Why Is A Budget Important

As a result, youll pay a lot less when those things happen, and youll have a lot more peace of mind in your day-to-day life.

Budgets can also help you pay down debt and build your savings if you build those into your plan. By making a long-term plan for your finances, youll have what you need for the things you want to do today and the confidence of knowing that you have a solid plan for the future.

The Mortgage Payoff Calculator

As you are now familiar with what a mortgage loan is, let’s quickly review the calculator’s specifications, and then learn how to use it:

- Mortgage balance

This is the amount of the money lent out, and constitutes the principal to be paid off over the agreed upon period.

- Amortization or loan term

This the interval over which the principal balance reaches zero. The longer its duration, the less you need to pay periodically, but the more you end up paying, since the bank charges interest for a longer period of time. It is important to note that the amortization term can be significantly shortened by extra payments. In such a case, the principal is paid off faster, so the interest charged becomes smaller.

- Interest rate

- Compounding frequency

This is the regularity with which the lender applies the annual rate of interest to the principal’s balance. The expression of compounding interest, however, is slightly misleading in this context. While savings accounts calculate compounding on both the interest earned and the principal, with amortization mortgages, the compounding effect is calculated solely on the current principal amount at the time of the calculation, and the entire interest is paid off with each payment.

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

Don’t Miss: Does Discover Bank Do Mortgages

How To Calculate Mortgage Payoff

This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems. This article has been viewed 99,370 times.

The method for precisely determining the rate of amortization, which is the amount needed to pay off a particular mortgage loan, will vary depending on factors like the type of loan, its terms, and what options are exercised by the borrower. However, there is a standard formula used for calculating the loan payoff amount of a mortgage based on the principal, the interest rate, the number of payments made, and the number of payments remaining. This article provides detailed information that will assist you in calculating your mortgage payoff amount based on the terms of your loan. Contact your lender to confirm that your calculation is correct based on the particulars of your mortgage.

What Is A Mortgage Balance

A mortgage balance is the amount owed at a particular moment in time during the mortgage loan term.

Here’s an example:

Mrs. Davis finances a home by taking out a fixed-rate $150,000.00 mortgage at 4% interest with a 30-year term. She has agreed to make payments of $900 per month. At this point in time, the mortgage balance is $150,000.00.

Mrs. Davis pays her mortgage for 10 years, and checks her mortgage balance using the Mortgage Balance Calculator. She knows that she has been paying every month for 10 years, so she enters 120 as the number of payments into the calculator, along with the rest of the required variables. She finds her mortgage balance at this point in time to be $91,100.05.

While Mrs. Davis was able to use the Mortgage Balance Calculator in our example, there are some things to keep in mind . . .

Recommended Reading: Can You Get A Conventional Mortgage On A Manufactured Home

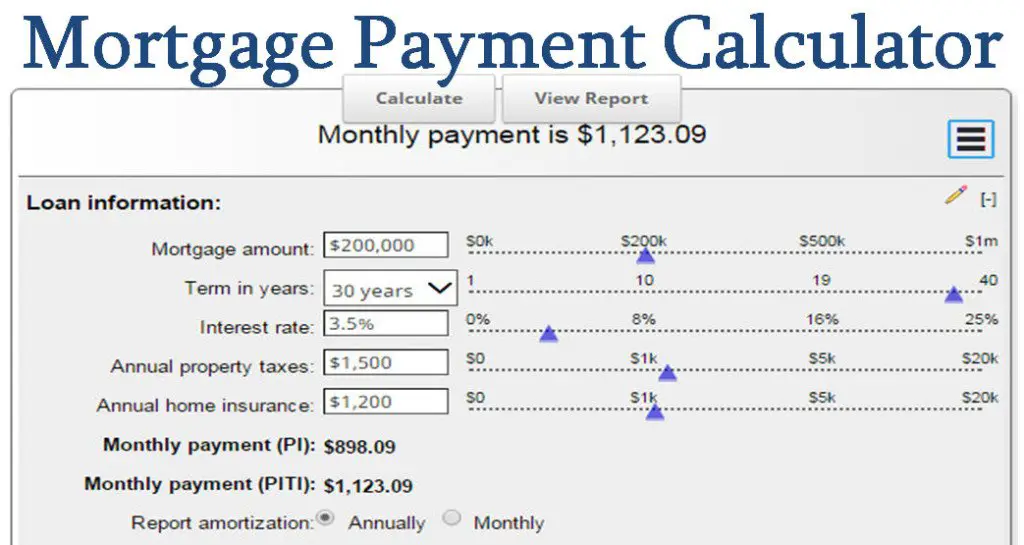

Calculate Monthly Payment And Summary Report

Once you have filled out the required information, click the Calculate button at the top of the page. The calculator will then determine two monthly payment amounts:

