Logan Mohtashami Lead Analyst At Housingwire

We shouldnt expect skyrocketing rates in the coming weeks, according to Mohtashami. He says that rates have stayed in a very low range for 2021, and that should still be the case for the rest of the year. As long as other economies around the world are still struggling, that puts a limit on how high rates can go in the U.S.

Borrowers may still have time to lock-in a great rate, but buying a home doesnt look like it will be getting any easier. This housing market is the most unhealthy housing market post 2010, he says. Not because theres a bubble or a credit boom or anything like that, its just that the shortage of homes is facilitating forced bidding. The number of homes for sale has increased somewhat from recent lows, but inventory still isnt fully meeting the demand. We may see a seasonal dip in housing inventory this winter which will not make it any easier for buyers in the coming months.

The Mortgage Production Line

The mortgage industry has three primary parts or businesses: the mortgage originator, the aggregator, and the investor.

The mortgage originator is the lender. Lenders come in several forms, from credit unions and banks to mortgage brokers. Mortgage originators introduce and market loans to consumers. They sell loans. They compete with each other based on the interest rates, fees and service levels that they offer. The interest rates and fees they charge determine their profit margins. Most mortgage originators do not portfolio loans . Instead, they sell the mortgage into the secondary mortgage market. The interest rates that they charge consumers are determined by their profit margins and the price at which they can sell the mortgage into the secondary mortgage market.

The aggregator buys newly originated mortgages from other institutions. They are part of the secondary mortgage market. Most aggregators are also mortgage originators. Aggregators pool many similar mortgages together to form mortgage-backed securities a process known as securitization. A mortgage-backed security is a bond backed by an underlying pool of mortgages. Mortgage-backed securities are sold to investors. The price at which mortgage-backed securities can be sold to investors determines the price that aggregators will pay for newly originated mortgages from other lenders and the interest rates that they offer to consumers for their own mortgage originations.

