Attractive But Not Riskless

There remain risks associated with taking advantage of the scheme.

One is that if you live long enough you are likely to eventually hit the ceiling and be unable to take out any more money, suffering a loss of income.

If you chose to sell your home and move to an aged care service, you need to use a big part of your sale proceedings to pay whats owed.

Other risks are that neither the interest rate nor home prices are fixed.

Just as the government has cut the rate charged in line with cuts to lower general interest rates, it might well lift it when interest rates climb. And home prices can go down as well as up, meaning that, at worst, all of the value of your home can be gobbled up in repayments.

A Breakdown Of A Mortgage Statement Template

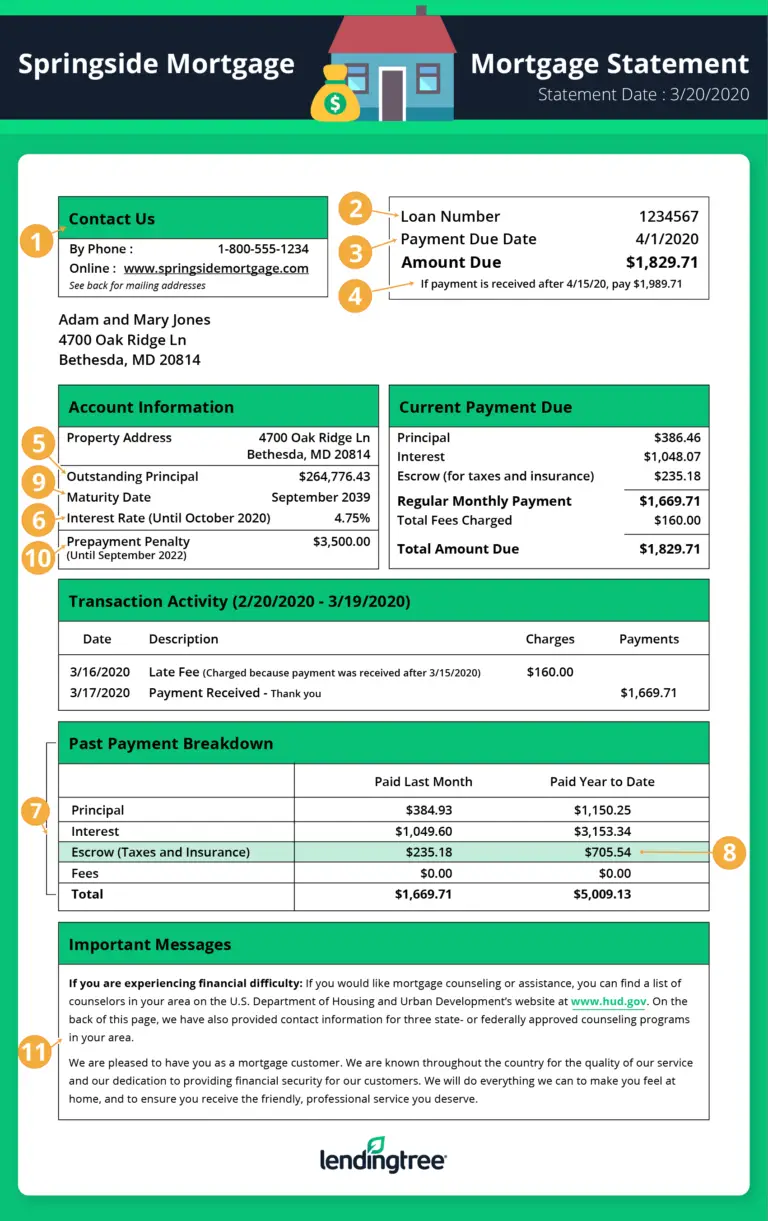

The Consumer Financial Protection Bureau created a mortgage statement sample on its website, which LendingTree adapted in the image below to explain how to read your home loan statement. Each number in the graphic corresponds to an item in the list below.

#1 Mortgage servicer information

First up on your mortgage statement will be information about your loan servicer. This is the bank or company that sends your monthly mortgage statement and handles the payments. The companys name, address, website and phone number are typically displayed here. Use this contact information if you have any questions about your mortgage.

#2 Account number

Your mortgage loan account number is what identifies the mortgage as yours. If you need to contact your loan servicer with a question or an issue, youll need to provide your account number.