- Monthly payment = monthly principal and interest payment for your mortgage

- Monthly payment = monthly payment including principal, interest, homeowners insurance and property taxes

In addition, you can use the calculator to generate a more detailed summary report by clicking the View Report button at the top of the page. The report will include the monthly payment amounts mentioned above, plus some additional information:

- Total principal and interest payments

- Total interest

- Payment schedule

As an important caveat, keep in mind that using an automatic mortgage payment calculator is merely a starting point in the home buying process. We strongly recommend that you talk with a bank advisor, such as one of our mortgage loan officers, before you start working with a real estate agent to look at homes. They can help you get pre-approved for a mortgage, which will help streamline the home buying process immensely and put you at a great advantage as a buyer.

How To Determine And Enter Your Income

The first step in the monthly budget calculator is to determine your monthly income. This will be the amount you can spend every month, so be sure to use your net income, not your gross income.

Gross income is what you make before anything is deducted from your paycheck. Net income is what you actually bring home after taking out taxes and any paycheck deductions for things like your retirement or your health insurance plan.

To determine what to enter under Salary/Wages in the budget calculator:

- If you get paid a regular check once a month, simply enter the take-home amount of that check.

- If you get paid twice a month, add the take-home amount of your two checks together and enter that amount.

- If you get paid every other week, multiply your take-home amount by 26 for the number of checks you get each year, and then divide by 12 to get your monthly take-home pay. Enter that amount in the budget calculator.

- If your income changes from month to month, add up your total monthly deposits for the last 3 months and divide that number by 3 to get a monthly estimate. Enter that amount in the budget calculator. If the last 3 months were unusually high or low, add up all your deposits for the past year instead and divide by 12 to get a better average.

If you have additional income such as a side job, child support, alimony, or other supplemental income, add the monthly amount you can spend in the monthly budget calculator under Other Income.

Also Check: What Mortgage Can You Afford Based On Salary

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Mortgage Payoff Calculator Terms & Definitions

- Principal Balance Owed â The remaining amount of money required to pay off your mortgage.

- Regular Monthly Payment â The required monthly amount you pay toward your mortgage, in this case, including only principal and interest.

- Number of Years to Pay Off Mortgage â The remaining number of years until you want your mortgage paid off.

- Principal â The amount of money you borrowed to buy your home.

- Annual Interest Rate â The percentage your lender charges on borrowed money.

- Mortgage Loan Term â The number of years you are required to pay your mortgage loan.

- Mortgage Tax Deduction â A deduction you receive at tax time on the interest you pay toward your mortgage.

- Extra Payment Required â The extra amount of money you’ll need to pay toward your mortgage every month to pay off your mortgage in the amount of time you designated.

- Interest Savings â How much you’ll save on interest by prepaying your mortgage.

Don’t Miss: How To Get Pre Approved For A Mortgage Chase

Finding The Right Down Payment Amount

A purchase calculator can help you determine the down payment you need. There are minimum down payments for various loan types, but even beyond that, a higher down payment can mean a lower monthly payment and the ability to avoid mortgage insurance.

On the flip side, a higher down payment represents a more significant hurdle, particularly for first-time home buyers who dont have an existing home to sell to help fund that down payment. The calculator can show you options so that you can balance the amount of the down payment with the monthly mortgage payment itself.

How To Estimate Your Mortgage Payment Using An Automatic Calculator

If youre thinking of buying a home in the near future, you may be planning your next steps. Perhaps youve browsed real estate listings online, but youre not exactly sure what would work for you financially.

Before you start looking at potential homes, you need to know what your budget is in other words, how much of a monthly mortgage payment you can afford.

If youre still in the early stages of your search , an automatic calculator can be a good place to start, as it can give you a general idea of what your price range is.

You May Like: How Much Would An 85000 Mortgage Cost

Can You Afford The Loan

Lenders tend to offer you the largest loan that theyll approve you for by using their standards for an acceptable debt-to-income ratio. However, you dont need to take the full amountand its often a good idea to borrow less than the maximum available.

Before you apply for loans or visit houses, review your income and your typical monthly expenses to determine how much youre comfortable spending on a mortgage payment. Once you know that number, you can start talking to lenders and looking at debt-to-income ratios. If you do it the other way around , you might start shopping for more expensive homes than you can afford, which affects your lifestyle and leaves you vulnerable to surprises.

