The Importance Of Pre

In order to be taken serious by the seller – as well as your real estate agent – you will want to be able to produce a pre-approval letter. It assures these parties that you will be able to make the purchase, and not simply produce an empty offer. Should there be any competition for the property you intend to purchase a pre-approval will be an advantage over someone without one since the seller is assured that you will be able to get the money necessary to buy his house.

Read Also: What Mortgage Amount Do I Qualify For

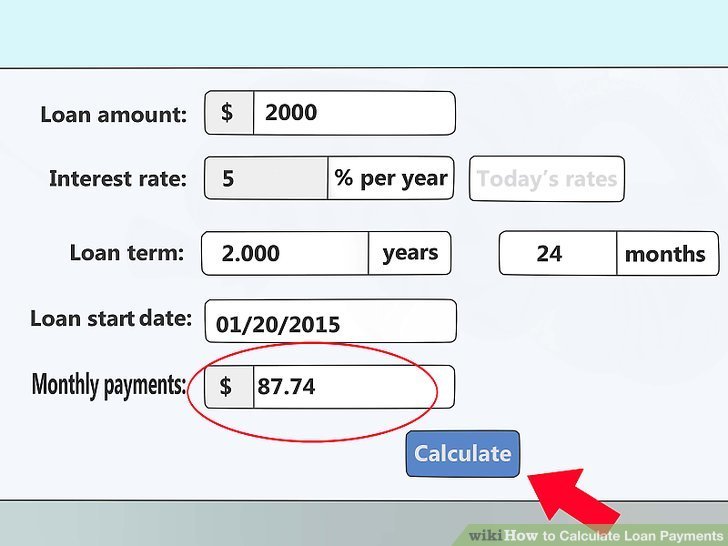

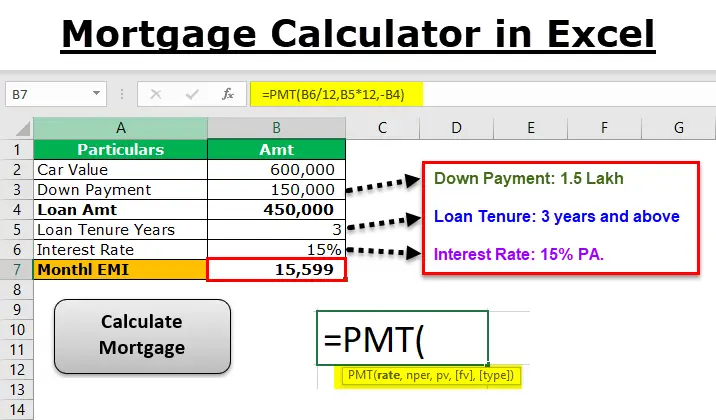

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward your interest.

How To Calculate Monthly Income For Self Employed Mortgage Borrowers

If the borrower is self-employed or a 1099 wage earner, two years of tax returns and income as 1099 is mandatory.

- Lenders will take the adjusted income after all deductions that filers report to the Internal Revenue Service

- Lenders will go off the Schedule C of the tax returns from the previous two years

- Lenders ill take borrowers adjusted annual income to qualify income

- The sum of the two years income from borrowers tax returns are added and divided by 24 months to determine the monthly income

- If the income from the most recent tax returns are lower than the reported income from the previous year, then the income of the most current year tax returns divided by 12 months will be used

Borrowers who wrote off depreciation can add depreciation back to the tax returns and can add it to income.

Don’t Miss: How To Calculate Self Employed Income For Mortgage

Is There Anything Else That Lenders See As Risk

There is one more risk that the lenders end up facing. The risk of you prepaying the loan.

What? Why is that a risk? As a lender, wouldnt I be happy if the money is paid back in full and before time? In full, yes. All lenders love that. But before time, not really.

Banks and other lenders are in the business of making loans. The original principal is what they owe to depositors. Their revenue solely comes from the interest you pay them. If you pay back early, they will not be earning interest from you any more.

One would ask, well they can make a new loan and start earning interest again. A very fair point.

Unfortunately, people prepay and refinance their loan only when interest rates go down. For a bank to be paid the loan amount in full is bad because the new loan the bank will make will be at a lower rate than what you were paying him so far.

This type of risk is called reinvestment risk. Because most mortgages in the US dont have a prepayment penalty associated with them, people can refinance whenever rates fall. So lenders face that risk. Unfortunately, no one refinances when rates go up to make it even for the lenders.

That risk is not with specific borrowers only. Its a risk they face with all borrowers in general. If borrowers were prohibited from early payment, all of us would have had slightly lower mortgage rates. But most borrowers are fine to have the option to prepay for a small cost in the form of a slightly higher mortgage rate.