The Current State Of Mortgage Interest Rates

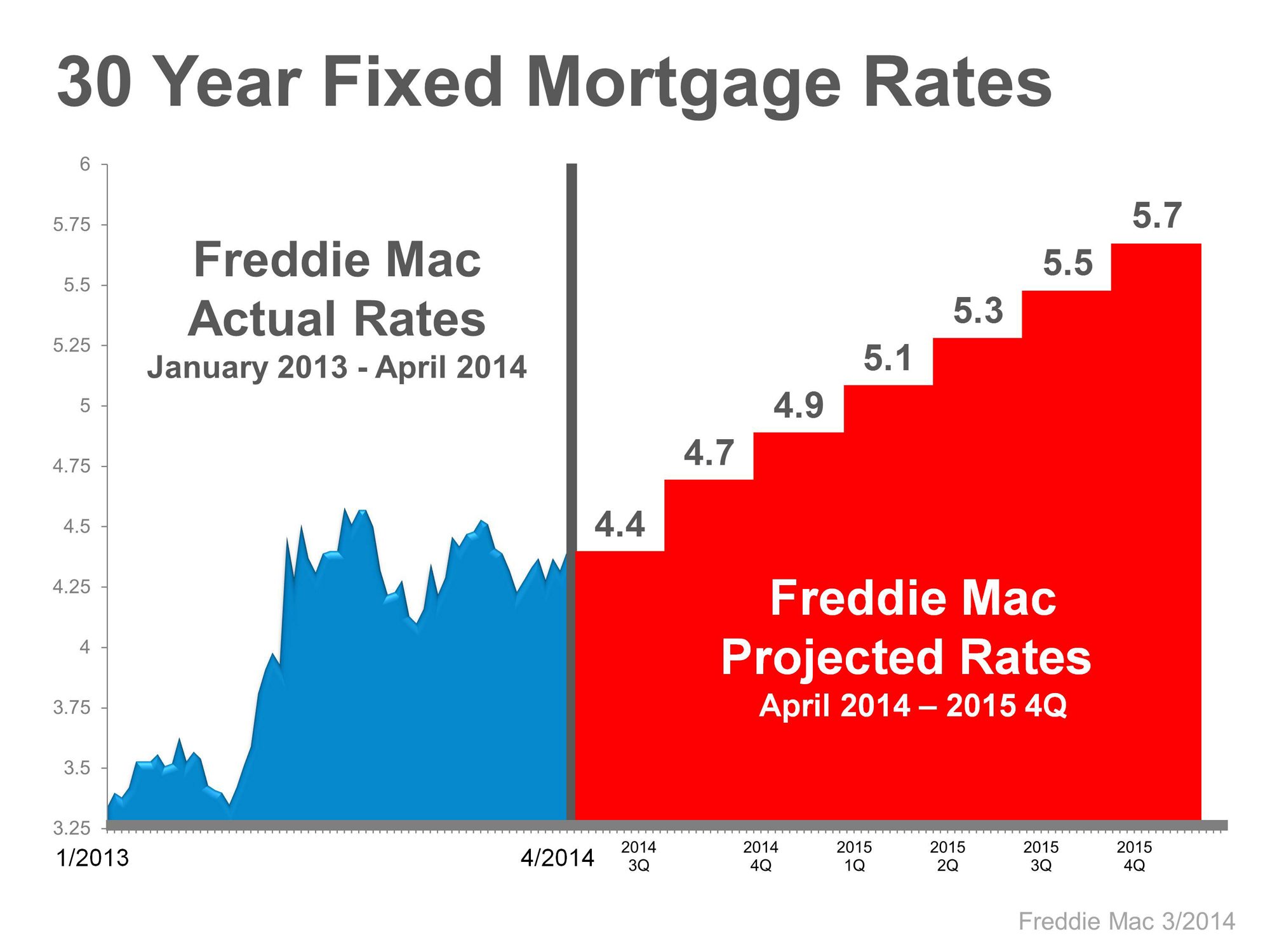

For the week ending Nov. 29, 2021, the average rate on a 30-year fixed-rate mortgage was 3.11%, according to Freddie Mac. Thats up slightly from 2.72% for the same week in 2020, but still very low.

Despite low rates, high home prices have discouraged many homebuyers. Home prices increased 18% from September 2020 to September 2021, according to data analysis company CoreLogic.

Of course, rising home prices can be good news for homeowners looking to refinance. Homeowners in the U.S. can and have taken advantage of the low interest rate environment. Around $1.3 trillion first-lien refinance originations occurred in the first half of 2021, Freddie Mac reports. Thats a 33% increase in refinancing activity compared to the first half of 2020.

Also Check: Can My Wife Get A First Time Buyer Mortgage

How To Find The Best Mortgage Lender

The best mortgage lender for you will be the one the can give you the lowest rate and the terms you want. Your local bank or credit union probably writes mortgage loans with rates close to the current national average. A loan officer in your local branch could guide you through the process.

Online lenders have expanded their market share over the past decade. You could get pre-approved within minutes. Your loan amount combined with current mortgage rates could define your price range for home prices in your area. Many online lenders also assign a dedicated loan officer to offer continuity as you shop.

Shop around to compare rates and terms, and make sure your lender has the loan option you need. Not all lenders write USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s veracity, ask for its NMLS number and search for online reviews.

The Federal Reserve And Mortgage Rates

Currently, the Federal Reserve is purchasing $40 billion per month in mortgage-backed securities as part of its Covid stimulus program.

This is one of the single biggest factors keeping mortgage rates as low as they are.

When the Fed slows or tapers its purchasing of MBS, mortgage rates are almost certain to increase by a wider margin than weve seen this year.

And that could be coming in the not-too-distant future.

In a speech on August 27, Fed Chair Jerome Powell indicated that asset purchase tapering could begin before the end of the year depending on how the Delta variant plays out economically.

Asset purchase tapering could begin before the end of the year depending on how the Delta variant plays out economically.

We have said that we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price stability goals, said Powell. My view is that the substantial further progress test has been met for inflation. There has also been clear progress toward maximum employment.

He continued on to say that in light of these positive trends, he and other Fed members believe it may be appropriate to start reducing the pace of asset purchases this year.