Its safest to buy less and enjoy some wiggle room each month. Struggling to keep up with payments is stressful and risky, and it prevents you from saving for other goals.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Don’t Miss: What Does A Mortgage Payment Consist Of

Current Mortgage Balance And Payment

Together with your home value estimate, your current mortgage balance is used to determine how much equity you have for the purposes of loan qualification as well as figuring how much cash you can take out.

The payment can be useful because sometimes the reason for refinancing is to try to lower your payment, usually accomplished either through lowering your rate or lengthening your term. Including this info will let you better compare options.

Mortgage Balance Calculator Terms & Definitions:

- Mortgage Loan â A debt instrument, secured by the collateral of specified real estate property, that the borrower is obliged to pay back with a predetermined set of payments.

- Mortgage Balance â The full amount owed at any period of time during the duration of the mortgage.

- Principal â Denoting an original sum of money lent.

- Annual Interest Rate â Money paid regularly at a particular rate for the use of money lent â in this case, it’s a percentage.

- Monthly Payment â The action or process of paying someone or something on a monthly basis â in this case, a mortgage.

- Loan Term â The length time it takes to pay off a loan â in this case, a mortgage.

Don’t Miss: How Much Income For A 600k Mortgage

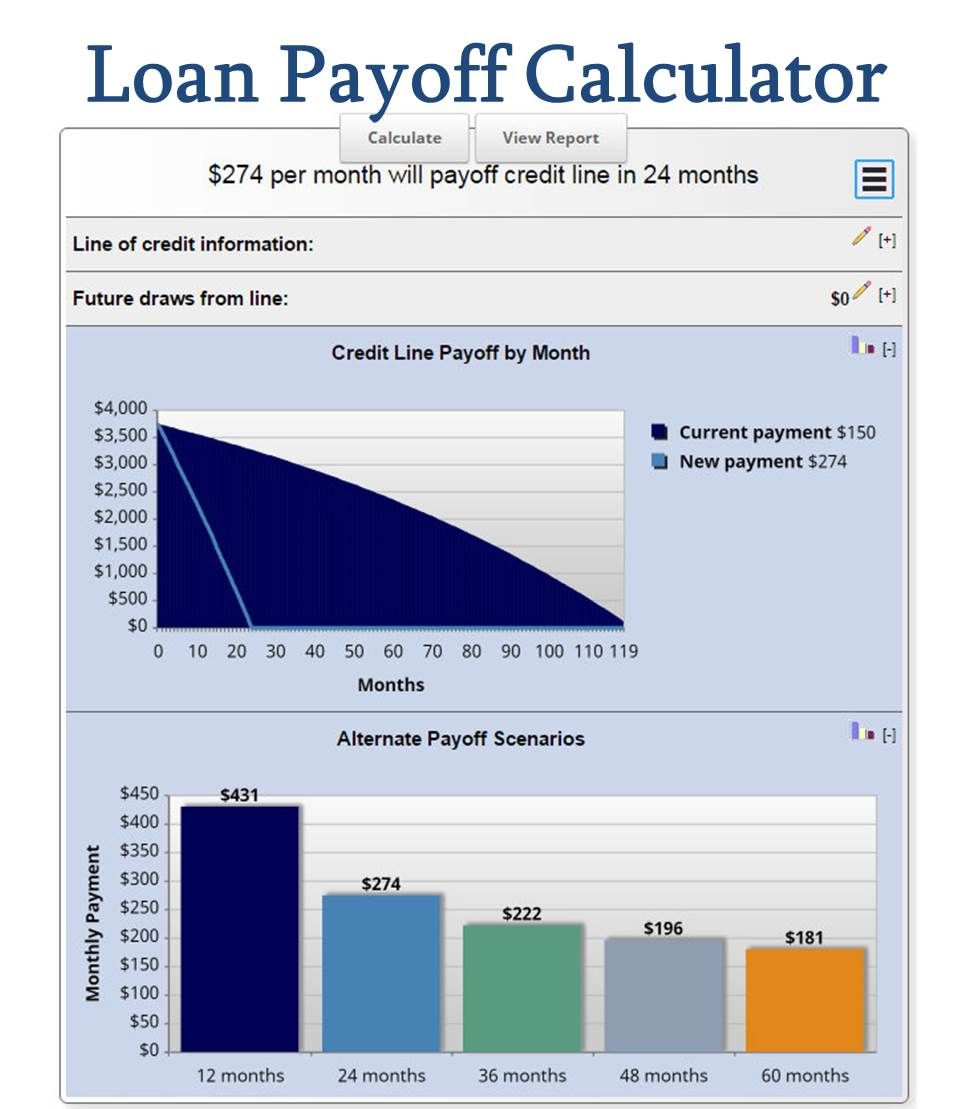

About The Mortgage Payoff Calculator

The calculator has four main sections. First, the top section where you enter the information about your loan and the additional amount you’d like to pay each month. Below that is a short summary showing your new monthly payments and comparative savings. Further down is a chart comparing the trends in your mortgage balance and interest payments over time with both your regular and additional payments.