#3 Payment due date

This is self-explanatory: the date by which you need to make your mortgage payment. Generally speaking, most lenders offer a grace or courtesy period usually two weeks before your payment is .

#4 If received after

Your payment is late if you dont pay it by the due date. But, as noted above, youll usually get a two-week grace period. The if received after date refers to the end of the courtesy period, at which point youll incur a late fee. Youll usually find this date grouped along with the payment due date and the amount due.

#5 Outstanding principal amount

#6 Interest rate

#7 Current mortgage payment breakdown

Both Spouses Older Than Age 62

Under FHA HECM rules, when both spouses are older than age 62, both are borrowing spouses regardless of whether one or both spouses’ names appear on the property’s title. The older or younger spouse can be the property’s sole owner. This rule does not vary if the property is situated in a community property or a common law state. For the purposes of the HECM loan, both borrowing spouses have the same rights and responsibilities.

You May Like: How To Calculate Your Mortgage

What Is A Mortgage Statement

Mortgage lenders are legally required to provide consumers with a mortgage statement for each billing cycle of their loan. Each mortgage statement includes up-to-date information about the loan, including the principal balance, interest rate changes , current payment amount and the payment breakdown.

In the past, the layout of mortgage statements and the information on them varied greatly between lenders. But the Dodd-Frank Act, passed as a direct result of the 2008 financial crisis, changed that. Now, mortgage servicers follow a standardized model for mortgage statements, and they must include specific loan information.

Why Its Important To Read Your Mortgage Statement

Its crucial to read your mortgage statement each month. By doing so, youll know in advance of an interest rate increase or changes to your escrow payments. Additionally, you might be able to catch issues such as overdue or delinquent payments or incorrect late charges.

If you see any errors on your mortgage statements, contact your loan servicer immediately. If you call, make a note of who you spoke to, the case number and the outcome of the conversation, and request a corrected statement. Follow up with your lender if you dont receive one. If you write to your loan servicer, make sure the letter has your name, address, account number from your mortgage statement and the exact reason for the dispute. Generally, lenders must address your written dispute within 30 days.

Many consumers question how long to keep mortgage loan statements. Whether you receive them via mail or online, the CFPB recommends you hold on to them for about three years.

You May Like: How To Get A Second Mortgage To Buy Another House

How Does A Small Business Loan Work

Category: Loans 1. SBA loans Small Business Administration In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, Lender Match connects you to · Microloans · Economic Injury Disaster Loans Sep 9, 2020 Small

Can You Lose Your House With A Reverse Mortgage

As with any mortgage, there are conditions for keeping your reverse mortgage in good standing, and if you fail to meet them, you could lose your home. The ways you could violate the terms of a reverse mortgage include:

- The home is no longer your primary residence.As part of the reverse mortgage agreement, the home must be your primary residence. This means that you cannot leave the home for more than 12 consecutive months, explains Michael Micheletti, spokesperson for Unlock Technologies, a company that helps homeowners access their equity. This rule doesnt bar you from leaving your home to travel or to come and go as you please, but if you vacate the property for 12 consecutive months, the reverse mortgage loan becomes eligible to be called due and payable.

- You decided to move or sell your home.If you have to move and put your home up for sale as part of the move, youre still bound by the requirement to live in the house for 12 consecutive months. If selling your home becomes a challenge and you dont find a buyer within that 12-month window, the reverse mortgage can be called due, Micheletti says.

- You dont pay your property taxes or homeowners insurance. Even with a reverse mortgage, youre still responsible for paying property taxes, and failure to do so could violate the terms of your loan. In addition, you must maintain current homeowners insurance.

You May Like: How Much Should Mortgage Payment Be Compared To Income

What Should I Do If I Have Required Repairs That Need To Be Completed

If you have certain repairs to your home that were required as a condition of receiving your reverse mortgage, you will receive information from us that will be mailed to you within 7-10 days.

This letter will provide you with a step-by-step instruction guide, which will take you through the repair process. You do not need to wait for this information before you start the repairs to your home. It is important that you get them started as soon as possible, to ensure that you are able to complete the repairs by your required deadline.

When The Servicer Must Send The Statement

The periodic statement must be delivered or placed in the mail within a reasonably prompt time after the payment due date or the end of any courtesy period provided for the previous billing cycle. . Generally, delivering, emailing, or placing the periodic statement in the mail within four days of the close of the courtesy period of the previous billing cycle is considered reasonably prompt.