But and its a big but the Fed still isnt clear on what the overall economic impact of the Delta variant will look like. And because of that, its not ready to make any firm plans to start withdrawing support in 2021.

Don’t Miss: What Is Tip In Mortgage

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Mortgage Lock Rate Techniques

Interest rates fluctuate daily. As you’re searching for houses and comparing loans, you’ll see how those interest rates are doing day-to-day. You may notice patterns, such as dips or hikes that last a little while. Use this information and your defined budget to decide when to lock in your mortgage rate.

Another technique is to lock in the mortgage rate early on. Regardless of what the interest rates do, you’ll know what you’re in for. Should interest rates drop dramatically in the future, you may be able to refinance your home to take advantage of the lower rates.

Another tip, whether you’re a first-time homebuyer or refinancing, is to negotiate mortgage rates with your lender.

Recommended Reading: Can You Add Someone To Your Mortgage Loan Without Refinancing

Mortgage Rates: Looking Forward

Looking forward, housing experts predict rates to gradually increase over the long term into 2022 but are divided on rate predictions over the short term. However, experts agree to anticipate rate volatility as competing economic factors push and pull on mortgage rates.

The introduction of the new Omicron COVID-19 variant puts downward pressure on rates, but could be short-lived depending on Omicrons severity. Raphael Bostic, the Federal Reserve Bank of Atlanta president, recently stated: Each successive wave of COVID-19 has led to milder economic slowdowns. If that holds, the economy will continue to grow through it.

On the flip side, we recently saw the highest inflation in 31 years. Rising inflation and strained supply chains are cited by experts as putting upward pressure on mortgage rates.

How Can I Lock In A Low Mortgage Rate

Some lenders allow you to lock in a mortgage rate before your loan closes usually for a period of 30 to 60 days. If rates go up during this time, your rate wont go up with them. However, some lenders charge a fee to lock in a rate. Also, if rates drop after you lock in your rate, you may lose out on the lower rates unless you pay extra for a float-down option, which allows you to switch to a lower rate after youre locked in.

To compare mortgage refinance rates and see actual prequalified rates from multiple lenders, visit Credible.

About the author: is an authority on income taxes and small business accounting. She was a CPA for over 12 years and has been a personal finance writer for more than five years. Janet has written for several well-known media outlets, including The New York Times, Forbes, Business Insider and Credit Karma. In 2021, Canopy named her one of the Top 10 Influential Women in Accounting and Tax.

You May Like: What Do Mortgage Rates Follow

How To Get Your Lowest Mortgage Refinance Rate

If youre interested in refinancing your mortgage, improving your credit score and paying down any other debt could secure you a lower rate. Its also a good idea to compare rates from different lenders if you’re hoping to refinance so you can find the best rate for your situation.

Borrowers can save $1,500 on average over the life of their loan by shopping for just one additional rate quote, and an average of $3,000 by comparing five rate quotes, according to research from Freddie Mac.

Be sure to shop around and compare rates from multiple mortgage lenders if you decide to refinance your mortgage. You can do this easily with Credibles free online tool and see your prequalified rates in only

Is The Lowest Ontario Mortgage Rate The Best Rate

Not always. The lowest rates usually come with more limitations. These restrictions can cost you much more than the small rate savings. Such terms are common with low frills mortgages and typically kick in when you try to port, break or increase the mortgage after closing. When comparing mortgage rates, dont be afraid to ask potential lenders questions to ensure you understand the terms and conditions of your mortgage.

You May Like: How Much Income To Qualify For 200 000 Mortgage

Refinancing Will Slow In 2021

As mortgage rates continue to climb, fewer homeowners will be able to save money by refinancing their mortgages.

Were seeing this happen in real time. In February, 18 million homeowners were refinance eligible, that is they could reduce their interest rate by 0.75% or more, according to data from Black Knight, a mortgage technology, data and analytics provider. But as rates surged above 3%, the number of eligible candidates shrunk to just 12.9 million homeownersa 30% reduction in less than a month.