At the top, there’s a green box labeled “See Report.” Clicking that will display a detailed amortization schedule showing exactly what your total payments, loan balances and accumulated interest payments will be over the life of the loan, on either a month-by-month or year-by-year.

How To Use The Early Mortgage Payoff Calculator

To fill in the calculator’s boxes accurately, consult a recent monthly statement or the first page of the Closing Disclosure that you received when you closed on your mortgage.

-

Under Loan term , enter the number of years for which your home is financed.

-

Under What was your mortgage amount?, fill in the loan amount. In the Closing Disclosure, you can find this on the first line of the Loan Terms section.

-

Under Interest rate, enter the percentage.

-

Under How many years are left on your mortgage?, you’ll need to enter a whole number, so round up or down.

-

Likewise, under In how many years do you want to pay off your mortgage?, you’ll have to enter a whole number, rounding up or down.

-

Under How much do you still owe ?, look for this figure in a recent monthly statement, or contact the mortgage servicer. Or you can use NerdWallet’s mortgage amortization calculator and drag the slider to find out how much you still owe.

Don’t Miss: How Much Would My Mortgage Payment Be

How Do I Calculate My Mortgage Payment

There are two ways to go about calculating a monthly mortgage payment. You can go old school and figure it out using a fairly complicated equation, or you can use a mortgage payment calculator. Either way, youll need to know several variables, so lets run through these.

- Loan Amount: If youre buying a home, youll want to put in the price of the homes youre looking at and subtract your down payment. If youre far enough along, you may be able to also add any costs being built into the balance. For a refi, include the expected balance after you close.

- Interest Rate: You want to look at the base rate and not the annual percentage rate . You use the lower base interest rate because your monthly payment doesnt contemplate closing costs. Knowing APR is still useful, but its more in the context of the overall cost of the loan as opposed to monthly expenses.

- Term: This is how long you have to pay the loan off. Longer terms mean smaller payments, but more interest paid. Shorter terms have the opposite properties.

- Property Taxes: Since property taxes are often built into your mortgage payment, having a fairly accurate estimate will help you get a better picture of cost. Regardless of whether you have an escrow account, these need to be accounted for as a cost of ownership.

Important Notes Regarding The Mortgage Balance Calculator

There is a difference between your mortgage balance and your mortgage payoff amount. If you are looking to pay off your mortgage, your mortgage balance may not provide you with the relevant information needed. The payoff amount will be higher than your mortgage balance. This is because of additional fees required by the lender to close out the mortgage.

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

Also remember this mortgage balance calculator only works with fixed-rate mortgages. Fixed-rate mortgages have fixed interest rates â meaning the interest rate stays the same over the course of the loan term. Adjustable-rate mortgages, on the other hand, have interest rates that are periodically adjusted.

There are, however, additional ways to find your mortgage balance. The Mortgage Balance Calculator isn’t the only way. Try one of these methods too . . .

You May Like: How To Get A Mortgage On A Foreclosure

What The Early Mortgage Payoff Calculator Does

Do you want to pay off your mortgage early? Maybe you have 27 years remaining on your home loan but you would rather pay it off in 18 years instead. The early payoff calculator demonstrates how to reach your goal.

The mortgage payoff calculator shows you:

-

How much more principal you would have to pay every month so you can pay off the loan in a certain number of years.

-

How much interest you would save by paying off the loan early.

There are many reasons you might want to accelerate the mortgage’s payoff, but the motivation usually boils down to either or both of these:

-

You want to own your home free and clear by a milestone in life, such as your retirement or the beginning or end of your kids’ college years.

-

You want to reduce the total interest you pay over the life of the loan.

To steadily pay off the mortgage early, you need to know how much more to pay toward the principal balance every month to accomplish that goal. This calculator lets you do that.

When paying down the principal on a mortgage faster, keep in mind that each servicer has its own procedures for assuring that your extra payments go toward the principal balance instead of toward future payments. Contact your servicer for instructions.