Also Check: Is Sebonic A Good Mortgage Company

How Home Equity Release Works

‘Equity’ is the value of your home, less any money you owe on it .

‘Home equity release’ lets you access some of your equity, while you continue to live in your home. For example, you may want money for home modifications, medical expenses or to help with living costs.

Ways to access equity in your home include:

- reverse mortgage

- home sale proceeds sharing

- equity release agreement

- the Government’s Pension Loans Scheme

The amount of money you can get depends on:

- your age

- the value of your home

- the type of equity release

Your decision could affect your partner, family and anyone you live with. So take your time to talk it through, get independent advice and make sure you understand what you’re signing up for.

Would You Benefit From One

A reverse mortgage might sound a lot like a home equity loan or line of credit. Indeed, similar to one of these loans, a reverse mortgage can provide a lump sum or a line of credit that you can access as needed based on how much of your home youve paid off and your homes market value. But unlike a home equity loan or line of credit, you dont need to have an income or good credit to qualify, and you wont make any loan payments while you occupy the home as your primary residence.

A reverse mortgage is the only way to access home equity without selling the home for seniors who dont want the responsibility of making a monthly loan payment or who cant qualify for a home equity loan or refinance because of limited cash flow or poor credit.

If you dont qualify for any of these loans, what options remain for using home equity to fund your retirement? You could sell and downsize, or you could sell your home to your children or grandchildren to keep it in the family, perhaps even becoming their renter if you want to continue living in the home.

Also Check: What Makes Mortgage Rates Change

Without A Good Plan You Could Outlive Your Loan Money

After seeing a reverse mortgage ad, you might think that a reverse mortgage guarantees your financial security no matter how long you live. Americans are living longer today than they were just a generation ago. Make sure you have a financial plan in place that accounts for a long life. That way if you need to tap your home equity, you wont do it too early and risk running out of retirement resources later in life.

How Heirs Pay Off A Reverse Mortgage

What happens when the last reverse mortgage borrower dies? How do the borrower’s estate or heirs immediately pay off the reverse mortgage balance, and how will they know the amount of the payoff? Here is the four-step payoff process:

Cease payouts

Upon the borrower’s death, the estate executor notifies the reverse mortgage lender. Reverse mortgage lenders generally track borrower deaths through public records and take action to terminate a loan when the last borrower dies. If the borrower was receiving monthly checks from the reverse loan at the time of death, the lender ceases making payments. If the borrower had a line of credit at the time of death, the lender closes the line of credit.

Conduct appraisal

Within 30 days of notifying the borrower’s estate or heirs, the HECM lender dispatches a HUD-approved appraiser to the property. The appraiser evaluates the home and assigns an appraised value, which the lender uses to determine the loan amount that is due and payable. This amount is the lesser of the reverse mortgage balance or 95 percent of the appraised value of the property.

Six months to satisfy the debt

Extension requests

Heirs can request up to two 90-day extensions to sell or refinance the property. To receive approval for the extension, they must prove that they are arranging the financing to keep the house or that they have it listed for sale.

About the Author

Recommended Reading: How To Make Biweekly Payments On Your Mortgage

Recent Changes To The Reverse Mortgage Program

In 2017, HUD determined changes are necessary to improve the financial health of the federally insured reverse mortgage program, which has suffered losses in recent years. Changes include raising premiums and tightening loan limits. The changes implemented October 2 apply to borrowers who take out new reverse mortgage loans .

These changes can be somewhat complicated to explain and vary from person to person. So it’s imperative you speak to a reverse mortgage expert to see how this may affect your loan.

If you or a loved one are curious about a reverse mortgage, make the call to one of our dedicated mortgage consultants. We can answer your questions and guide you through what to expect.

These materials are not from HUD or FHA and were not approved by HUD or a government agency.

Documents Youll Need To Get Preapproved

Your lender will need the following documents, depending on the type of income you receive:

- Social Security benefit verification letter

- Statements of retirement assets and income from the organization that holds them, such as your brokerage, bank, or plan administrator

- Statements from the company that awarded and distributes your pension funds

- Dividend statements

- W-2 or 1099 forms )

- Bank statements showing recent receipt of income sources

- Signed tax returns for past two years, showing receipt of income

Recommended Reading: What Is The Best Mortgage Company To Refinance With

One Spouse Older And The Other Younger Than Age 62

Under FHA HECM rules, the spouse older than 62 is the borrowing spouse. The spouse younger than age 62 is the eligible non-borrowing spouse. This means after the death of the borrowing spouse, eligible non-borrowing spouses can defer vacating the property and repaying the loan. Whenever a reverse mortgage includes an eligible non-borrowing spouse, his or her age must be used to calculate the loan amount because the potential for deferral increases the possibility of the loan balance outstripping the home value. The rules are the same whether the property is in a community property or a common-law state an eligible spouse doesn’t need to be on the property’s title.