The MBA predicts that refinancing volume will fall from $2.149 trillion in 2020 to $1.191 trillion in 2021, mainly due to rising rates. There will be an even sharper decline of refinancing volume in 2022 to $573 billion, according to MBAs latest forecast. The refinance share of all mortgage originations is predicted to drop to 41% in 2021 from 57% in 2020.

Refinance activity will depend on rates. Even if rates rise a few basis points above where were at now, we can expect a pretty robust refi demand market in 2021, says Odeta Kushi, deputy chief economist for First American Financial Corporation, a title insurance provider. There are still many homeowners who can save money by refinancing.

As rates rise, the pool of people who can save money by refinancing their mortgage will start to shrink again. If rates hit 3.13%, 6.2 million borrowers will no longer be able to cut costs with a new mortgage.

Todays Mortgage Rates And Your Monthly Payment

More than other factors, your annual percentage rate on your real estate purchase will affect your monthly payments â whether you’re refinancing or buying a new home.

On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

Refinancing to a lower interest rate could save hundreds of dollars a month if you kept the same loan terms. Shortening the loan term could negate your monthly savings but save thousands over the life of the loan. You can experiment with a mortgage calculator to find out how much a lower rate could save you.

Other factors besides interest affect how much you’ll pay in mortgage payments:

Recommended Reading: How To Get Rid Of Escrow On Mortgage

How Do Mortgages Work

In the simplest terms, mortgages are basically large loans from banks or financial institutions. Its just another way to borrow money.

For example, if you borrow $200,000 at 3.00% APR, you will pay approximately $6,000 per year for the ability to have $200,000 to purchase a house to live in. This is why mortgage rates are so important, because the higher your mortgage rate, the more money you will pay in the long-run.

How Does A Fixed Home Loan Work

A fixed rate loan package will guarantee a static interest rate to the borrower for a specified period, which is typically between two to five years. During this fixed period, your monthly repayments would remain the same with pre-determined interest rates irrespective of changes in market interest rates.

However, after this period, your fixed interest rate home loan will be automatically pegged to SIBOR, SORA or FDR as offered by the bank loan package. Now the new interest rates may be equal or even higher than a banks floating rate home loan after the lock-in period, depending on the bank spread. The revised interest rates may be tied down to higher interest rates if rates fall during the lock-in period.

It is advisable to take out a fixed rate home loan over a floating rate loan when overall interest rates are threatening to rise. This way, your loan package will ensure a fixed interest rate for a specified time, providing you with an opportunity to save future costs when market interest rates rise upwards. However, this also might leave you at a disadvantage in low interest rate environments.

Also Check: Can You Wrap Closing Costs Into Mortgage

What Are Todays Mortgage Rates

Low mortgage rates are still available. You can get a rate quote within minutes with just a few simple steps to start.

1Todays mortgage rates based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

Popular Articles

Resources

Canadian Interest Rate Forecast To 2023

HIGHLIGHTS

-

Long-term government bond rates have risen from 0.3% to 1.0% since January. This has a knock-on effect on mortgage rates which have risen roughly half a percent.

-

At its May announcement, the Bank of Canada signalled it might start raising short-term interest rates in late 2022, as a result of a brighter outlook for the Canadian economy. At its announcement in June, the BoC confirmed this economic and rate outlook.

-

5-year mortgage rates are expected to remain low by historical standards, but they are expected to continue rising.

-

A majority of forecasters anticipate the economic recovery will not gain full traction until late 2021 or 2022.

-

Short-term variable interest rates at their lower bound and are not expected to fall any further.

Every economist surveyed expects the Bank of Canada will keep its Target Rate at the effective lower bound of 0.25% until the second half of 2022.

According to a recent Reuters report, Money markets expect two Bank of Canada rate hikes in 2022.

The Bank of Canada says it will keep variable interest rates low until the economy has recovered and inflation has reached roughly 2 percent. Thats great, but they havent stopped fixed mortgage rates from rising significantly.

While low rates are intended to help borrowers weather the economic storm, many Canadians appear to be using them to buy larger homes. The expectation of prolonged lower interest rates shows the economy is unlikely to recover fully until late 2022.

You May Like: How To Remove Pmi From Mortgage Payment