How To Avoid Reverse Mortgage Scams

As you shop for a reverse mortgage and consider your options, be on the lookout for two of the most common reverse mortgage scams:

- Contractor loans Some contractors will try to convince you to get a reverse mortgage when touting home improvement services.

- Veteran loans The U.S. Department of Veterans Affairs doesnt provide reverse mortgages, but you may see ads promising special deals for veterans, such as a fee-free reverse mortgage to attract borrowers.

The best way to avoid a reverse mortgage scam is to be aware and vigilant. If an individual or company is pressuring you to sign a contract, for example, its likely a red flag.

Don’t Miss: How To Calculate Mortgage Payoff Amount

What An Equity Release Agreement Costs

It’s not a loan, so you don’t pay interest. Instead, you pay fees such as:

- an application fee

- periodic service fees, potentially deducted in advance from your home’s equity

- a fee to end the agreement

Get the fund to go through projections with you, showing the impact on your home equity over time. Get a copy of this to take away, and discuss it with your adviser. Ask questions if there’s anything you’re not sure about.

How To Choose A Reverse Mortgage Payment Plan

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

There are six different ways you can receive the proceeds from the most popular type of reverse mortgage, the home equity conversion mortgage . The U.S. Department of Housing and Urban Development , which regulates HECMs, calls these choices payment plans.

You can opt to get a large lump sum upfront, establish a line of credit that you can draw upon as needed, receive equal monthly payments, or pick some combination of these options.

- The Fixed-Rate Payment Plan

- Option 1: Tenure Payment Plan

- Option 2: Term Payment Plan

- Option 3: Line of Credit

- Option 4: Modified Tenure Plan

- Option 5: Modified Term Plan

The plan you choose will affect how much money you receive in the short and long run, how quickly you use up your home equity, and how effectively a reverse mortgage assists your financial goals. Heres a look at how each payment plan works, along with their pros and cons.

Read Also: Should I Take Out A Mortgage

Increase Your Approval Odds With A Co

If youre not able to get approved for a mortgage on your own, you might consider asking one of your adult children or another trusted person to co-sign for you. Lenders sometimes approve loans with co-signers if the co-signer has strong credit and sufficient income to qualify for the mortgage.

Co-signers are responsible for the repayment of the loan if you are no longer able to make payments, so make sure to review your finances carefully with them. They should be clear on the terms and payment amounts and understand your income and assets and how those might change.

Should you no longer be able to live in the home or eventually move to an assisted living facility, your co-signer may need to step in to manage your payments or the sale of the house. You may want to meet with them and your wealth advisor together so they can confidently make the decision to take out the loan with you.

Understanding Reverse Mortgage Net Principal Limits

A reverse mortgage net principal limit is the net principal a borrower receives in a reverse mortgage loan, after deducting any costs and fees. The net principal limit will often be higher than the reverse mortgage initial principal limit, which is the maximum amount one can obtain in the first year.

Reverse mortgages are available for seniors aged 62 or older. They are also known as home equity conversion mortgages. They allow borrowers to receive cash for the equity in their homes with no monthly payments required. Money can be disbursed either in installments or as a lump sum, depending on the reverse mortgage’s terms. Reverse mortgages are sponsored by the Federal Housing Administration and supported by the U.S. Department of Housing and Urban Development . Interested borrowers can find an FHA-approved lender online at HUD’s website.

Reverse mortgages are an alternative type of second mortgage with a borrower’s property used as the secured collateral. Interest accrues over the life of the loan at a specified interest rate. Most importantly, borrowers must make full repayment on the loan if they sell the property. Complete repayment is also required in the case of a death that leaves the secured property and any recourse assets to the lender.

A regulation implemented in 2013 placed a limit of 60% on the amount of the initial principal limit borrowers can receive as reverse mortgage proceeds in the first year they have the loan.

Recommended Reading: What Is Mortgage Insurance For Fha Loan